Overview

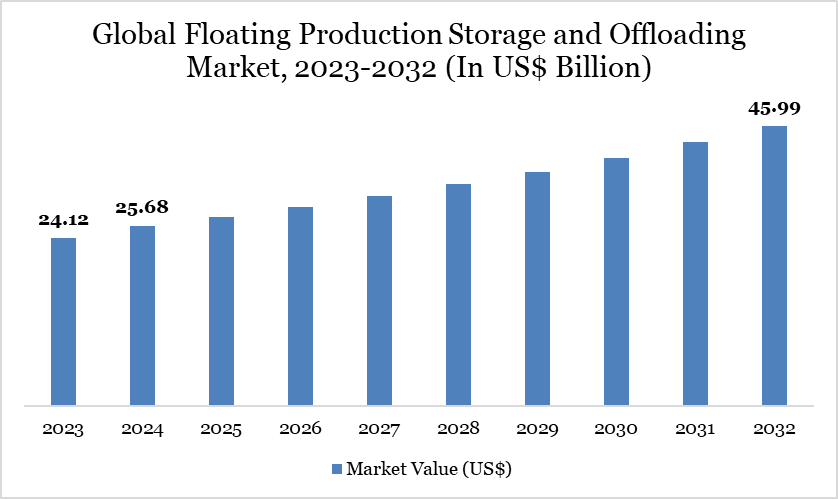

The global market for floating production storage & offloading reached US$ 25.68 billion in 2024 and is expected to reach US$ 45.99 billion by 2032, growing at a CAGR of 7.67 during the forecast period 2025-2032.

The global Floating Production Storage and Offloading (FPSO) market is gaining strong momentum as offshore oil exploration intensifies, driven by global energy demand, cost-effective production solutions, and deepwater field developments. Historical data shows the market value rising from US$ 24.12 billion in 2023 to US$ 25.68 billion in 2024, reflecting steady growth as operators invest in flexible offshore production infrastructure.”

FPSOs like the BW Pioneer offer flexibility and faster deployment compared to fixed platforms, making them ideal for remote or deep-sea projects. With advances in digital monitoring and hull design, FPSOs are becoming more efficient and reliable. Key offshore regions such as the Gulf of Mexico, Brazil, and West Africa continue to drive demand. The market is expected to grow steadily as oil companies seek to optimize operations and tap into untapped reserves.

A recent example is Murphy Oil Corporation’s strategic acquisition of the BW Pioneer FPSO vessel from BW Offshore for US$125 million in March 2025. This move aims to cut Murphy’s annual operating costs by approximately US$60 million while reaffirming its 2025 capital expenditure guidance between US$1,135 million and US$1,285 million.

Floating Production Storage & Offloading Market Trend

The rise of floating LNG (FLNG) projects is a significant trend shaping the FPSO market, as these vessels extend the FPSO concept to natural gas production and liquefaction at sea. With growing global demand for LNG, FLNG units offer a scalable and cost-effective solution for offshore gas fields, especially in remote areas. Their ability to reduce the need for extensive onshore infrastructure enhances project feasibility and lowers environmental impact. This innovation broadens the application of FPSOs beyond oil, boosting overall market demand.

Energy companies are seeking ever larger FPSOs to fulfill growing operational demands. For instance, in early 2023, Petrobras, the Brazilian energy company, recently took delivery of a large new FPSO with a production capacity of 150,000 bpd of oil and 6 million cubic meters of natural gas. The FPSO will be deployed at the Itaipu offshore field off the coast of Brazil and will commence full production by the end of 2023.

Market Scope

Metrics | Details |

By Type | Converted FPSO, New-build FPSO |

By Propulsion | Self-Propelled, Towed |

By Hull Type | Single Hull, Double Hull |

By Application | Shallow Water, Deepwater, Ultra-Deepwater |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

By Type (Converted FPSO, New-build FPSO), By Propulsion (Self-Propelled, Towed), By Hull Type (Single Hull, Double Hull), By Application (Shallow Water, Deepwater, Ultra-Deepwater), By Region (North America, South America, Europe, Asia-Pacific, Middle East and Africa)

Market Dynamics

Increasing Offshore Oil and Gas Exploration and Production

Increasing offshore oil and gas exploration and production is significantly boosting the floating production storage and offloading (FPSO) market. According to the US Department of the Interior, in 2025, liquid fuels demand is expected to rise by 0.8 million barrels per day (b/d), followed by a 1.1 million b/d increase in 2026. This growth is primarily driven by non-OECD countries, which are projected to account for 0.9 million b/d of the increase in 2025 and 1.0 million b/d in 2026. With production stagnating at existing onshore oil and gas fields, energy companies are moving to exploit various offshore oil and gas reserves, particularly in South America, the Middle East, and Africa.

A prime example is Shell’s 2025 revival of the Penguins field in the UK North Sea, where production has resumed using a new state-of-the-art FPSO. Replacing the decommissioned Brent Charlie platform, this FPSO is designed to deliver up to 45,000 barrels of oil equivalent per day. It also integrates environmental improvements, operating with 30% lower emissions. Moreover, it is capable of supplying enough gas to heat 700,000 UK homes, ensuring a balanced energy supply during the transition era.

Regulatory and Environmental Compliance

Regulatory and environmental compliance acts as a significant restraint on the Floating Production Storage and Offloading (FPSO) market due to the complex and evolving nature of offshore oil and gas regulations. Regulatory bodies such as the International Maritime Organization (IMO), US Bureau of Safety and Environmental Enforcement (BSEE), and the European Union Agency for the Cooperation of Energy Regulators (ACER) impose stringent safety, emissions, and environmental impact rules on FPSO operations. Compliance with standards like the IMO's MARPOL Convention for pollution prevention, and SOLAS for safety, requires expensive retrofitting and operational adjustments.

These rules often delay project approvals, extend timelines for commissioning, and increase the overall cost of FPSO deployment. Additionally, regional regulations, such as Brazil’s ANP (Agência Nacional do Petróleo) requirements or Nigeria’s DPR (Department of Petroleum Resources) guidelines, further complicate operations in key offshore markets. Environmental impact assessments (EIAs) and decommissioning liabilities also add to the burden, discouraging investment. As governments tighten climate-related regulations, FPSO operators face increasing pressure to adopt greener technologies, raising both capital and operational expenditures.

Segment Analysis

The global floating production storage & offloading market is segmented based on type, propulsion, hull type, application and region.

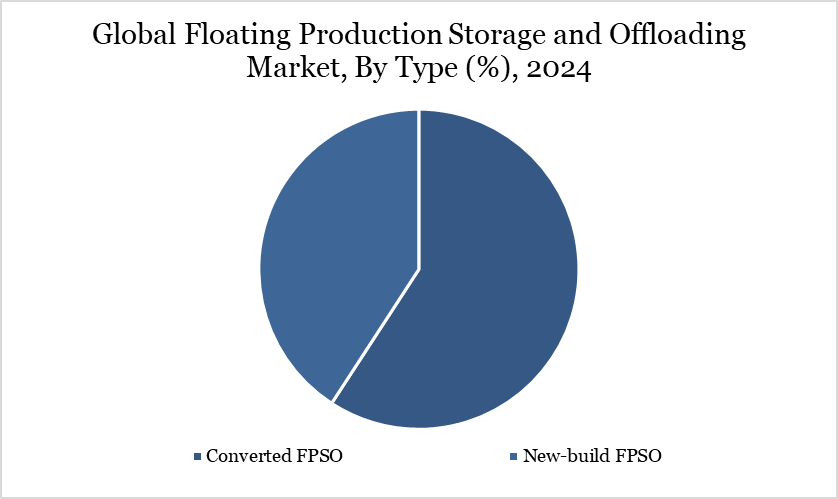

Converted FPSOs Command a Significant Share in the Global FPSO Market Due to Cost-Effectiveness and Faster Deployment

Converted FPSOs hold a significant share in the global Floating Production Storage and Offloading (FPSO) market due to their cost-effectiveness and shorter delivery timelines compared to new builds. These units are typically repurposed from large oil tankers, such as Very Large Crude Carriers (VLCCs), allowing operators to save on hull construction costs.

A notable example is TotalEnergies and its partners initiating the conversion of a VLCC into the all-electric FPSO "Kaminho" for deployment in Angola’s Block 20/11 in April 2025. This marks a pivotal step for Angola, as Kaminho will serve its first-ever deepwater oil and gas project in the Kwanza Basin. The dry dock ceremony, held in Nantong, China, was attended by major stakeholders including Petronas, Sonangol, Saipem, and ANPG, reflecting strong international collaboration.

This project highlights the strategic advantage of converted FPSOs in unlocking untapped offshore reserves. It also showcases innovation in using electrification to reduce emissions and improve efficiency. By leveraging conversion, companies can accelerate project timelines and reduce capital expenditure. As such, converted FPSOs remain a preferred choice, especially in frontier and emerging offshore regions.

Geographical Penetration

South America's Dominance in the FPSO Market Driven by Offshore Oil Developments in Brazil and Guyana

South America has emerged as a dominant force in the global floating production storage and offloading (FPSO) market, driven largely by Brazil’s aggressive offshore exploration and development strategy. On June 17, 2025, Brazil’s National Agency of Petroleum, Natural Gas and Biofuels (ANP) awarded 34 offshore and onshore blocks during its 5th Permanent Concession Offer Cycle, drawing global attention. Energy giants like Petrobras, Shell, ExxonMobil, Chevron, and Equinor secured key assets across prolific basins such as Foz do Amazonas, Santos, and Pelotas. The auction attracted US$250 million in planned exploration investment and shattered expectations with a record-breaking US$180 million signing bonus, over 500% above projections.

This surge in upstream activity underscores the region’s attractiveness for FPSO deployment, given its deepwater potential and need for flexible, cost-efficient production systems. With Brazil leading the charge, South America continues to solidify its position as a strategic hotspot in the global FPSO landscape, attracting technological innovation, investment, and international partnerships.

Technological Advancement Analysis

The floating production storage & offloading (FPSO) market is undergoing a technological transformation driven by the need for greater efficiency, sustainability, and operational resilience. One of the most significant milestones was announced on June 12, 2025, when Petrobras partnered with ABB and Seatrium to develop two next-generation FPSOs—P-84 and P-85—for Brazil’s Atapu and Sépia oil fields. These vessels mark a historic shift, as Petrobras adopts an all-electric FPSO design for the first time. Equipped with electric compressors and motors, the all-electric system is set to enhance energy efficiency, simplify maintenance, and significantly reduce carbon emissions.

Each FPSO will deliver an impressive 225,000 barrels of oil daily and a combined power output of 165MW, requiring sophisticated power management systems. This innovation aligns with broader industry trends, including integrating digital twin technology, AI-powered automation, and real-time data analytics for predictive maintenance. Additionally, using corrosion-resistant materials and hybrid energy systems extends FPSO life cycles and minimizes environmental impact. With companies like Petrobras leading the charge, the FPSO market is setting new standards in clean energy production and offshore performance.

Competitive Landscape

The major global players in the market include MODEC, Inc., Teekay Corporation, SBM Offshore N.V., BW Offshore Limited, Shell, ExxonMobil, Chevron, Bumi Armada, ABB Group, BP plc.

Key Developments

In April 2025, Mitsubishi Heavy Industries (MHI) and SBM Offshore initiated a joint study to evaluate the integration of carbon capture technology into future Petrobras FPSO units. The project will utilize MHI’s Advanced KM CDR Process alongside SBM’s Fast4Ward FPSO design to capture CO₂ emissions from onboard gas turbines.

In February 2025, China unveiled the world’s first FPSO vessel equipped with an integrated carbon capture and storage (CCS) system, marking a major milestone in sustainable offshore oil operations. Built in Shanghai, the ship measures 333 meters long and 60 meters wide, with a production capacity of 120,000 barrels of crude oil per day. What sets it apart is its ability to capture CO₂ emissions during both navigation and oil extraction processes.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies