Healthcare Automation Tools Market Size

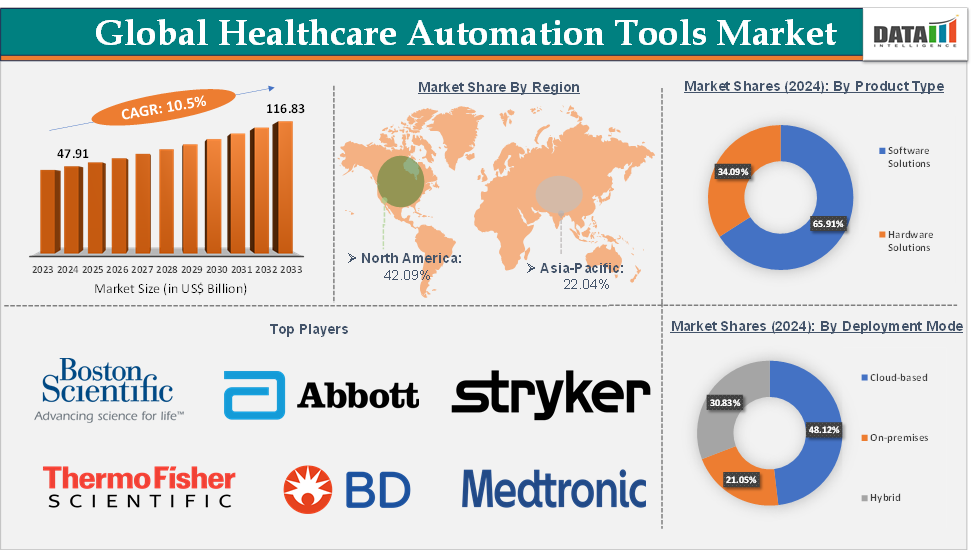

Healthcare Automation Tools Market Size reached US$ 47.91 Billion in 2024 and is expected to reach US$ 116.83 Billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025-2033.

Healthcare Automation Tools Market Overview

The global healthcare automation tools market is experiencing significant growth, driven by technological advancements, increasing demand for operational efficiency, and the need for improved patient outcomes. The market is poised for continued growth, with advancements in AI and robotics leading to more sophisticated and efficient healthcare delivery systems. The integration of automation in telehealth, diagnostics, and administrative functions is expected to further enhance patient care and operational efficiency.

Automation greatly lessens healthcare practitioners' administrative workload. Healthcare institutions may save time and personnel expenses by automating repetitive processes like data input, billing, and appointment scheduling. One medical practice, for example, claimed that automating paper-based chores saved them more than $4,000 a month. Furthermore, there is a clear trend toward automation for operational efficiency, as half of US healthcare providers want to implement robotic process automation (RPA) technology within the next three years.

Executive Summary

For more details on this report – Request for Sample

Healthcare Automation Tools Market Dynamics: Drivers & Restraints

Rising adoption of telemedicine and remote patient monitoring is significantly driving the healthcare automation tools market growth

Telemedicine and remote patient monitoring (RPM) have recently gained popularity due to an aging population, the need for more effective chronic illness management, and a rising need for patient-centered care. The COVID-19 pandemic has hastened the deployment of these technologies, emphasizing their value in ensuring access to healthcare in difficult situations. Thus, the adoption of telemedicine and remote patient monitoring is driving the market growth.

For instance, according to the Centers for Disease Control and Prevention (CDC), a significant percentage of medical specialists (27.4%) used telemedicine for 50% or more of their patient visits, compared to primary care physicians and surgical specialists. The majority of primary care physicians (76.7%) and medical specialists (73.1%) reported being able to provide comparable quality treatment during telemedicine consultations as they would in person, while around half of surgical specialists (50.6%) reported the same ability.

RPM and telemedicine both leverage automated data analytics, allowing medical personnel to extract valuable insights from massive volumes of patient data. These automated systems look for trends, abnormalities, and predictive analytics to help with proactive and preventative treatment.

For instance, the FDA-approved portable EKG device AliveCor KardiaMobile monitors a patient's heart rate and rhythm in real time and delivers this data to medical specialists. The potential of automated analytics to uncover abnormalities for cardiologists to study facilitates early diagnosis and ongoing sickness management.

Data privacy and security concerns are hampering the healthcare automation tools market

Automated healthcare systems often rely on cloud storage, AI, and IoT devices that are vulnerable to cyberattacks. A breach can expose sensitive health data like medical history, test results, and personal identifiers. For instance, according to the HIPAA Journal, in 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day. In March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach.

Healthcare Automation Tools Market Segment Analysis

The global healthcare automation tools market is segmented based on product type, deployment mode, application, end-user, and region.

The software solutions from the product type segment are expected to hold 65.91% of the market share in 2024 in the healthcare automation tools market

The software solutions category is likely to dominate the market, owing to its flexibility, scalability, and capacity to solve a wide range of healthcare operations and clinical processes. Unlike hardware, which frequently necessitates specialized and expensive equipment, software solutions may be integrated into current systems, allowing healthcare practitioners to automate a variety of activities with reduced startup costs and fewer infrastructure adjustments.

Software solutions are very customizable and may be adjusted to a wide range of healthcare applications, such as administrative duties, clinical decision assistance, patient interaction, and data analytics. Given the high need for software solutions, several major market players are concentrating on providing software automation solutions, which further boosts the segment’s growth.

For instance, in May 2025, Innovaccer Inc., a leading healthcare AI company, launched ‘Innovaccer Gravity’, its Healthcare Intelligence Platform, designed to help organizations unlock the full value of their data and accelerate AI-driven transformation. Innovaccer Gravity seamlessly integrates healthcare enterprise data, enables cross-domain intelligence, and delivers faster return on investment (ROI), all while reducing total cost of ownership (TCO).

Additionally, in June 2024, Keragon launched out of stealth. It says it is the first no-code workflow automation platform designed specifically for the US healthcare industry. Currently, it is used by practices and clinics, fast-growing digital health startups, all the way up to hospitals & NASDAQ-listed companies, across the 50 states. The platform enables instant connection of various popular software used by healthcare practitioners (such as EHRs, healthcare CRMs, AI medical scribes, appointment scheduling & billing software). It has built-in personalised AI assistants that fuel faster automations with less hassle.

Healthcare Automation Tools Market Geographical Analysis

North America is expected to dominate the global healthcare automation tools market with a 42.09% share in 2024

The North America region is expected to have the largest market share due to its strong technological infrastructure, high adoption of robotics and AI in healthcare, the presence of leading market players, and frequent product launches. North America, particularly the United States, has a highly established healthcare IT and technical infrastructure, which allows for the easy deployment of modern automation techniques. The region's strong internet access, widespread use of electronic health records, and established telehealth networks make it easier for healthcare facilities to implement automation technologies.

The region is at the forefront of robotics and artificial intelligence use in healthcare, notably surgical robots, diagnostics, and clinical decision support. Robotics and AI are widely employed in hospitals to increase surgical precision, diagnostic accuracy, and patient monitoring. The presence of major market players in the region is accelerating the market growth through the development of advanced AI automation platforms.

For instance, in May 2025, Smarter Technologies, the automation and insights platform for healthcare efficiency, launched the industry’s first AI-powered revenue management platform that helps hospitals and health systems optimize administrative workflows and strengthen financial performance.

Access Healthcare is the leading revenue cycle management (RCM) operations and services company that partners with many of the largest U.S.-based healthcare organizations. SmarterDx is the leading provider of proprietary clinical AI for revenue integrity, and Thoughtful.ai is the leading AI-powered business and revenue cycle automation platform.

Asia-Pacific is growing at the fastest pace in the healthcare automation tools market, holding 22.04% of the market share

Asia-Pacific, and especially Japan, is emerging as the fastest-growing region in the global healthcare automation tools market due to a powerful convergence of demographic, technological, and policy-driven factors. The Japanese government actively promotes healthcare automation under its “Society 5.0” initiative, a national vision integrating AI, robotics, and big data to address social challenges, including healthcare efficiency.

Japan has strong R&D capabilities and advanced digital infrastructure, enabling rapid development and deployment of cutting-edge automation tools, including AI diagnostics, medical robotics, and wearable health tech.

Healthcare Automation Tools Market Top Companies

Top companies in the healthcare automation tools market include Medtronic, Stryker, Smith+Nephew, Koninklijke Philips N.V., Thermo Fisher Scientific Inc., Boston Scientific Corporation, BD, Ethicon, Inc., Cisco Systems, Inc., and Abbott, among others.

Healthcare Automation Tools Market Key Developments

In April 2025, Elumina Health Inc. launched an AI-based patient risk triaging capability in Basis EHR. Basis EHR leverages AI to identify home healthcare patients who are at high risk for hospitalization on the basis of their demographic and medical data. This enables clinicians to monitor the high-risk patients more closely to reduce hospitalizations. Basis EHR uses AI automation to reduce clinical documentation workload, therefore enabling medical staff to increase their attention on patient healthcare activities.

In March 2025, UiPath, a leading enterprise automation and AI software company, announced that it had negotiated a new global consulting agreement with a major Electronic Medical Records (EMR) platform to accelerate professional services programs for customers in 16 new countries. With the agreement, UiPath significantly expands its professional services capabilities for healthcare organizations and makes customer and partner access to this EMR platform faster and more seamless.

In April 2025, Honeywell introduced TrackWise Manufacturing, an artificial intelligence (AI)-assisted, cloud-native platform designed to transform how life sciences companies manage, automate, and digitalize operations.

In October 2024, Microsoft launched new healthcare data and artificial intelligence tools, including a collection of medical imaging models, a healthcare agent service, and an automated documentation solution for nurses. The tools aim to help healthcare organizations build AI applications quickly and save clinicians time on administrative tasks, a major cause of industry burnout.

In October 2024, Visionet Ventures launched a transformative clinical care application that leverages ambient AI to streamline medical documentation and enhance the clinician and patient experience. Reteta is more than just automating documentation and processes, it’s about bringing the joy of medicine back to healthcare professionals and pushing the envelope of possibilities with AI in healthcare.

Market Scope

Metrics | Details | |

CAGR | 10.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Software Solutions and Hardware Solutions |

Deployment Mode | On-premises, Cloud-based, and Hybrid | |

Application | Clinical Automation, Patient Monitoring and Engagement, Administrative and Operational Automation, and Others | |

End-User | Hospitals and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, Homecare Settings, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global healthcare automation tools market report delivers a detailed analysis with 70 key tables, more than 64 visually impactful figures, and 157 pages of expert insights, providing a complete view of the market landscape.