Oncology Information Systems Market: Industry Outlook

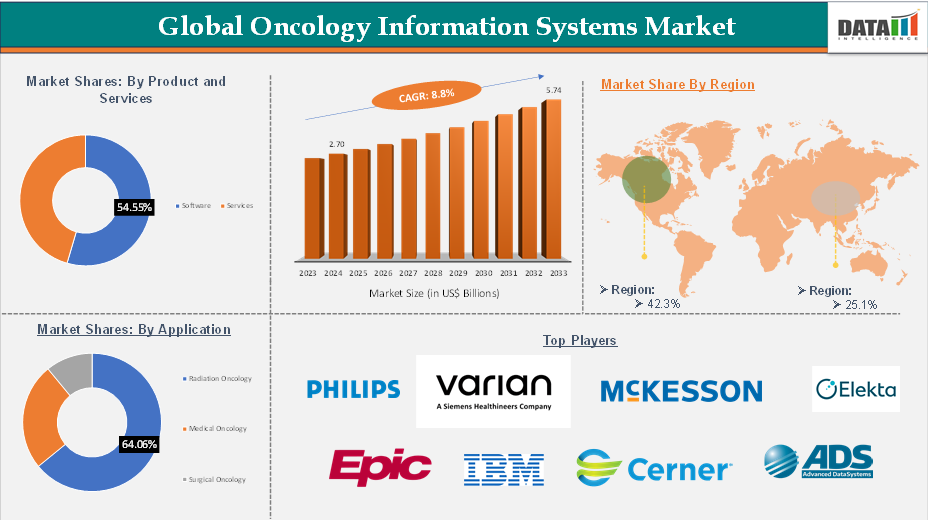

Oncology Information Systems Market reached US$ 2.70 Billion in 2024 and is expected to reach US$ 5.74 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

Oncology information systems (OIS) manage data on cancer patient hospitalization programs, treatment deliveries, plans, and diagnostic results.

The global Oncology Information Systems (OIS) market is experiencing significant growth due to the increasing cancer incidence, adoption of advanced healthcare IT solutions, and demand for integrated cancer care. OIS helps healthcare providers manage cancer treatment workflows, patient scheduling, and electronic medical records. However, challenges like high implementation costs, data security concerns, and skilled professionals in developing regions may hinder market expansion.

North America currently dominates the market due to its advanced healthcare infrastructure, while the Asia-Pacific region is expected to experience the fastest growth due to increasing healthcare investments and cancer prevalence.

For more details on this report, Request for Sample

Oncology Information Systems Market Dynamics: Drivers & Restraints

Driver: Increasing Prevalence of Cancer Worldwide

The global cancer incidence is driving the growth of the oncology information systems (OIS) market. With millions of new cancer cases diagnosed annually, healthcare systems need efficient, technology-driven solutions. OIS platforms streamline patient data management, facilitate accurate treatment planning, and enable real-time monitoring, contributing to the expansion of the global OIS market.

For instance, as per the International Agency for Research on Cancer, globally, nearly 20 Billion incident cases were reported in 2022. In 2030, nearly 24.10 Billion cases and in 2040, nearly 29.90 Billion cases were expected.

Hence, the rise in cancer incidence helps the healthcare providers face pressure to deliver timely, accurate, and personalized treatment. OIS platforms manage large patient data, support complex treatment planning, and improve workflow efficiency. The growing patient load requires scalable digital solutions to coordinate care across departments and specialists. This trend is accelerating OIS adoption in hospitals, oncology centers, and research institutions, contributing to global market expansion.

Restraint: Data Security and Privacy Concerns

The global oncology information systems market faces challenges in data security and patient privacy due to the growing adoption of cloud-based solutions and stringent data protection regulations. Ensuring end-to-end encryption, secure user authentication, and system interoperability presents technical and operational challenges, potentially slowing market growth in regions with limited cybersecurity infrastructure or regulatory clarity.

Oncology Information Systems Market Segment Analysis

The global oncology information systems market is segmented based on product & services, application, end user, and region.

Product & Services:

The software segment of the product & services is expected to hold 54.5% in the oncology information Systems market

The software segment in the oncology information systems market is experiencing significant growth due to the need for centralized data management, improved treatment planning, and real-time patient monitoring. The rise in cancer incidence is driving healthcare providers to adopt advanced digital tools for efficient clinical workflows and improved patient outcomes.

The shift towards value-based care and personalized medicine has increased demand for integrated software systems for data-driven decision-making and tailored treatment protocols. Technological advancements in AI, cloud computing, and big data analytics are enhancing oncology software's capabilities.

For instance, in May 2204, GE HealthCare unveiled Revolution RT, a new radiation therapy CT solution with innovative hardware and software, aiming to increase imaging accuracy and simplify simulation workflow. The AI-enhanced Intelligent Radiation Therapy platform interfaces with the Spectronic MRI Planner.

Oncology Information Systems Market Geographical Analysis

North America dominated the global oncology information systems market with the highest share of 42.3% in 2024

North America dominates the global oncology information systems market due to advanced healthcare infrastructure, high IT adoption, and significant cancer research investments. The region benefits from EHR integration and interoperability policies. The growing number of cancer cases and focus on precision medicine in the U.S. and Canada encourage healthcare providers to adopt robust OIS platforms. Key market players, technological advancements, and favorable reimbursement scenarios further accelerate the market's growth.

For instance, the American Cancer Society predicts that by 2025, the US will experience 2,041,910 new cancer cases and 618,120 deaths, based on data from central cancer registries and the National Center for Health Statistics. This data is based on population-based cancer occurrence and outcomes.

Asia-Pacific region in the global oncology information systems market is expected to grow with the highest CAGR of 18.5% in the forecast period of 2025 to 2033

The Asia Pacific region is experiencing rapid growth in the oncology information systems market due to rising cancer prevalence, healthcare expenditure, and awareness of advanced technologies. Countries like China, India, and Japan are investing in digital healthcare infrastructure to improve care delivery and patient outcomes. Government initiatives, electronic health records, and telemedicine are driving demand for integrated systems. The rising burden of cancer cases in densely populated areas prompts hospitals to streamline workflows using comprehensive information systems for efficient patient data management and outcome monitoring.

For instance, in September 2024, the Indian Cancer Genome Atlas (ICGA) launched India's first comprehensive cancer multi-omics data portal, offering open access to clinically correlated data from Indian cancer patients, aiming to transform cancer research and treatment.

Oncology Information Systems Market Key Players

The major global players in the oncology information systems market include Koninklijke Philips N.V., Varian Medical Systems, McKesson Corporation, Elekta AB, Epic Systems Corporation, IBM, Cerner Corporation, Advanced Data Systems, and Bogardus Medical Systems, Inc., among others.

Industry Trends

- In January 2024, Apollo Cancer Centre in Bengaluru launched India's first AI-Precision Oncology Centre (POC), enhancing oncology care quality. The centre provides comprehensive medical services, including accurate diagnosis, real-time insights, cancer risk assessment, treatment protocol, and care continuum. It is patient-centric, identifying eligible patients for targeted therapy and immunotherapy, and educating patients and families.

Scope

| Metrics | Details | |

| CAGR | 8.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product & Services | Software, Services |

| Application | Radiation Oncology, Medical Oncology, Surgical Oncology | |

| End User | Hospitals & Diagnostic Imaging Centers, Government Institutions, Ambulatory Surgical Centers, Research Facilities | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |