Expectorant Drugs Market Size

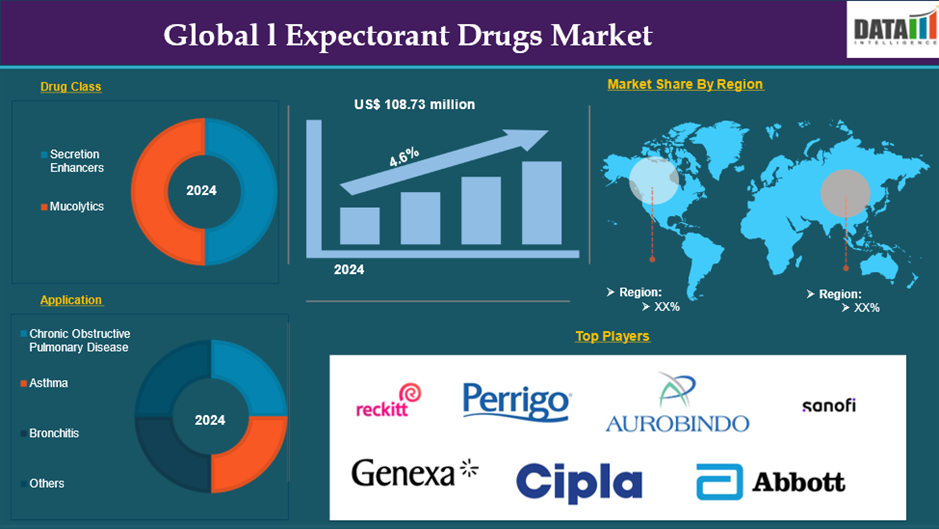

The Global Expectorant Drugs Market reached US$ 108.73 million in 2024 and is expected to reach US$ 156.15 million by 2033, growing at a CAGR of 4.6 % during the forecast period 2025-2033.

The global expectorant drugs market encompasses the segment of the pharmaceutical industry dedicated to medications that facilitate the expulsion of mucus from the respiratory tract. These drugs are primarily utilized to alleviate symptoms associated with respiratory conditions such as bronchitis, asthma, and chronic obstructive pulmonary disease (COPD) by promoting mucus clearance and easing cough and congestion. Expectorants enhance bronchial secretions or reduce mucus viscosity, making it easier for patients to cough up phlegm. A common active ingredient in these medications is guaifenesin, known for its effectiveness in thinning mucus.

The global expectorant drugs market plays a vital role in respiratory healthcare by providing effective treatments that enhance breathing comfort for patients suffering from various respiratory ailments. Ongoing innovations in drug formulations and delivery mechanisms, along with a growing emphasis on early intervention and preventive healthcare practices, are anticipated to further drive market expansion in the coming years.These factors have driven the global expectorant drugs market expansion.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising Prevalence of Respiratory Disorders

The rising prevalence of respiratory disorders is significantly driving the growth of the global expectorant drugs market and is expected to drive throughout the market forecast period.The increasing incidence of chronic respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, and bronchitis, significantly drives growth in the global expectorant drugs market. This trend underscores a growing public health concern, as millions of individuals are affected by these conditions worldwide.

According to the Centers for Disease Control and Prevention (CDC) data in 2023, chronic respiratory diseases rank among the leading causes of morbidity and mortality globally. The burden of these diseases is reflected in healthcare utilization patterns. COPD is noted in about 4.2% of visits to office-based physicians, indicating that it is a common reason for seeking medical attention. Furthermore, there were over 791,000 visits to emergency departments where COPD was the primary diagnosis, underscoring the acute exacerbations many patients experience.

Patients suffering from conditions like COPD and asthma often experience symptoms such as cough and congestion due to excessive mucus production. Expectorant medications are crucial in managing these symptoms by promoting mucus clearance from the airways, thereby improving patient comfort and quality of life.

Furthermorew, key players in the industry innovative launches sthat would drive this global expectorant drugs market.For instance, in November 2023, Mucinex, a brand under Reckitt, launched the "Flip the Script" campaign to raise awareness about the misuse of antibiotics, particularly concerning their application in treating cold and flu symptoms. This initiative aims to inform consumers about the risks associated with inappropriate antibiotic use, which significantly contributes to antibiotic resistance—a pressing public health issue.All these factors demand the global expectorant drugs market.

Moreover, the rising demand for the research and development advancements contributes to the global expectorant drugs market expansion.

Stringent Regulatory Compliance

The stringent regulatory compliance will hinder the growth of the global expectorant drugs market.One of the primary challenges in the expectorant drugs market is navigating the complex regulatory landscape. Stringent approval processes established by health authorities can delay the development, manufacturing, and commercialization of expectorant medications. Companies are required to invest substantial resources to ensure compliance with evolving regulations, which can prolong market entry timelines and increase costs.

Meeting rigorous regulatory requirements, including safety assessments and efficacy validations, poses significant hurdles for manufacturers. The need for continuous adaptation to changing standards can lead to delays in product approvals and hinder the timely introduction of new expectorant drugs.Thus, the above factors could be limiting the global expectorant drugs market's potential growth.

Market Segment Analysis

The global expectorant drugs market is segmented based on drug class, route of administration, application, end-user, and region.

Drug Class:

The secretion enhancers segment is expected to dominate the global expectorant drugs market share

The secretion enhancers segment holds a major portion of the global expectorant drugs market share and is expected to continue to hold a significant portion of the global expectorant drugs market share during the forecast period. The global expectorant drugs market features a segment dedicated to secretion enhancers, which are essential for managing respiratory conditions by promoting mucus clearance. This segment includes several key compounds includes guaifenesin, potassium citrate, potassium iodide, and ammonium chloride.

Guaifenesin is one of the most widely utilized expectorants. It works by increasing the volume and reducing the viscosity of mucus in the airways, thereby facilitating easier expulsion of phlegm. This action effectively relieves chest congestion associated with colds and respiratory infections. Due to its proven effectiveness and favorable safety profile, guaifenesin is a popular choice in both prescription and over-the-counter (OTC) medications, significantly contributing to overall market growth.

Potassium citrate primarily used to manage urinary conditions, potassium citrate also functions as a secretion enhancer. It helps maintain alkaline urine, which may indirectly support respiratory health by promoting mucus clearance.Potassium iodide acts as an expectorant by stimulating mucus secretion in the respiratory tract. It is often used for chronic bronchitis or other conditions where increased mucus production is necessary.Ammonium chloride is another effective expectorant that aids in thinning and loosening mucus in the airways, making it easier to expel through coughing.

Furthermore, key players in the industry product launches and approvals that would drive this segment growth in the global expectorant drugs market.For instance, in August 2022, Granules India Limited obtained approval to sell a new over-the-counter (OTC) medication that combines Guaifenesin and Pseudoephedrine Hydrochloride in extended-release tablet formulations of 600 mg/60 mg and 1200 mg/120 mg. This medication is intended to relieve symptoms associated with respiratory issues, including those stemming from the common cold, allergies, and other upper respiratory tract infections (URTIs).

Also, in September 2023, Genexa introduced two new over-the-counter (OTC) cough and cold medications tailored for children: the Kids' Multi-Symptom Cold & Flu and the Kids' Daytime + Nighttime Cough Relief Value Pack. These products are designed to offer parents effective and clean alternatives in the children's medicine section, especially with the cold and flu season approaching.These factors have solidified the segment's position in the global expectorant drugs market.

Market Geographical Analysis

North America is expected to hold a significant position in the global expectorant drugs market share

North America holds a substantial position in the global expectorant drugs market and is expected to hold most of the market share.

The North America Expectorant Drugs Market is experiencing substantial growth, driven by several key factors that underscore the rising demand for effective treatments for respiratory conditions. The region has a significant incidence of respiratory conditions, including chronic obstructive pulmonary disease (COPD), asthma, and bronchitis. For instance, approximately 4.6% of adults in the U.S. reported being diagnosed with COPD, emphysema, or chronic bronchitis in 2022. This high prevalence creates a strong demand for expectorant medications to alleviate symptoms such as cough and congestion.

Increasing levels of air pollution contribute significantly to respiratory health issues. The correlation between environmental factors and respiratory diseases necessitates greater access to medications that can help manage symptoms exacerbated by poor air quality. The presence of leading pharmaceutical companies in North America, along with significant investments in research and development, drives innovation in expectorant formulations. New product launches and advancements in drug efficacy contribute to market expansion by providing patients with more effective treatment options.

Furthermore, in the region, a major number of key players presence, well-advanced healthcare infrastructure, and product launches & approvals that would drive this global expectorant drug market growth. For instance, in August 2023, Marksans Pharma received approval from the U.S. Food and Drug Administration (FDA) for its Guaifenesin Extended-Release Tablets, available in 600 mg and 1200 mg dosages. These tablets are formulated to alleviate cough and chest congestion by loosening phlegm (mucus) and thinning bronchial secretions, which helps clear the bronchial passages of bothersome mucus and makes coughs more productive. Thus, the above factors are consolidating the region's position as a dominant force in the global expectorant drugs market.

Asia Pacific is growing at the fastest pace in the global expectorant drugs market share

Asia Pacific holds the fastest pace in the global expectorant drugs market and is expected to hold most of the market share. The APAC region is witnessing a rising incidence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and bronchitis. As urbanization progresses and environmental factors contribute to respiratory issues, there is a critical demand for expectorant medications to alleviate symptoms like cough and mucus production.

Rapid urbanization in countries like India, China, and various Southeast Asian nations leads to increased exposure to air pollution and other environmental stressors that exacerbate respiratory conditions. This trend necessitates greater access to medications that can effectively manage symptoms associated with these ailments. Many countries in the APAC region are investing in healthcare infrastructure improvements, enhancing access to medications, including expectorants. As healthcare systems expand, patients are more likely to seek treatment for respiratory conditions, thereby boosting market growth.

Furthermore, in this region, key players launch that would drive this global expectorant drug market growth. For instance, in March 2024, Shionogi Healthcare launched an over-the-counter (OTC) version of Mucodyne, an expectorant that contains L-carbocysteine. This product was designed to help relieve symptoms associated with excessive mucus production, such as cough and chest congestion. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global expectorant drugs market.

Major Global Players

The major global players in the expectorant drugs market include Reckitt Benckiser Group plc., Perrigo Company plc, Aurobindo Pharma, Sanofi, Genexa Inc., Cipla., Abbott, Marksans Pharma Ltd., and Granules India Limited. among others.

Key Developments

- In September 2024, Mucinex introduced the Mucinex Sinus Saline Nasal Spray, marking it as the first non-medicated saline nasal spray to utilize Power Jet Technology. This innovative product is specifically designed to alleviate sinus-related symptoms, particularly congestion caused by allergies, colds, or dryness.

- In February 2024, Mucinex introduced "The Mucus Masher," an innovative online gaming experience that allows players to creatively crush Mr. Mucus, the brand's iconic mascot symbolizing coughs, colds, and congestion. This innovative game combines health awareness with entertainment by utilizing advanced artificial intelligence (AI) technology.

| Metrics | Details | |

| CAGR | 4.6% | |

| Market Size Available for Years | 2023-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Drug Class | Secretion Enhancers, Mucolytics |

| Route of Administration | Oral, Injectable, Inhalation | |

| Application | Chronic Obstructive Pulmonary Disease, Asthma, Bronchitis, Others | |

| End-User | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global expectorant drugs market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.