Market Size

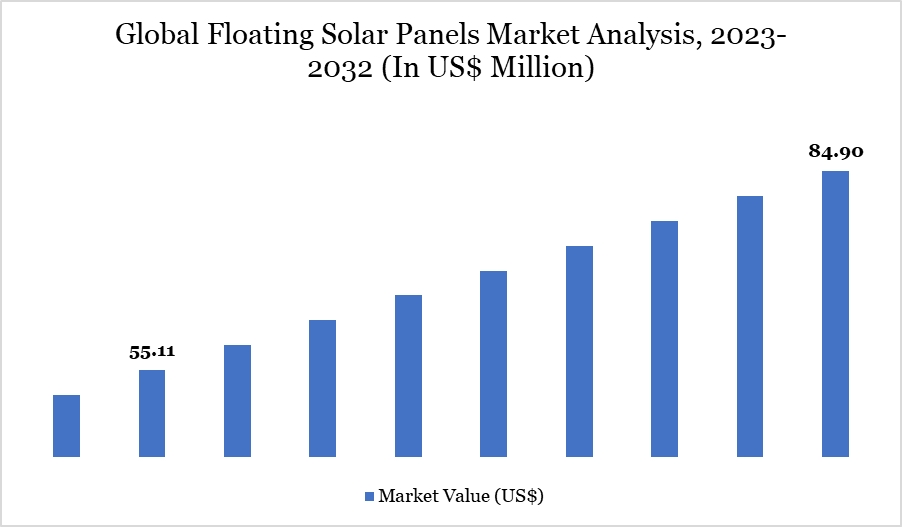

Global Floating Solar Panels Market size reached US$ 55.11 million in 2024 and is expected to reach US$ 84.90 million by 2032, growing with a CAGR of 5.55% during the forecast period 2025-2032.

The global floating solar panels market is experiencing significant growth, driven by technological advancements and the increasing need for efficient land use in renewable energy generation. As of 2022, the installed capacity of floating solar power worldwide reached approximately 13 gigawatts (GW), a substantial increase from 3 GW in 2020. This expansion underscores the rising adoption of floating photovoltaic systems across various regions. The World Bank has identified over 6,600 large bodies of water suitable for floating solar installations, estimating a technical potential exceeding 4,000 GW if just 10% of their surfaces were utilized.

In India, the National Thermal Power Corporation (NTPC) has been instrumental in advancing floating solar projects. The NTPC Ramagundam floating solar power plant in Telangana, fully operational since July 2022, boasts a capacity of 100 megawatts (MW). Similarly, the NTPC Kayamkulam floating solar power plant in Kerala achieved its full capacity of 92 MW by mid-2022. These projects exemplify the country's commitment to integrating innovative renewable energy solutions to meet its growing power demands.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Product Type | Tracking Floating Solar Panels, Stationary Floating Solar Panels | |

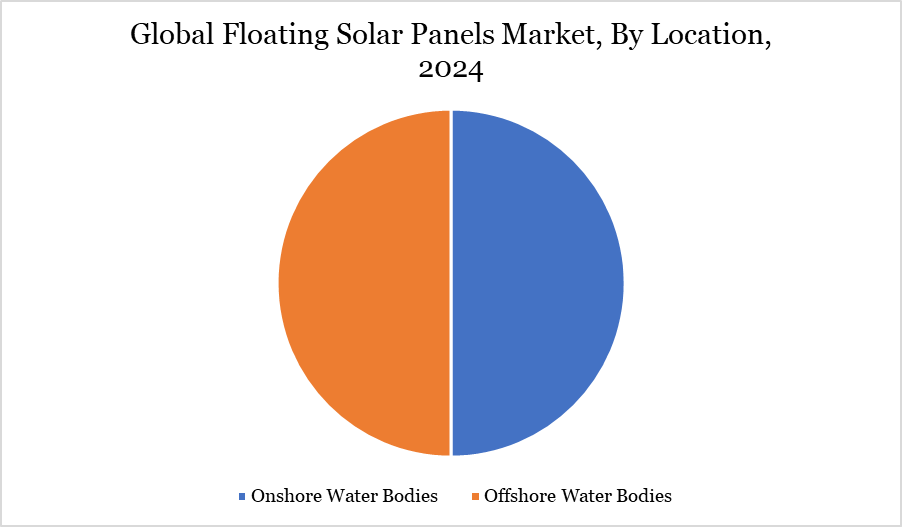

| By Location | Onshore Water Bodies, Offshore Water Bodies | |

| By Technology | Photovoltaic, Concentrated Solar Power (CSP), Concentrator Photovoltaics (CPV), Others | |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Floating Solar Panels Market Trends

Driver – Rising Adoption of Floating Solar to Optimize Land Use Efficiency

The global adoption of floating solar technology is significantly enhancing land use efficiency by utilizing water bodies for energy generation. A 2024 study estimates that deploying floating solar arrays on nearly 68,000 lakes and reservoirs worldwide could generate approximately 1,302 terawatt-hours (TWh) annually, with a conservative 10% surface area coverage. This potential is equivalent to about four times the total annual electricity demand of the United Kingdom. Notably, five countries—Benin, Ethiopia, Kiribati, Rwanda, and Papua New Guinea could meet their entire electricity needs through floating solar installations.

Projections indicate that global floating solar photovoltaic (FPV) capacity will reach 77 gigawatts direct current (GWdc) by 2033, with the Asia-Pacific region accounting for 81% of installations. India, China, and Indonesia are expected to lead this expansion, collectively achieving an installed capacity of 31 GWdc. In Europe, Germany, France, and the Netherlands are anticipated to contribute over 60% of the region's FPV capacity by 2033, despite facing regulatory challenges. These developments underscore the pivotal role of floating solar in optimizing land use and advancing global renewable energy objectives.

Restraint - High Initial Investment and Complex Installation Requirements

High initial investment and complex installation requirements are notable constraints in the floating solar panels market. The World Bank reports that, while floating solar installations offer advantages such as higher energy yield due to the cooling effect of water, they also entail higher up-front costs compared to traditional land-based systems. Additionally, the unique challenges associated with anchoring and mooring floating structures contribute to increased complexity and costs. These factors can deter potential investors and slow the widespread adoption of floating solar technology.

Market Segment Analysis

The global floating solar panels market is segmented based on product type, location, technology and region.

Offshore Floating Solar Projects Driving Market Expansion in the Floating Solar Panels Market

Offshore water bodies are emerging as a crucial segment in the floating solar panels market, driven by the increasing deployment of large-scale renewable energy projects. Countries like Japan, South Korea, and India are investing in offshore floating solar farms to optimize available water surfaces for energy production. According to the Ministry of New and Renewable Energy (MNRE) in India, the government has identified offshore locations with a potential of over 10 GW for floating solar projects. In South Korea, the Saemangeum floating solar farm, expected to generate 2.1 GW of electricity, is a significant step toward offshore solar expansion.

Floating Solar Panels Market Regional Share

Surging Demand for Floating Solar Panels in Asia-Pacific Driven by Large-Scale Renewable Energy Projects

The Asia-Pacific region is experiencing a significant surge in demand for floating solar panels, driven by the need to optimize land use and expand renewable energy capacity. Countries like China, India, and Indonesia are at the forefront of this growth, collectively projected to achieve an installed floating solar capacity of 31 gigawatts direct current (GWdc) by 2033. This accounts for a substantial portion of the anticipated 57 GWdc total capacity in the Asia-Pacific region. In 2024 alone, approximately 1.7 GWdc of new floating solar capacity is expected to become operational in the region.

Several large-scale projects underscore this trend. In India, the Omkareshwar Floating Solar Power Park is being developed on the Omkareshwar Dam reservoir, with a planned capacity of 600 megawatts (MW). As of August 2023, 278 MW had been commissioned, marking it as one of the largest floating solar installations globally. Similarly, the NTPC Ramagundam Floating Solar Power Plant in Telangana, India, reached its full operational capacity of 100 MW in July 2022, spanning 500 acres and utilizing over 400,000 solar panels. These developments reflect the region's commitment to integrating innovative renewable energy solutions to meet growing energy demands and sustainability goals.

Technological Analysis

Floating solar panels, or floating photovoltaic (FPV) systems, represent a significant technological advancement in solar energy deployment. By installing solar panels on water bodies such as lakes, reservoirs, and ponds, FPV systems utilize otherwise underutilized surfaces, thereby conserving valuable land resources. This approach is particularly advantageous in regions with limited available land. Additionally, the natural cooling effect of water enhances the efficiency of solar panels, potentially leading to higher energy yields compared to traditional ground-mounted systems.

Major Global Players

The major global players in the market include Ciel & Terre International, Trina Solar Limited, JA Solar Technology Co., Ltd., Kyocera Corporation, Vikram Solar Limited, Hanwha Q CELLS Co., Ltd., LONGi Green Energy Technology Co., Ltd., Sharp Corporation, Suntech Power Holdings Co., Ltd., and First Solar, Inc.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies