Overview

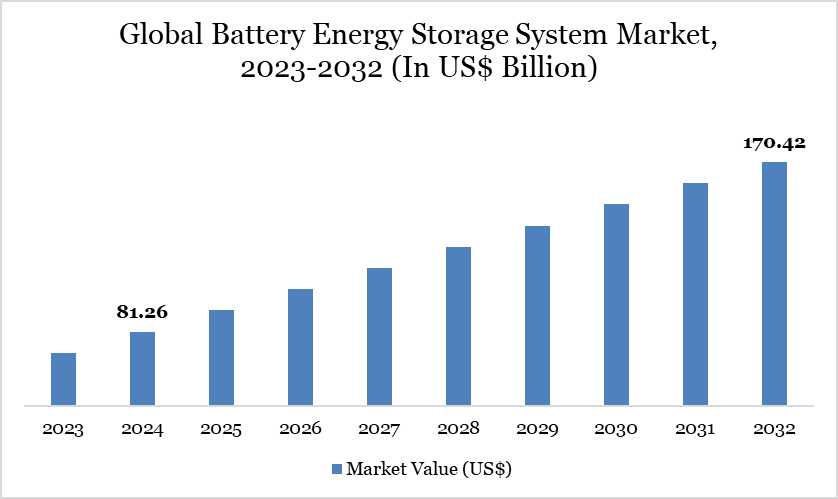

Global Battery Energy Storage System Market reached US$ 81.26 billion in 2024 and is expected to reach US$ 170.42 billion by 2032, growing with a CAGR of 9.70% during the forecast period 2025-2032.

The global battery energy storage system market is witnessing robust growth, driven by the accelerating integration of renewable energy sources, grid modernization efforts, and rising demand for reliable power backup across sectors. For instance, the critical importance of backup power is the National Fire Protection Association (NFPA) 110 mandate, which requires healthcare facilities to restore power to essential life-saving equipment within 10 seconds of an outage.

This regulation ensures uninterrupted operation of critical systems such as ventilators and monitors during emergencies. Similarly, other businesses and infrastructure—such as high-rise buildings—are legally required to have backup power to operate elevators, emergency lighting, and fire alarms, emphasizing the vital role of reliable power continuity in ensuring safety, compliance, and uninterrupted operations. Thus, the BESS market is evolving into a cornerstone of the global clean energy transition, playing a vital role in enabling net-zero targets, enhancing grid reliability, and fostering energy security.

Battery Energy Storage System Market Trend

The solar-based energy storage market is witnessing rapid growth, primarily driven by the dominance of lithium-ion (Li-ion) batteries, which currently hold around 98.8% of the market share. The rise of the EV industry has significantly improved Li-ion technology, boosting efficiency and reducing costs. Lithium battery prices are declining by 8% annually, making solar + storage solutions increasingly affordable and attractive for residential, commercial, and utility-scale use.

A growing trend is the adoption of Energy Storage-as-a-Service (ESaaS), allowing users to access energy storage without large upfront investments. This model offers flexibility and is particularly appealing to businesses and grid operators. At the same time, emerging technologies like flow batteries (developed by NASA) and fuel cells are gaining attention for future deployment, especially for long-duration storage needs.

Government incentives and supportive policies are accelerating deployment globally. The need for grid resilience, backup power, and energy independence is driving demand. Hybrid systems that integrate solar panels with battery storage are becoming the new norm, enabling smarter and cleaner energy usage.

Market Scope

Metrics | Details |

By Battery Type | Lithium-ion Batteries, Lead-acid Batteries, Flow Batteries, Sodium-sulfur (NaS) Batteries, Others |

By Connection Type | On-grid, Off-grid |

By Energy Capacity | Below 500 kWh, 500 kWh to 1 MWh, 1 MWh to 5 MWh, Above 5 MWh |

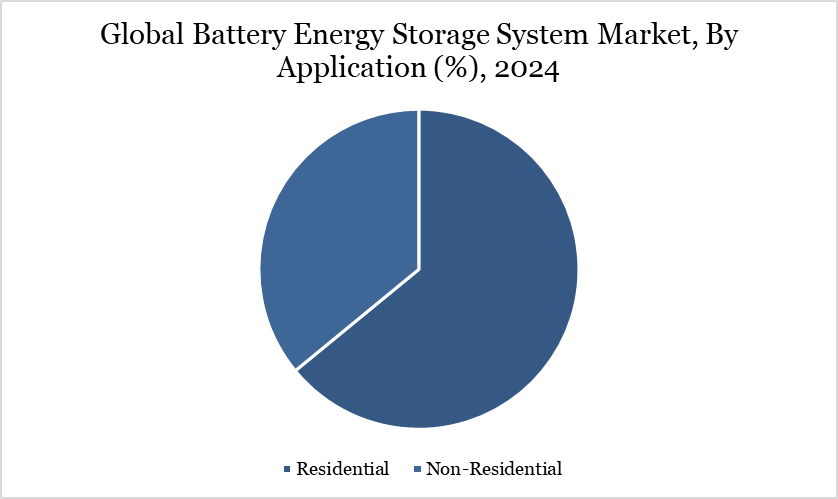

By Application | Residential, Non-Residential |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Strategies Adopted by the Companies

Strategies such as investments, product launches, and strategic partnerships are playing a vital role in driving the growth of the global battery energy storage system (BESS) market. Leading players are heavily investing in R&D to enhance battery performance and reduce costs.

For instance, in 2025, The International Finance Corporation (IFC) has announced a $72 million investment to support Egypt’s first utility-scale battery energy storage system (BESS), in partnership with AMEA Power and the Egyptian government, marking a major milestone in the country’s transition to clean energy. This is the first project of its kind under Egypt’s fast-track 4GW Emergency Renewable Energy Program, designed to meet rising electricity demand through clean, competitive energy sources and reduce reliance on imported natural gas.

Additionally, on 21 May, 2025, ABB had launched of its new Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service) – a flexible, zero-CapEx solution designed to accelerate the shift to clean, resilient and affordable energy. BESS-as-a-Service is the first in a range of next generation service models being developed to remove the barriers to clean technology adoption and accelerate industries’ transition to net zero. These strategies not only accelerate technological advancements but also strengthen market penetration, improve supply chain reliability, and increase end-user adoption—collectively propelling overall market expansion.

High Initial Investment Costs

The high initial cost of battery energy storage systems (BESS) remains a significant barrier to widespread adoption and market growth. Despite declining battery prices, the upfront expenses involved in procuring and installing advanced lithium-ion systems—including battery packs, power conversion systems, thermal management, and integration with renewable sources—can be substantial. This is particularly challenging for small businesses, residential users, and organizations in developing regions with limited access to financing or incentives.

The cost burden is further amplified in large-scale utility projects, where installation, grid connection, and regulatory compliance add to capital expenditure. As a result, many potential users delay adoption or opt for traditional energy backup solutions, slowing down the pace of deployment. Without broader financial support mechanisms such as subsidies, favorable loans, or leasing models, the high initial cost continues to hinder market expansion and limit the transition to clean, reliable energy storage solutions.

Segment Analysis

The global battery energy storage system market is segmented based on battery type, connection type, energy capacity, application and region.

Residential Energy Storage: Empowering Homes and Driving Market Growth

The residential segment is emerging as a key driver in the battery energy storage system (BESS) market, fueled by rising electricity costs, increasing solar panel installations, and the growing need for energy independence. Homeowners are increasingly adopting solar + storage systems to reduce reliance on the grid and ensure backup power during outages. For instance, Tesla’s Powerwall has gained significant traction in the U.S. and Europe, enabling households to store excess solar energy and use it during peak hours or blackouts.

Similarly, in countries like Germany and Australia, government incentives and feed-in tariff reforms have encouraged residential energy storage adoption at scale. These systems not only enhance energy efficiency but also allow consumers to participate in demand response programs, contributing to grid stability. As awareness of sustainability and resilience grows, the residential segment continues to expand, playing a critical role in decentralizing power infrastructure and accelerating the global shift toward clean energy.

Geographical Penetration

Asia-Pacific: Powering the Surge in Global Battery Energy Storage Adoption

Asia-Pacific (APAC) region is a major driver of growth in the global battery energy storage system (BESS) market, supported by rapid urbanization, growing electricity demand, and strong government backing for renewable energy adoption. Countries like China, Japan, South Korea, and India are leading investments in solar and wind energy, creating a strong demand for efficient storage solutions.

For instance, China, which dominates global battery production, has implemented large-scale energy storage projects to support its ambitious carbon neutrality goals. In Japan, government-subsidized residential storage programs and disaster-resilient energy initiatives have accelerated the deployment of home battery systems.

Meanwhile, India has launched national tenders for grid-scale battery storage to support its solar energy targets under the National Energy Storage Mission. The presence of major battery manufacturers such as CATL, BYD, LG Energy Solution, and Samsung SDI also strengthens the region’s supply chain capabilities. Thus, APAC’s proactive policies, large-scale renewable installations, and manufacturing strength position it as a critical growth engine in the global BESS market.

Sustainability Analysis

The sustainability analysis of the battery energy storage system (BESS) market highlights both its environmental benefits and areas of concern. On the positive side, BESS plays a crucial role in enabling the integration of renewable energy sources like solar and wind, reducing dependence on fossil fuels and lowering greenhouse gas emissions. By storing excess clean energy and supplying it during peak demand, BESS enhances grid efficiency and supports the transition to a low-carbon energy ecosystem.

However, sustainability challenges remain, particularly around the extraction and sourcing of raw materials such as lithium, cobalt, and nickel, which can have environmental and ethical implications. Additionally, the end-of-life management of batteries poses risks, as recycling infrastructure for lithium-ion systems is still developing in many regions. To address these concerns, industry players are investing in green battery technologies, improving energy density, and promoting closed-loop recycling systems.

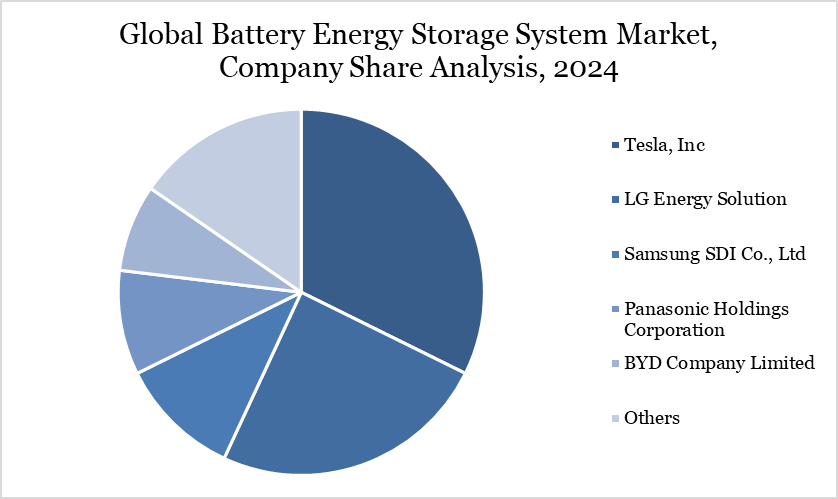

Competitive Landscape

The major global players in the market include Tesla, Inc, LG Energy Solution, Samsung SDI Co., Ltd, Panasonic Holdings Corporation, BYD Company Limited, Contemporary Amperex Technology Co. Limited (CATL), ABB Ltd, Hitachi Energy Ltd, Siemens Energy AG, General Electric (GE) and among others.