Global Automotive Carbon Fiber Market is segmented By Application (Exterior, Interiors, Structural Assembly, Powertrain Cowl, Others), By Material (Long Fiber Thermoplastic, Short Fiber Thermoplastic, Continuous Carbon Fiber Thermoplastic, Sheet Molding Compound, Others), and by Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Automotive Carbon Fiber Market Report Overview

The Global Automotive Carbon Fiber Market report provides an analysis of the market shares, size, recent trends, future market outlook, and competitive intelligence. The demand for automotive carbon fiber is increasing due to the growing emphasis on lightweight materials in the automotive industry to improve fuel efficiency and reduce emissions. The market is witnessing a surge in demand from the Asia-Pacific region, where increasing urbanization and changing consumer preferences toward lightweight and high-performance vehicles are driving the demand for automotive carbon fiber. The competitive rivalry is intensifying with major players such as Toray Industries Inc., SGL Carbon SE, Mitsubishi Chemical Holdings Corporation, and others actively operating in the market.

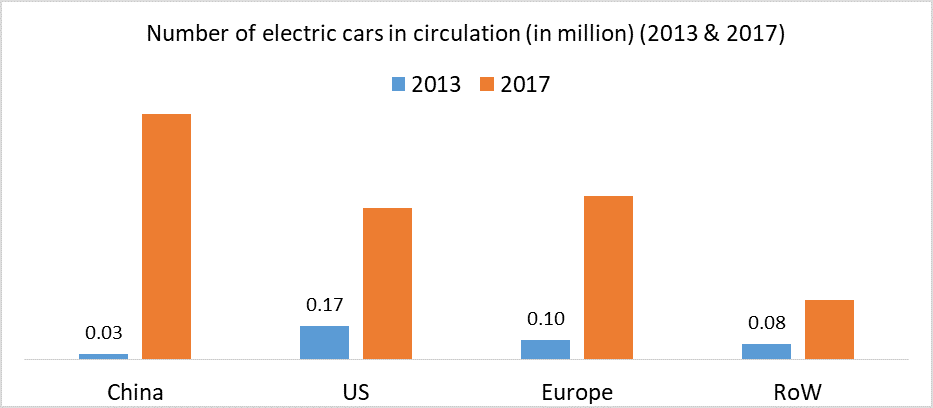

This is mainly due to the increasing demand for fuel-efficient vehicles coupled with the rising penetration of lightweight electric vehicles in developed countries like the US, the UK, Germany, Norway, and others.

Automotive Carbon Fiber Market Scope

|

Metrics |

Details |

|

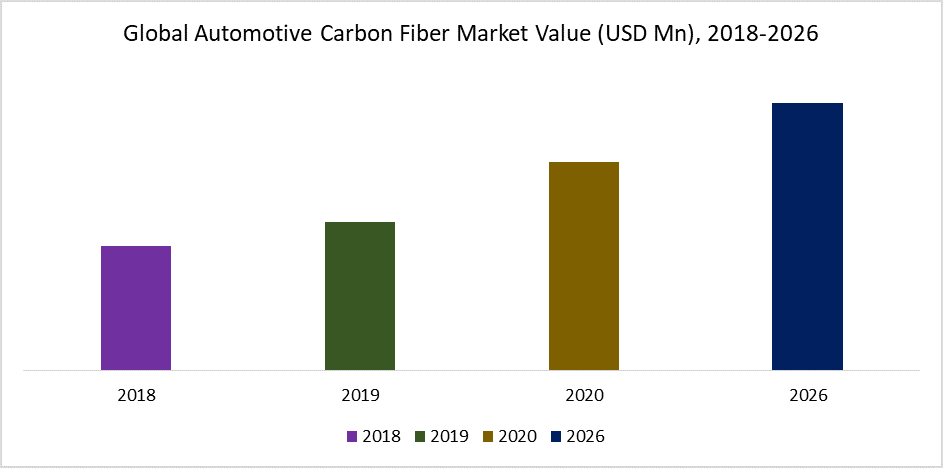

Market CAGR |

8% |

|

Segments Covered |

By Application, By Material, and By Region |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other key insights. |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Market Share |

North America |

To Get a Free Sample Click here

Source: DataM Intelligence Analysis (2023)

Source: DataM Intelligence Analysis (2023)

Carbon Fiber is a polymer and is sometimes known as graphite fiber. It is a very strong material that is also very lightweight. Carbon fiber is five times stronger than steel and twice as stiff. Though carbon fiber is stronger and stiffer than steel, it is lighter than steel; making it the ideal manufacturing material for the automotive industry. According to the US Department of Energy, carbon fiber composites could reduce passenger car weight by 50%, which would improve fuel efficiency by nearly 35% without compromising the performance of the car or the safety of its passengers. Therefore, rising awareness about the benefits of carbon fiber and increased adoption of carbon fiber by manufacturers in the automotive industry will further boost growth in the market.

The report covers all the major trends and drivers playing a vital role in the growth of the global Automotive Carbon Fiber market. The global Automotive Carbon Fiber market has been segmented based on region, application, and material.

Source: DataM Intelligence

Automotive Carbon Fiber Market Dynamics

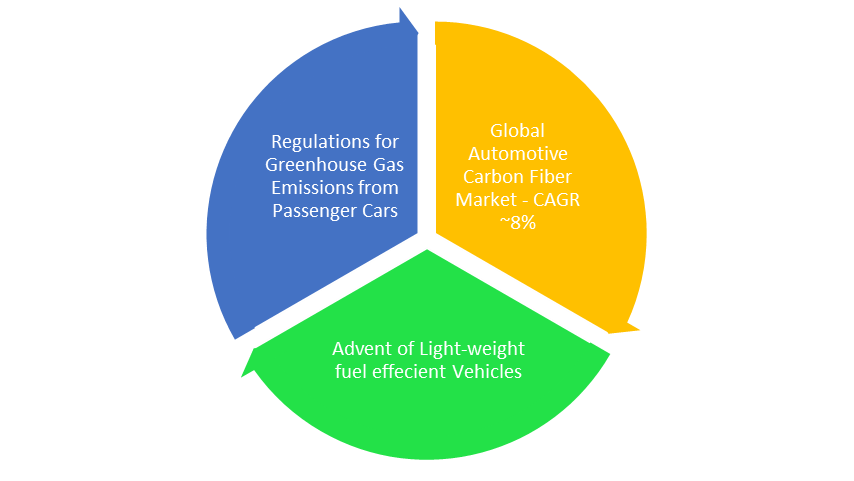

The global Automotive Carbon Fiber market growth is primarily driven by various technological advancements happening in the industry coupled with the launch of new and innovative Carbon Fiber for automobiles by the market players. Moreover, the growing demand for carbon fiber-reinforced plastics in luxury cars, race cars, and other high-performance cars pushes the market toward growth. Technological development and new material systems to make carbon fiber parts for mass-volume vehicles have a direct impact on the dynamics of the automotive composites carbon fiber market.

Besides, vehicle production is increasing owing to the rising demand for comfort, rise in penetration, and demand for lightweight passenger vehicles, government norms regarding pollution & steps taken to implement electric vehicles. Many car companies, such as BMW, Audi, GM, Honda, and Polestar have established agreements with carbon fiber material producers for mass production, and are investing in their processes to support low-cost carbon fiber manufacturing. Therefore, the rise in popularity among passenger and commercial vehicle manufacturers and the increase in sales of EVs is expected to drive the market over the forecast period.

Source: DataM Intelligence

However, various microeconomic factors and high initial costs might hinder the market growth. For instance, India’s passenger vehicle industry suffered its worst sales performance in nearly 19 years in 2019; as a slowing economy, higher ownership costs, and floods in some states deterred buyers.

Automotive Carbon Fiber Market Segmentation

By application, the global automotive carbon fiber market is segmented into exteriors, interiors, structural assembly, powertrain cowl, and others (under body system, pressure vessel). In 2018, the Exterior segment accounted for the majority share of the global market. Carbon fiber body panels are used on performance-oriented vehicles because they are approximately twice as rigid, and significantly stronger but are much lighter than panels made from steel and are also more rigid, stronger, and lighter than aluminum panels. Reduced weight increases the performance as the engine will have less weight to carry and it will get better fuel efficiency.

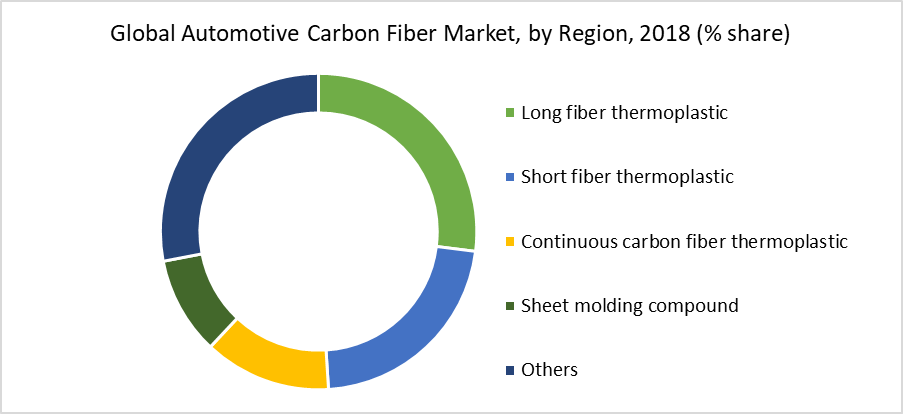

By material, the global automotive carbon fiber market is segmented into long-fiber thermoplastic, short-fiber thermoplastic, continuous carbon fiber thermoplastic, sheet molding compound, and others (textile, Prepreg). Carbon fiber-reinforced plastics (CFRPs) are finding their way into new applications as industries demand materials with ever-higher strength-to-weight ratios, corrosion resistance, and workability. The widespread adoption of CFRPs in alternative vehicles such as electric/hybrid and fuel cell vehicles, and CO2 emission regulations mandated by the European and U.S. parliaments are also expected to drive the automotive carbon fiber market globally.

Source: DataM Intelligence

Automotive Carbon Fiber Market Geographical Analysis

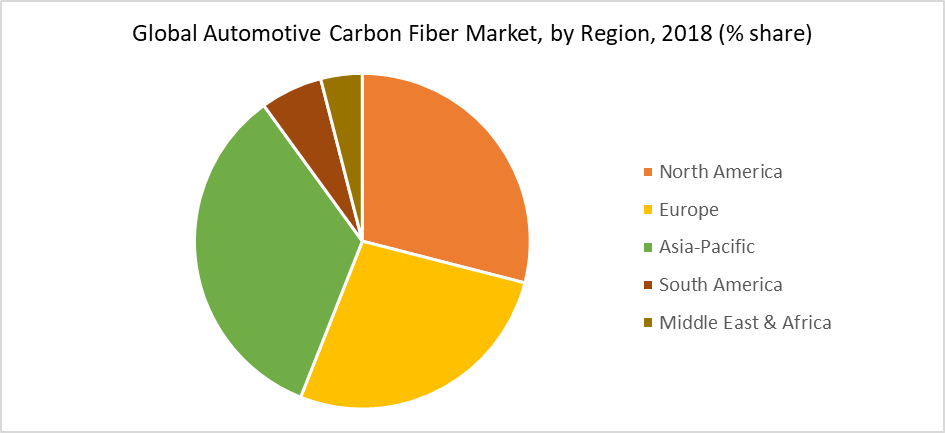

By geography, the global Automotive Carbon Fiber Market is segmented into North America, Asia-Pacific (APAC), Europe, South America, and the Middle East and Africa (MEA).

Source: DataM Intelligence

In 2018, APAC dominated the global Automotive Carbon Fiber market. Besides, China is the leading country in the region as well as globally. Most of the product demand in the Asia Pacific is fulfilled by China, India, South Korea, and Japan. China is the number one automotive market, with 300 million cars on the road (vs. 270 million in the US) and production of 24.8 million vehicles in 2017, compared to 11.2 million in the US, 8.4 million in Japan, almost 5.7 million in Germany, and 4 million and 3.7 million in India and South Korea, respectively.

In North America and Europe, the automotive industry continues to develop composites for lightweighting vehicles, driven by fuel economy and emissions regulations. For instance, EU emissions regulations mandate a mere 95 g/km of CO2 by 2021, with another 15% reduction by 2025, and 2030, a further 30% reduction by 2021.

To meet the standards for emissions and carbon fiber use, major manufacturers and OEMs in the market have started investing in R&D activities as well as entering into partnerships for technology exchange across borders. For instance, Magna Exteriors formed a joint venture with GAC Component Co. Ltd. (GACC, Guangzhou, China) to begin production of thermoplastic composite (TPC) liftgates for a global automaker's crossover vehicle starting in late 2018.

Kangde Group (Hong Kong) entered an agreement with BAIC Motor to build an Industry 4.0 smart factory in Changzhou to produce CFRP car body and other components beginning in 2019 and scaling to 6 million parts/yr — its 66,000 MT/yr carbon fiber facility in Rongcheng will begin production in 2023.

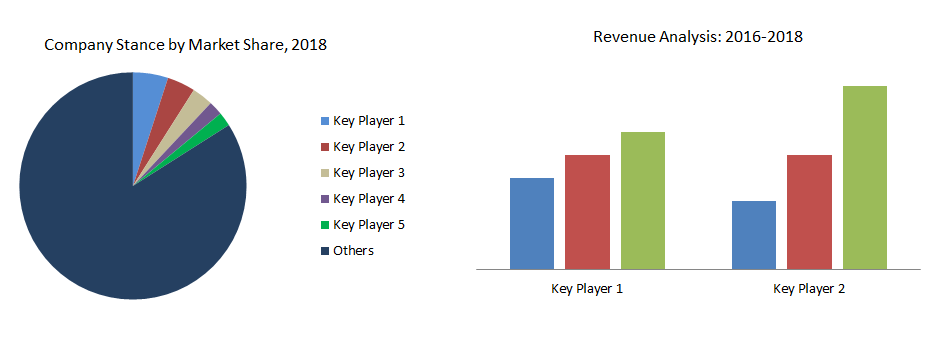

Automotive Carbon Fiber Companies and Competitive Landscape

Global Automotive Carbon Fiber Market is fragmented with the presence of global and regional players in the market. The market players in the Automotive Carbon Fiber market are focusing on expanding through strategic interventions, such as acquisitions, collaborations, expansion, and launching advanced products in Automotive Carbon Fiber market. To that end, besides expanding their presence, companies are expected to formulate effective distribution strategies to make their presence felt in the upcoming markets for Automotive Carbon Fiber.

Intense rivalry among top players in the market has started the fierce competition at various levels for setting a low price, driving aggressive marketing strategies, and new and innovative product launches as per consumers’ preferences.

Some major players in the market are Hexcel Corporation, Mitsubishi Chemical Corporation, SGL Carbon SE, Teijin Limited, Toray Industries Inc., A&P Technology Inc, DowAksa USA LLC, Solvay, Kemrock Industries and Exports Limited, Cytec Industries Inc, and among others.

Source: DataM Intelligence

Why Purchase the Report?

-

Identify new growth opportunities with In-depth insights for strategic business plans and design innovative strategies for sustainable growth.

-

Comprehensive details on factors that will drive or challenge the growth of market players.

-

Deep Sector-Specific Intelligence

-

Highlights of the competitive landscape

**The global Automotive Carbon Fiber market report would provide access to an approx., 92 market data tables,76 figures, and 188 pages.

Target Audience

-

Automobile manufacturers

-

Industry associations and automotive experts

-

Automotive component manufacturers

-

Automotive technology providers

-

Tier 1, Tier 2, and Tier 3 suppliers

-

Industry Investors/Investment Bankers