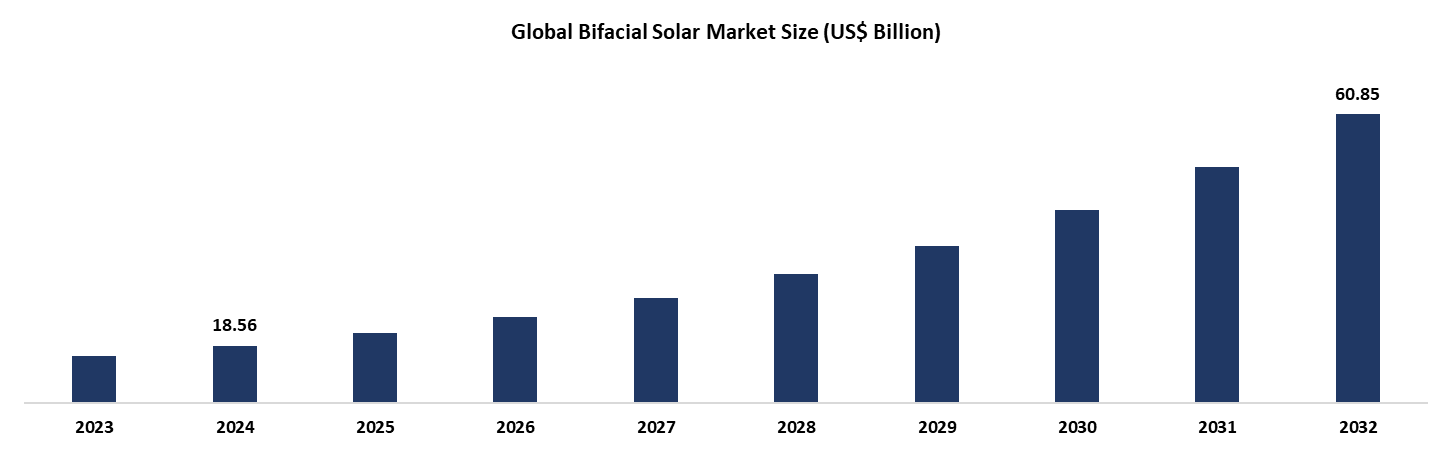

Bifacial Solar Market Size

Global Bifacial Solar Market reached US$ 18.56 billion in 2024 and is expected to reach US$ 60.85 billion by 2032, growing with a CAGR of 16% during the forecast period 2025-2032.

The global bifacial solar market is experiencing rapid expansion, driven by increasing demand for high-efficiency solar energy solutions. Bifacial solar panels generate electricity from both sides, capturing reflected sunlight, leading to enhanced energy output compared to traditional monofacial modules. The market growth is fueled by rising investments in renewable energy, favorable government policies, and advancements in photovoltaic (PV) technologies. According to the International Energy Agency (IEA), global solar capacity is projected to reach between 5,457 and 7,203 GW by 2030, with bifacial technology playing a crucial role in this growth. Key market players are focused on innovation to improve panel efficiency and reduce costs.

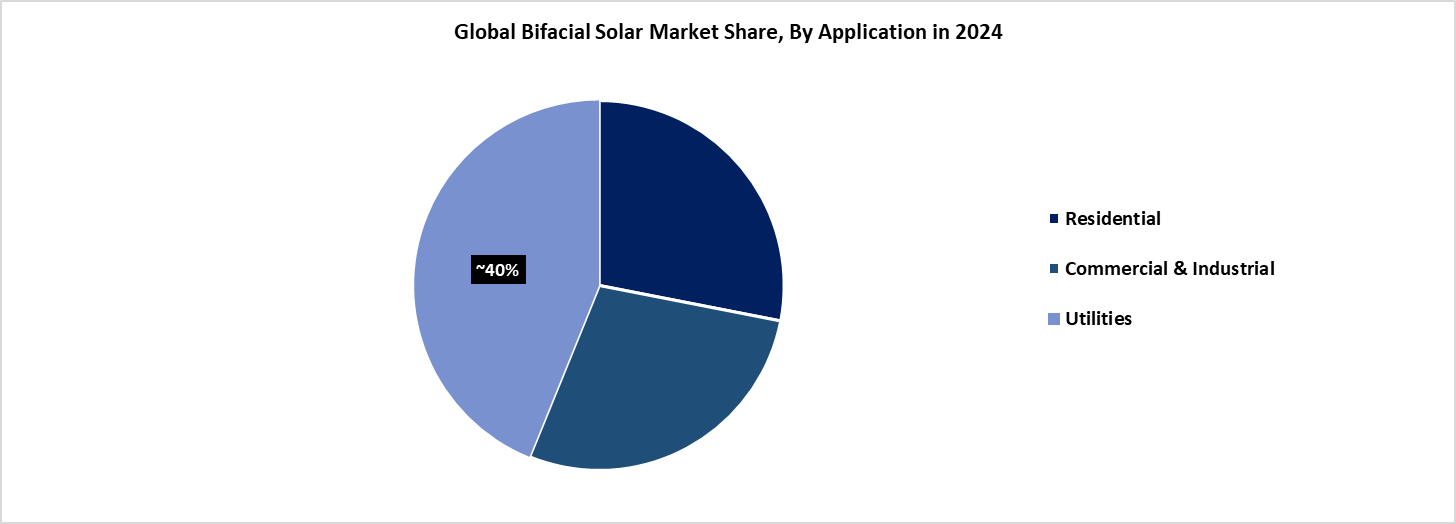

Bifacial Solar Market Segment Outlook (Application)

The Utilities segment expanded from US$ 4.33 billion in 2022 to US$ 4.83 billion in 2023, owing to rising adoption in the global market.

The utility-scale segment dominates the bifacial solar market, accounting for the largest share due to its widespread adoption in large solar farms and power plants. Utility companies prefer bifacial modules because they offer higher energy yield and lower Levelized Cost of Electricity (LCOE) compared to conventional panels. The ability to capture sunlight from both sides increases energy generation by up to 20%, making it an attractive solution for large-scale projects. Several major bifacial solar projects have been commissioned globally. In February 2024, Vikram Solar announced the development of new 725 W bifacial heterojunction PV modules with efficiency levels ranging from 22.53% to 23.34%. Similarly, in January 2024, Tata Power Renewable Energy initiated a 1,000kW bifacial solar project in West Bengal, expected to generate 1.5 million units of energy annually, reducing the carbon footprint by 29,420 lakh tons.

Bifacial Solar Market Regional Overview

Asia-Pacific led the Global Bifacial Solar Market in 2022 with a market size of US$4.65 billion and expanded further to US$5.37 billion in 2023.

Asia-Pacific leads the global bifacial solar market, driven by the rapid expansion of solar infrastructure, supportive government policies, and growing energy demand. China, India, and Japan are the primary contributors to this growth, with significant investments in renewable energy projects. China remains the dominant player in the bifacial solar sector, supported by its robust manufacturing capabilities and ambitious solar energy targets. The country installed over 100 GW of solar capacity in 2023, with bifacial modules comprising a significant share. The Chinese government’s 14th Five-Year Plan prioritizes renewable energy expansion, with bifacial technology playing a crucial role in achieving its carbon neutrality goals by 2060. India is another major market for bifacial solar panels, with the government aiming to achieve 280 GW of solar capacity by 2030. In December 2023, the Indian government introduced new incentives for bifacial solar projects under its Production-Linked Incentive (PLI) scheme, encouraging domestic manufacturing and reducing dependency on imports.

Highest Market Share

Asia-Pacific occupied a market share of ~45% in 2024.

Fastest Growing Market

Asia-Pacific is growing at the fastest CAGR of ~17.5% during the forecast period (2025-2032)

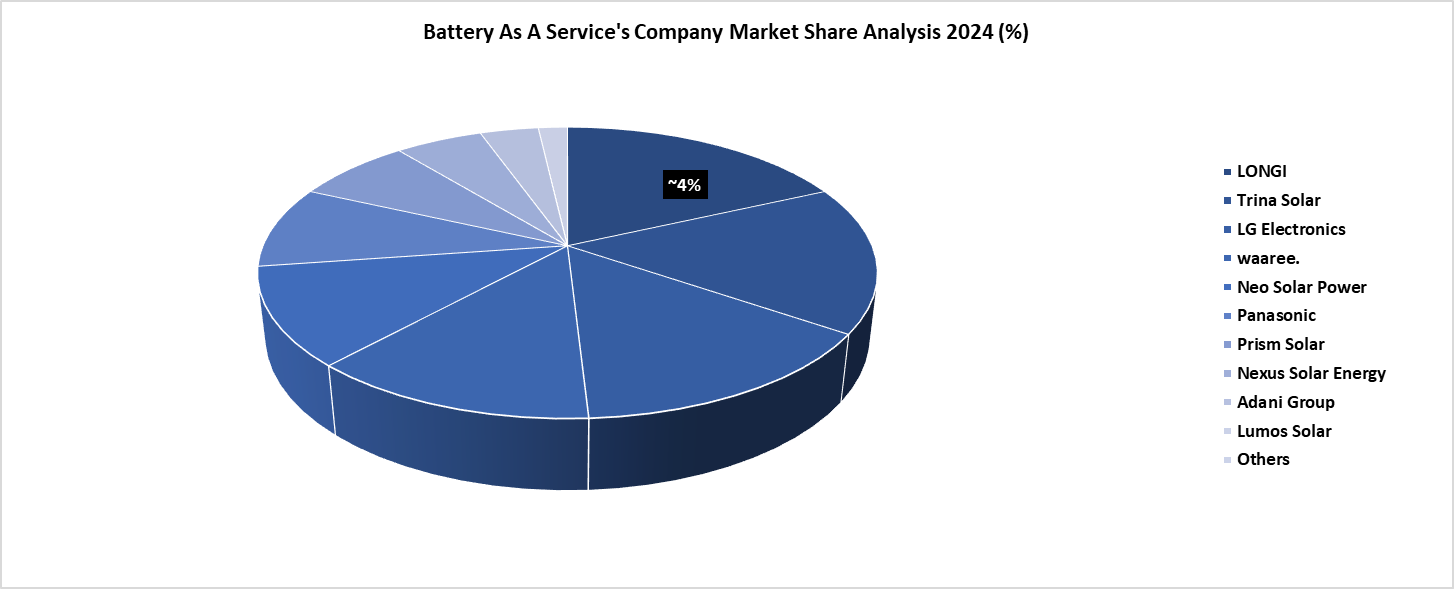

Competitive Landscape in Bifacial Solar Market

The competitive landscape of the Bifacial Solar market is highly competitive, with key players such as LONGI, LG Electronics, and Adani Group dominating the market. Factors influencing competition include technological innovation, strategic partnerships, and regional presence. Companies are focusing on R&D investments to develop next-generation platforms while navigating challenges like high lifecycle maintenance costs and export regulations.

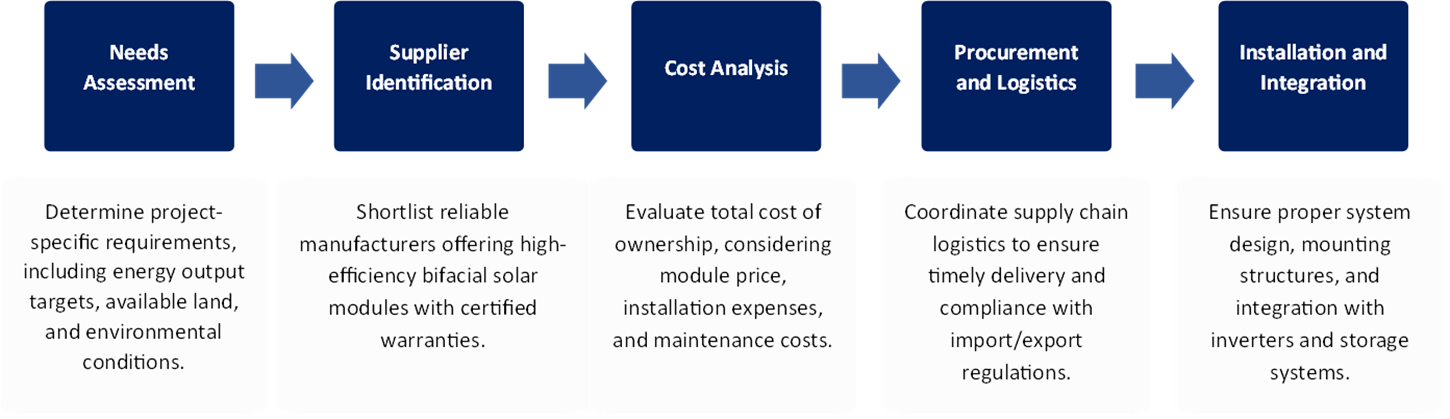

Procurement Analysis for Bifacial Solar

This report provides a comprehensive analysis of the procurement process, covering key phases such as requirement assessment, supplier selection, bid evaluation, contract finalization, and implementation. It includes insights into supplier landscapes, cost-benefit considerations, regulatory compliance, and quality assurance measures. Additionally, the report examines procurement challenges, risk mitigation strategies, and best practices for optimizing supply chain efficiency.

Technological Road Map for Bifacial Solar Market (2025, 2028, 2032)

The technological roadmap outlines the phased development and adoption of emerging technologies within a specific market, covering milestones for innovation, commercialization, and large-scale deployment. It typically includes key targets for production capacity, infrastructure expansion, cost reduction, policy support, and sustainability goals over current, mid-term (4 years), and long-term (8 years) horizons.

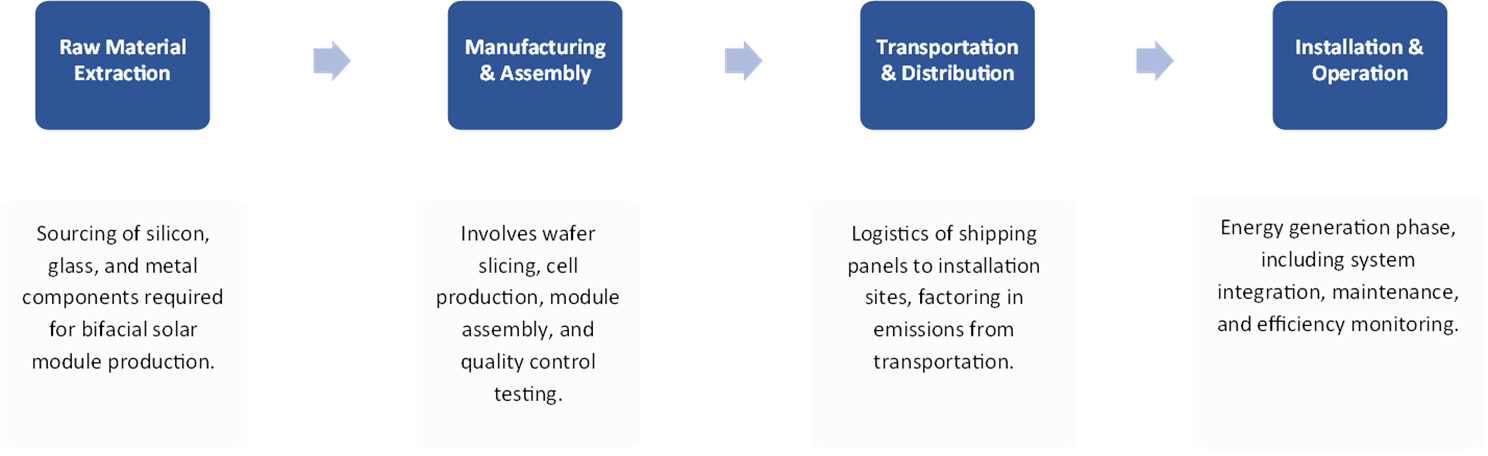

Life Cycle Analysis (LCA) for Bifacial Solar

This report will provide a comprehensive analysis of the hydrogen economy life cycle, covering key aspects such as technical expertise, regulatory compliance, financial stability, product reliability, scalability, and after-sales support. It will include meticulous examination of each phase, considering the specific production methods, storage solutions, distribution logistics, and end-use applications to comprehensively assess environmental and economic impacts.

Insights Covered in This Report:

- Comprehensive market size analysis and year-over-year growth projections.

- Breakdown of market segmentation by panel type, power capacity, frame type, cell technology, application, and region.

- Regional analysis covering North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- Industry dynamics, including key drivers, restraints, opportunities, and impact assessments.

- Covers supplier landscape, procurement strategies, and cost optimization for industry players.

- Highlights potential international markets, trade policies, and key exporting nations.

- Mergers, acquisitions, and key strategic developments shaping the competitive landscape.

- Future outlook and investment opportunities for new and existing market participants.

- Regulatory framework analysis to help businesses navigate compliance challenges.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares, and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Report Updates: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Segment Covered in Bifacial Solar Market

By Panel Type

- Monocrystalline

- Polycrystalline

By Power Capacity

- Upto 200 WP

- 200−400 WP

- Above 400 WP

By Frame Type

- With-Frame Type

- Frameless Bifacial Solar

By Cell Technology

- Passivated Emitter and Rear Contact (PERC)

- Heterojunction

- Topcon

- Others

By Application

- Residential

- Commercial & Industrial

- Utilities

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa