Wearable Heart Monitoring Devices Market Size - Industry Trends & Outlook

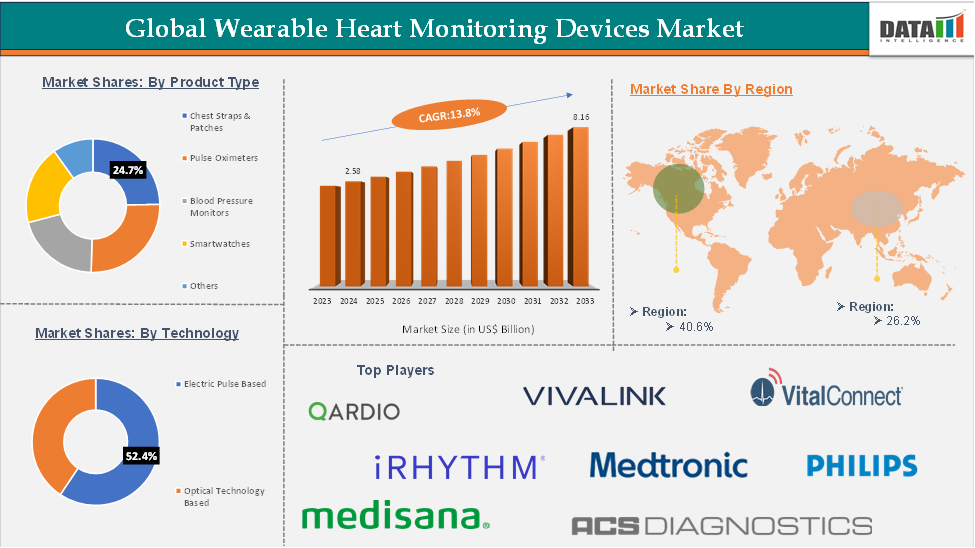

Wearable Heart Monitoring Devices Market size reached US$ 2.58 Billion in 2024 and is expected to reach US$ 8.16 Billion by 2033, growing at a CAGR of 13.8% during the forecast period 2025-2033.

Wearable heart monitor devices are popular tools for tracking heart rate and pulse rate, offering personal use convenience and wireless connectivity to smartphones and computers for easy data access. These devices are available in various forms, including chest straps, wristbands, rings, and smartwatches. Their accuracy depends on the type of detection and user activity while wearing them.

The global wearable heart monitoring devices market is experiencing robust growth, driven by rising incidences of cardiovascular diseases, increasing health awareness, and the growing adoption of advanced wearable technologies. The integration of AI and IoT in healthcare wearables, coupled with the demand for real-time patient monitoring, presents significant growth opportunities, especially in remote patient management and fitness tracking applications.

Moreover, the shift toward preventive healthcare and the rising geriatric population further fuel market expansion. North America currently dominates the market due to its advanced healthcare infrastructure, high consumer awareness, and early adoption of innovative health technologies, while Asia-Pacific is emerging as a key growth region owing to its large population base and increasing healthcare investments.

Executive Summary

For more details on this report – Request for Sample

Wearable Heart Monitoring Devices Market Dynamics: Drivers & Restraints

A rise in technological advancements is expected to drive the wearable heart monitoring devices market

Technological advancements have played a significant role in the development of wearable heart rate monitor devices, enhancing their functionality, accuracy, and usability. These advancements include the integration of various sensors, such as electrocardiogram (ECG) sensors, photoplethysmography (PPG) sensors and accelerometers, which provide real-time data on heart rate, blood oxygenation levels, blood pressure and physical activity.

For instance, in April 2025, LifeSignals, Inc. unveiled its latest innovation at Heart Rhythm 2025 in San Diego. Launched in partnership with UltraLinQ Healthcare Solutions, this new Holter solution streamlines cardiac monitoring by significantly reducing diagnostic report turnaround times and eliminating the need to mail or retrieve the biosensor device, offering a faster and more efficient workflow for healthcare providers.

The high cost of hospital beds is expected to hinder the wearable heart monitoring devices market

Personal health data breaches pose significant challenges to both healthcare providers and clients, undermining trust and potentially exposing sensitive patient information to misuse. In the context of wearable heart monitoring devices, data security and privacy concerns are expected to hinder market growth. These devices continuously collect and transmit personal health metrics, making them vulnerable to cyberattacks and unauthorized access.

Regulatory compliance with data protection laws such as HIPAA and GDPR further increases the complexity and cost of deploying these technologies. As a result, concerns over data integrity, potential misuse, and lack of transparency in how health data is stored and shared may discourage both consumers and healthcare institutions from adopting wearable heart monitoring solutions at scale.

Wearable Heart Monitoring Devices Market Segment Analysis

The global wearable heart monitoring devices market is segmented based on product type, technology, application, end user, and region.

Product Type:

The chest straps & patches segment is expected to hold 44.2% of the global wearable heart monitoring devices market

The chest straps & patches from the product type segment accounted for approximately 39.3%. Wearable devices for ECG monitoring include patches, clothing-based monitors, chest straps, upper arm bands, devices that one can touch with fingers from different arms, and wristbands. Patches are popular for long-term ambulatory monitoring.

Several recent solutions include patches on the left side of the chest that can be monitored for several weeks (e.g., Vital Connect Patch). Others include a small device attached to a strip or two electrodes on the chest (e.g., Body Guardian Heart). Devices often measure temperature and impedance and have accelerometers to detect motion.

For instance, in December 2023, Neuranics launched a magnetic sensor development kit for monitoring the magnetic activity of the heart. The company designed the kit to record heart activity and wirelessly transfer recordings over Bluetooth. It provides live, 24/7 recording and analysis straight to a smartphone, tablet, or laptop.

Wearable Heart Monitoring Devices Market Geographical Analysis

North America is expected to hold 41.8% of the global wearable heart monitoring devices market

North America is expected to hold a significant portion of the global wearable heart monitoring devices market. Significant factors like rising incidences of CVDs, FDA approvals, novel product launches by key players, and the presence of major market players and their strategic initiatives are expected to drive the region’s market growth.

For instance, in July 2023, Biostrap USA introduced the new wearable Biostrap Kairos device for stress resilience measurement and insights into heart rate variability (HRV). Biostrap offers a data visualisation of the autonomic nervous system, accompanied by the innovative Vital Science app, for quantifying the sympathetic and parasympathetic branches from a wrist-worn device. The device features a modular design, which enables it to be easily positioned on the forearm or bicep.

Wearable Heart Monitoring Devices Market Top Companies

The top companies in the wearable heart monitoring devices market include Medtronic, Qardio Inc, VitalConnect, ACS Diagnostics, medisana GmbH, iRhythm Inc., Koninklijke Philips N.V., VivaLNK, Inc., Abbott, SmartCardia Inc., among others.

Key Developments

- In May 2025, Element Science received U.S. Food and Drug Administration (FDA) approval for its Jewel Patch Wearable Cardioverter Defibrillator (Patch-WCD), designed for patients at increased risk of sudden cardiac arrest. This milestone follows earlier regulatory approvals, including the CE mark in Europe and the UKCA mark in the United Kingdom.

Market Scope

| Metrics | Details | |

| CAGR | 13.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Chest Straps & Patches, Pulse Oximeters, Blood Pressure Monitors, Smartwatches, Others |

| Technology | Electric Pulse-Based, Optical Technology-Based | |

| Application | Sports and Fitness, Medical Monitoring, Remote Patient Monitoring, Others | |

| End User | Hospitals, Homecare Settings, Cardiac Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global wearable heart monitoring devices market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.