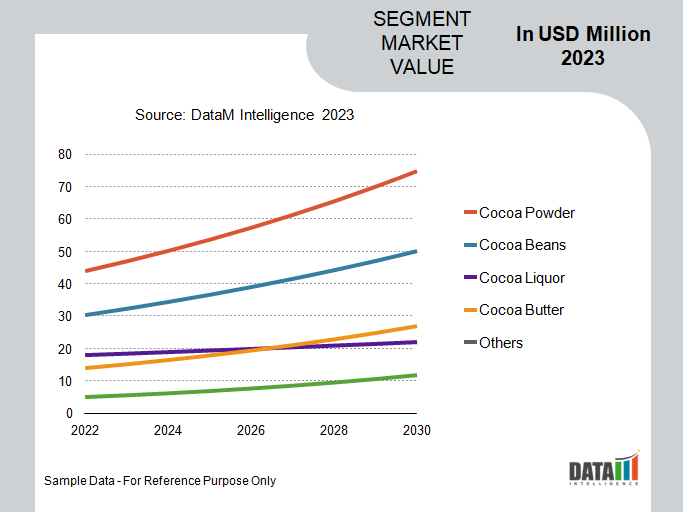

Cocoa Market is segmented By Type (Dutch-processed, Natural), By Form (Cocoa powder, Cocoa beans, Cocoa liquor, Cocoa butter, Others), By Application (Cosmetics, Food & Beverages, Pharmaceuticals, Confectionery, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Cocoa Market Size

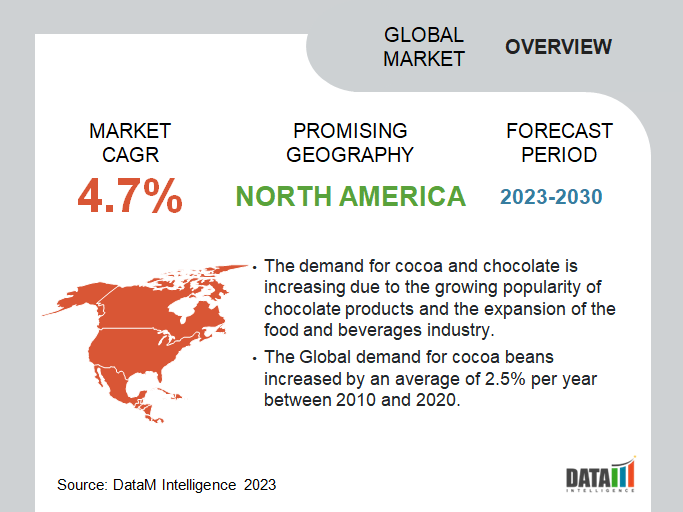

The Global Cocoa Market will be USD 12.5 billion by 2022 and will witness lucrative growth by reaching up to USD 18.02 billion by 2030. The market is growing at a CAGR of 4.7% during the forecast period 2024-2031.

Cocoa is the critical ingredient in chocolate and chocolate confections. The Global Cocoa Market report analyzes the global market size, shares, recent trends, competitive intelligence, and future market outlook. Cocoa is a key ingredient used in the production of chocolate, confectionery, and beverages. The market is driven by factors such as the growing demand for chocolate and cocoa-based products, increasing consumer awareness about the health benefits of cocoa, and favorable government policies supporting cocoa farming. The Global Cocoa Market is witnessing significant growth in the Asia Pacific region. Key players in the market include Barry Callebaut AG, Cargill, Incorporated, Nestlé S.A., and other prominent players operating in the market.

The primary distinction between cocoa and chocolate is that cocoa is a powder substance that contains little or less cocoa butter and is, therefore, e healthy. The demand for cocoa and chocolate is increasing due to the growing popularity of chocolate products and the expansion of the food and beverages industry.

Cocoa liquor, cocoa butter, and cocoa powder are commercially available cocoa products, but chocolate products are available in chocolate filled with dark white milk. This industry trend is expected to fuel demand for cocoa and chocolate shortly.

Cocoa Market Summary

|

Metrics |

Details |

|

Market CAGR |

4.7% |

|

Segments Covered |

By Type, By Form, By Application, and By Region |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other key insights. |

|

Fastest Growing Region |

Asia Pacific |

|

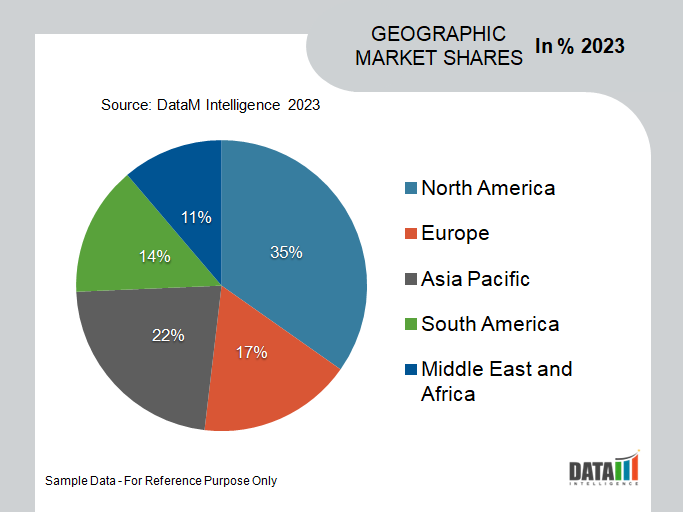

Largest Market Share |

North America |

For More Insights - Download the Sample

Cocoa Market Dynamics

High Demand for Confectionery is Driving the Cocoa Market

The demand for confectionery products is a significant driver of the growth of the cocoa market. According to the International Cocoa Organization (ICCO), the global demand for cocoa beans increased by an average of 2.5% per year between 2010 and 2020, primarily driven by the demand for chocolate confectionery products. The chocolate confectionery market is projected to continue growing in the coming years.

For example, in the United States, premium chocolate sales increased by 12.5% in 2020, according to the National Confectioners Association. This information derives from how the demand for confectionery will drive the cocoa market.

Climatic Changes are Acting as a Hindrance to the Cocoa Market Growth

Climate change is a major restraint on the growth of the cocoa market, with significant impacts on cocoa production, quality, and yields. According to a study by the International Center for Tropical Agriculture (CIAT), climate change could lead to a 0.93 to 2.23 million tonne reduction in cocoa production by 2050, depending on the climate scenario. This represents a reduction of up to 38% from current production levels. Rising temperatures and changes in rainfall patterns can lead to a decline in the quality of cocoa beans.

COVID-19 Impact on Cocoa Market Growth

COVID Impact Analysis

The COVID-19 outbreak has caused market disruption. The global pandemic, associated lockdowns, and other restrictions impacted consumer purchasing power in 2020. According to a report published in October 2020 by the National Confectioners Association, seasonal demand for confectionery in the United States has decreased due to the pandemic.

Because chocolate confectioneries are frequently consumed outside of the home or while traveling, sales of these items initially fell in 2020. The outbreak of the COVID-19 pandemic has caused a sudden drop in chocolate production and sales.

Cocoa Market Segment Analysis

The global cocoa market is segmented based on type, form, application, and region.

The Food & Beverage Sector Exhibits Promising Growth Owing to a Wide Application Array

The food and beverage segment holds the largest market share in the cocoa market, driven by the industry's high demand for cocoa-based products. The chocolate confectionery market is the largest segment of the cocoa market, accounting for the majority of cocoa consumption globally.

Cocoa is also used in various beverages, including hot chocolate, cocoa-based drinks and coffee blends. The demand for cocoa-based beverages is growing, with consumers increasingly seeking healthier and more sustainable alternatives to traditional drinks.

Global Cocoa Market Geographical Share

North America is Dominating the Global Cocoa Market During the Forecast Period

North America holds the largest share in the cocoa market, driven by the region's high consumption of cocoa-based products. North America is one of the largest consumers of chocolate globally. The premium chocolate market in North America is also growing, driven by increasing demand for high-quality, artisanal chocolates.

According to Statista, the U.S. cocoa market is estimated to be worth 9.67 billion USD. The report also suggests that U.S. consumers ate, on average, 10.8 kilograms of chocolate per person during the first year of the pandemic.

Cocoa Market Companies

The major global players are Barry Callebaut, PLOT Enterprise Ghana Limited, Cocoa Processing Co. Ltd., Cargill, Inc., BD Associates Ghana Ltd., ECOM Agro-industrial Corporation, Touton S.A, Olam International, Niche Cocoa Industry Ltd., Fuji Oil Company Ltd.

Key Developments

- In May 2022, Bloomer Chocolate Company and DouxMatok collaborated to launch the new chocolate and confectionery coatings.

- In March 2020, Mars, Incorporated, a world leader in confectionery brands, announced a new sustainability-inspired chocolate experience, CO2COA, is joining the family of snacks and treats that includes M&M'S, SNICKERS, SKITTLES, and EXTRA Gum.

- In September 2021, Lindt & Sprungli Group announced the integration of Caffarel S.p.A to make Lindt & Sprüngli S.p.A. The operation aims to increase the synergies between the two organizations while keeping their different local identities and strong business and industrial strategies.

Why Purchase the Report?

- To visualize the global cocoa market segmentation based on type, form and application and understand vital commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous cocoa market-level data points, all for segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of critical products of all the major players.

The Global Cocoa Market Report Would Provide Approximately 61 Tables, 60 Figures and 102 Pages.

Target Audience 2024

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies