Disposable Endoscopes Market Size and Growth

The global disposable endoscopes market size reached US$ 2.35 billion in 2023, with a rise of US$ 2.70 billion in 2024, and is expected to reach US$ 8.94 billion by 2033, growing at a CAGR of 14.4% during the forecast period 2025-2033. The market is expected to witness strong growth due to the increasing adoption of disposable endoscopic devices to reduce cross-contamination risks and improve cost-efficiency in clinical settings.

Key Market Trends & Insights

North America accounted for 38.6% of the global disposable endoscopes market in 2024 and is expected to maintain a significant share over the forecast period.

Asia Pacific is expected to emerge as the fastest-growing region, driven by increased healthcare investments and rising awareness about infection control.

By Product Type, the gastrointestinal endoscopes segment held the largest market share in 2023, owing to the rising prevalence of GI disorders and demand for minimally invasive diagnostic tools.

By Application, diagnostic procedures dominated the market due to higher utilization of disposable endoscopes in routine examinations and screenings.

Market Size & Forecast

2024 Market Size: USD 2.70 Billion

2033 Projected Market Size: USD 8.94 Billion

CAGR (2025–2033): 14.4%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics: Drivers & Restraints

Driver: Regulatory Support & Guidelines Favoring Disposable Devices

Regulatory support and evolving guidelines are expected to be a significant driver for the disposable endoscopes market, as global health authorities increasingly emphasize infection prevention and patient safety. Agencies like the FDA, CDC, and European Centre for Disease Prevention and Control (ECDC) have raised concerns over persistent contamination risks associated with reusable endoscopes, even after high-level disinfection. The FDA has recommended using duodenoscopes with disposable components or fully disposable models to minimize infection transmission. Such endorsements have legitimized the clinical value of disposable scopes and accelerated their adoption across hospitals, especially in critical care and immunocompromised patient settings.

As regulatory bodies continue tightening sterilization protocols and mandating traceability, healthcare facilities increasingly view disposable devices as a compliance-friendly, cost-predictable, and low-risk alternative, fueling sustained market growth.

Restraint: High Costs Compared to Reusable Scopes

High costs compared to reusable scopes can significantly hinder the growth of the market, particularly in cost-sensitive healthcare systems. While disposable devices offer clear benefits in terms of infection control and convenience, their higher per-procedure cost can be a barrier to widespread adoption.

For more details on this report, Request for Sample

Market Segmentation Analysis

The disposable endoscopes market is segmented based on product type, application, end-user, and region.

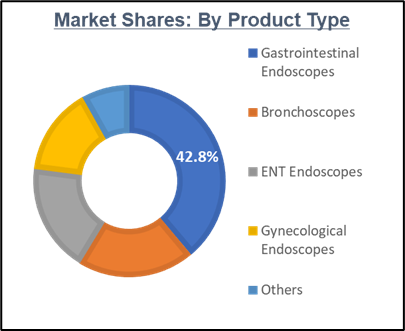

Product Type—The gastrointestinal endoscopes segment is estimated to have 42.8% of the disposable endoscopes market share.

The gastrointestinal (GI) endoscopes segment is expected to dominate the market due to the high volume of GI procedures performed globally and the significant infection control risks associated with traditional reusable scopes. Conditions like colorectal cancer, gastric ulcers, GERD, and inflammatory bowel disease drive millions of endoscopic procedures annually. Traditionally, these have relied on reusable endoscopes, which require complex and time-consuming reprocessing.

Regulatory bodies such as the FDA have highlighted duodenoscopes in particular as high-risk for infection transmission, recommending the adoption of devices with disposable components or entirely disposable models. Moreover, with the growing elderly population, increased screening programs, and the expansion of ambulatory surgical centers (ASCs) that favor low-maintenance devices, demand for disposable GI scopes is accelerating. The segment is also benefiting from technological advancements, such as high-definition disposable gastroscopes and colonoscopes, which now offer comparable imaging quality to reusable models. Collectively, these factors position the GI segment as the dominant force in the disposable endoscopes market.

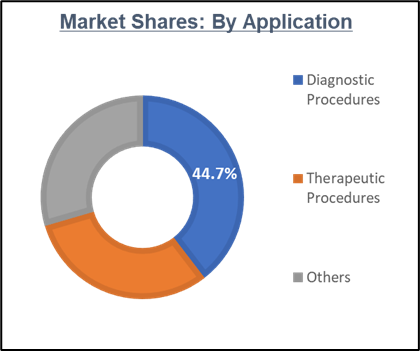

Application—The diagnostic procedures segment is estimated to have 44.7% of the disposable endoscopes market share

Diagnostic procedures are expected to hold a significant position in the market due to their high frequency, lower procedural complexity, and increasing demand for safe, efficient, and cost-effective tools. These procedures are often performed in outpatient settings, emergency departments, and ICUs, where rapid turnaround and infection control are critical. Disposable endoscopes are ideal for diagnostics as they eliminate the need for sterilization, reduce the risk of cross-contamination, and streamline workflow.

Market Geographical Share

The North America disposable endoscopes market was valued at 38.6% market share in 2024

North America is expected to hold a dominant position in the market due to a combination of strong regulatory support, high healthcare spending, and a well-established infrastructure for advanced medical technologies. The region, particularly the United States, has been at the forefront of adopting disposable endoscopy solutions, driven by heightened awareness of hospital-acquired infections (HAIs) and growing emphasis on infection prevention protocols. The FDA’s active recommendations for the use of disposable scopes have accelerated market adoption.

In addition, the presence of major players such as Boston Scientific, Olympus Corporation, Cook, and Teleflex Incorporated, along with a high volume of gastrointestinal, pulmonary, and urological procedures, ensures consistent demand. The region also benefits from favorable reimbursement policies, strong investment in R&D, and the rapid expansion of ambulatory surgical centers (ASCs), which prefer disposable devices due to lower upfront costs and operational simplicity. These factors collectively position North America as the largest and most mature market for disposable endoscopes globally.

Market Major Players

The major players in the disposable endoscopes market include Medtronic, Boston Scientific Corporation, KARL STORZ, FUJIFILM Corporation, Olympus Corporation, Cook, Teleflex Incorporated, PENTAX Medical, among others.

Disposable Endoscopes Market Scope

Metrics | Details | |

CAGR | 14.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Gastrointestinal Endoscopes, Bronchoscopes, ENT Endoscopes, Gynecological Endoscopes, Others |

Application | Diagnostic Procedures, Therapeutic Procedures, Others | |

| End-User | Hospitals, Ambulatory Surgical Centers (ASCs), Clinics, and Diagnostic Centers |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here