Optical Sensors Market Size

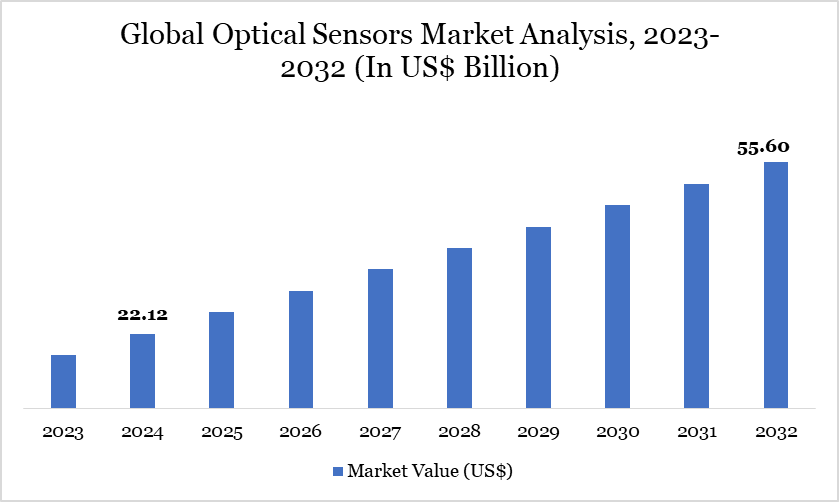

Optical Sensors Market Size reached US$ 22.12 billion in 2024 and is expected to reach US$ 55.60 billion by 2032, growing with a CAGR of 12.21% during the forecast period 2025-2032.

The optical sensors market is experiencing strong growth, supported by government-led technology initiatives. In India, a US$ 9.1 billion incentive program under the “Make in India” campaign includes funding for semiconductor and sensor manufacturing, including optical sensors.

The Ministry of Electronics and Information Technology (MeitY) is prioritizing sensor-based innovations under its national R&D programs. India’s RRCAT is developing advanced optical sensing solutions like fiber Bragg gratings for medical and environmental applications. Globally, optical sensors are becoming key components in sectors like renewable energy and EV monitoring systems, aligning with climate policy targets.

Optical Sensors Market Trend

A notable trend in the optical sensors market is their integration into diverse public infrastructure projects. In Guwahati, India, the city-wide CCTV surveillance initiative is progressing, with plans to install 2,000 cameras equipped with AI-powered Pan-Tilt-Zoom (PTZ) capabilities, enhancing public safety and traffic management.

Similarly, Mumbai's Brihanmumbai Municipal Corporation (BMC) is upgrading its rainwater logging detection systems by incorporating GPS-based anti-theft tracking and vehicle-hit sensors, aiming to improve urban flood management. These developments underscore the expanding role of optical sensors in enhancing urban infrastructure and public safety.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Type | Extrinsic sensor, Intrinsic Sensor |

| By Sensor | Fiber Optic Sensor, Photoelectric Sensor, Optical Temperature Sensors, Biomedical Sensors, Displacement & Position Sensors, Point Sensors, Others |

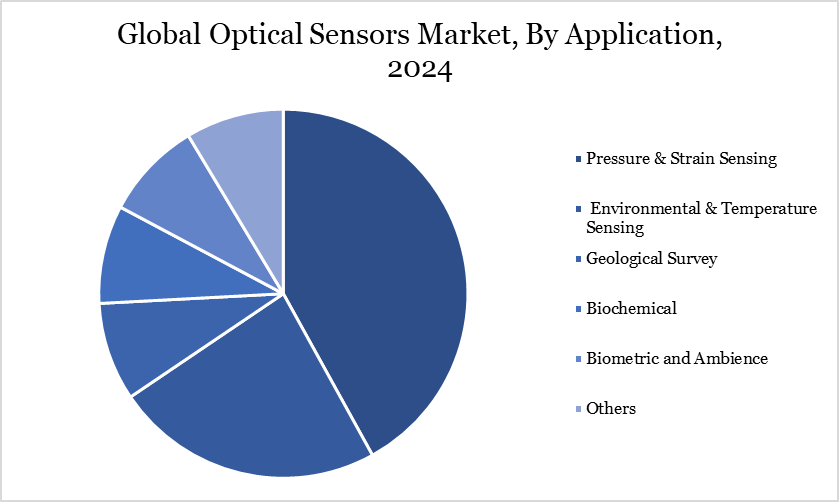

| By Application | Pressure & Strain Sensing, Environmental & Temperature Sensing, Geological Survey, Biochemical, Biometric and Ambience, Others |

| By End-User | Aerospace and Defense, Utilities, Oil and Gas, Medical, Construction, Consumer Electronics, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Optical Sensors Market Dynamics

Growing Demand in Healthcare and Security

Optical sensors play a crucial role in healthcare and security due to the importance of precision, non-invasiveness and reliability. Applications in remote health monitoring, diagnostics and imaging are on the rise due to an aging global population and increased prevalence of chronic diseases.

According to the World Health Organization (WHO), chronic diseases, also known as noncommunicable diseases (NCDs), account for 74% of all deaths worldwide, this figure expected to rise due to lifestyle and demographic changes. The sensors, which are used in medical devices for pulse oximetry, glucose monitoring and wearable health devices, provide immediate data that assist in prompt healthcare intervention.

In security, the adoption of optical sensors in surveillance, facial recognition and biometrics has become vital due to heightened security concerns and regulatory mandates worldwide. The US Department of Homeland Security (DHS) and the European Union Agency for Cybersecurity (ENISA) have established rules to encourage sensor-based solutions for improved border and facility security.

High Production Costs and Regulatory Constraints

Despite the optimistic outlook, high production costs and regulatory complexities pose challenges to the market. The manufacture of advanced optical sensors involves significant capital investment due to the complexity of fabrication processes and the requirement for high-grade materials. The International Trade Centre (ITC) has noted that the high cost of optical sensors can limit adoption in cost-sensitive markets, particularly in developing economies.

Moreover, regulatory compliance is a major concern, especially in healthcare and automotive applications, where sensors must meet stringent safety and quality standards. Adhering to both the European Medical Device Regulation (MDR) and US Food and Drug Administration (FDA) guidelines for medical devices can be time-consuming and resource-intensive, possibly hindering market entry.

Optical Sensors Market Segment Analysis

The global optical sensors market is segmented based on type, sensor, application, end-user and region.

Environmental & Temperature Sensing Segment Driving Optical Sensors Market

Temperature and environmental sensing applications in optical sensors are experiencing high demand, driven by their critical role in monitoring air quality, water quality and pollutant levels. These sensors are crucial for a variety of industries and smart city initiatives that depend on up-to-the-minute data to uphold secure, eco-friendly settings.

In smart cities, they provide systems to manage traffic, increase energy efficiency and monitor the environment, helping to reduce pollution and enhance urban living. The precision of optical sensors in detecting temperature and pollutants also helps industries comply with environmental regulations, fostering safer working and public spaces.

According to a United Nations report of 2024, air pollution costs the global economy approximately US$ 8.1 trillion annually, which equates to 6.1% of the world's GDP, primarily due to health-related expenses and productivity losses. The importance of using optical sensors in environmental applications is emphasized by this economic impact. The integration of temperature and environmental sensors in urban and industrial systems thus not only helps mitigate economic burdens but also promotes sustainability and healthier communities globally.

Optical Sensors Market Geographical Share

Demand for Optical Sensors in Asia-Pacific

Asia-Pacific is one of the fastest-growing markets for optical sensors, driven by rapid industrialization, smart city initiatives and the expansion of electronics manufacturing. Countries like China, Japan and South Korea are investing heavily in semiconductor production and sensor technologies. The Asia-Pacific Economic Cooperation (APEC) has highlighted the region's ambition to lead the world in technology adoption and infrastructure development, particularly in the automotive and industrial sectors.

In China, the Made in China 2025 initiative has accelerated the adoption of high-tech manufacturing, including optical sensors, to reduce dependence on imports. Additionally, India's Digital India program has increased investments in smart cities. In August 2024, the Cabinet Committee on Economic Affairs of India approved 12 new smart city projects under this program, with an investment of US$ 3.41 billion, where optical sensors play a pivotal role in applications like energy management and surveillance.

Sustainability Analysis

The optical sensors market is increasingly aligning with global sustainability goals, focusing on energy efficiency and resource optimization. Automated optical sensors in intelligent infrastructure initiatives decrease energy usage by supplying precise information on environmental conditions and adapting lighting, heating and cooling systems accordingly. US Department of Energy has noted that integrating sensors into building management systems can reduce energy use by up to 30%, making them essential for sustainable urban development.

Furthermore, Optical sensors in healthcare allow for accurate and non-invasive monitoring, decreasing the reliance on invasive diagnostic procedures and reducing waste. This aligns with the United Nations’ emphasis on sustainable healthcare practices, aiming to reduce the environmental impact of medical equipment and devices.

Optical Sensors Market Major Players

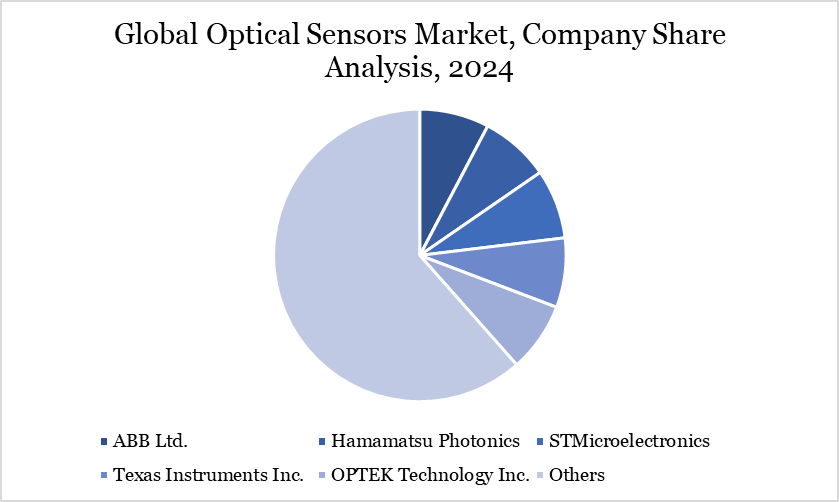

The major global players in the market include ROHM Semiconductor, ABB Ltd, Hamamatsu Photonics, STMicroelectronics, Texas Instruments Inc., OPTEK Technology Inc., OMRON Corporation, Honeywell International Inc., Eaton Corporation PLC, and Siemens AG.

Key Developments

In October 2024, EGE-Elektronik announced the launch of the revised UF2 series of intrinsically safe optical level sensors, now with ATEX/IECEx approval for use in Zone 0 environments. These innovative sensors utilize an optical measuring principle that operates independently of the liquid's dielectric constant or conductivity. This advantage distinguishes them from traditional conductive, capacitive, or microwave-based level controllers, which often struggle to detect liquids with low dielectric constants.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies