Disease Overview:

Waldenstrom macroglobulinemia (WM) is a rare, slowly progressing type of non-Hodgkin lymphoma that originates from abnormal B cells. It is characterized by the excessive production of immunoglobulin M (IgM) antibodies, which can lead to blood thickening and associated symptoms.

Common signs include fatigue, vision problems, and nerve issues. Diagnosis typically involves blood tests, bone marrow biopsy, and genetic analysis.

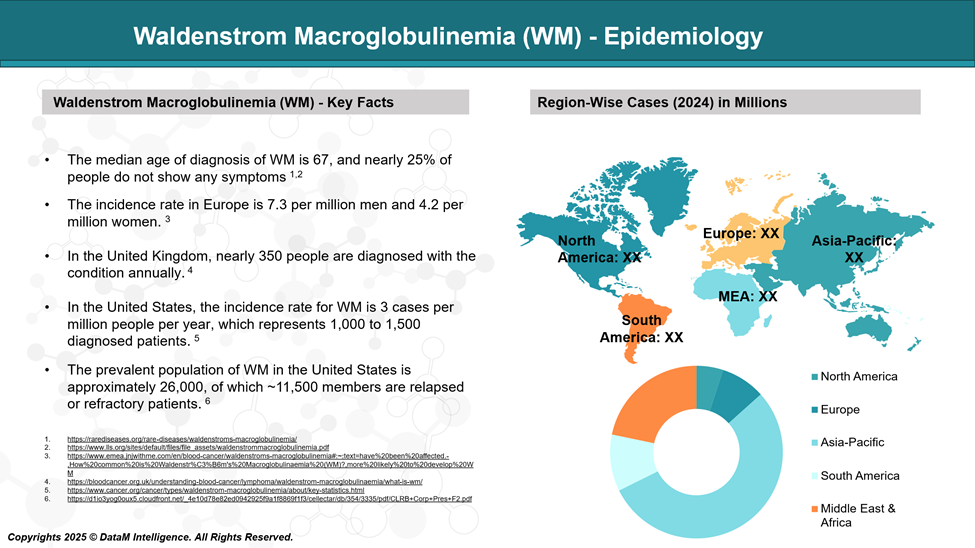

Epidemiology Analysis (Current & Forecast)

Waldenstrom macroglobulinemia (WM) is a rare blood cancer that affects about 3 to 5 people per million each year. It is more common in older adults, typically diagnosed around the age of 70, and occurs more often in men.

WM is seen more frequently in people of European ancestry and is uncommon in other ethnic groups. It makes up a small portion of all non-Hodgkin lymphoma cases.

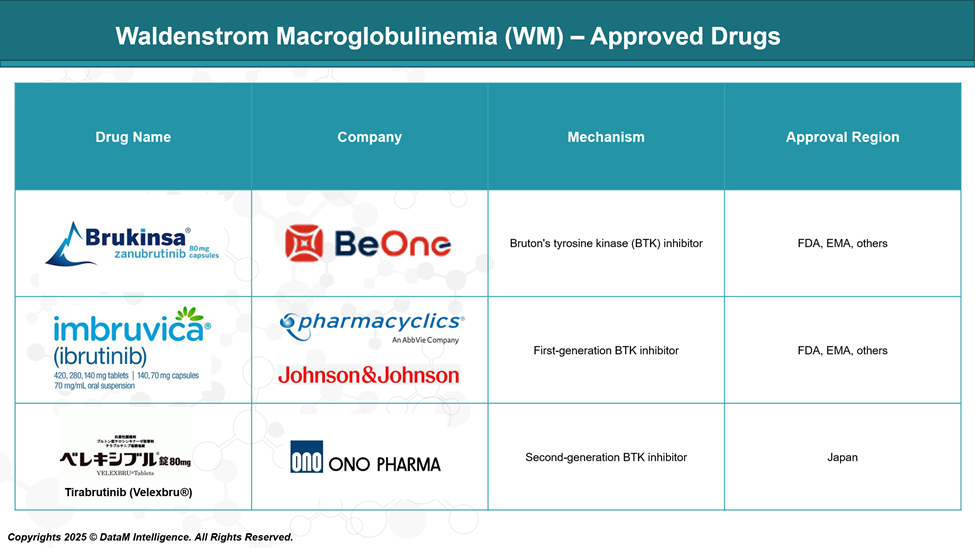

Approved Drugs - Sales & Forecast

Approved treatments for Waldenstrom macroglobulinemia mainly include BTK inhibitors, which block signals that help cancerous B cells grow. Drugs like ibrutinib, zanubrutinib, and tirabrutinib have shown strong activity in managing the disease and are approved in various regions. These therapies offer effective, targeted options for patients with WM.

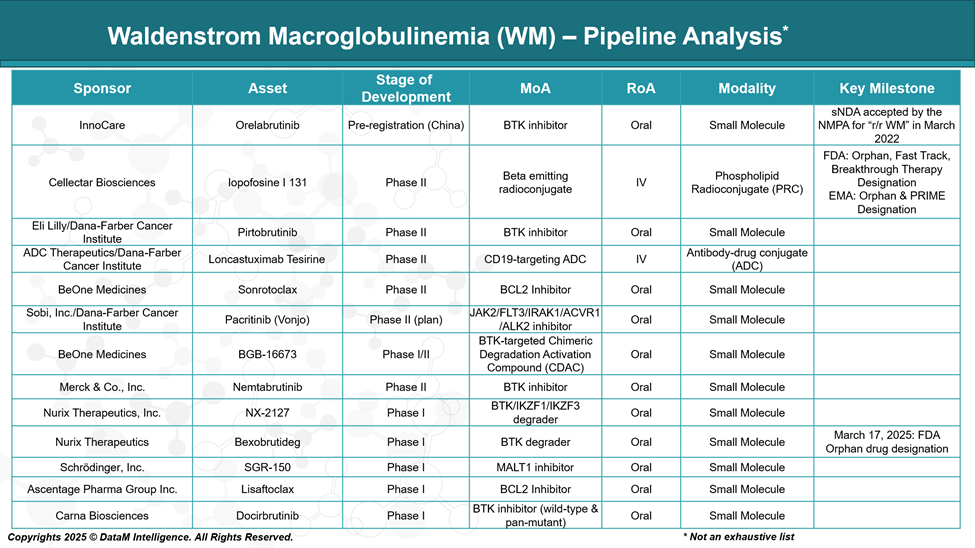

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for Waldenstrom macroglobulinemia is evolving, with several novel therapies under investigation. Current research focuses on improving outcomes through next-generation BTK inhibitors, combination regimens, and therapies targeting genetic mutations.

These pipeline developments aim to overcome resistance, enhance safety, and offer more personalized treatment options for patients with WM.

Competitive Landscape and Market Positioning

The competitive landscape for Waldenstrom Macroglobulinemia (WM) is rapidly evolving with multiple approved BTK inhibitors dominating the market alongside emerging therapies exploring novel mechanisms. Established drugs like ibrutinib and zanubrutinib lead treatment, but newer pipeline candidates aim to address resistance and safety limitations.

Additionally, innovative modalities such as antibody-drug conjugates and targeted radiotherapies are expanding therapeutic options, intensifying competition, and improving patient outcomes.

Drug | Company | Approval Status / Phase | Mechanism of Action | Key Differentiators | Market Positioning |

Ibrutinib | AbbVie / Janssen | Approved / Marketed globally | Covalent BTK inhibitor | First-in-class; broad indications; off-target effects (bleeding, AFib) | Market pioneer; leader with some safety & resistance challenges |

Zanubrutinib | BeOne Medicines | Approved (US, China, others) | Covalent BTK inhibitor | Improved selectivity; better safety profile | Safer alternative to ibrutinib; gaining frontline use |

Tirabrutinib | Ono Pharmaceutical | Approved (Japan, others) | Covalent BTK inhibitor | Highly selective; CNS penetration; favorable safety | Targeting Asian markets, CNS-involved cases |

Orelabrutinib | Beijing InnoCare Pharma Tech / InnoCare Ltd. | Pre-registration (China) | Covalent BTK inhibitor | Local approval focus; competitive BTK option for Chinese market | Positioned for China market; competing with global BTK drugs |

Pirtobrutinib | Eli Lilly / Dana-Farber Cancer Institute | Phase II | Non-covalent BTK inhibitor | Reversible binding; active against resistant mutations | Next-gen option for resistant/intolerant patients |

Nemtabrutinib | Merck & Co., Inc. | Phase II | Covalent BTK inhibitor | Designed for resistant disease; next-gen safety | Competing in resistant/refractory patient segments |

BGB-16673 | BeOne Medicines | Phase I/II | BTK degrader | Novel BTK degradation mechanism | Innovative approach to overcome resistance |

Iopofosine I-131 | Cellectar Biosciences | Phase II | Radiopharmaceutical (targeted radiation) | Unique targeted radiotherapy modality | Novel non-BTK modality; for relapsed/refractory patients |

Loncastuximab Tesirine | ADC Therapeutics /Dana-Farber | Phase II | Antibody-drug conjugate (CD19-targeted) | ADC targeting CD19; an alternative to chemo | Differentiated by ADC mechanism; relapsed/refractory disease |

Sonrotoclax | BeOne Medicines | Phase II | BCL-2 inhibitor | Targets apoptotic pathway; potential synergy with BTK inhibitors | Explores a complementary mechanism to BTK inhibition |

Pacritinib (Vonjo) | Sobi, Inc. / Dana-Farber Cancer Institute | Phase II (planned) | JAK2/FLT3 inhibitor | Addresses inflammation and proliferation signaling pathways | Potentially complementary or alternative pathway targeting |

Summary:

- BTK inhibitors (approved + pipeline) dominate, targeting resistance and safety improvements.

- Orelabrutinib adds regional focus with China pre-registration.

- Non-BTK modalities (Iopofosine I-131, Loncastuximab Tesirine) provide important alternatives, especially in relapsed/refractory settings.

- Emerging mechanisms such as BTK degradation (BGB-16673) and apoptosis modulation (Sonrotoclax) add diversity and potential combination options.

- Pacritinib targets JAK2/FLT3 signaling, offering a distinct approach.

Key Companies:

Target Opportunity Profile (TOP)

Emerging drugs aiming to disrupt the WM market must demonstrate a clear clinical advantage in safety and efficacy while leveraging innovative mechanisms and convenient dosing to attract physicians and patients. Overcoming resistance and improving quality of life will be key differentiators to gain market share against well-established BTK inhibitors and novel therapies.

Parameter | Current Approved SoC | Emerging Drugs Target Profile | Gap / Opportunity |

Safety | Moderate to high incidence of adverse events such as atrial fibrillation (especially ibrutinib), bleeding, hypertension, infections | Significantly improved safety with fewer off-target effects and lower serious adverse event rates | Reduce chronic toxicities that limit long-term adherence |

Efficacy | High overall response rates; durable remissions but resistance can develop over time | Equal or better efficacy with activity in patients resistant/intolerant to current drugs | Overcome resistance and improve durability of response |

Mechanism of Action | Covalent BTK inhibitors (irreversible binding) | Novel MoAs: non-covalent/reversible BTK inhibitors, BTK degraders, apoptosis modulators, targeted radiotherapy | Address resistance mutations and diversify treatment options |

Route of Administration (RoA) | Oral once or twice daily | Oral preferred; alternative routes (IV, radiotherapy) if benefit is substantial | Maintain or improve convenience to support adherence |

Dose | Fixed dosing with some drugs requiring twice-daily dosing | Simplified regimens (once daily or less frequent) with flexible dosing | Reduce pill burden and improve pharmacokinetics |

Modality | Small molecules (BTK inhibitors) | Small molecules plus novel modalities like ADCs and radiopharmaceuticals | Expand treatment landscape for refractory patients |

Innovation | Established kinase inhibition, limited to BTK | Innovative approaches overcoming resistance and improving safety | Differentiation through new MoAs and reduced side effects |

Pharmacokinetics / Dynamics | Steady target inhibition but potential drug-drug interactions (e.g., with CYP3A4 inhibitors) | Minimal drug-drug interactions; rapid and sustained target engagement | Better suitability for polypharmacy patients |

Market Access | Well established, reimbursed; some pricing concerns | Competitive pricing with robust clinical data is needed | Price and reimbursement pressures require clear advantages |

Key Takeaways:

Current BTK inhibitors provide effective frontline therapy for WM but have limitations in safety, resistance management, and treatment diversity. Emerging therapies that improve tolerability, overcome resistance, and offer novel mechanisms or modalities have strong potential to disrupt the market and meet unmet patient needs.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: