Overview

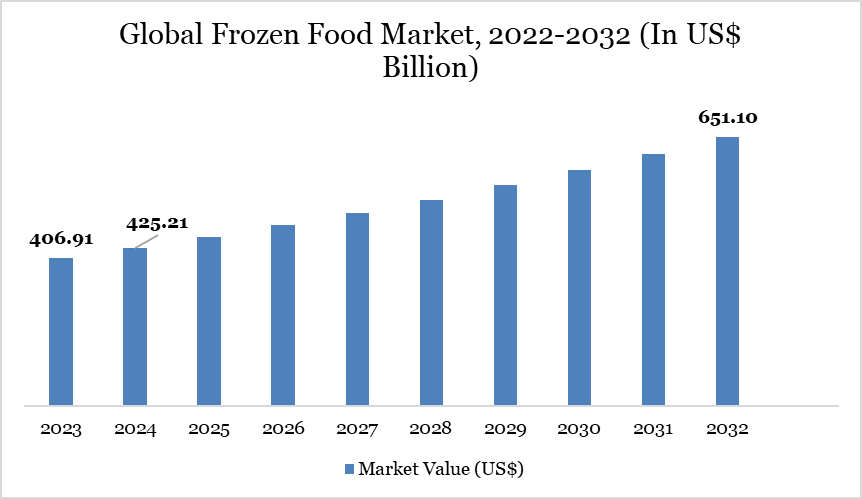

The global frozen food market was approximately US$ 425.21 billion in 2024 and is expected to reach US$ 651.10 billion in 2032 growing at a CAGR of about 5.6% during the forecast period (2024-2032).

The fast-paced lifestyle of consumers, especially in urban areas, has led to increased demand for convenient meal options. Frozen foods offer the advantage of longer shelf life without compromising taste, making them ideal for busy professionals and students. For instance, in an article published in The Food Institute, 2023, stated that in a new survey from Good-natured, 72% of respondents claimed they have consistently purchased or increased their consumption of ready-to-eat meals since the start of the year, including meal kits, grab-and-go, takeout and delivery.

In the second quarter of 2023, for instance, customers placed a record 532 million orders on DoorDash and the gross value of those orders rose 26% to US$ 16.5 billion. Furthermore, total dollar sales for deli-prepared foods and meals reached US$ 24.5 billion in the 52 weeks ending July 23, per Circana, marking a 6.7% increase year-over-year. Additionally, with rising health consciousness, there is an increasing demand for plant-based and organic frozen foods. Consumers seeking vegan, gluten-free and low-calorie options are turning to frozen aisles, where they can find nutritious meals that fit their dietary preferences.

Frozen Food Market Trend

The global frozen food market offers significant growth opportunities by catering to evolving consumer preferences for diverse, health-oriented and specialized dietary products. Expanding the range of international and ethnic frozen foods can attract adventurous eaters and multicultural communities seeking global culinary experiences.

For instance, Trader Joe’s in the US has successfully introduced frozen Asian dumplings and Indian curries, while European markets show growing interest in Mediterranean and Middle Eastern frozen dishes.

Moreover, increasing the availability of organic, low-calorie and nutrient-dense frozen foods can further attract health-conscious consumers, as seen with the popularity of Amy’s Kitchen’s organic frozen meals. By leveraging these opportunities, brands can broaden their consumer base and strengthen market positioning.

Market Scope

Metrics | Details |

By Product Type | Fruits and Vegetables, Meat and Seafood, Bakery Products and Snacks, Ready Meals, Desserts, Beverages, Others |

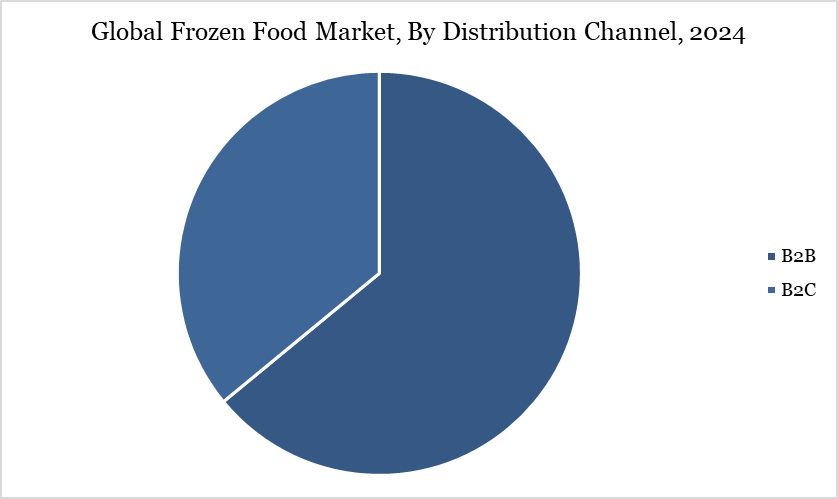

By Distribution Channel | B2B, B2C |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Increasingly Diverse Flavors Continue to Grow in the Frozen Aisle

The increasing availability of diverse flavors in the frozen aisle is significantly driving market growth by catering to evolving consumer palates and global culinary interests. Consumers today seek more than just basic frozen meals; they are exploring unique, international and gourmet flavors that offer restaurant-quality experiences at home.

This driving factor is particularly strong among millennials and Gen Z, who are open to experimenting with global cuisines and fusion dishes. Frozen food manufacturers are responding by introducing products that feature authentic ethnic flavors, regional specialties and premium ingredients.

For instance, Indian-inspired meals such as tikka masala and Japanese flavors like teriyaki are booming, while global street food hit over US$ 543 million in sales according to Circana, LLC, 2022 and younger generations are embracing these adventurous tastes and are 24% more likely to purchase globally inspired products.

Moreover, Trader Joe's in the US offers frozen meals like Butter Chicken with Basmati Rice, Mandarin Orange Chicken and Korean Bulgogi, appealing to consumers who crave Asian flavors. Similarly, IKEA's Swedish Meatballs in the frozen section cater to those interested in Scandinavian cuisine. In India, brands like ITC Master Chef have introduced frozen snacks like Cheesy Corn Triangles and Punjabi Samosas, blending local tastes with modern flavors. Moreover, in Europe, frozen Italian pastas with truffle sauces or seafood paella are gaining popularity, highlighting the demand for gourmet options.

Side Effects Associated with the Products

The global frozen food market faces restraints due to health-related side effects associated with the consumption of certain frozen products. These concerns negatively impact consumer trust and purchasing decisions, especially among health-conscious buyers.

For instance, frozen meals and snacks often contain high levels of sodium, which is used as a preservative and flavour enhancer. Consuming too much sodium can lead to health issues such as high blood pressure, heart disease and stroke. The American Heart Association recommends limiting sodium intake to 2,300 milligrams per day, but many frozen foods contain close to or exceed this amount in a single serving. Regular consumption of high-sodium frozen foods can, therefore pose serious health risks.

Additionally, to enhance flavor, color and shelf life, many frozen foods contain artificial additives and preservatives. These chemicals, such as monosodium glutamate (MSG), artificial colours and synthetic flavorings, can have adverse effects on health. For example, some people may experience allergic reactions, headaches or other symptoms due to these additives.

Moreover, frozen convenience foods, such as pizzas, pies and pastries, often contain trans fats and unhealthy saturated fats. Trans fats, which are created during the hydrogenation process to increase shelf life, are particularly harmful as they raise bad cholesterol (LDL) levels and lower good cholesterol (HDL) levels. This increases the risk of heart disease, stroke and type 2 diabetes. Although some countries have regulations limiting trans fats, many frozen foods still contain significant amounts of unhealthy fats. Thus, the above factors restrain the market growth.

Segment Analysis

The global frozen food market is segmented based on product type, distribution channel and region.

B2B Segment Driving Frozen Food Market

B2B in the global frozen food market was valued at US$ 278.70 billion in 2024 and are expected to reach US$ 412.54 billion by 2032, growing at a CAGR of 5.1% between 2025 and 2032.

The B2B distribution channel holds a significant share in the global frozen food market due to its strong presence in various industries such as hotels, restaurants, catering services and institutional buyers. Bulk purchasing by these sectors ensures steady demand for frozen foods, allowing manufacturers to streamline production and maintain consistent supply chains. Food service providers prefer frozen products for their long shelf life, convenience and cost-effectiveness, reducing waste while ensuring year-round availability of seasonal ingredients. The rise of quick-service restaurants (QSRs) and cloud kitchens has further driven demand, as they rely on pre-prepared frozen ingredients for efficiency.

In September 2021, TGB Group expanded into quick service restaurants (QSRs), cloud kitchens and frozen food exports under its new brand, Samosa & Co., starting with 50 outlets in Gujarat before expanding across India. TGB’s QSRs and cloud kitchens will source frozen food from Manish Somani’s factory in Changodar, with plans to export to the US and other markets. Additionally, TGB has partnered with Radisson Hotel in Kandla for official catering services.

A report from the American Frozen Food Institute (AFFI) reveals that over 40% of food service operators are purchasing more frozen food, with 90% of restaurants incorporating frozen items into their menus. The most popular frozen products include vegetables (83%), potato products (78%) and fruit (76%), while the fastest-growing categories are appetizers (75%), seafood (55%) and vegetables (53%). This growing demand highlights the increasing reliance of the food service industry on frozen food for convenience, consistency and efficiency.

Geographical Penetration

Europe Drives the Global Frozen Food Market

Europe Frozen Food market was valued at US$ 150.18 billion in 2024 and is estimated to reach US$ 219.36billion by 2032, growing at a CAGR of 4.9% during the forecast period from 2025-2032.

The European frozen food industry is witnessing steady growth, driven by changing consumer habits, technological advancements and evolving retail trends. Urban consumers with busy lifestyles increasingly prefer quick, ready-to-eat frozen meals, as they offer convenience, longer shelf life and reduced cooking time. The rise in single and dual-income households has further fueled this demand.

To cater to evolving preferences, brands are expanding premium frozen meal kits, allowing consumers to enjoy restaurant-quality meals at home. Leading retailers like Tesco, Carrefour and Aldi are strengthening their online frozen food offerings, while delivery apps such as Gorillas, Getir and Uber Eats have enhanced frozen food accessibility across Europe.

Product innovation and market expansion remain top priorities for major players like General Mills, Unilever, Nestlé, Tyson Foods and Nomad Foods. Companies are focusing on both online and offline retail channels to maximize reach. For instance, in May 2021, Iceland and The Food Warehouse introduced a Del Monte Frozen Fruit collection, available in physical stores and online.

Sustainability Analysis

Sustainability in the frozen food market focuses on reducing food waste, energy-efficient cold chain logistics and eco-friendly packaging. Frozen foods help cut household food waste by 47%, as reported by the British Frozen Food Federation. Modern cold storage technologies have improved energy efficiency by up to 20%, reducing carbon emissions. Brands are increasingly shifting to recyclable or compostable packaging—over 60% of leading producers now use sustainable materials. Additionally, frozen food extends shelf life, lowering spoilage-related emissions across the supply chain.

Competitive Landscape

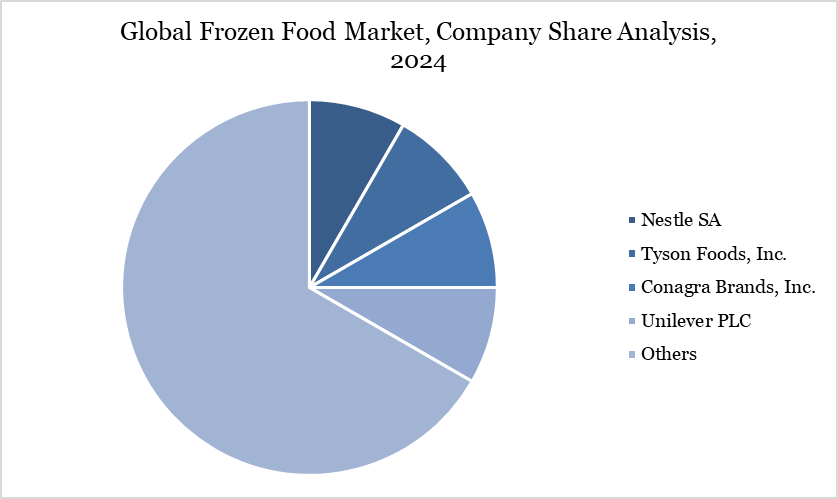

The major global players in the market include Nestlé SA, Tyson Foods, Inc., Conagra Brands, Inc., Unilever PLC, ITC Limited, The Kraft Heinz Company, General Mills, Inc., Nomad Foods, Ltd., Kellanova and Ajinomoto Co., Inc.

Key Developments

In January 2025, Kellanova has partnered with Golden West Food Group to introduce a new line of ice cream flavors inspired by its popular Eggo and Rice Krispies Treats brands. This collaboration aims to expand Kellanova's presence in the frozen dessert category, bringing nostalgic and indulgent flavors to consumers.

In October 2024, The The Kraft Heinz Company Company has extended its licensing agreement with TGI Fridays to continue producing and distributing the brand’s frozen appetizers. This deal allows The The Kraft Heinz Company Company to expand its range of frozen snacks, including popular items like mozzarella sticks and loaded potato skins, leveraging TGI Fridays' well-known restaurant flavors for the retail market.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies