1. Disease Overview:

Sickle cell disease (SCD) is a group of inherited blood disorders characterized by abnormalities in hemoglobin production. These abnormal hemoglobin cells are sickle-shaped, unlike the regular disc-shaped cells, hence the name sickle cell disease. These cells cannot perform regular functions and often accumulate in the small blood vessels, obstructing blood flow and leading to painful episodes called vaso-occlusive crises, organ damage, and stroke.

2. Epidemiology Analysis (Current & Forecast)

- Approximately 5% of the world’s population carries trait genes for hemoglobin disorders, mainly sickle-cell disease and thalassemia.

- Over 300,000 babies with severe hemoglobin disorders are born each year

| Parameter | Details |

| People affected by sickle cell disease (U.S.) | Over 100,000 individuals |

| People affected by sickle cell disease (Worldwide) | 8 million individuals |

| Percentage of U.S. sickle cell disease cases in people of African ancestry or who identify as Black | 90% (9 out of 10) |

| Black babies born with sickle cell trait | 1 in 13 |

| Black babies born with sickle cell disease | 1 in 365 |

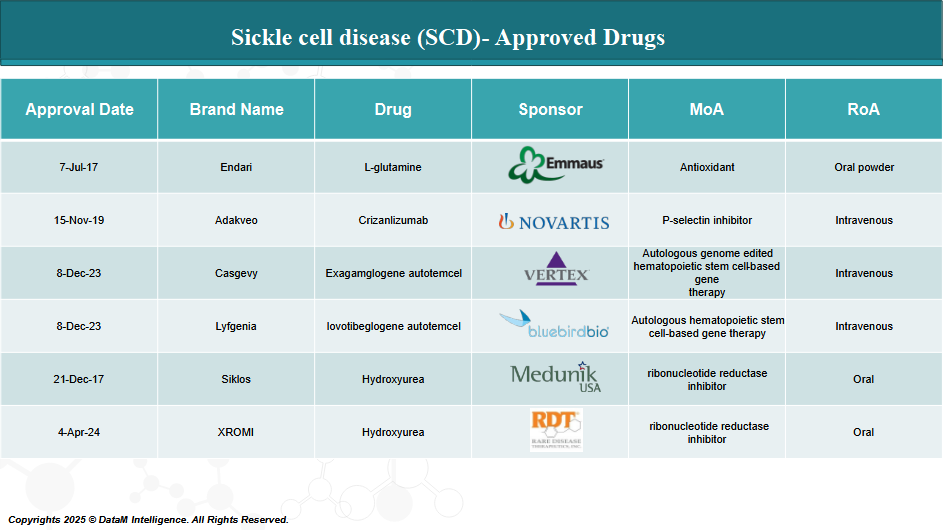

3. Approved Drugs (Current SoC) - Sales & Forecast

Over the past few decades, advancements in medical research have led to the development of several FDA-approved treatments aimed at managing symptoms, reducing complications, and improving the quality of life for individuals living with SCD. Recently, groundbreaking gene therapies have also been approved, offering the potential for a long-term cure.

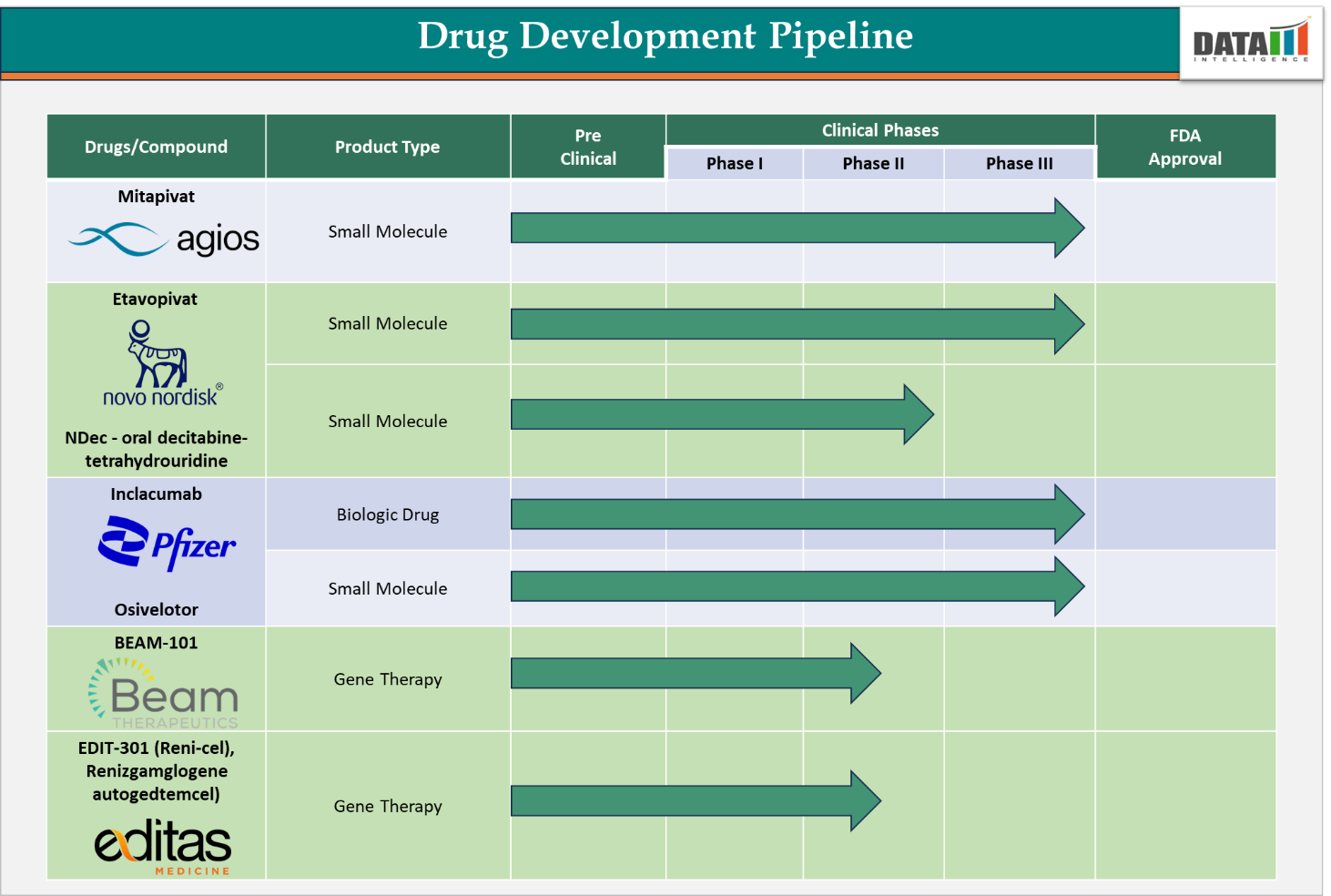

4. Pipeline Analysis and Expected Approval Timelines

While several treatments have been approved to manage SCD, ongoing research continues to explore innovative therapies aimed at providing more effective and potentially curative options

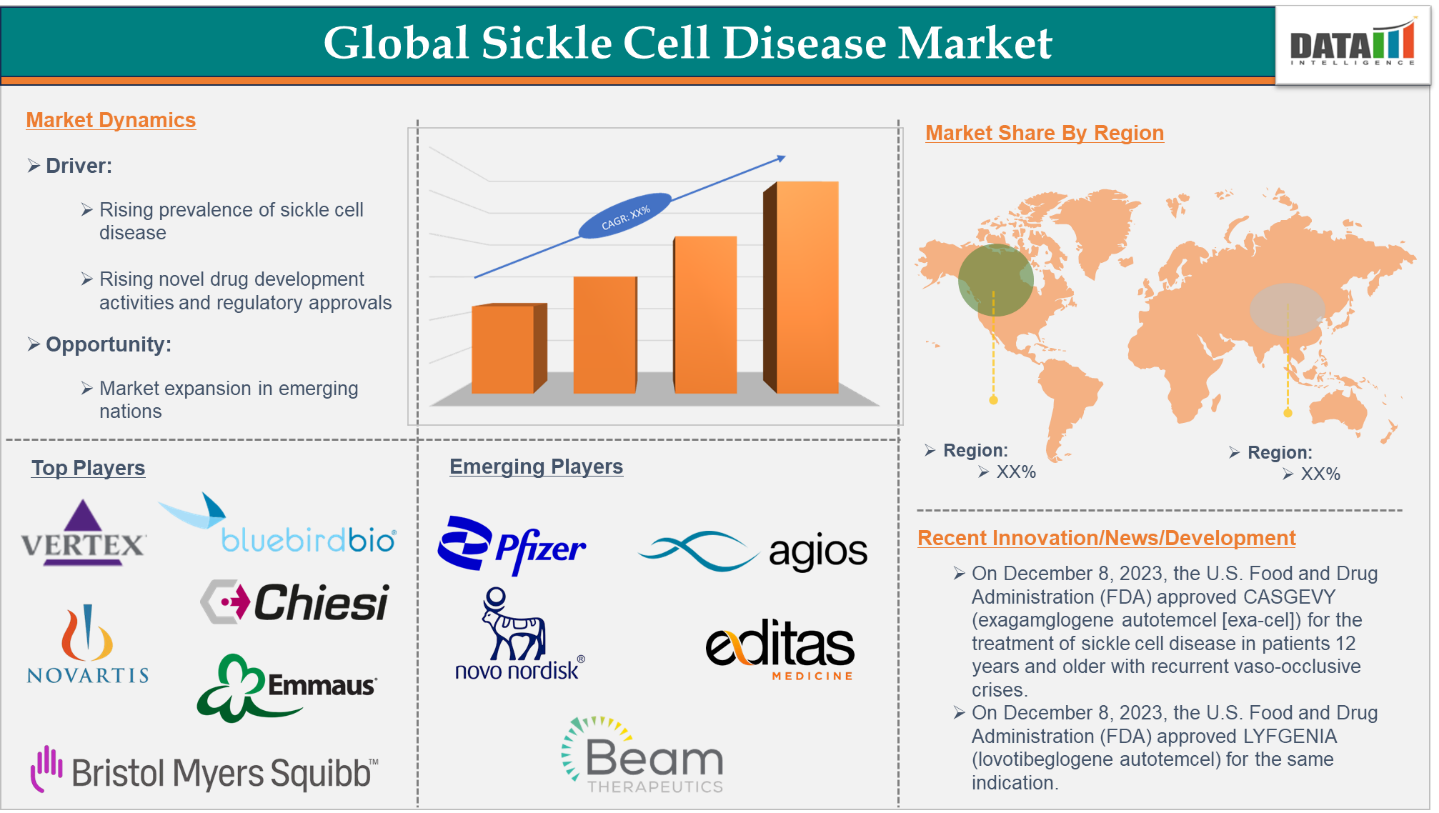

5. Market Size & Forecasting

The global sickle cell disease treatment market reached US$2.73 billion in 2023 and is expected to reach US$7.04 billion by 2032, growing at a CAGR of 11.3% during the forecast period of 2024-2032.

Unmet Needs

While significant advancements have been made in understanding and treating the condition, many critical gaps in care still remain.

| Area | Unmet Need |

| Pain Management | Current therapies do not fully prevent or relieve vaso-occlusive crises (pain episodes). |

| Curative Treatments | While gene therapies show promise, they are expensive, complex, and not widely accessible. |

| Access to Care | Many patients, especially in low- and middle-income countries, lack access to specialized care. |

| Early Diagnosis | Newborn screening is not universally implemented, delaying diagnosis and treatment. |

| Comprehensive Support | Lack of mental health care, social support, and education resources for patients and families. |

| Long-Term Monitoring | Inadequate follow-up leads to under-management of organ damage and chronic complications. |

| Pediatric to Adult Transition | Poor transition programs result in care gaps for adolescents aging out of pediatric care. |

| Stigma and Awareness | Public and professional misconceptions about the disease can hinder proper treatment. |

| Innovation in Therapies | There is a need for more diverse and affordable treatment options, including oral and once-daily regimens. |

6. Competitive Landscape and Market Positioning

The SCD therapeutic market is evolving rapidly, driven by advancements in gene therapy, disease-modifying drugs, and supportive care. It includes both established players and emerging biotech firms aiming to deliver curative or more convenient treatment options.

Key Players & Marketed Drugs

| Company | Drug(s) | Drug Type | Market Positioning |

| Pfizer (formerly GBT) | Oxbryta (withdrawn 2024), GBT-601 | HbS polymerization inhibitor | Shifted focus to next-gen molecule (GBT-601) post Oxbryta exit |

| Novartis | Adakveo | Monoclonal antibody | Differentiated by targeting VOCs; used with hydroxyurea |

| Emmaus Life Sciences | Endari | Antioxidant therapy (L-glutamine) | First oral therapy for SCD; moderate market uptake |

| Agios Pharma | Mitapivat | PKR activator | Promising in late-stage trials; aims to reduce hemolysis |

| Forma Therapeutics | Etavopivat | PKR activator | Competing with Agios in the same mechanism class |

| Vertex & CRISPR Tx. | Casgevy (exa-cel) | Gene-editing therapy (CRISPR) | First FDA-approved CRISPR-based curative therapy |

| Bluebird Bio | Lyfgenia | Lentiviral gene therapy | Alternative one-time gene therapy; approved Dec 2023 |

Market Segmentation & Positioning

| Segment | Target Audience | Key Players/Products | Positioning Strategy |

| Chronic Management | Adolescents and adults with frequent VOCs | Hydroxyurea, Adakveo, Endari | Focus on symptom relief and crisis reduction |

| Anemia Management | Patients with chronic hemolytic anemia | Voxelotor (past), Mitapivat, Etavopivat | Targeting improved hemoglobin and energy levels |

| Curative Solutions | Severe SCD patients eligible for gene therapy | Casgevy, Lyfgenia | High-cost, one-time therapies aimed at disease elimination |

| Low-resource Settings | Children in sub-Saharan Africa and LMICs | Hydroxyurea (generic), potential oral innovations | Cost-effective, scalable treatments with easier delivery formats |

Key Companies:

7. Target Opportunity Profile (TOP)

The Target Opportunity Profile for SCD therapeutics outlines the ideal characteristics of a treatment that addresses the unmet needs in the current market. This profile serves as a framework for identifying promising candidates in development and for evaluating existing therapies.

| Category | Details |

| Ideal Product Profile (IPP) | - Disease-modifying or curative - Oral or single-administration - Long-term efficacy and safety - Scalable in LMICs - Pediatric- and adult-approved |

| Barriers to Entry | - High cost of gene therapies - Manufacturing/logistical complexity - Need for genetic infrastructure (screening, counseling) |

| Competitive Intensity | High – driven by legacy players (Novartis, Pfizer) and innovators (Vertex, Bluebird Bio, Editas, Beam Therapeutics) |

| Commercial Potential | Estimated multi-billion-dollar market, especially with curative therapies gaining approval; high demand in both high- and low-income regions |

| Regulatory Pathway | Orphan Drug Designation, Breakthrough Therapy, Fast Track, Priority Review – all are commonly granted in SCD drug development |

| Drug | Company | Mechanism | Trial & Phase | Key Results | Status |

| Voxelotor | Pfizer (GBT) | Inhibits HbS polymerization | HOPE – Phase 3 | ↑ Hb by ≥1 g/dL in 51% vs 7% placebo ↓ hemolysis biomarkers | Withdrawn (2024) |

| Adakveo | Novartis | P-selectin inhibitor (IV) | SUSTAIN – Phase 3 | ↓ VOCs by 45% ↑ time to first VOC | Approved |

| Endari | Emmaus | Antioxidant (L-glutamine) | Phase 3 | ↓ VOCs and hospitalizations (~25%) | Approved |

| Casgevy (exa-cel) | Vertex/CRISPR Tx. | CRISPR-Cas9 gene editing (↑ HbF) | CLIMB-111/121 – Ph 1/2/3 | 95%+ VOC-free ≥12 months ↑ HbF > 40% | Approved (2023) |

| Lyfgenia | Bluebird Bio | Lentiviral gene therapy | HGB-206 (Group C) – Phase 3 | 88% VOC-free at 6–18 months ↑ Hb by 3–5 g/dL | Approved (2023) |

| Mitapivat | Agios Pharma | PKR activator (improves RBC energy metabolism) | RISE UP – Phase 3 | >50% had sustained Hb ↑ ≥1 g/dL ↓ VOCs and transfusions | Late-stage |

| Etavopivat | Forma Therapeutics | PKR activator (similar to Mitapivat) | Phase 2/3 | Early data: ↑ Hb and ↓ transfusion need | In trials |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs