Disease Overview:

Von Willebrand Disease (VWD) is an inherited bleeding disorder caused by a deficiency or dysfunction of von Willebrand factor (VWF), a protein that helps blood platelets form clots and adhere to damaged blood vessels. This leads to prolonged bleeding episodes, ranging from mild to severe, depending on the type of VWD. It is the most common inherited bleeding disorder and affects both males and females.

There are three main types:

Type 1: Partial quantitative deficiency of VWF (most common and usually mild).

Type 2: Qualitative defects in VWF function (subtypes: 2A, 2B, 2M, 2N).

Type 3: Severe quantitative deficiency or absence of VWF (rarest and most severe).

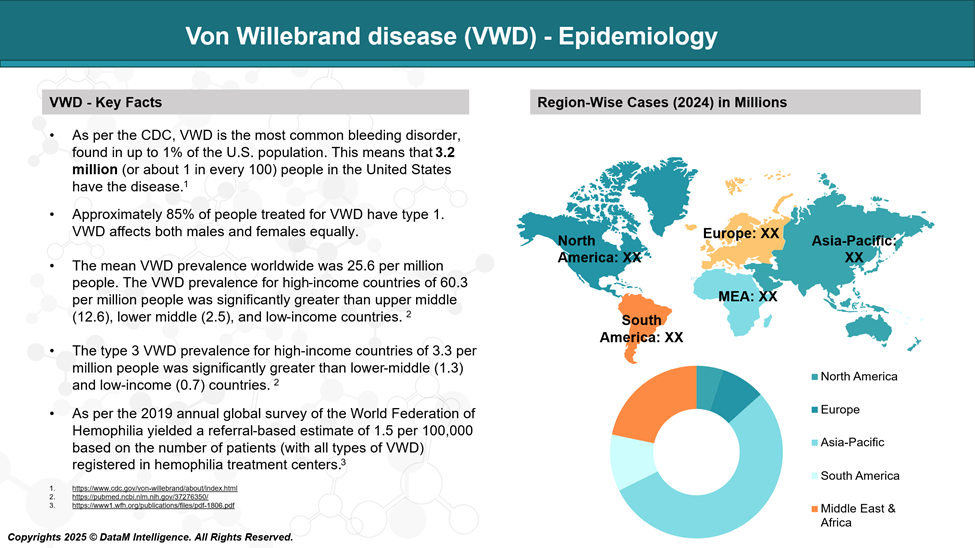

Epidemiology Analysis (Current & Forecast)

Von Willebrand disease (VWD) affects both men and women equally and is estimated to occur in up to 1% of the general population.

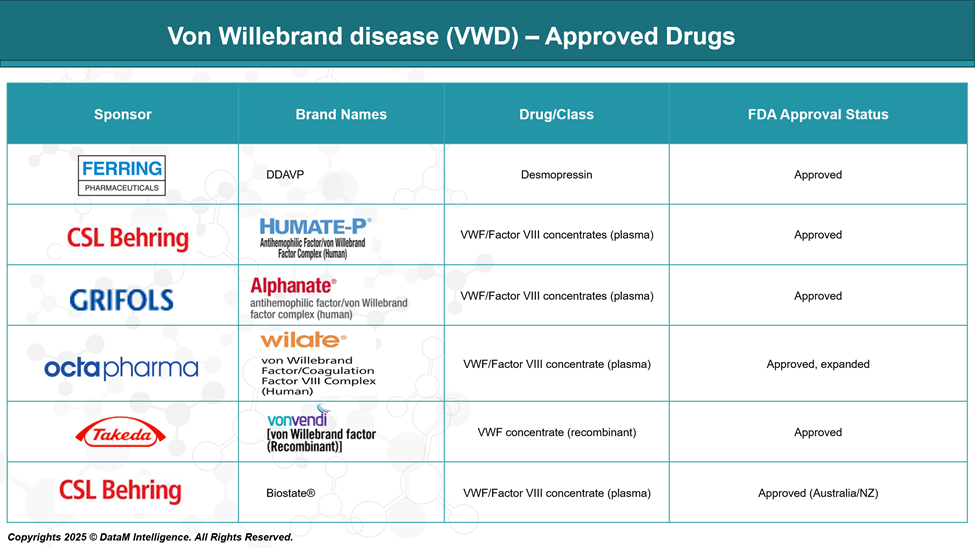

Approved Drugs - Sales & Forecast

Several approved drugs are available to manage von Willebrand disease, aiming to prevent or control bleeding episodes. The main treatments include desmopressin (DDAVP), which stimulates the release of von Willebrand factor, and replacement therapies with concentrates containing von Willebrand factor and factor VIII for those who do not respond to desmopressin.

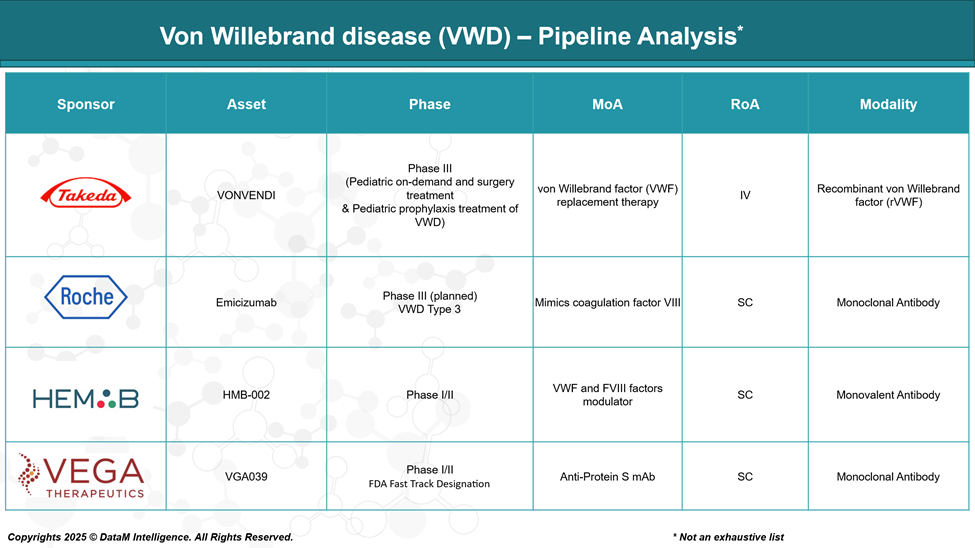

Pipeline Analysis and Expected Approval Timelines

The therapeutic pipeline for von Willebrand disease is expanding, with several innovative candidates in various stages of development and a focus on improving convenience, efficacy, and addressing unmet needs.

Competitive Landscape and Market Positioning

The von Willebrand disease (VWD) market is highly competitive, featuring a mix of global pharmaceutical leaders and innovative biotech firms. Established companies such as Takeda, CSL Behring, Grifols, and Octapharma dominate with a broad portfolio of plasma-derived and recombinant factor concentrates, leveraging extensive global reach, strong clinician trust, and investment in research and development.

The pipeline is also heating up with emerging players like Vega Therapeutics (VGA039) and Roche (Emicizumab), aiming to disrupt the market through innovative mechanisms and more convenient administration routes

Strategic Market Segmentation and Future Positioning

Drug/Class | Company | Route | Strategic Positioning | Market Status |

Humate-P, Wilate, Alphanate | CSL Behring, Octapharma, Grifols | IV | Standard of care, broad label, high clinician trust | Approved, market leaders |

VONVENDI | Takeda | IV | Only recombinant VWF, pediatric label, premium safety | Approved, expanding |

Emicizumab | Roche | Subcutaneous | Disruptive, home use, inhibitor segment | Pipeline, high potential |

HMB-002 | Hemab Therapeutics | Subcutaneous | Next-gen bispecific, severe/frequent bleeds | Pipeline, innovative |

VGA039 | Vega Therapeutics | Subcutaneous | Universal, all VWD types, Fast Track | Pipeline, broad potential |

Strategic Implications

- Short-term: Plasma-derived and recombinant concentrates will continue to dominate, with VONVENDI consolidating its leadership in safety-conscious and pediatric markets.

- Mid- to Long-term: The emergence of subcutaneous, next-generation biologics (Emicizumab, HMB-002, VGA039) will redefine the competitive landscape, shifting the market toward patient-centric, home-based care and targeting previously underserved populations (e.g., those with inhibitors or frequent bleeds).

- Innovation and Access: Companies investing in novel delivery systems, digital health integration, and real-world evidence generation will be best positioned to capture share in this evolving landscape.

Key Companies:

Target Opportunity Profile (TOP)

Here is a comparative table outlining the target opportunity profile for emerging drugs in von Willebrand disease (VWD) versus currently approved therapies, focusing on key differentiators such as safety, efficacy, mechanism of action (MOA), route of administration (ROA), dosing, modality, and innovation:

Attribute | Approved Drugs (Desmopressin, Plasma-derived & Recombinant VWF/FVIII, Antifibrinolytics) | Target Profile for Emerging Drugs (e.g., Emicizumab, VGA039, HMB-002) |

Safety | Plasma-derived: risk of viral transmission, allergic reactions; desmopressin: fluid retention, tachyphylaxis | Superior safety (non-plasma, low immunogenicity, minimal allergic/infusion reactions) |

Efficacy | Effective for most, but not all, VWD types; variable response in severe/refractory cases | Equal or greater efficacy, especially in severe/refractory and inhibitor cases; lower annualized bleeding rates |

MOA | Factor replacement (VWF/FVIII), stimulates endogenous VWF release (desmopressin) | Novel MOAs (e.g., bispecific antibodies, protein S modulation, aptamers) targeting broader or alternative pathways |

ROA | IV (most), intranasal (desmopressin), oral (antifibrinolytics) | Subcutaneous or oral preferred for ease of use and home administration |

Dosing | Frequent IV infusions or repeated nasal sprays; short-acting | Less frequent dosing (weekly or longer intervals), long-acting formulations |

Modality | Plasma-derived proteins, recombinant proteins, and small molecules | Monoclonal antibodies, aptamers, siRNA, nanotechnology, gene therapies |

Innovation | Incremental (improved purity, viral safety) | Transformative (new MOAs, delivery systems, digital health integration) |

Personalization | Limited; some tailoring by VWD type and response | Precision medicine approaches, adaptable to genetic subtype or patient profile |

Key Takeaway:

Emerging drugs that offer superior safety, innovative mechanisms, subcutaneous/oral administration, less frequent dosing, and the ability to address unmet needs in severe or refractory VWD will be best positioned to surpass currently approved therapies.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: