Clinical Trials Market – Industry Trends & Outlook

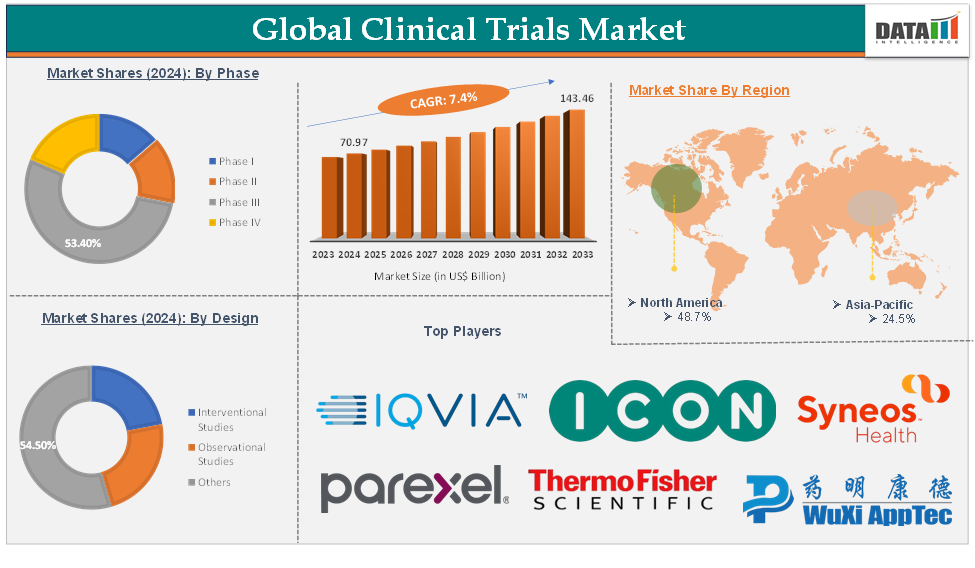

The global clinical trials market was valued at US$ 65.89 Billion in 2023. The market size reached US$ 70.97 Billion in 2024 and is expected to reach US$ 143.46 Billion by 2033, growing at a CAGR of 7.4% during the forecast period 2025-2033.

The global clinical trials market refers to the industry segment dedicated to conducting research studies that evaluate the safety, efficacy, and outcomes of new medical interventions, including drugs, devices, and therapies on human participants.

Key drivers of the global clinical trials market include the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, which fuel the demand for novel therapies and interventions. Additionally, increasing investments in pharmaceutical and biotechnology R&D, the adoption of decentralized and virtual clinical trial models, and technological advancements, such as artificial intelligence, big data analytics, and digital biomarkers, are accelerating drug development and enhancing trial efficiency.

Major trends shaping the clinical trials market include the rapid adoption of decentralized clinical trials (DCTs), which leverage digital platforms to allow remote participation and improve patient engagement. The integration of AI and real-world evidence (RWE) is transforming trial design, execution, and monitoring, enabling more adaptive, patient-centric, and cost-effective studies.

Global Clinical Trials Market – Executive Summary

Global Clinical Trials Market Dynamics: Drivers

Growth in pharmaceutical and biotech R&D

The sustained growth in pharmaceutical and biotech research and development (R&D) is a major driver for the global clinical trials market. As pharmaceutical and biotechnology companies increase their investments in R&D, there is a corresponding rise in the number of new drug candidates and innovative therapies entering the clinical pipeline. This expansion directly fuels demand for clinical trials, which are essential for evaluating the safety and efficacy of these new products before regulatory approval and commercialization.

For instance, in March 2024, Maximizing product launch success by connecting clinical and commercial strategies refers to integrating the scientific, regulatory, and medical aspects of drug development (clinical) with the business, marketing, and market access activities (commercial) from the earliest stages through to launch and beyond. This approach ensures that insights, data, and planning from both domains inform each other, reducing risks and increasing the likelihood of a successful product introduction. All these factors demand the global clinical trials market.

Rising demand for outsourcing to contract research organizations (CROs)

The rising demand for outsourcing to contract research organizations (CROs) is a major driver in the global clinical trials market. CROs provide essential services to pharmaceutical, biotechnology, and medical device companies, supporting every stage of the clinical trial process from protocol design and site management to patient recruitment, data analysis, and regulatory compliance.

This outsourcing model allows sponsors to access specialized expertise, advanced technology, and global infrastructure without investing heavily in their internal resources, leading to significant cost savings and operational efficiencies. As clinical trials become increasingly complex and globalized, the need for experienced partners who can navigate regulatory requirements and manage multi-country studies has grown. CROs offer end-to-end solutions that help sponsors accelerate drug development timelines and bring new therapies to market faster.

For instance, in January 2025, Advarra, a leading provider of clinical research solutions, announced the launch of a new product called Study Collaboration. This innovative solution is designed to make it easier for organizations involved in clinical trials (such as sponsors, research sites, and contract research organizations) to work together more efficiently. All these factors demand the global clinical trials market.

Global Clinical Trials Market Dynamics: Restraints

High cost and complexity

High cost and complexity are major restraints for the global clinical trials market. The expense of conducting modern clinical trials has risen dramatically, driven by a combination of factors including more intricate study designs, increasing regulatory requirements, and the need to collect and analyze vast amounts of data.

The growing complexity of clinical trials further compounds these challenges. Trials now often target smaller, more specific patient populations, require more protocol amendments, and involve a greater number of procedures and data points. This complexity leads to longer timelines, higher personnel and administrative costs, and an increased likelihood of delays.

Regulatory compliance is another significant cost driver. Navigating the evolving and often stringent requirements across multiple regions demands specialized expertise and resources, increasing both the direct and indirect costs of clinical trials. The need for compliance with global standards, coupled with the administrative burden of managing multiple sites and complex logistics, further elevates costs and slows down the process of bringing new therapies to market. Thus, the above factors could be limiting the global clinical trials market's potential growth.

Global Clinical Trials Market Dynamics: Opportunities

Expansion of decentralized and virtual trials

The expansion of decentralized and virtual trials represents a significant opportunity for the global clinical trials market. Decentralized clinical trials (DCTs) leverage digital technologies such as telemedicine, wearable devices, mobile health applications, and remote monitoring to allow participants to take part in studies from their homes or local healthcare settings, rather than traveling to centralized research sites. This model increases accessibility for diverse patient populations, reduces geographic and logistical barriers, and enhances convenience, leading to improved recruitment and retention rates.

Moreover, decentralized trials are particularly valuable for reaching underrepresented groups, elderly or disabled patients, and those living in rural or remote areas who might otherwise be excluded from research due to travel constraints. As healthcare systems and sponsors continue to invest in digital maturity and integrated research infrastructure, the shift toward decentralized and virtual trials is expected to transform the clinical research landscape, making studies more flexible, inclusive, and efficient.

For instance, in March 2025, IQVIA, a global leader in healthcare analytics and clinical research services, was recognized as a "Leader" in the 2024 IDC MarketScape assessment for decentralized clinical trial (DCT) technologies and consulting services. This recognition highlights IQVIA’s expertise and strong capabilities in supporting pharmaceutical and life sciences companies as they shift toward decentralized, virtual, and hybrid clinical trial models.

Also, in February 2024, Curavit Clinical Research, a virtual contract research organization (VCRO) specializing in decentralized clinical trials (DCTs) for digital therapeutics (DTx), successfully concluded a decentralized study evaluating the Sana Device. Sana has now submitted the trial results to the U.S. Food and Drug Administration (FDA) for consideration of Breakthrough Device Designation. The Sana Device is a wearable, virtual-reality-style mask that utilizes audiovisual stimulation to help alleviate symptoms of post-traumatic stress disorder (PTSD). Thus, the above factors could be limiting the global clinical trials market's potential growth.

For more details on this report, Request for Sample

Global Clinical Trials Market - Segment Analysis

The global clinical trials market is segmented based on phase, service type, design, indication, and region.

Phase:

The phase III segment is expected to hold 53.3% of the global clinical trials market in 2024

The Phase III segment is the largest and most critical phase within the global clinical trials market. This dominance is due to the extensive scale, complexity, and investment required for Phase III studies, which are essential for validating the safety and efficacy of new drugs or therapies before they are submitted for regulatory approval.

Phase III trials are large-scale, multicenter studies typically involving hundreds to thousands of participants across diverse geographic locations. The primary goal is to confirm the therapeutic benefits and monitor adverse reactions in a broad patient population, providing robust statistical evidence for regulatory agencies such as the FDA or EMA. These trials often include randomized, double-blind, and controlled designs to minimize bias and ensure reliable results.

The Phase III segment is experiencing transformation due to technological advancements such as artificial intelligence, big data analytics, and the adoption of decentralized and hybrid trial models. These innovations are streamlining trial management, enhancing patient recruitment, and reducing operational costs. There is also a growing emphasis on patient-centric and adaptive trial designs, which allow for more flexible and efficient study protocols.

For instance, in March 2025, Biogen Inc. started dosing patients in its global Phase 3 clinical trial, called TRANSCEND, to evaluate the efficacy and safety of the investigational drug felzartamab in adult kidney transplant recipients who have developed late antibody-mediated rejection (AMR). These factors have solidified the segment's position in the global clinical trials market.

Global Clinical Trials Market – Geographical Analysis

North America is expected to hold 48.7% of the global clinical trials market in 2024

North America, particularly the United States, is home to many of the world’s leading pharmaceutical, biopharmaceutical, and medical device companies. These firms invest heavily in research and development, fueling a continuous pipeline of new drugs and therapies that require extensive clinical testing. The presence of well-established contract research organizations (CROs) and a mature ecosystem for outsourcing further supports market growth.

The adoption of advanced technologies such as artificial intelligence, big data analytics, and decentralized clinical trial platforms is transforming the region’s clinical research landscape. These innovations streamline data collection, improve patient recruitment and retention, and enhance trial efficiency, making North America a leader in modern clinical trial methodologies.

A surge in chronic diseases such as cancer, diabetes, and cardiovascular conditions, along with the need for advanced treatments for rare and emerging diseases, is driving demand for clinical trials in North America. The region’s diverse and aging population further increases the need for innovative therapies and supports the expansion of clinical research activities.

North America benefits from strong regulatory frameworks, particularly through the U.S. Food and Drug Administration (FDA), which has implemented programs to fast-track drug development and approval processes. Government funding and initiatives to promote clinical research, including support for diversity and inclusion in trials, also play a significant role in market growth.

For instance, in January 2024, in the US, BioStem Technologies launched a pivotal clinical trial to evaluate the effectiveness of its Vendaje product, which utilizes the company’s proprietary BioREtain technology, in treating non-healing diabetic foot ulcers (DFUs). This trial is a significant step for BioStem as it aims to demonstrate that Vendaje provides superior wound healing compared to the current standard of care, supporting broader market adoption and expansion.

Asia Pacific is expected to hold 24.5% of the global clinical trials market in 2024

Asia-Pacific offers access to a vast and diverse patient population, which enables faster and more efficient patient recruitment for clinical trials. This diversity is particularly valuable for studies targeting a broad range of diseases and for generating data across different ethnic groups, enhancing the global applicability of trial results.

Conducting clinical trials in Asia-Pacific is generally more cost-effective compared to Western countries. Lower operational costs, competitive investigator fees, and affordable infrastructure make the region attractive for pharmaceutical and biotech companies seeking to optimize R&D budgets while maintaining high-quality standards.

Governments in countries such as China, India, Japan, and Singapore are actively promoting biomedical research through funding, regulatory reforms, and incentives. Fast-track approvals, orphan drug designations, and streamlined regulatory pathways have accelerated the initiation and completion of trials, especially for rare and life-threatening diseases.

The region faces a rising prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders, as well as infectious diseases. This growing disease burden drives demand for innovative therapies and fuels the need for extensive clinical research to address unmet medical needs.

Asia-Pacific is rapidly adopting new clinical research technologies, including digital health platforms, decentralized trial models, and personalized medicine approaches. These innovations improve trial efficiency, patient engagement, and data quality, further propelling market growth.

For instance, in May 2025, India’s “dual potential” in the clinical trials sector refers to its emerging role both as a hub for advanced, global clinical research and as an untapped market for more inclusive, diverse studies. This duality was a major focus at the ETPharma Clinical Research and Excellence Conference (CREC), where industry leaders, regulators, and innovators discussed how India can simultaneously drive cutting-edge innovation and expand access to research for its vast, diverse population. Thus, the above factors are consolidating the region's position as a dominant force in the global clinical trials market.

Global Clinical Trials Market – Competitive Landscape

The major global players in the clinical trials market include IQVIA, ICON plc, Parexel, PPD (Thermo Fisher Scientific), Syneos Health, WuXi AppTec, PSI, Medpace, Lindus Health, Precision for Medicine, Charles River Laboratories International, Inc., Syneos Health, Inc., Pharmaron Beijing Co., Ltd., Clinipace (Caidya), Celero, SGS SA, Chiltern International Ltd (Laboratory Corporation of America, LabCorp/Covance), Eli Lilly and Company, Novo Nordisk A/S, and Pfizer, among others.

Global Clinical Trials Market – Key Developments

- In May 2025, Markel Insurance, a division of Markel Group Inc., introduced a new insurance product specifically designed for clinical trials. This move demonstrates Markel’s commitment to supporting the global life sciences sector by offering specialized insurance solutions.

In May 2025, on International Clinical Trials Day, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) celebrated significant advancements in the clinical trials sector and announced a new public consultation focused on the use of real-world data (RWD) in clinical trials.

In March 2025, Medidata, a Dassault Systèmes brand and a leading provider of clinical trial solutions for the life sciences sector, announced the launch of its Medidata Site Insights Program. This new initiative is designed to speed up the delivery of life-changing therapies to patients by fostering more open communication with clinical trial sites. The program aims to transform the clinical trial landscape by driving innovation, enhancing collaboration, and minimizing the technological challenges faced by research sites.

In April 2024, Flatiron Health, a health technology company focused on transforming clinical research by integrating it into everyday healthcare, announced a partnership with Veeva Systems, a global leader in cloud software for the life sciences industry. As part of this collaboration, Flatiron Health is joining the Veeva Product Partner Program

Global Clinical Trials Market – Scope

Metrics | Details | |

CAGR | 7.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Phase | Phase I, Phase II, Phase III, Phase IV |

Service Type | Laboratory Services, Bioanalytical Testing Services, Data Management Services, Medical Device Testing Services, Others | |

Design | Interventional Studies, Observational Studies, Others | |

Indication | Oncology, Infectious Diseases, Neurology, Metabolic Disorders, Immunology, Cardiology, Genetic Diseases, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global clinical trials market report delivers a detailed analysis with 100 key tables, more than 80 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.