Gerontechnology Market Size and Overview

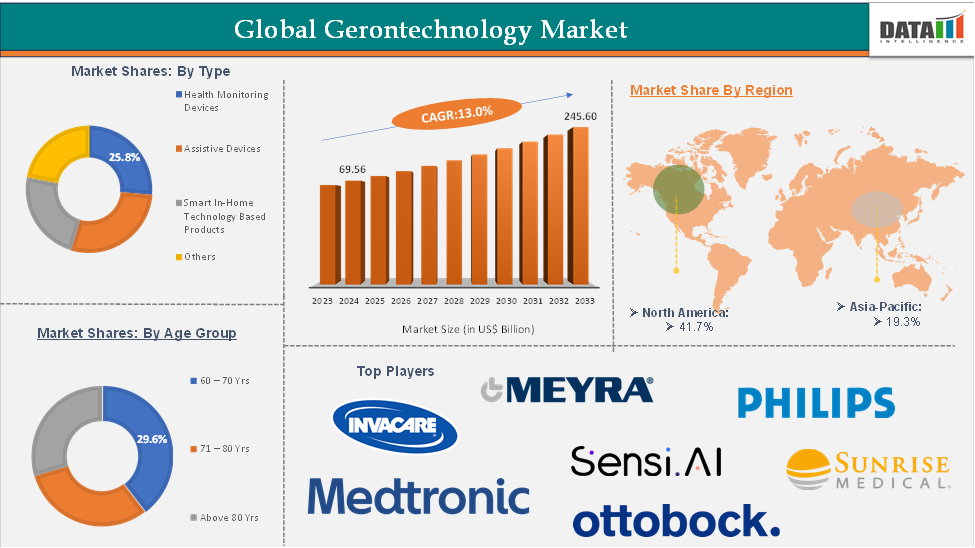

Gerontechnology Market size reached US$ 69.56 Billion in 2024 and is expected to reach US$ 245.60 Billion by 2033, growing at a CAGR of 13.0% during the forecast period 2025-2033.

The gerontechnology market is experiencing significant growth globally, driven by the rapid rise in the aging population and the increasing demand for technologies that support independent, healthy, and dignified aging. This demographic shift is fueling demand for innovative solutions in areas such as health monitoring, mobility aids, and assistive devices.

Technological advancements combined with supportive government policies and rising private sector investments are accelerating the development and adoption of gerontechnology. Key players are introducing cutting-edge products, such as radar-based fall detection systems and eSIM-enabled medical alert devices, to meet the evolving needs of the elderly.

North America currently leads the market due to its strong healthcare infrastructure and early adoption of tech-based eldercare solutions, while Asia-Pacific is emerging as a fast-growing region. With increasing emphasis on aging-in-place and proactive eldercare, the gerontechnology market is poised for robust expansion in the coming years.

Executive Summary

For more details on this report – Request for Sample

Gerontechnology Market Dynamics: Drivers & Restraints

The increasing geriatric population is expected to drive the gerontechnology market

The increasing global geriatric population is a key driver of the growing demand in the gerontechnology market. As people live longer, there is a rising need for innovative technologies that support healthy aging, independent living, and effective elder care. According to the World Health Organization (WHO), by 2030, one in six people globally will be aged 60 years or older, with this number expected to reach 1.4 billion, up from 1 billion in 2020.

By 2050, the elderly population is projected to double to 2.1 billion, with the number of individuals aged 80 and above expected to triple to 426 million. Notably, 80% of older adults by 2050 will reside in low- and middle-income countries, further highlighting the need for scalable, accessible gerontechnology solutions. This demographic shift is occurring at an unprecedented pace, with people aged 60 and older already outnumbering children under five as of 2020.

Combined with advancements in technology and increased funding for aging-related research, this surge in the elderly population is expected to significantly drive the expansion and innovation within the global gerontechnology market.

Strict regulatory compliances are expected to hinder the gerontechnology market

The high cost of gerontechnology products is expected to restrain the growth of the gerontechnology market by limiting accessibility and adoption, especially among price-sensitive consumers and institutions. Advanced devices such as AI-powered health monitors, robotic mobility aids, and smart home systems often involve expensive research, development, and manufacturing processes, resulting in premium pricing. This financial barrier can discourage elderly users, caregivers, and healthcare providers from investing in these technologies.

Gerontechnology Market Segment Analysis

The global gerontechnology market is segmented based on type, age group, end-user, and region.

Product Type:

The health monitoring devices segment is expected to hold 25.8% of the market share in 2024 in the gerontechnology market

The health monitoring devices segment is expected to dominate the gerontechnology market over the forecast period, owing to rapid technological advancements, growing demand for remote care solutions, and strong support from both government regulations and private sector investments.

These devices enable continuous, real-time health tracking, offering seniors greater independence while ensuring timely medical interventions. For instance, in April 2023, AT&T partnered with Cherish Health to develop the Cherish Serenity, an innovative radar-based monitoring device capable of detecting falls and emergencies without the need for cameras or wearables. Using AI and radar technology, combined with AT&T’s cellular network, this device allows older adults to live more independently while staying safe at home.

Similarly, in February 2024, KORE and Medical Guardian introduced the first-ever medical alert device with eSIM technology. This solution ensures 24/7 connectivity by allowing electronic switching between carriers, effectively addressing signal reliability issues and healthcare access disparities, particularly in underserved areas.

Gerontechnology Market Geographical Analysis

North America is expected to hold 41.7% of the market share in 2024 in the global gerontechnology market, with the highest market share

North America is anticipated to maintain its dominance in the global gerontechnology market, driven by a rapidly aging population, robust technological infrastructure, and increasing investments in elderly care innovations.

According to a 2024 journal by the Population Reference Bureau, the number of Americans aged 65 and older is projected to grow from 58 million in 2022 to 82 million by 2050, a 47% increase, raising their share of the population from 17% to 23%. Notably, the number of seniors aged 85 and above, who typically require more intensive care, is expected to nearly quadruple between 2000 and 2040. To address the growing needs of this demographic, companies across North America are accelerating gerontechnological advancements.

For instance, in January 2024, Robooter unveiled its advanced X40 power wheelchair at CES 2024 in Las Vegas. This innovation aims to improve accessibility and independence for the elderly and disabled through smart technologies and strategic partnerships.

Similarly, in April 2023, AT&T partnered with Cherish Health to develop an "industry first" radar-based monitoring device that detects emergencies and fall risks, enabling older adults to live independently while preserving their privacy. These forward-looking innovations demonstrate North America’s strong position and continued leadership in shaping the future of gerontechnology.

Asia-Pacific is expected to hold 21.8% of the global gerontechnology market share in 2024

The Asia-Pacific region is poised to become one of the fastest-growing markets in gerontechnology, driven by a rapidly aging population and increasing demand for elderly care. According to a 2024 report by the Asian Development Bank, the number of individuals aged 60 and above in the region is expected to nearly double to 1.2 billion by 2050, comprising around a quarter of the total population. This demographic shift is significantly boosting the need for innovative healthcare and assistive solutions.

Reflecting this trend, several initiatives across the region are focusing on developing and adopting gerontechnology. For instance, in March 2024, the Singapore University of Social Sciences partnered with SG Assist to establish Singapore's first community-based gerontechnology lab, designed to foster the use and co-creation of assistive technologies in a community setting. Similarly, in India, GreenPioneer Mobility launched 'NonStop' in August 2024. It is a retail concept aimed at providing high-quality mobility aids to the elderly and others with physical limitations through a nationwide network of stores.

Furthermore, on October 10, 2024, Dozee introduced 'Dozee Shravan,' an AI-powered Remote Parent Monitoring system that allows NRIs to remotely and effortlessly track their elderly parents' health in India through continuous, contactless monitoring. These developments underscore how Asia-Pacific is becoming a hub for gerontechnological innovation to meet the evolving needs of its aging population.

Gerontechnology Market Top Companies

Top companies in the gerontechnology market include Invacare Corporation, Karman Healthcare Inc., Ottobock, Pride Mobility Products Corp., Medtronic, Sunrise Medical, Meyra GmbH, Koninklijke Philips N.V., Sensi.AI, Labrador Systems Inc., among others.

Market Scope

Metrics | Details | |

CAGR | 13.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Health Monitoring Devices, Assistive Devices, Smart In-Home Technology-Based Products, Others |

Age Group | 60 – 70 Yrs, 71 – 80 Yrs, Above 80 Yrs | |

| End-User | Hospitals, Old Age Homes, Homecare, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global gerontechnology market report delivers a detailed analysis with 68 key tables, more than 61 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.