Air Handling Units Market Overview

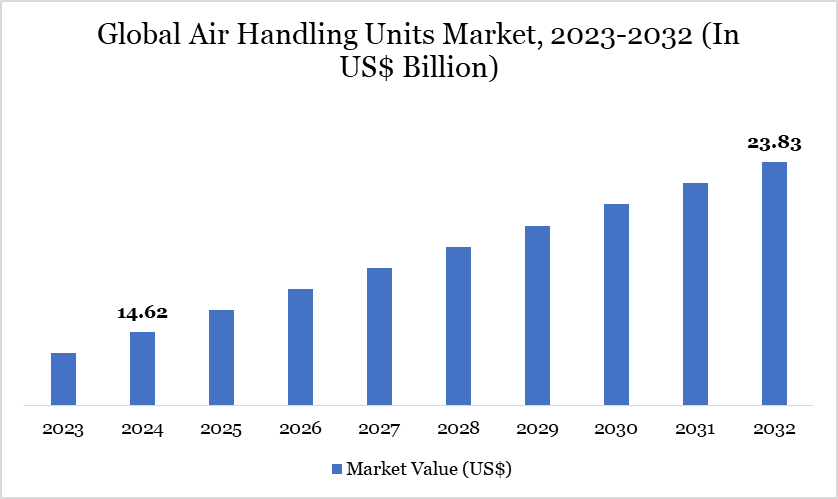

Air Handling Units Market reached US$ 14.62 billion in 2024 and is expected to reach US$ 23.83 billion by 2032, growing with a CAGR of 6.30% during the forecast period 2025-2032.

The global air handling units (AHU) market is experiencing steady growth, primarily driven by the increasing demand for energy-efficient HVAC systems across residential, commercial, and industrial applications. Rising awareness regarding indoor air quality, especially in the post-pandemic era, has significantly boosted the adoption of AHUs in healthcare facilities, office spaces, and educational institutions.

Countries like the US and Germany are witnessing higher retrofitting activities where old HVAC systems are being replaced with modular, energy-efficient AHUs. Additionally, stringent government regulations related to energy consumption and emissions are pushing building owners and developers toward advanced AHU systems with heat recovery, variable speed drives, and intelligent control features.

Air Handling Units Market Trend

The market is witnessing several evolving trends that are shaping its growth trajectory globally. One of the most prominent trends is the increasing demand for energy-efficient and eco-friendly systems. With governments and industry bodies enforcing strict energy codes and sustainability norms, manufacturers are developing AHUs with features like heat recovery wheels, EC (electronically commutated) fans, and advanced insulation materials.

For instance, Carrier launched its WeatherExpert Ultra High-Efficiency Rooftop Units with integrated energy recovery systems aimed at reducing HVAC energy use by up to 40%. Another significant trend is the integration of smart and connected technologies. Building automation systems are being increasingly linked with AHUs to optimize energy usage, monitor air quality, and allow predictive maintenance.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Type | Modular, Packaged, Custom, DX Integrated Low Profile (Ceiling), Roof-Mounted, Others |

| By Capacity | ≤5,000 m3/h, 5,001 – 15,000 m3/h, 15,001 – 30,000 m3/h, 30,001 – 50,000 m3/h, ≥50,001 m3/h |

| By Effect | Single, Double |

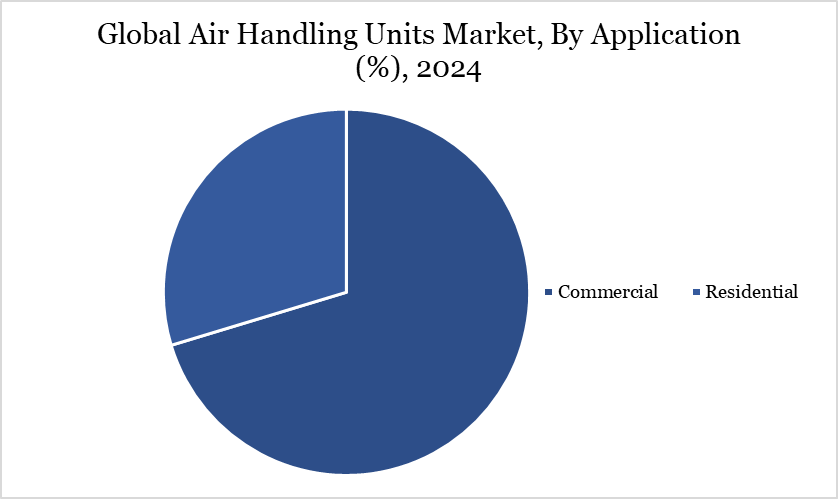

| By Application | Commercial, Residential |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Air Handling Units Market Dynamics

Improving Demand for Air Conditioning Systems Due To Rising Urbanization and Growth in Population

Cities currently host roughly 56% of the world's population or 4.2 billion people. The pattern is likely to persist in the future. Furthermore, by 2050, the urban population is predicted to double, with roughly seven out of ten people on the planet living in cities. For example, the expanding population in Gulf countries is expected to impact building investment in GCC countries considerably.

By 2050, the region's population is expected to exceed 600 million, up from 350 million in 2015. The mentioned numbers are anticipated to boost infrastructure and building activity, notably in education, housing, and healthcare facilities, to help communities. The growing population results from increased demand for retail, commercial, and residential structures. In metropolitan areas, mixed-use buildings combining business and retail space with residential apartments and condominiums are being constructed.

Vacant warehouses and buildings are being transformed into new commercial and residential areas. The growing construction transformation puts even more pressure on developers to determine what renters want and need in building design and facilities to maintain high occupancy rates. These factors increase the demand for energy-efficient air conditioning equipment, such as air handling units.

Rising Fluctuation in Raw Material Prices and Lack of Enough Awareness

Metals and alloys, polypropylene, and fiber-reinforced polymers construct air handling systems. The OEMs' ability to source high-quality raw materials and manage the supply schedules imposed by suppliers is hampered by fluctuating raw material prices, which drives up the cost of air handling units.

With rapid technological advancement, it is critical to educate end customers about the advantages of new goods. In the case of HVAC systems, there is a lack of information about their economic and environmental benefits; they are typically considered expensive, making market penetration difficult in emerging and poor economies. There is also a lack of knowledge about energy-efficient HVAC systems.

Air Handling Units Market Segment Analysis

The global air handling units’ market is segmented based on type, capacity, effect, application and region.

Commercial Sector Leads the Air Handling Units Market with High-Performance HVAC Demand

The commercial segment dominates the AHU market due to the expansive use of HVAC systems in buildings such as office complexes, malls, hospitals, hotels, airports, and educational institutions. These establishments require large-scale, reliable ventilation and climate control systems to maintain comfort and air quality for high occupant densities.

For instance, modern buildings have complex layouts with varied spaces, making consistent ventilation and air quality a challenge. HVAC systems, with air handling units (AHUs) at their core, play a key role in filtering and circulating clean air. Typically located on rooftops, AHUs mix outdoor and indoor air, condition it for temperature and humidity, and use powerful fans to distribute it through filters and ducts.

Filters are rated by MERV (per ASHRAE 52.2) for their ability to trap particles from 0.3 to 10 microns, while ISO16890 classifies them into PM1, PM2.5, and PM10 categories. These standards help in selecting the right filter based on specific air quality needs. Thus, the commercial sector's dominance in the AHU market is underpinned by the scale of operations, stricter air quality mandates, and a growing focus on energy-efficient and smart HVAC systems across public and private infrastructures worldwide.

Air Handling Units Market Geographical Share

North America Leads the Air Handling Units Market with Advanced Infrastructure and Regulatory Push

North America dominates the AHU market due to its advanced infrastructure, stringent energy regulations, and heightened awareness of indoor air quality. The region has a well-established HVAC industry with widespread deployment of AHUs in commercial buildings, hospitals, data centers, and educational institutions. The US, in particular, leads the market with strong investments in smart buildings and retrofitting projects aimed at improving energy efficiency and sustainability.

For instance, in 2024, Johnson Controls, the global leader for smart, healthy and sustainable buildings, announced the launch of its new YORK Mission Critical Vertical Computer Room Air Handler (MCV CRAH), engineered to meet the growing demand for sustainable data center technology. Downflow air handling units are purpose-built to meet the demands of mission-critical data center applications. Thus, the combination of regulatory support, technological innovation, and high demand from commercial and institutional sectors cements North America's leadership in the global AHU market.

Sustainability Analysis

The AHU market is increasingly aligning with global sustainability goals, driven by regulatory pressure, environmental awareness, and the rising demand for energy-efficient building solutions. AHUs play a critical role in reducing energy consumption in HVAC systems, which are among the highest energy consumers in commercial and industrial buildings. The shift toward energy recovery systems, such as heat recovery wheels and enthalpy exchangers, significantly minimizes energy wastage by reusing thermal energy from exhaust air, thereby reducing the load on heating and cooling systems.

One of the major sustainability drivers is the adoption of EC (electronically commutated) motors, which consume 30-50% less energy compared to traditional motors. These motors, when combined with variable frequency drives (VFDs), allow AHUs to adjust airflow based on occupancy and real-time demand, reducing unnecessary power usage.

Air Handling Units Market Major Players

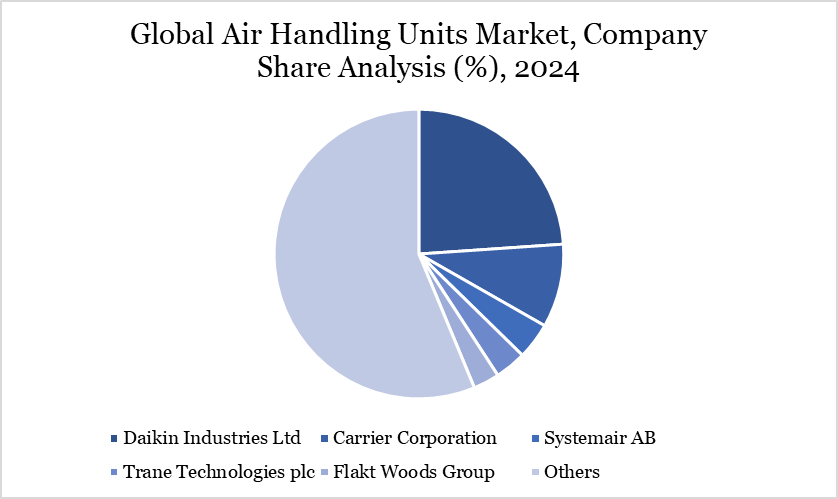

The major global players in the market include Daikin Industries Ltd, Carrier Corporation, Systemair AB, Trane Technologies plc, Flakt Woods Group, Trox GmbH, Lennox International, Inc, Munters AB, Johnson Controls International plc, Blue Star Limited and among others.

Key Developments

In 2024, Daikin is upgrading its air handling units (AHU) product portfolio by introducing advanced ventilation solutions tailored to the 'compact' market segment. As part of this strategy, Daikin is pleased to announce the launch of a new AHU range.

In 2024, Trane, a strategic brand of Trane Technologies, announced the launch of the revolutionary Climate Changer Magicube (CLCM) air handling unit to address the challenges associated with the installation and maintenance of air conditioning equipment in modern buildings.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies