Cardiac Monitoring Devices Market Size & Industry Outlook

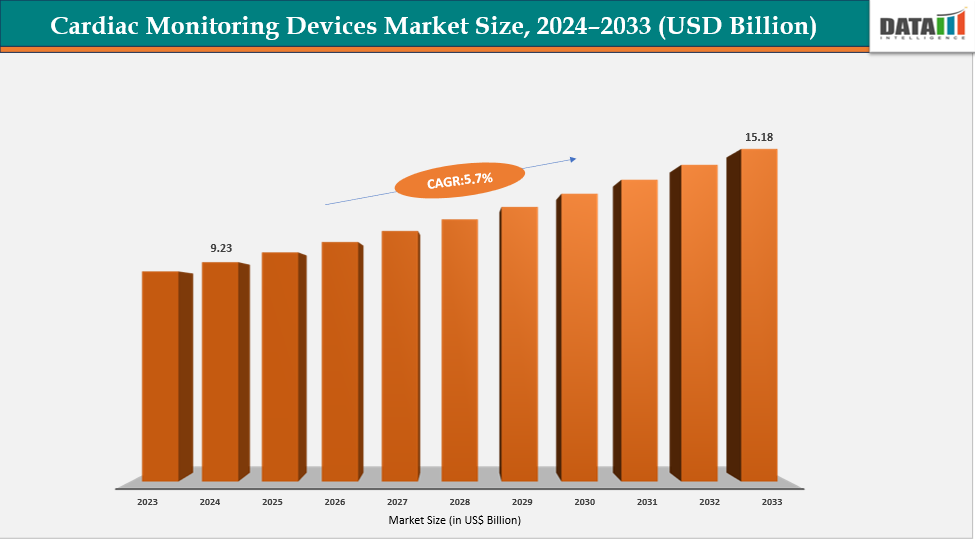

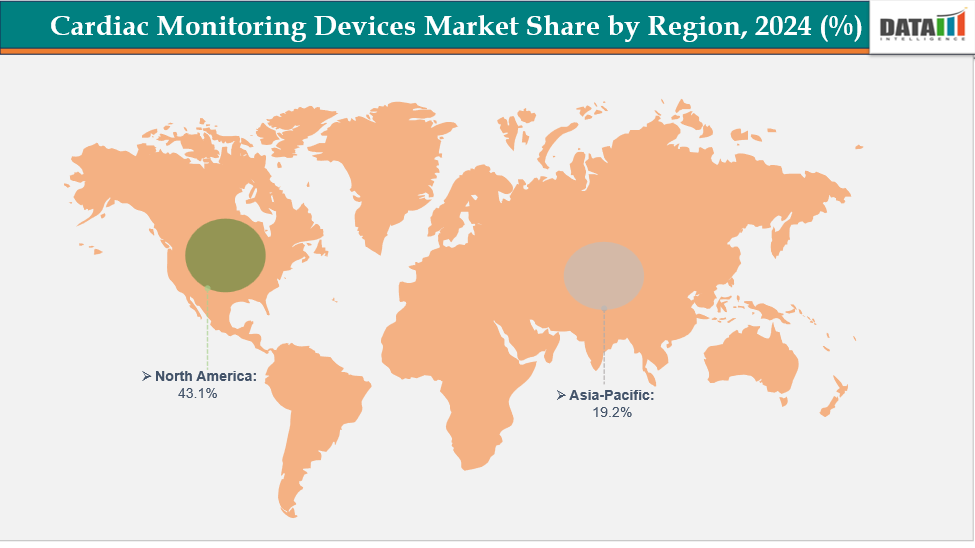

The global cardiac monitoring devices market size reached US$ 8.77 Billion with rise of US$ 9.23 Billion in 2024 is expected to reach US$ 15.18 Billion by 2033, growing at a CAGR of 5.7% during the forecast period 2025-2033. The global cardiac monitoring devices market is growing due to the rise in cardiovascular diseases, aging population, and demand for early diagnosis and continuous monitoring. Technological advancements like wearable ECG devices, wireless telemetry, and AI-enabled diagnostic tools are transforming cardiac care, improving clinical outcomes and reducing hospital readmissions. However, challenges like high device costs and stringent regulatory requirements may limit wider adoption. North America dominates the market due to strong healthcare infrastructure, while Asia-Pacific is expected to emerge as the fastest-growing region due to increased healthcare investments and awareness of cardiac health.

Key Market Trends & Insights

Global cardiac monitoring devices market highlights the rapid shift toward wearable and minimally invasive solutions, such as patches and implantable loop recorders, which offer greater patient comfort and continuous monitoring. The integration of AI, cloud platforms, and mobile health applications is enabling advanced analytics and remote diagnostics, supporting the growth of telecardiology and virtual care models.

There is also a strong trend toward ambulatory and home-based monitoring, driven by rising healthcare costs and the need for early detection of arrhythmias and atrial fibrillation outside hospital settings. Additionally, major players are focusing on strategic partnerships, product innovations, and digital health ecosystems to strengthen their market position, while emerging markets are seeing increased adoption due to expanding healthcare infrastructure and awareness of preventive cardiac care.

North America dominates the Cardiac Monitoring Devices market with the largest revenue share of 43.1% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 9.1% over the forecast period.

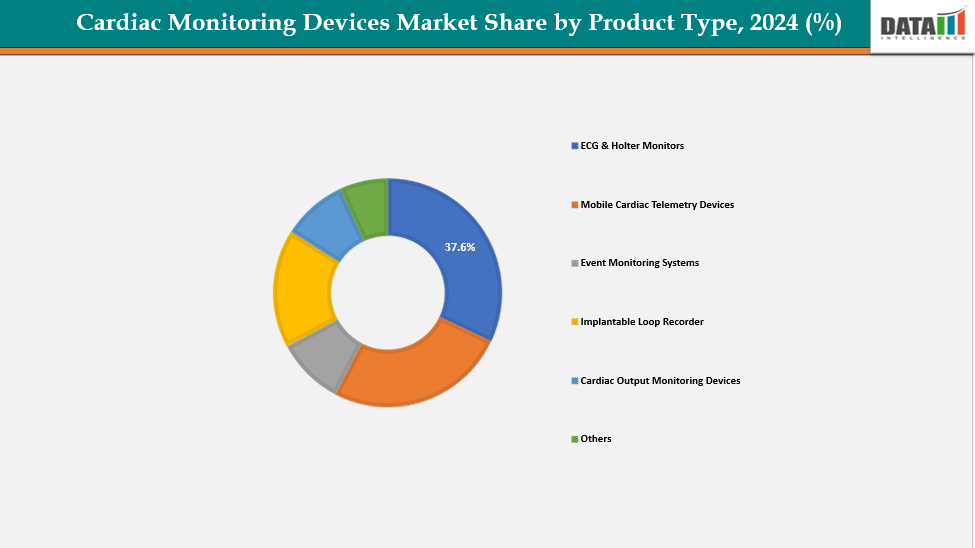

Based on product type, the ECG & Holter monitors segment led the market with the largest revenue share of 37.6% in 2024.

The major market players in the cardiac monitoring devices market are Medtronic, Abbott Laboratories, Boston Scientific Corporation, GE Healthcare, iRhythm Technologies Inc, Biotronik, Hill Rom Holdings, Schiller, Biotelemetry (Philips), VitalConnect among others

Market Size & Forecast

2024 Market Size: US$ 9.23 Billion

2033 Projected Market Size: US$ 15.18 Billion

CAGR (2025–2033): 5.7%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Drivers:The rising prevalence of cardiovascular diseases is significantly driving the cardiac monitoring devices market growth

The global cardiac monitoring devices market is driven by the increasing prevalence of cardiovascular diseases (CVDs), such as arrhythmias, atrial fibrillation, heart failure, and coronary artery disease. These devices are crucial for early detection, timely intervention, and effective patient management, reducing morbidity and mortality rates. Healthcare providers are adopting advanced solutions like wearable ECG monitors, implantable loop recorders, and remote telemetry systems to track heart activity outside clinical settings.

According to the World Health Organization, an estimated 520 million people worldwide are currently living with CVDs, creating a significant need for advanced monitoring solutions in both hospital and homecare settings.

Atrial fibrillation, one of the most common cardiac arrhythmias, affects over 37 million people globally, and this number continues to increase with aging populations and lifestyle-related risk factors. Such high prevalence directly fuels the demand for devices like Holter monitors, implantable loop recorders, and wearable ECG patches, supporting market growth.

Restraints:Reimbursement and regulatory challenges are hampering the growth of the cardiac monitoring devices market

The global cardiac monitoring devices market faces significant restraint due to reimbursement and regulatory challenges. Obtaining regulatory approvals for new technologies is complex and costly, causing delays and limiting innovation speed. Reimbursement policies for advanced monitoring solutions vary across countries, making it difficult for healthcare providers and patients to adopt high-cost devices, especially in developing markets. Despite technological advancements, market penetration is hindered by uncertain regulatory pathways and inadequate reimbursement structures.

For more details on this report – Request for Sample

Segmentation Analysis

The global cardiac monitoring devices market is segmented based on product type, application, end-user, and region.

Product Type:The ECG & Holter monitors segment is dominating the cardiac monitoring devices market with a 37.6% share in 2024

The ECG and Holter monitors segment are growing due to the need for accurate, continuous, and non-invasive cardiac monitoring solutions. The increasing prevalence of arrhythmias, atrial fibrillation, and unexplained syncope has led to the need for devices that can capture long-term heart activity beyond standard in-clinic tests. Technological advancements like lightweight digital Holter devices, wireless connectivity, and AI-enabled ECG interpretation are enhancing diagnostic accuracy and patient comfort. This segment is one of the most widely used and essential categories in the global cardiac monitoring devices market.

For instance, in April 2025, LifeSignals, Inc. launched the UbiqVue 2AYe Holter System at Heart Rhythm 2025 in San Diego. Distributed by UltraLinQ Healthcare Solutions, the system accelerates cardiac monitoring workflows by delivering diagnostic reports quickly and eliminating the need to mail or recover the Biosensor device.

Moreover, in May 2024, Vivalink, a leading provider of digital healthcare solutions, has launched a technology solution for Mobile Cardiac Telemetry (MCT) and Holter monitoring. The solution integrates remote patient monitoring technologies and advanced arrhythmia detection algorithms, streamlining deployment and enhancing patient care.

Geographical Analysis

North America is expected to dominate the global cardiac monitoring devices market with a 43.1% in 2024

North America has established itself as the dominant region in the global cardiac monitoring devices market, largely due to its advanced healthcare infrastructure, and favorable reimbursement frameworks. This has enabled early adoption of innovative solutions like implantable cardiac monitors, wearable ECG devices, and mobile cardiac telemetry systems.

Moreover, product launches, strong investments in digital health, telemedicine, and AI-based cardiac analytics accelerate growth. Leading global players like Abbott, Medtronic, GE Healthcare, and iRhythm Technologies ensure a constant pipeline of product innovations and strategic partnerships, reinforcing North America's leadership position in this market.

For instance, in June 2025, Cardinal Health has launched the Kendall DL Multi System, a multi-parameter, single-patient use monitoring cable and lead wire system. This system allows continuous monitoring of cardiac activity, blood oxygen level, and temperature with one point of connection, enhancing clinician workflows, determining the best care course, and maximizing hospital value.

The Asia Pacific region is the fastest-growing region in the global cardiac monitoring devices market, with a CAGR of 7.1% in 2024

The Asia-Pacific region is expected to experience the fastest growth in the cardiac monitoring devices market due to the increasing prevalence of cardiovascular diseases and the aging population. Countries like China, India, and Japan are experiencing a surge in atrial fibrillation, stroke, and heart failure cases, leading to a demand for accessible and cost-effective monitoring solutions. Improving healthcare infrastructure, government initiatives, and increased healthcare expenditure are boosting the adoption of advanced monitoring devices. Rising awareness about preventive healthcare and the popularity of wearable technologies are expanding opportunities for manufacturers.

For instance, in February 2025, CB Scientific, Inc., a non-invasive ambulatory cardiac monitoring company, is launching its next-generation MyCardia AT cardiac event monitor in partnership with Datrix, LLC. The FDA-cleared device offers an improved patient remote cardiac monitoring experience with its lightweight, easy-to-wear design. It allows for flexible and convenient transmission of event recordings over iOS or Android smartphones and the MyCardia Apple, Google, or WeChat app.

Moreover, in November 2024, Hyderabad-based startup Monitra Healthcare has received US Patent No. 12,109,029 B2, titled Wireless Cardiac Monitoring Device and Method to Measure and Transmit Cardiac Physiological Signals, marking a significant milestone in its mission to revolutionize cardiac care through innovation.

Competitive Landscape

Top companies in the cardiac monitoring devices market include Medtronic, Abbott Laboratories, Boston Scientific Corporation, GE Healthcare, iRhythm Technologies Inc, Biotronik, Hill-Rom Holdings, Schiller, Biotelemetry (Philips), VitalConnect among others.

Arthrex, Inc.: Medtronic is a global leader in the cardiac monitoring devices market, known for its Reveal LINQ Insertable Cardiac Monitor. The company has invested in innovation, integrating AI-powered algorithms to improve diagnostic accuracy and reduce false alerts. Medtronic's extensive global presence, trust among cardiologists, and comprehensive ecosystem of connected monitoring solutions make it a benchmark player. The company's focus on remote monitoring, digital health integration, and patient-centric technologies sets it apart from competitors, reinforcing its position as the market leader in cardiac monitoring devices.

Key Developments:

In July 2025, Boston Scientific Corporation has received CE Mark for its LATITUDE Patient Management system, which remotely monitors patients with implantable cardiac devices, gathers information on their heart health status, detects clinical events, and sends relevant data to their physicians. The system will be launched in Europe in a phased approach.

In May 2025, iRhythm Technologies has launched its Zio long-term continuous ECG monitoring system in Japan, known as the Zio ECG Recording and Analysis System. This system offers up to 14 days of uninterrupted ECG monitoring and uses a deep-learned artificial intelligence algorithm approved by Japan's Pharmaceuticals and Medical Devices Agency. This is a significant advancement over traditional ambulatory cardiac monitoring options, such as wired Holter monitors and patch-based services that only monitor up to 7 days.

Market Scope

Metrics | Details | |

CAGR | 5.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | ECG & Holter Monitors, Resting ECG Devices, Stress ECG Devices, Event Monitoring Systems, Implantable Loop Recorder, Cardiac Output Monitoring Devices, Mobile Cardiac Telemetry Devices, Others |

Application | Arrhythmia, Atrial Fibrillation, Others | |

End-User | Hospitals, Ambulatory Surgical Centers Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global cardiac monitoring devices market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here