Global Wearable Sensor Market is segmented By Product (Neckwear, Bodywear, Wristwear, Footwear, Eyewear, others), By Sensor (Accelerometers, Temperature sensor, Pressure sensor, Image/Optical Sensor, Motion Sensor, Medical-Based Sensor, Others), By Connectivity (Wired Wearable Sensor, Wireless Wearable Sensor), By Application (Health and Wellness, Safety Monitoring, Sports and Fitness, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Wearable Sensor Market Size

Global Wearable Sensor Market reached USD 840.2 million in 2022 and is expected to reach USD 4,027.6 million by 2030, growing with a CAGR of 19.2% during the forecast period 2024-2031. The wearable sensor market is growing gradually due to advancements in sensors, wireless communication, power supply and other technologies. Also, sensor technology advancements, an increase in the use of wearable sensors for infants and more home and remote patient monitoring are driving the market for wearable sensors.

Additionally, because these sensors may be integrated into other devices, the development of smart consumer electronics, such as tablets and smartphones, has made it possible to monitor and gather information.

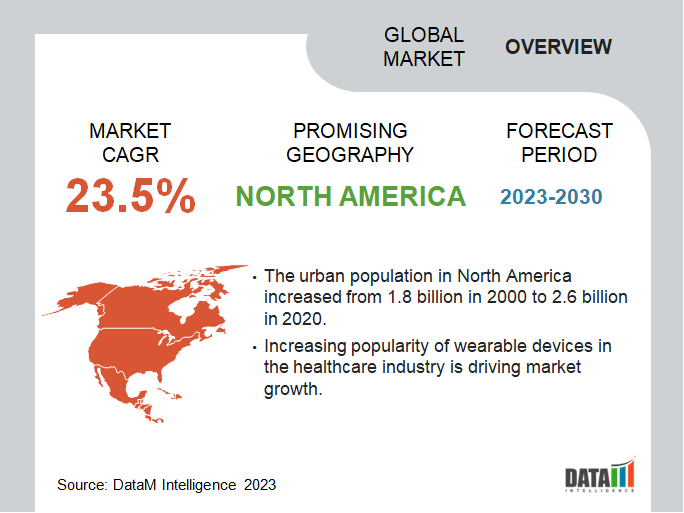

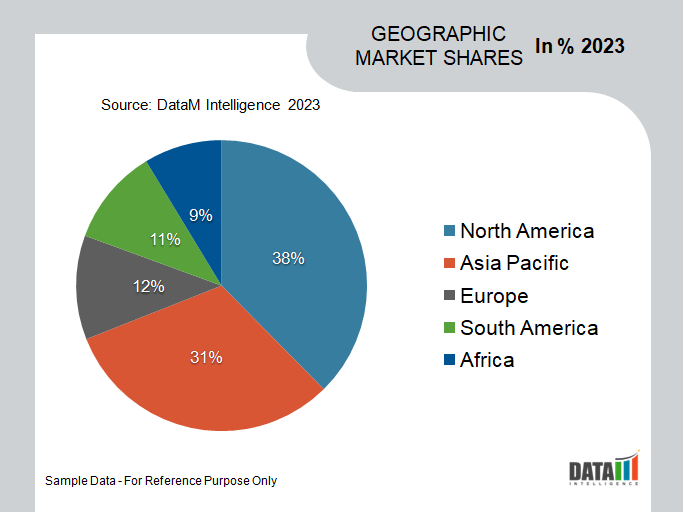

North America is among the growing regions in the global wearable sensor market covering more than 1/3rd of the market owing to U.S. rapid acceptance of digital technologies. A growing healthcare industry in the region is also expected that will accelerate the adoption of wearable sensor-enabled electronic devices.

Technological developments and advancements, which lead to the launch of new goods, are one of the most crucial aspects. Medical applications and rising consumer demand have both fueled the market's expansion in North America. the rising prevalence of chronic illnesses is one of the other reasons driving growth.

Wearable Sensor Market Summary

|

Metrics |

Details |

|

CAGR |

19.2% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Product, Sensor, Connectivity, Application and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Wearable Sensor Market Growth Trends

Increasing Popularity of Wearable Devices in Healthcare Industry

The popularity of various wearable gadgets in the healthcare industry has contributed to market revenue development. Furthermore, factors such as continual surveillance, government financing and increased healthcare research and investment are boosting market revenue growth. In June 2023, for example, a team of researchers from the University of Hawaii demonstrated a unique sweat collector built using 3D printing processes, which might lead to the development of inexpensive body-sensing technologies. Wearable biosensors are fast evolving and have the potential to improve healthcare and well-being.

Additionally, these devices may identify biochemical indicators in human blood without annoying treatments, allowing for continuous screening. The data acquired by these biosensors can be extremely useful for illness prediction, diagnosis and therapy, as well as fitness monitoring. Demand for wearable health sensors is also being pushed by the miniaturization of physiological sensors, developments in smart devices with enhanced sensor functions, greater battery sizes and the growing requirement for continuous surveillance in healthcare services.

Increasing Number of Connected Devices

Global Internet penetration has increased dramatically in the last five years. Almost one-third of the world's population currently uses the Internet at greater bandwidths. This has resulted in a rise in the number of Internet-enabled smart gadgets in developing countries. Worldwide smartphone usage increased by 25% in 2014. Smartphones are among the most extensively utilized portable devices in the wearable ecosystem and they are largely used for gathering and tracking data linked to health and fitness for the 0-9 and 60+ age groups.

Furthermore, wearable technology is an important part of platforms such as loT and M2M and these platforms are significant components in the growing number of connected devices around the world.

According to Cisco, there were 6.3 billion individuals and approximately 500 million devices connected to the Internet in 2003. By dividing the number of connected devices by the world population, it was discovered that each individual uses fewer than one (0.08) gadget. With customers' increased concentration on smart gadgets, this estimate is anticipated to be 6.58 devices for a single person by 2020. As a result, the expanding market for platforms such as loT and M2M is expected to expand the breadth of the Wearable Sensor market between 2016 and 2022.

Lack of Connectivity and Uniform Standards for Devices Issues

The market is currently overflowing with smart, Internet-connected products and the number is expanding quickly. The primary condition for enabling effective sensor data and information transmission is standardization. A few businesses have developed standards for sensor communication. For example, the OGC's Sensor Web Enablement (SWE) standards satisfy the need for improved sensor connectivity in both extremely complicated and basic applications.

The thousands of geospatial applications that use the OGC or other standards may easily include this data thanks to the SWE standards. The lack of standardized standards for sensor communication also poses interoperability concerns. Interoperability and the simple sharing of information across connected devices are critical for the evolution of the wearable ecosystem.

Currently, the technological and market situations for wearable technology are not very promising in terms of an architectural solution or a global standard to handle the issue of interoperability. To do this, corporations, organizations and developers will need to invest significant time in understanding the function of security and its value. As a result, the lack of common standards and concerns about interoperability impede the expansion of the overall wearable sensor business.

Wearable Sensor Market Segment Analysis

The global wearable sensor market is segmented based on product, sensor, connectivity, application and region.

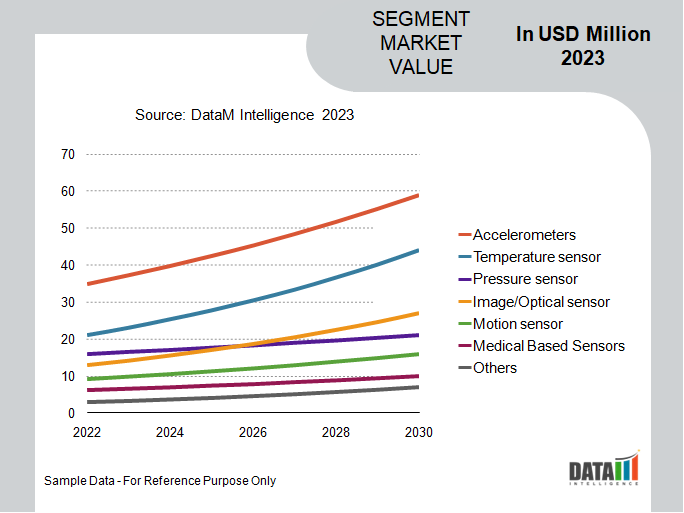

Rising Tracking and Monitoring of User Activity

The accelerometer sensors have seen significant growth covering 23.3% share globally owing to the increasing adoption of wearable technology has been associated with the growth of the type. The tracking and monitoring of user activity is improved when accelerometer sensors are used for motion detection. The supply of fitness and wellness-related data via wrist-worn gadgets with accelerometers is a significant source of commercial growth.

For instance, to analyze and evaluate physician assistants in clinical/laboratory settings or free-living contexts, wearable devices have a growing need for accelerometer sensors. Because there is such a high demand for wearable technology, several industry companies, including NXP Semiconductors NV, Analogue Devices, ST Microelectronics and others, are investing in the manufacturing of advanced accelerometers. For example, in 2022 TDK Corporation launched InvenSense ICM-45xxx SmartMotionTM with BalancedGyroTM technology for consumer applications.

Global Wearable Sensor Market Geographical Share

North America Growing Expansion of Government Funding in the Sports and Fitness Industry

Major manufacturers, technical developments, large disposable incomes and a developed healthcare industry are some of the factors influencing north america. For instance, Penn State University researchers from U.S. created a low-cost wearable sensor employing pencil-on-paper technology in June 2023.

They have developed a sensor with the capacity to monitor a variety of health information, including gas molecules, temperature and electrical impulses, by depositing graphite on paper that has been treated with salt chloride. This technique is especially appealing for large-scale population monitoring in public health programs because of how affordable it is. It allows for the gathering of baseline data across diverse populations or geographic regions, providing thorough health monitoring on a larger scale.

Additionally, the market expansion has also been boosted by the government's significant research funding and recent major growth in the region's sports and fitness industry. Fitbit, Google Glass, e-wristwatches and Microsoft bands are increasingly commonly utilized in the region as a result of the latter factor. The U.S. is one of the most robust marketplaces in north america due to the presence of several OEMs.

In addition, as the usage of wearable technology has increased, the market in the area and notably in U.S. has profited substantially from recent innovations and advancements made by a number of U.S.based companies. Consumers in U.S. have proved that wearables are popular and they are rapidly gaining traction in new industries, including healthcare. For instance, Northwestern University researchers created small wireless biosensors that resemble adhesives that may be used to monitor vital signs without the use of expensive equipment or connections.

Wearable Sensor Companies

The major global players include STMicroelectronics, TE Connectivity, ams AG, Texas Instruments, Maxim Integrated, Bosch Sensortec, TDK Corporation, Analog Devices, Knowles Corporation and Infineon Technologies.

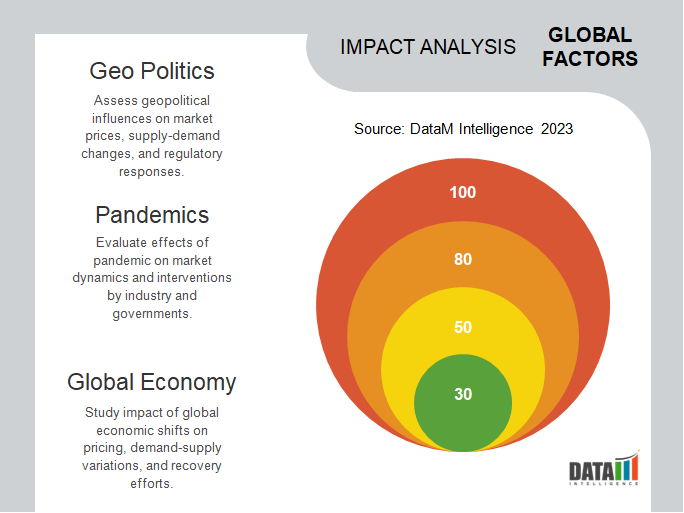

COVID-19 Impact on Wearable Sensor Market

COVID Impact

The COVID-19 pandemic has highlighted the importance of integrating and using our digital infrastructure for remote patient monitoring. We see a need for more robust illness diagnosis and monitoring of individual and group health, which might be facilitated by wearable sensor, as existing viral testing and vaccinations are sluggish to appear. While this technology has been utilized to associate physiological measures with everyday life and human performance, its use in forecasting the occurrence of COVID-19 remains a requirement.

Russia-Ukraine War Impact

Ukraine is home to several electronics manufacturing facilities that produce components and assemble wearable devices. If the conflict escalates and disrupts manufacturing operations in Ukraine, it can impact the production capacity of wearable sensors. Manufacturers may need to find alternative locations for manufacturing, which can result in additional costs and potential delays.

The conflict may affect research and development collaborations between Russian and Ukrainian companies working on wearable sensor technologies. Collaboration and knowledge exchange can be disrupted, leading to a slowdown in innovation and technological advancements in the field.

Key Developments

- On February 2023, STMicroelectronics, a worldwide semiconductor pioneer serving clients across a range of electronics applications, collaborated with 221e srl, an innovator in embedded AI software, leader in intelligent precision sensing and ST Authorised Partner, to provide new AI software and ISPU Smart Sensors.

- On May 6, 2022, Bosch Sensortec is expanding its portfolio of microelectromechanical systems (MEMS) micro speakers with the acquisition of Arioso Systems, a German-based sensor startup. Arioso Systems develops MEMS micro speaker technology that will complement Bosch’s MEMS sensors for wearables and hearables.

- On September 8, 2021, Analogue Devices, Inc. acquired Maxim Integrated Products, Inc. On an estimated basis, the merger improves ADI's position as a high-performance analog semiconductor company, with trailing twelve-month revenue of more than USD 3 billion.

Why Purchase the Report?

- To visualize the global wearable sensor market segmentation based on product, sensor, connectivity, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of wearable sensor market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Technology mapping available as excel consisting of key technologies of all the major players.

The global wearable sensor market report would provide approximately 69 tables, 76 figures and 181 Pages.

Target Audience: 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies