Hysteroscopy Market Size

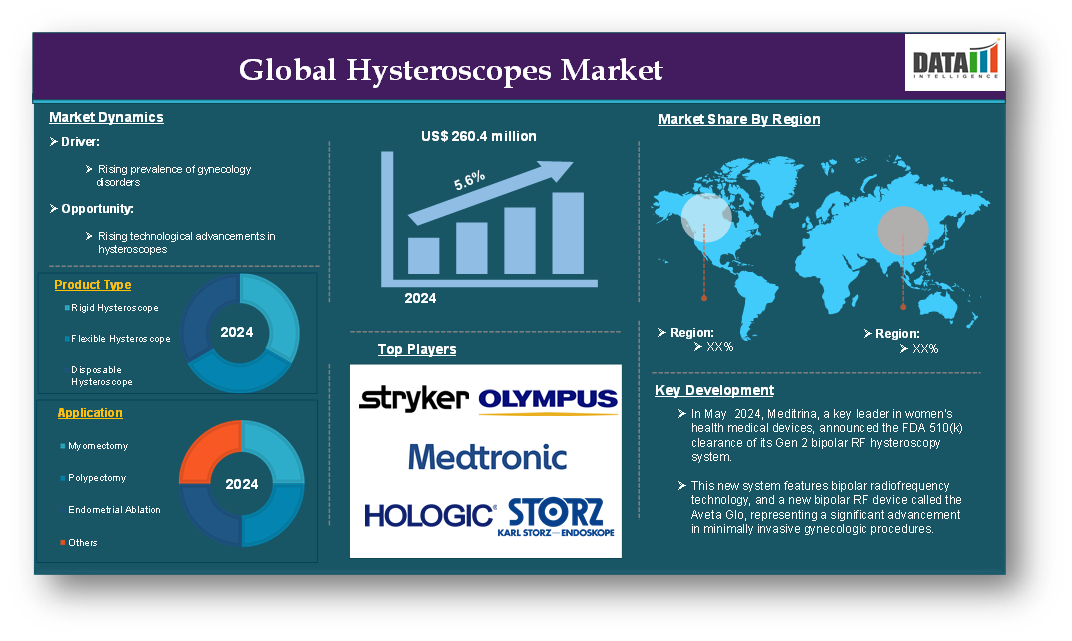

The Global Hysteroscopy market reached US$ 260.4 million in 2024 and is expected to reach US$ 424.00 million by 2033, growing at a CAGR of 5.6% during the forecast period 2025-2033.

A hysteroscope is a medical instrument used for visual examination of the interior of the uterus (womb). It is a type of endoscope specifically designed for gynecological procedures. The device consists of a thin, tubular structure that can be inserted through the cervix (the lower part of the uterus) into the uterus. It is typically equipped with a light source and a camera, allowing the physician to view the uterine lining on a monitor in real time. Hysteroscopy is typically performed in an outpatient or hospital setting under local or general anesthesia, depending on the complexity of the procedure. The hysteroscope is inserted through the cervix into the uterus, and carbon dioxide or saline solution may be used to expand the uterus to improve visibility.

The hysteroscope market is experiencing significant growth, driven by factors such as the increasing prevalence of gynecological disorders and rising advancements in Hysteroscopy for minimally invasive procedures. For instance, in May 2024, Meditrina, a key leader in women's health medical devices, announced the FDA 510(k) clearance of its Gen 2 bipolar RF hysteroscopy system. This new system features bipolar radiofrequency technology, and a new bipolar RF device called the Aveta Glo, representing a significant advancement in minimally invasive gynecologic procedures.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising prevalence of gynecology disorders

The rising prevalence of gynecology disorders is significantly driving the growth of the Hysteroscopy market and is expected to drive the market over the forecast period. Uterine fibroids, endometrial polyps and abnormal uterine bleeding are common gynecological conditions that often necessitate hysteroscopic evaluation and treatment. The global incidence of these conditions is rising due to factors such as age, lifestyle changes, and increased awareness.

For instance, according to the National Institute of Health (NIH), Uterine leiomyomas are one of the most common and yet understudied diseases in women. These tumors, commonly known as fibroids, affect women mainly during their reproductive years and are diagnosed in up to 70% of white women and more than 80% of women of African ancestry during their lifetime. Additionally, according to DynaMed, endometrial polyps are reported in 21%-28% of postmenopausal patients with abnormal uterine bleeding and in 10%-40 % of premenopausal patients with abnormal uterine bleeding.

Endometrial cancer (cancer of the uterine lining) is becoming more common, especially in postmenopausal women. For instance, according to the World Cancer Research Fund, there were 420,368 new cases of endometrial cancer in 2022, including China with 77,722, the United States with 66,055, Russia with 29,852, Japan with 18,338 and India with 17,240. Hysteroscopy is a key diagnostic tool for detecting endometrial cancer, and its use in biopsies and assessments of the uterine lining for abnormal growths is essential, increasing the demand for advanced hysteroscopic systems.

Risk of complications

The risk of complications associated with hysteroscopic procedures is a significant factor hampering the growth of the hysteroscope market. While hysteroscopy is generally considered minimally invasive and safe, it still carries certain risks that can deter both patients and healthcare providers from opting for the procedure.

One of the most serious risks of hysteroscopy is uterine perforation, where the hysteroscope punctures the wall of the uterus. Although rare, this can lead to bleeding, infection, or injury to nearby organs, requiring immediate intervention. For instance, according to a study published by the National Institute of Health, uterine perforation is one of the most common complications of operative hysteroscopy with an incidence of 0.8–1.5%. Uterine perforation can happen during cervical dilation or during insertion of the hysteroscope. The fear of such complications can discourage patients from choosing hysteroscopy, limiting its adoption, especially in settings with less experienced practitioners.

Another significant concern is the potential for infection during the procedure, especially when foreign instruments are introduced into the uterus. Infections can lead to complications like pelvic inflammatory disease (PID) or endometritis, requiring antibiotic treatment. Though the risk of infection is low, it can still lead to hospital readmissions, additional treatments, and longer recovery times, which impacts patient satisfaction and the overall appeal of the procedure.

Excessive bleeding is another complication that can arise during hysteroscopic procedures, particularly in operative hysteroscopy (e.g., myomectomy or polypectomy). While bleeding is often controlled with the use of electrosurgical instruments, in some cases, it can lead to a need for further surgical intervention.

Market Segment Analysis

The global Hysteroscopy market is segmented based on product type, application, end-user and region.

Product Type:

The disposable hysteroscope segment is expected to dominate the Hysteroscopy market share

One of the primary advantages of disposable Hysteroscopy is their single-use design, which eliminates the risk of cross-contamination and infection that can occur with reusable instruments. After each use, disposable Hysteroscopy are discarded, ensuring that they are sterile for every procedure. The World Health Organization (WHO) has highlighted the importance of reducing infection risks in medical procedures, which has significantly influenced the adoption of single-use instruments like disposable Hysteroscopy. Thus, many market players are focusing on disposable Hysteroscopy.

For instance, in May 2024, Minerva Surgical announced the immediate and exclusive distribution of a new disposable hysteroscope that will be displayed at the Annual Clinical & Scientific Meeting of the American College of Obstetricians and Gynecologists in San Francisco, CA. The company plans to soon rebrand the new disposable hysteroscope as HERizon, and its goal is to redefine the standards of efficiency and accessibility in gynecological care.

While reusable Hysteroscopy require significant upfront investment and maintenance costs (cleaning, sterilization, repairs), disposable Hysteroscopy have a lower cost for healthcare facilities and eliminate the ongoing expenses associated with maintaining reusable equipment. This cost-effectiveness is particularly attractive to smaller healthcare providers and those in developing regions, where budget constraints are a concern.

Market Geographical Share

North America is expected to hold a significant position in the Hysteroscopy market share

North America especially in the United States, is home to many leading and emerging manufacturers of Hysteroscopy, such as Olympus Corporation, Karl Storz, UroViu Corp and Stryker Corporation, which continually push the envelope on technological innovations in the field. Innovations in high-definition cameras, flexible Hysteroscopy, and single-use disposable models have contributed to the growth of the hysteroscope market in the region, as these advancements improve the accuracy, safety, and convenience of procedures.

For instance, in June 2022, UroViu Corp launched the new Hystero-V, a single-use hysteroscope compatible with UroViu’s Always Ready endoscopy platform. The 12-Fr, semi-rigid, Hystero-V features a hydrophilic coating enabling gentle insertion and superior visualization for highly effective intrauterine examinations. The single-use hysteroscope eliminates the need for reprocessing the equipment, and the ease-of-use, portability, and time-saving aspects of the Hystero-V mean more efficient and comfortable procedures for both doctors and patients.

In North America, there is a high level of awareness around women’s health, with strong healthcare campaigns focusing on early diagnosis and treatment of gynecological conditions. Institutions like the U.S. Department of Health and Human Services have launched programs targeting early detection of gynecological cancers, which drives the use of hysteroscopy for diagnosis and treatment. Public awareness campaigns, such as National Women's Health Week in the U.S., encourage women to undergo routine gynecological screenings, including hysteroscopy for conditions like abnormal uterine bleeding and fibroids.

Asia-Pacific is growing at the fastest pace in the Hysteroscopy market

The Asia-Pacific region is witnessing an increase in the availability of advanced hysteroscopy technology, including high-definition cameras, flexible scopes, and disposable Hysteroscopy. These innovations are enhancing the appeal of hysteroscopy in diagnosing and treating gynecological conditions with greater accuracy and minimal risk of infection. Countries like Japan and South Korea are leaders in adopting cutting-edge medical technologies, which are contributing to the growth of the hysteroscope market in the region.

In November 2022, India Medtronic Private Limited launched the TruClear system, a mechanical hysteroscopic tissue removal system used for the safe and effective treatment of intrauterine abnormalities (IUA). Some of the commonly seen IUA include fibroids, polyps, retained products of conception, adhesions, malignancies or hyperplasia.

Major Global Players

The major global players in the Hysteroscopy market include Olympus Corporation, Stryker Corporation, Medtronic plc, Hologic, Inc., KARL STORZ, Richard Wolf GmbH, Zhejiang Geyi Medical Instrument Co., Ltd, LiNA Medical ApS, Delmont imaging, Meditrina, Inc. and among others.

Market Scope

| Metrics | Details | |

| CAGR | 5.6% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Rigid Hysteroscope, Flexible Hysteroscope, Disposable Hysteroscope |

| Application | Myomectomy, Polypectomy, Endometrial Ablation and Others | |

| End-User | Hospitals, Gynecology Clinics, Ambulatory Surgical Centers and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global Hysteroscopy market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.