Overview

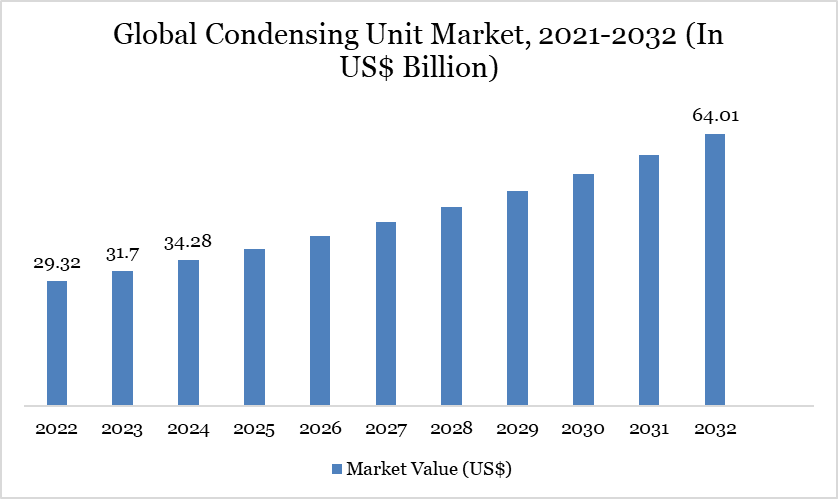

Global Condensing Unit Market reached US$ 34.28 billion in 2024 and is expected to reach US$ 64.01 billion by 2032, growing with a CAGR of 8.12% during the forecast period 2025-2032.

The global condensing unit market continues to expand, driven by rising demand across residential, commercial, and industrial sectors. Government mandates—like the US DOE’s 2023 shift to SEER2/EER2 ratings—require higher energy efficiency, saving users up to US$ 3,977 in lifetime costs on federally purchased heat pumps and air conditioners. These efficiency upgrades are expected to cut 300 million kWh and save US$ 38 billion in utility costs over 30 years. In Canada, programsa like the Greener Homes Grant offer up to (US$ 3683) 5,000 CAD for heat pump installations, reflecting broad public-sector support for sustainable cooling.

Condensing Unit Market Trend

A standout trend is the adoption of inverter-equipped, smart condensing units compliant with new government standards. Inverter systems dynamically adjust capacity and can cut energy use by 20–30% compared to conventional units. Light commercial HVAC units using these technologies have been shown to deliver up to 30% energy savings over standard models. Integration of IoT-based controls enables real-time refrigerant monitoring and grid-responsive operation, accelerating the shift toward decentralized, efficient cold chain and HVAC systems aligned with public decarbonization targets.

Market Scope

Metrics | Details |

By Type | Air-cooled Condensing Unit, Water-cooled Condensing Unit, Evaporative Condensing Unit |

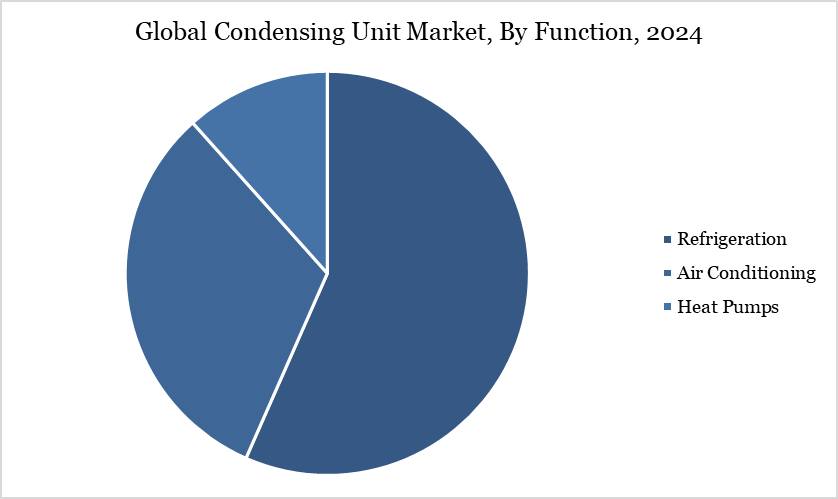

By Function | Refrigeration, Air Conditioning, Heat Pumps |

By Compressor Type | Hermetic, Semi-Hermetic, Open |

By Refrigerant Type | Fluorocarbons, Hydrocarbons, Inorganics |

By End-User | Food & Beverage, Retail, Healthcare, Hospitality, Chemical & Industrial Processing, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Electrification of Cold Chain Logistics in Emerging Economies

The electrification of cold chain logistics in emerging markets is accelerating demand for advanced condensing units. According to the Food and Agriculture Organization (FAO), over 14% of global food is lost post-harvest, with inadequate cold storage being a major factor in developing regions. To address this, India’s Ministry of Food Processing Industries (MoFPI) approved ₹6,000 crore (US$ 720 million) under the PMFME scheme to expand energy-efficient cold chain infrastructure. This push for electrified, sustainable refrigeration is boosting adoption of modern condensing units tailored for transport and storage applications.

Regulatory Uncertainty Surrounding Refrigerant Phase-Down Timelines

Regulatory uncertainty surrounding refrigerant phase-down timelines is restraining the global condensing unit market. The US AIM Act mandates an 85% reduction in HFC production and consumption by 2036, with interim cutbacks already in place, but unclear future allocations leave manufacturers unsure when to fully transition. Additionally, recent changes to compliance deadlines for equipment GWP limits have created confusion across the industry. This lack of clarity is causing delays in product development and forcing companies to maintain multiple inventories, slowing overall adoption of newer condensing technologies.

Segment Analysis

The global condensing unit market is segmented based on function, type, compressor type, refrigerant type, end-user and region.

Refrigeration Segment Driving Condensing Unit Market

The global rise in air conditioning demand is significantly propelling the condensing unit market. According to the International Energy Agency (IEA), air conditioner ownership is expected to grow from 1.6 billion units in 2020 to 5.6 billion by 2050, with much of this growth concentrated in emerging economies. In the US, the EIA’s 2020 Residential Energy Consumption Survey found that 87% of households use air conditioning, with 60% relying on central systems incorporating condensing units—highlighting their critical role in residential cooling infrastructure.

To meet this demand sustainably, governments are implementing stricter efficiency standards that spur innovation in condensing units. The US Department of Energy (DOE) updated regulations in 2023 requiring residential air conditioning systems to meet Seasonal Energy Efficiency Ratio (SEER2) metrics, indirectly influencing condensing unit design. In response, companies like Johnson Controls, in their 2023 sustainability update, report expanded R&D investment in high-efficiency residential condensing units that meet these new benchmarks, reinforcing how AC adoption continues to shape the global condensing unit market.

Geographical Penetration

North America Drives the Global Condensing Unit Market

Demand for condensing units in North America is driven by commercial refrigeration growth and HVAC upgrades. According to the US Energy Information Administration (EIA), over 90% of US households use air conditioning, and commercial refrigeration accounts for approximately 1.1 quadrillion BTUs of energy use annually. This growing load, combined with the Department of Energy’s 2023 efficiency standards, is accelerating demand for energy-efficient condensing units in retail, foodservice, and healthcare sectors.

On the commercial side, companies are scaling production to meet demand for low-emission systems. Emerson, in its 2023 ESG Report, highlights expanded manufacturing capacity in North America to support the shift to CO₂-based condensing units. The US EPA’s SNAP program further boosts demand by phasing down high-GWP refrigerants, pushing retailers and cold storage operators to adopt next-gen units that meet both cooling needs and environmental compliance.

Sustainability Analysis

The global condensing unit market is shifting toward sustainability due to rising energy efficiency mandates. According to the IEA, space cooling consumed nearly 10% of global electricity in 2022, prompting regulatory action. The US DOE’s 2023 rule targets a 30% energy use reduction in commercial condensing units by 2027. The EU’s Eco-design Directive also mandates low-GWP refrigerants and efficiency upgrades.

Emerson reports a 21% drop in emissions intensity (2020–2023) through eco-efficient units using natural refrigerants like CO₂. Japan’s METI enforces fluorocarbon regulations, accelerating green adoption in retail cooling. These shifts indicate strong policy and industry alignment with net-zero targets.

Competitive Landscape

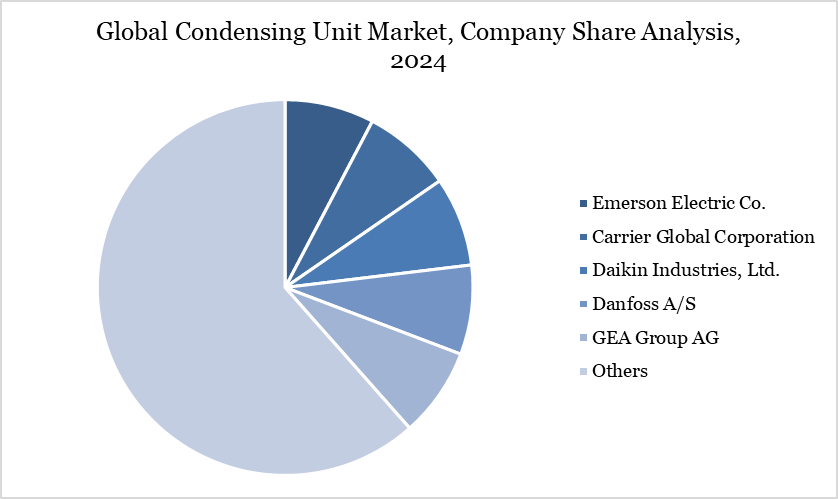

The major global players in the market include Emerson Electric Co., Carrier Global Corporation, Daikin Industries, Ltd., Danfoss A/S, GEA Group AG, Mitsubishi Electric Corporation, BITZER Kühlmaschinenbau GmbH, Johnson Controls International plc, Heatcraft Refrigeration Products LLC, and Tecumseh Products Company LLC.

Key Developments

In February 2025, Daikin has introduced the ERA range of condensing units, designed to provide energy-efficient climate control while using the lower Global Warming Potential (GWP) refrigerant R-32. The new units maintain the performance benefits of R-410A while contributing to reduced environmental impact.

In February 2024, Panasonic Europe introduced a new 20HP CO2 outdoor condensing unit to the European market, adding to its existing lineup of 2HP, 4HP, and 10HP CO2 outdoor systems. This unit is designed specifically for supermarkets and industrial process cooling, suitable for various applications such as walk-in cold rooms, freezers, low-temperature display cases, and blast chillers for food retail and process cooling.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies