Disease Overview:

Vitiligo is an acquired skin condition characterized by the loss of pigment-producing cells in the epidermis. This leads to the development of white patches or macules on various parts of the body. Vitiligo is often linked to autoimmune disorders, with thyroid dysfunction being the most frequently observed association.

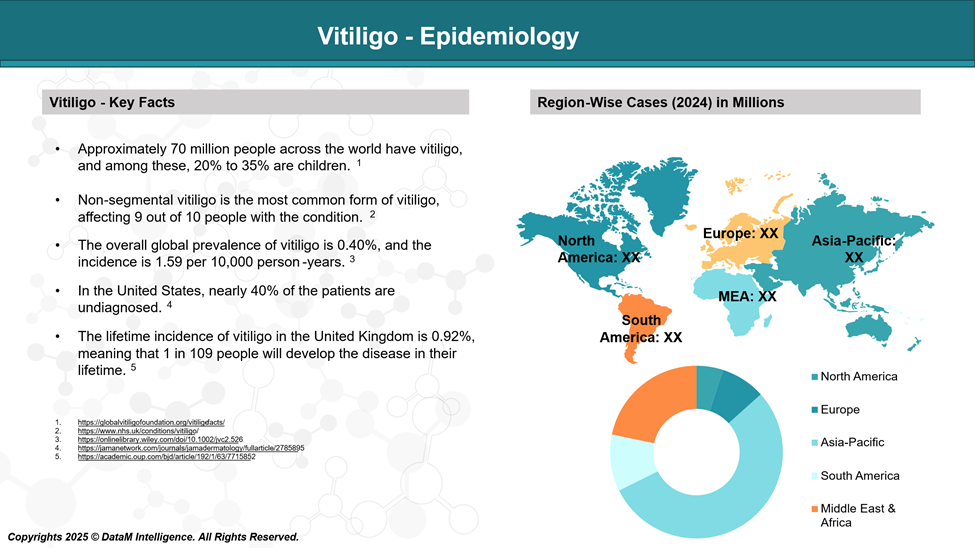

Epidemiology Analysis (Current & Forecast)

Vitiligo affects an estimated 0.5% to 2% of the global population, though the majority of studies suggest the prevalence is around 0.6% or lower. This means roughly 70 million people worldwide are living with the condition. It occurs across all ethnic groups, age ranges, and genders.

Approved Drugs - Sales & Forecast

As of May 2025, the U.S. Food and Drug Administration (FDA) has approved one medication specifically for the treatment of vitiligo:

Opzelura (ruxolitinib) cream: Approved in July 2022, Opzelura is a topical Janus kinase (JAK) inhibitor indicated for the treatment of nonsegmental vitiligo in adults and pediatric patients aged 12 years and older. It is the first and only FDA-approved medication that directly addresses repigmentation in vitiligo patients.

Opzelura is applied as a 1.5% cream to affected areas twice daily. Clinical trials have demonstrated its efficacy in promoting repigmentation, particularly on facial areas.

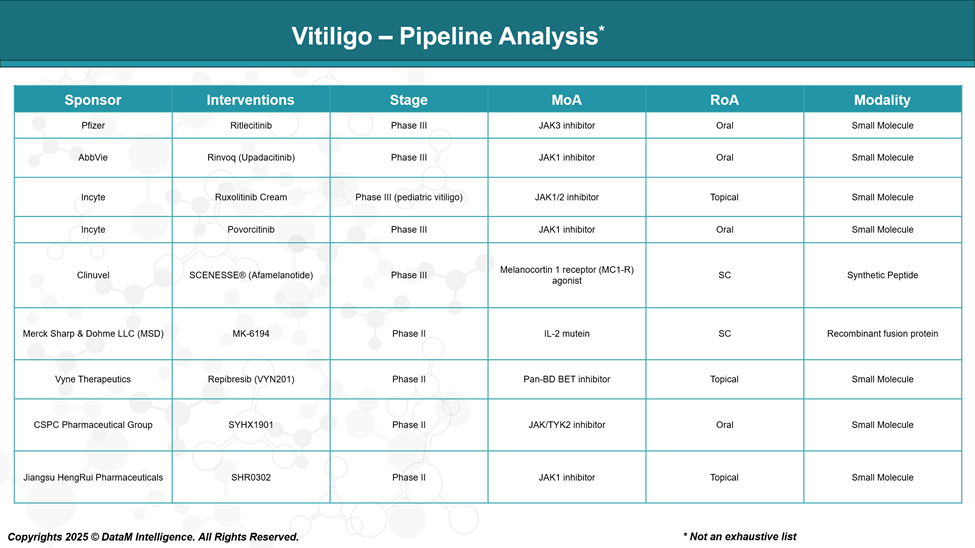

Pipeline Analysis and Expected Approval Timelines

The vitiligo treatment landscape is experiencing significant advancements, with numerous therapies in various stages of clinical development.

Here's an overview of the current pipeline:

Competitive Landscape and Market Positioning

The vitiligo treatment market is undergoing rapid transformation, with multiple players vying for leadership as new therapies emerge. Here's a strategic analysis of the current landscape:

Sponsor | Intervention | Stage | MoA | RoA | Strength / Market Positioning |

Incyte | Opzelura (Ruxolitinib) | Approved | JAK1/2 inhibitor | Topical | Only FDA-approved drug; strong market lead; expanding into pediatric use |

Incyte | Povorcitinib | Phase III | JAK1 inhibitor | Oral | Complements Opzelura with a systemic option; dual-leadership strategy |

Pfizer | Ritlecitinib | Phase III | JAK3 inhibitor | Oral | Oral convenience; potential for systemic cases; large pharma backing |

AbbVie | Rinvoq (Upadacitinib) | Phase III | JAK1 inhibitor | Oral | Backed by AbbVie’s immunology strength; effective oral option |

Clinuvel | SCENESSE (Afamelanotide) | Phase III | MC1-R agonist | SC implant | First melanocyte stimulator; effective but invasive route may limit uptake |

Merck (MSD) | MK-6194 | Phase II | IL-2 mutein (non-JAK) | SC | Novel mechanism; potential breakout if safe and effective |

Vyne Therapeutics | Repibresib (VYN201) | Phase II | Pan-BD BET inhibitor (epigenetic) | Topical | Unique MoA; next-gen class targeting gene transcription; strong innovation appeal |

CSPC Pharma | SYHX1901 | Phase II | JAK/TYK2 inhibitor | Oral | Dual inhibition may improve outcomes; focus on the Asian market |

Jiangsu HengRui | SHR0302 | Phase II | JAK1 inhibitor | Topical | Competing in topical space; potential for regional leadership in Asia |

Summary of Strategic Insights

- Market Leader: Incyte with both topical (Opzelura) and oral (Povorcitinib) assets.

- Key Oral Competitors: Pfizer and AbbVie with JAK inhibitors.

- Non-JAK Innovators: Clinuvel, Merck, and Vyne—offering differentiated approaches.

- Regional Players: CSPC and Jiangsu HengRui focusing on Asia with innovative MoAs

Key Companies:

Target Opportunity Profile (TOP)

To outperform existing vitiligo therapies like Opzelura (ruxolitinib cream) and capture meaningful market share, emerging drugs must exceed benchmarks in multiple areas. Here's a Target Opportunity Profile summarizing what next-generation therapies need to demonstrate across key attributes:

Target Opportunity Profile for Emerging Vitiligo Therapies

Attribute | Benchmark (Current Standard – Opzelura, etc.) | Target for Emerging Drugs |

Efficacy | ~50% patients achieve ≥75% facial repigmentation (F-VASI75) in 6–12 months | ≥60–70% F-VASI75 within 3–6 months; faster onset; durable full-body repigmentation |

Safety / Tolerability | Generally well tolerated; mild application-site reactions; some JAK-related systemic concerns | Minimal systemic immunosuppression risk; no black-box warnings; superior long-term safety |

Mechanism of Action (MoA) | JAK inhibition (JAK1/2/3) | Non-JAK or multi-pathway innovation (e.g., IL-2, MC1-R, epigenetic, melanocyte stimulators) |

Route of Administration (RoA) | Topical (Opzelura); oral (in trials); implant (SCENESSE) | Oral or long-acting SC with monthly or quarterly dosing; or elegant, once-daily topical |

Dose Frequency | Twice daily (Opzelura) for 24+ weeks | Once-daily or less frequent dosing with sustained results |

Modality | Small molecule JAK inhibitors | New modalities: biologics, peptide agonists, gene modulators, or nanocarrier topicals |

Durability of Response | Often requires continuous treatment to maintain repigmentation | Sustained repigmentation post-treatment; possibly disease-modifying |

Innovation Potential | Limited mechanistic diversity | Breakthrough innovation (e.g., immune tolerance restoration, melanocyte regeneration) |

Pediatric Suitability | Opzelura approved ≥12 years | Safe for <12 years with pediatric data and formulations |

Global Accessibility | U.S./EU approved; expensive | Lower-cost, scalable, or region-specific pricing strategies |

Strategic Gaps That New Therapies Can Exploit

- Systemic options for extensive vitiligo: Safer oral therapies are still unapproved.

- Disease modification: Most current drugs control symptoms, not the underlying pathogenesis.

- Speed and durability: Patients want faster, longer-lasting visible results.

- Pediatric unmet need: Few therapies are rigorously studied in children.

- Psychosocial benefit: Addressing stigma via cosmetic + functional restoration in darker skin tones.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: