Coffee Beans Market Size

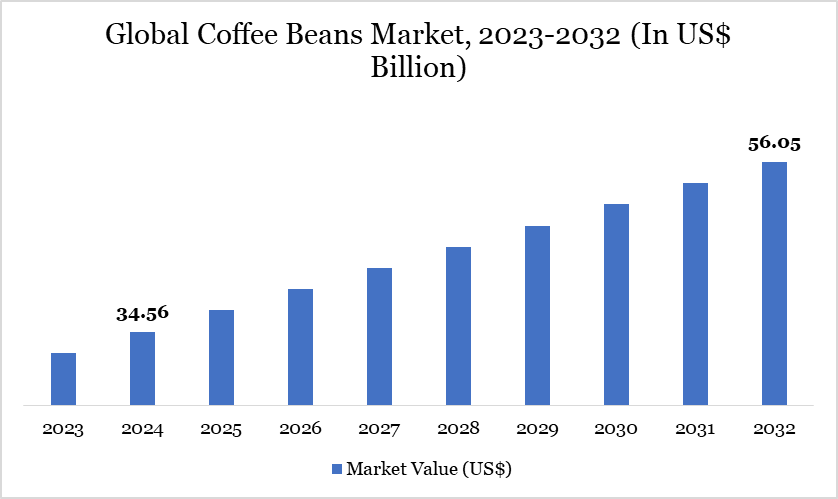

Coffee Beans Market reached US$ 34.56 billion in 2024 and is expected to reach US$ 56.05 billion by 2032, growing with a CAGR of 6.23% during the forecast period 2025-2032.

The global coffee beans market is growing steadily, fueled by rising coffee consumption, especially in markets like North America and Asia-Pacific. For instance, globally, an estimated 2.25 billion cups of coffee are consumed daily, highlighting the massive demand and cultural significance of coffee worldwide. This high consumption rate is a major driver of the global coffee beans market, fueling its market growth. The rise of premium instant coffee and ready-to-drink coffee products is expanding market reach. Digital sales channels and subscription services are gaining popularity, making specialty coffee more accessible.

Coffee Beans Market Trend

The surge in specialty and premium coffee reflects growing consumer demand for high-quality, unique coffee experiences. According to the Specialty Coffee Association, specialty coffee now makes up about 55% of the global coffee market. This highlights how much consumer preferences have shifted toward higher-quality, ethically sourced, and unique coffee experiences worldwide.

Companies are launching e-commerce platforms to capitalize on and accelerate the growing global trend toward specialty and premium coffee, making high-quality, single-origin Arabica beans more accessible to consumers nationwide. For instance, in April 2025, Coffeeverse, a premium specialty coffee brand known for its acclaimed Roastery Cultúr café in Ahmedabad, unveiled its new e-commerce platform. The online store features a curated range of coffee beans, ground coffee, instant powders, along with brewing equipment and stylish merchandise.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Bean | Arabica, Robusta, Others |

| By Nature | Conventional, Organic |

| By Application | Food & Beverage, Pharmaceutical, Cosmetics, Others |

| By End-User | Household, Commercial Use, Foodservice Industry, Industrial Use |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Coffee Beans Market Dynamics

Expansion of Coffee Culture and Convenience Offerings

The expansion of coffee culture and convenience offerings is a major driver of the coffee beans market by making coffee more accessible and appealing to a broader audience. The NCA’s Spring 2024 National Coffee Data Trends report shows that 67% of American adults drank coffee daily, making it the most consumed beverage, surpassing even water. Similarly, according to the PIB, India’s domestic coffee consumption has grown steadily, rising from 84,000 tonnes in 2012 to 91,000 tonnes in 2023, reflecting a gradual increase in coffee demand within the country.

The rise of specialty cafes and global coffee chains has popularized unique brewing methods and high-quality beans, creating a growing demand for premium coffee. Additionally, innovations like ready-to-drink (RTD) coffee, cold brews, and single-serve pods cater to busy, on-the-go lifestyles, boosting consumption. These convenient formats make it easier for consumers to enjoy coffee anytime and anywhere, increasing overall market volume.

Climate Change and Weather Variability

Climate change and weather variability are major restraints on the coffee bean market because they directly impact coffee-growing regions with unpredictable and extreme conditions. Increased temperatures, prolonged droughts, and unexpected frosts reduce crop yields and affect bean quality, leading to inconsistent supply. These changes also shift suitable cultivation areas, forcing farmers to adapt or relocate, which is costly and time-consuming. Additionally, altered rainfall patterns can increase the prevalence of pests and diseases, further harming plants. The uncertainty caused by these factors drives price volatility and threatens the livelihoods of smallholder farmers. As a result, climate change creates long-term risks for the stability and sustainability of the global coffee market.

Coffee Beans Market Segment Analysis

The global coffee beans market is segmented based on bean, nature, application, end-user and region.

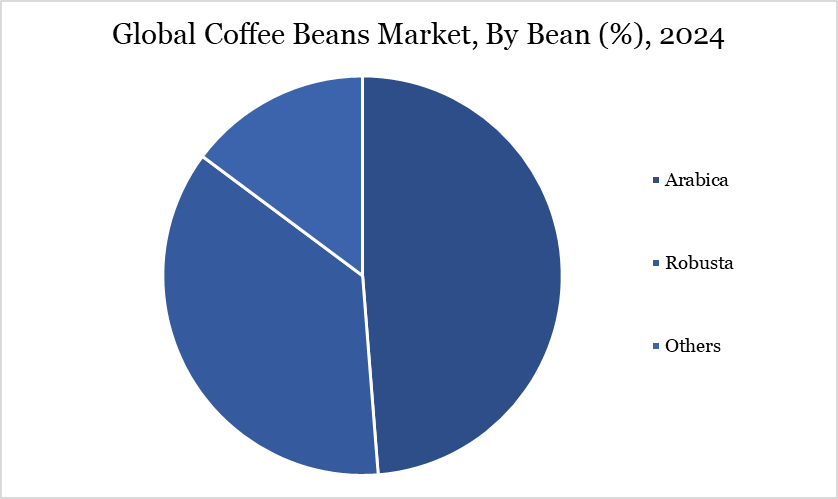

Arabica Beans Dominate the Global Coffee Market Due to Their Superior Flavor and Higher Quality Perception

Arabica beans hold a significant share in the global coffee bean market due to their superior flavor profile, which is smoother, sweeter, and less bitter compared to other varieties like Robusta. According to the International Coffee Organization's Coffee Report and Outlook for December 2023, Arabica coffee constituted approximately 55.9% of the world's total coffee production in the 2022/23 coffee year, marking a slight increase from 55.0% in the previous year.

Arabica coffee thrives in high-altitude regions with cooler climates, mainly in countries like Brazil, Colombia, and Ethiopia, contributing to their distinct taste and quality. Consumers worldwide prefer Arabica for specialty coffees and premium blends, driving higher demand. Additionally, Arabica beans generally fetch higher prices due to their perceived quality and complex aroma. The global trend towards gourmet and specialty coffee further boosts Arabica's market dominance.

Coffee Beans Market Geographical Share

South America Holds the Largest Share in the Global Coffee Bean Market Due to Its Ideal Climate and Extensive Coffee Plantations

South America holds the largest share in the global coffee bean market primarily due to its ideal climate and geography, which provide perfect conditions for coffee cultivation. Countries like Brazil and Colombia are among the top coffee producers worldwide, contributing significantly to global supply. For instance, according to the USDA, in the 2024/2025 marketing year, Brazil leads global coffee production, accounting for 38% of the total market with 66.4 million 60-kg bags produced. This solidifies Brazil’s position as the top coffee producer worldwide.

The region’s rich volcanic soil and consistent rainfall create high-quality Arabica beans favored by many consumers. Additionally, South America has a long-established coffee farming tradition and extensive infrastructure supporting large-scale production and export. Government support and investment in coffee technology have further boosted productivity. The combination of high yield and quality makes South America a dominant player in the coffee industry. This strong presence ensures its leading position in the global market.

Sustainability Analysis

The global coffee bean market faces significant sustainability challenges, including deforestation, water scarcity, and climate change, impacting crop yields and quality. Smallholder farmers often struggle with low incomes and lack access to sustainable farming practices. Increasing consumer demand for ethically sourced and organic coffee is driving growth in certifications like Fair Trade and Rainforest Alliance.

Climate resilience initiatives and agroforestry practices are being adopted to mitigate environmental impact. For instance, the European Union's Deforestation Regulation (EUDR), effective from December 30, 2024, requires proof that coffee and other products are not linked with deforestation to be sold in Europe. This regulation poses challenges for coffee producers, especially small farmers, and may lead to market exclusions for non-compliant producers.

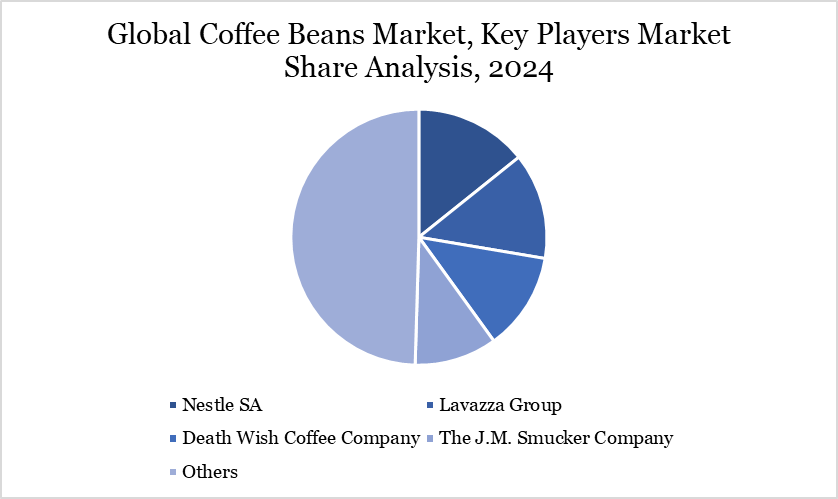

Coffee Beans Market Major Players

The major global players in the market include Nestle SA, Lavazza Group, Death Wish Coffee Company, The J.M. Smucker Company, PEET'S COFFEE, illycaffè S.p.A., MKC Food Products, Tata Coffee, Kicking Horse Coffee Co. Ltd., The Bean Coffee Company and others.

Key Developments

In March 2025, Maverick & Farmer, an artisanal coffee company, partnered with Nuvedo, a leader in functional mushrooms, and launched India’s first whole bean-infused mushroom coffee in Bangalore, combining premium Arabica beans with Lion’s Mane mushroom for a unique, functional beverage experience.

In October 2024, voco Hotels, a premium brand under IHG Hotels & Resorts, launched Birdie Bean, a new coffee brand designed especially for travelers. Featuring organic coffee beans sourced from Pu’er, Yunnan, Birdie Bean emphasizes sustainability and local specialty ingredients.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies