Market Overview

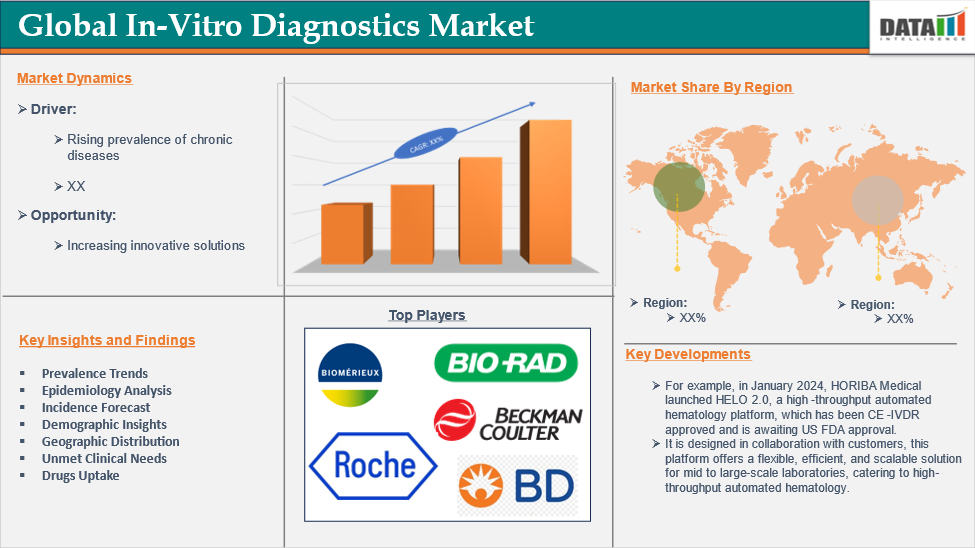

The Global In-Vitro Diagnostics market reached US$ 84.90 billion in 2024 and is expected to reach US$ 131.68 billion by 2032, growing at a CAGR of 5.0% during the forecast period 2025-2032.

In-vitro diagnostics (IVDs) are tests used to detect diseases, conditions, and infections outside the body, typically in glassware, as opposed to in vivo tests, which are performed within the body. These tests can be carried out in various settings, including laboratories, healthcare facilities, or even at home, using a range of instruments from handheld devices to complex laboratory equipment.

IVDs play a crucial role in helping doctors diagnose patients accurately, facilitating appropriate treatment decisions and effective treatment planning.

Executive Summary

For more details on this report – Request for Sample material

Market Dynamics: Drivers & Restraints

Rising prevalence of chronic diseases

The increasing prevalence of chronic diseases has significantly boosted the growth of the in-vitro diagnostics (IVD) market, as these tests enable the early detection and monitoring of conditions such as diabetes, cardiovascular diseases, and cancers. IVD plays a vital role in regular screenings and follow-up care, helping to track disease progression and adjust treatments as necessary.

The rising demand for early, accurate, and accessible diagnostic solutions has driven innovations in technologies such as molecular diagnostics, immunoassays, and point-of-care testing. These advancements have made IVD an indispensable tool in healthcare systems, essential for managing the growing burden of chronic diseases.

For example, according to the Mayo Clinic in 2023, the shift from infectious to noncommunicable diseases began in the early 1900s due to improvements in public health. As life expectancy increases, the prevalence and costs associated with chronic diseases are rising, with the estimated cost of managing these conditions projected to reach $47 trillion by 2030. Factors such as individual lifestyle, behaviors, and community health significantly impact the development and management of chronic diseases.

As a result, the demand for IVD continues to rise, meeting the need for early diagnosis, ongoing monitoring, and treatment planning for noncommunicable diseases (NCDs). This makes IVD a vital component of healthcare systems worldwide, playing a key role in managing the increasing burden of chronic diseases.

High cost of advanced diagnostics

The high costs of advanced diagnostics are expected to hinder the growth of the in-vitro diagnostics market. Advanced diagnostic technologies such as molecular diagnostics, next-generation sequencing, and high-throughput systems require expensive equipment and specialized technology. The high upfront costs and maintenance of these advanced in-vitro diagnostics can be expensive.

Market Segment Analysis

The global in-vitro diagnostics market is segmented based on product type, technique type, application, end-user, and region.

Product:

Instruments segment is expected to dominate the global in-vitro diagnostics market share

The instruments segment is expected to hold a significant position in the in-vitro diagnostics market share. In the in-vitro diagnostics (IVD) market, instruments are essential for accurate disease detection, analysis, and monitoring. These include devices such as analyzers, PCR machines, immunoassay systems, and next-generation sequencing platforms. Advanced IVD instruments offer high precision, automation, and faster processing times, which are crucial for handling the growing volume of diagnostic tests driven by chronic diseases, infectious diseases, and personalized medicine.

Technological advancements, including miniaturization, integration with digital platforms, and point-of-care devices, are offering more flexible testing options. This shift toward automation and real-time data transfer is improving patient management and treatment outcomes, underscoring the significance of these instruments in modern healthcare.

The instruments segment is expected to experience growth due to factors such as new product launches, technological advancements, the rising prevalence of chronic diseases, and strategic partnerships and collaborations. These factors are expected to expand the segment during the forecast period.

For example, in January 2024, HORIBA Medical launched HELO 2.0, a high-throughput automated hematology platform, which has been CE-IVDR approved and is awaiting US FDA approval. Designed in collaboration with customers, this platform offers a flexible, efficient, and scalable solution for mid to large-scale laboratories, catering to high-throughput automated hematology.

Additionally, in January 2024, ELITechGroup introduced the GI Bacterial PLUS ELITe MGB Kit. This diagnostic tool targets major pathogens like Campylobacter spp., Clostridium difficile, Salmonella spp., Shigella spp., and Yersinia enterocolitica, which are common causes of food and waterborne gastrointestinal infections.

Market Geographical Share

North America is expected to hold a significant position in the global in-vitro diagnostics market share

The North America region is expected to be having highest market share due to factors like, rise in the incidence of chronic diseases, novel test launches, advancements in the products and others. According to NIH America Seed Fund, around 3.3 billion in-vitro diagnostic (IVD) tests are conducted annually in the U.S., ranging from simple reagent devices to advanced genetic tests for cancer therapy response prediction. These tests, which can include reagents, instruments, or other systems, diagnose diseases and monitor and treat health conditions.

Moreover, integration of innovative technologies like molecular diagnostics and point-of-care testing. Regulatory support from agencies like the FDA boosts market confidence.

Additionally, key players' investments in research and the demand for home healthcare diagnostics contribute to market growth. Early disease detection and monitoring awareness, along with a robust reimbursement framework, enhance market penetration and promote regional expansion.

Moreover, significant test launches, FDA approvals, partnerships and agreements help the overall region to grow during the forecast period. For instance, in November 2023, Veracyte signed a multi-year agreement with Illumina to develop and offer high-performing molecular tests as decentralized in-vitro diagnostic (IVD) tests on Illumina's NextSeq 550Dx next-generation sequencing instrument. This is part of Veracyte's expanded, multi-platform IVD approach, which includes qPCR, and aims to make its tests available to more patients globally.

Additionally, in April 2024, ProciseDx, a subsidiary of Biosynex, partnered with Revvity's EUROIMMUN US INC. for exclusive distribution of its delocalized biology systems in the US and Canadian markets, a strategic agreement in the field of high-quality in-vitro diagnostics.

Asia Pacific is at the fastest growing pace in the global In-Vitro Diagnostics market share

The rising prevalence of chronic diseases, infectious diseases, and an aging population in the region are pushing healthcare systems to adopt more efficient and accurate diagnostic solutions. Furthermore, the growing awareness of early disease detection and the increasing adoption of personalized medicine are contributing to the expansion of the IVD market. With ongoing advancements in technology and a shift towards point-of-care diagnostics, Asia Pacific is emerging as a dominant force in the global IVD market, attracting significant investments and innovation in the sector.

Competitive Landscape

The major global players in the in-vitro diagnostics market include BioMerieux, Becton, Dickinson and Company, Beckman Coulter, Inc, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc, Abbott Laboratories, Qiagen NV, FUJIFILM Holdings Corporation, Sysmex Corporation and Siemens Healthineers AG among others.

| Metrics | Details | |

| CAGR | 5.0% | |

| Market Size Available for Years | 2022-2032 | |

| Estimation Forecast Period | 2025-2032 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Instruments, Reagents, Software and Services, Others |

| Technique Type | Immunoassays, POC Diagnostics, Molecular Diagnostics, Hematology, Tissue Diagnostics, Microbiology, Self-Blood-Glucose Monitoring, Others | |

| Application | Infectious Diseases, Diabetes, Oncology, Cardiology, Autoimmune Diseases, Nephrology, Drug Testing, Others | |

| End User | Diagnostic Laboratories, Hospitals, Academics and Research Institutes, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Key Developments

- In November 2023, Newland EMEA unveiled a new IVD product line for the healthcare industry. The company showcased high-performance, user-friendly barcode scanners at the MEDICA tradeshow in Dusseldorf. The scanners, integrated into IVD instruments, enhance the speed and quality of diagnoses, detection, prevention, and care, further improving healthcare efficiency.

- In January 2023, BD and CerTest Biotec received EUA from the U.S. FDA for a PCR test for Mpox virus detection, driven by the increasing demand for genetic testing in personalized health care, such as diabetes and cancer.

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Global In-Vitro Diagnostics Market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.