Overview

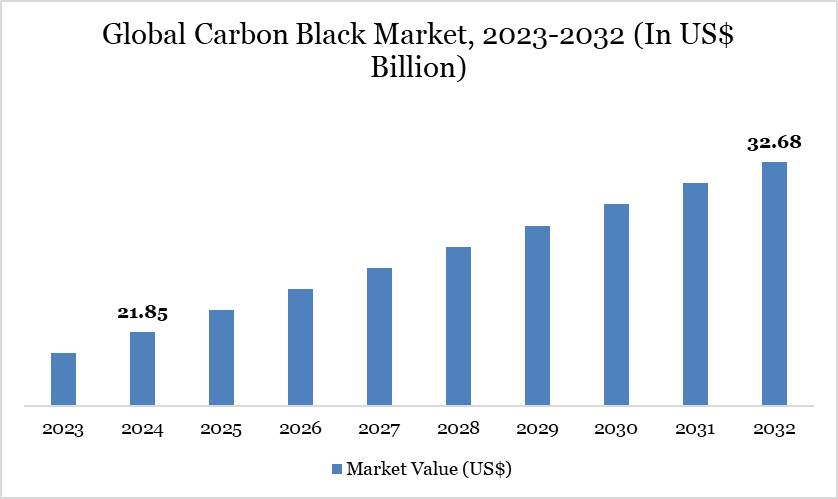

Global Carbon black Market reached US$ 21.85 billion in 2024 and is expected to reach US$ 32.68 billion by 2032, growing with a CAGR of 5.16% during the forecast period 2025-2032, accoding to DataM Intelligence report.

The increasing demand from the automotive and tire industries is a primary driver, as carbon black is used in tire manufacturing for strength and durability. Aditya Birla Management Corporation Pvt. Ltd. reports that over 13 million tonnes of carbon black are produced annually, with 70% used in rubber tires. It accounts for about one-fourth of the weight of a standard automobile tire, emphasizing its crucial role in tire production. Additionally, the growing demand for industrial rubber products, coatings, and plastics is contributing to market growth. The rise in infrastructure development, particularly in emerging economies, is boosting the demand for carbon black in construction materials.

The demand for environmentally friendly and sustainable products has led to innovations in production processes, with a focus on reducing emissions and energy consumption. The expansion of the electronics and battery industries is also fueling the market, as carbon black is used in conductive materials. Investments in eco-friendly production align with the industry's sustainability goals. For example, in June 2024, Orion S.A. installed tire pyrolysis oil tanks at its Jaslo plant in Poland to boost circular carbon black production, showcasing its dedication to eco-friendly and sustainable practices.

Carbon black Market Trend

The carbon black market is witnessing several notable trends driven by both industrial demand and sustainability goals. One key trend is the rising demand for specialty carbon black in high-performance applications such as automotive coatings, plastics, and electronics, where enhanced conductivity, tinting strength, and UV resistance are critical.

Another emerging trend is the shift toward sustainable production methods, including the use of recovered carbon black (rCB) derived from end-of-life tires, aligning with circular economy practices and reducing environmental impact. Additionally, the growth of electric vehicles (EVs) is influencing product development, as manufacturers seek carbon black grades suitable for EV tires and battery components.

Market Scope

Metrics | Details |

By Process | Furnace Black, Channel Black, Thermal Black, Acetylene Black |

By Grade | Standard Grade, Specialty Grade |

By Application | Tires and Industrial Rubbers, Non-Tire Rubber, Inks & Toners, Plastics, Textile Fiber, Battery, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report - Request for Sample

Market Dynamics

Growing Automotive Industry

The growing automotive sector is a significant driver for the carbon black market, particularly due to its vital role in the production of tires and rubber products. According to the European Automobile Manufacturers' Association (ACEA), around 82 million motor vehicles are sold globally each year, driving significant demand for automotive components, including tires, which rely heavily on carbon black. This high volume of vehicle sales contributes to the continuous growth of the carbon black market.

According to the Automotive Tyre Manufacturers Association, tire production for two- and three-wheelers saw significant growth, with a 15% increase in 2022 and a 6% increase in 2023. This surge in tire production directly drives the demand for carbon black, which is essential for enhancing tire performance, durability, and safety. Carbon black is used extensively in the manufacturing of tires, providing strength, durability, and wear resistance, while also enhancing the tire’s performance, fuel efficiency, and safety.

Environmental And Health Concerns

Environmental and health concerns are significant restraining factors for the carbon black market, primarily due to the harmful effects of its production and use. Carbon black production, which involves the incomplete combustion of hydrocarbons, releases pollutants such as volatile organic compounds (VOCs), particulate matter, and other hazardous chemicals. These emissions contribute to air pollution, particularly in urban and industrial areas, which can have severe environmental and health impacts.

As a result, there is increasing pressure from governments, environmental agencies, and health organizations to regulate and limit carbon black emissions. The U.S. Environmental Protection Agency (EPA) has established National Emission Standards for Hazardous Air Pollutants (NESHAP) targeting carbon black production facilities. These standards aim to control emissions of hazardous air pollutants (HAPs), including benzene, from facilities producing carbon black through processes such as furnace black, thermal black, or acetylene decomposition.

Segment Analysis

The global carbon black market is segmented based on process, grade, application and region.

Industrial Rubber and Tire Boom: Powering Carbon Black Consumption

The Tires and Industrial Rubbers segment plays a crucial role in driving the carbon black market. In India, rising automotive production—up 7% in 2023 to 5.85 million units—has directly fueled tire demand, with output exceeding 217 million units. This growth has significantly increased carbon black usage in tire manufacturing. Globally, rubber production reached 29.7 million metric tons in 2022, reflecting the expanding demand for industrial rubber products.

China also saw an 11.3% surge in tire production in March 2023, highlighting strong regional momentum. The segment benefits from supportive policies, such as India’s anti-dumping duties on carbon black imports, which promote local manufacturing. Thus, the expanding automotive and rubber industries continue to reinforce carbon black consumption worldwide.

Geographical Penetration

Rising Automotive Output and Sustainability Fuel Asia-Pacific Carbon Black Demand

The Asia-Pacific carbon black market is experiencing robust growth, driven by expanding rubber, automotive, plastics, and coatings industries. Carbon black is vital in enhancing the strength and durability of products, particularly tires. The region’s automobile production rose from 46 million units in 2021 to over 51 million in 2023, with major contributions from China, India, and Japan, fueling carbon black demand.

The 15th Asia-Pacific Carbon Black Conference in Kolkata in October 2024 highlighted innovations and sustainability trends, with companies like Aditya Birla Group and PCBL showcasing eco-friendly solutions. The rise of electric vehicles (EVs) is also influencing consumption patterns, promoting lightweight and durable materials. These factors collectively position the Asia-Pacific for long-term market growth aligned with green initiatives.

Sustainability Analysis

Sustainability is becoming a central focus in the carbon black market, especially as industries face increasing pressure to reduce their environmental footprint. Traditional carbon black production is energy-intensive and emits significant greenhouse gases, prompting a shift toward more sustainable alternatives. Companies are increasingly investing in recovered carbon black (rCB) derived from end-of-life tires and other waste materials, aligning with circular economy principles.

Bio-based carbon black, made from renewable feedstocks, is also gaining traction as a low-emission alternative. Leading manufacturers in the Asia-Pacific region and globally are adopting cleaner production technologies, improving energy efficiency, and incorporating carbon capture methods.

Competitive Landscape

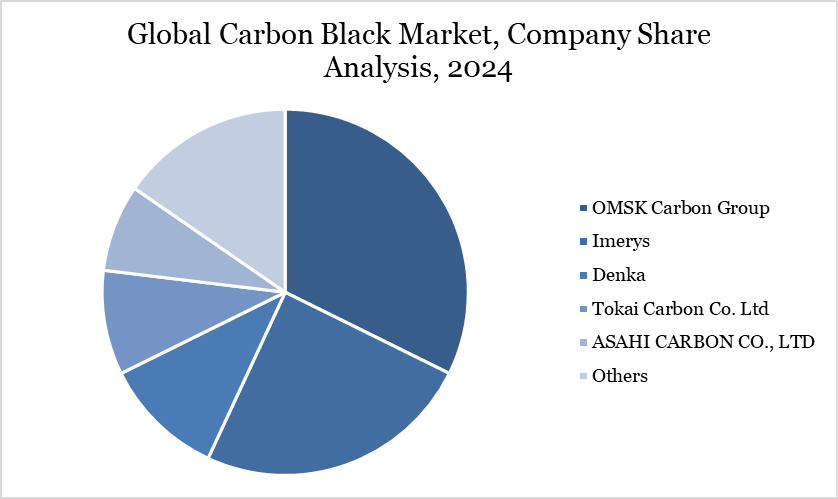

The major global players in the market include OMSK Carbon Group, Imerys, Denka, Tokai Carbon Co. Ltd, ASAHI CARBON CO., LTD., Birla Carbon, Continental Carbon Company, Lion Specialty Chemicals Co., Ltd., OCI COMPANY LTD, Cabot Corporation and among others.

Key Developments

In 2025, Imerys has completed the acquisition of Chemviron’s European diatomite and perlite business, a subsidiary of Calgon Carbon Corporation. The business, which generated around €50 million in revenue in 2024 and employed approximately 130 people, includes three high-quality mining and industrial assets in France and Italy.

In 2024, Mitsubishi Corporation (MC) and Denka Company Limited (Denka) announced the signing of a joint-venture agreement in the business of fullerenes, carbon molecules that form the foundation of cutting-edge materials in the field of nanotechnology. Under the terms of the agreement, Denka will acquire a 50% stake in Frontier Carbon Corporation (FCC) from MC. FCC is a company focused on the manufacturing and sales of fullerenes.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report