Disease Overview:

Rett syndrome is a rare and severe neurological disorder that affects nearly all areas of a person’s life, interfering with basic functions such as speaking, walking, eating, and breathing.

It is a genetic condition typically caused by a spontaneous mutation in the MECP2 gene. When this gene malfunctions, it disrupts normal brain and body function, often leaving individuals with greater comprehension than they can communicate.

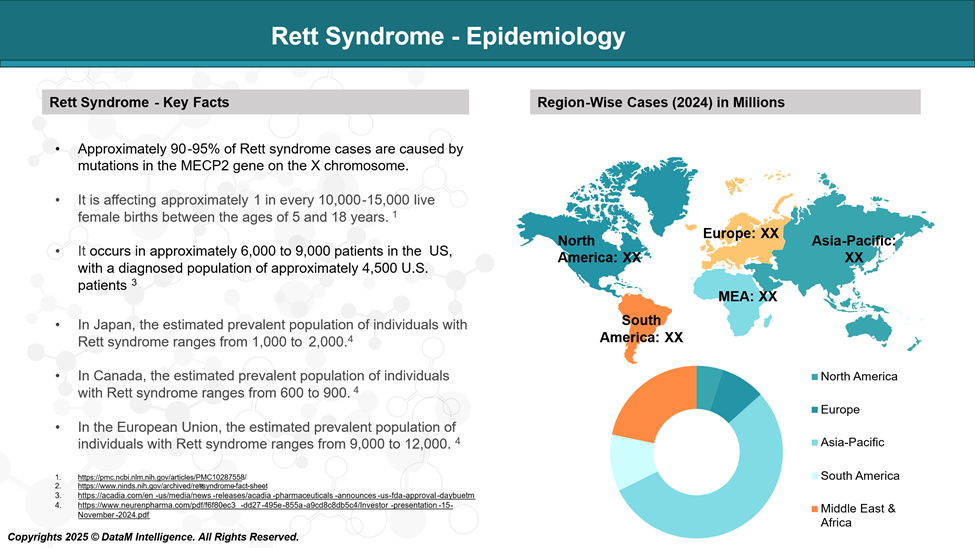

Epidemiology Analysis (Current & Forecast)

Rett syndrome is a rare, genetic, neurodevelopmental disorder that primarily affects females, with an estimated incidence of 1 in 10,000-15,000 female births.

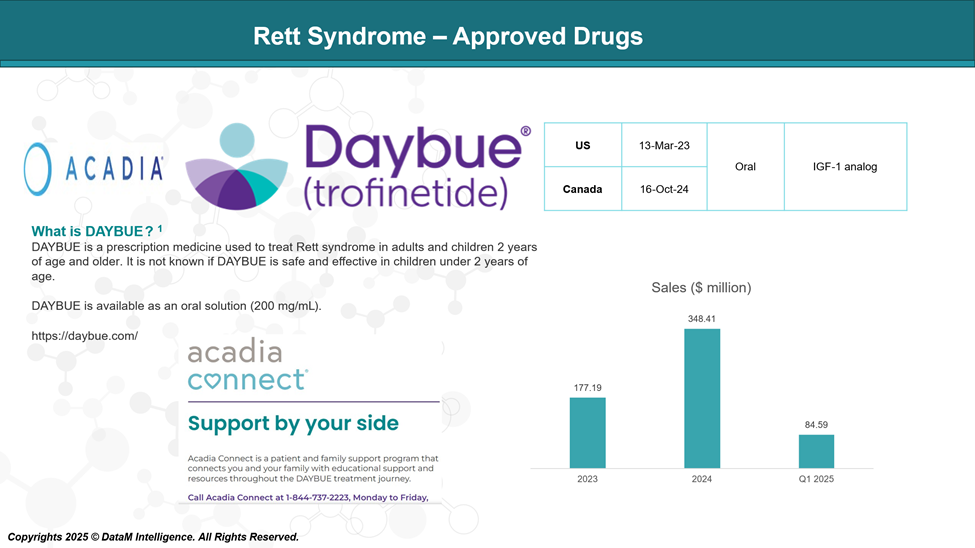

Approved Drugs (Current SoC) - Sales & Forecast

Currently, the first and only drug approved by the Food and Drug Administration (FDA) for Rett syndrome is trofinetide (Daybue) by ACADIA Pharmaceuticals.

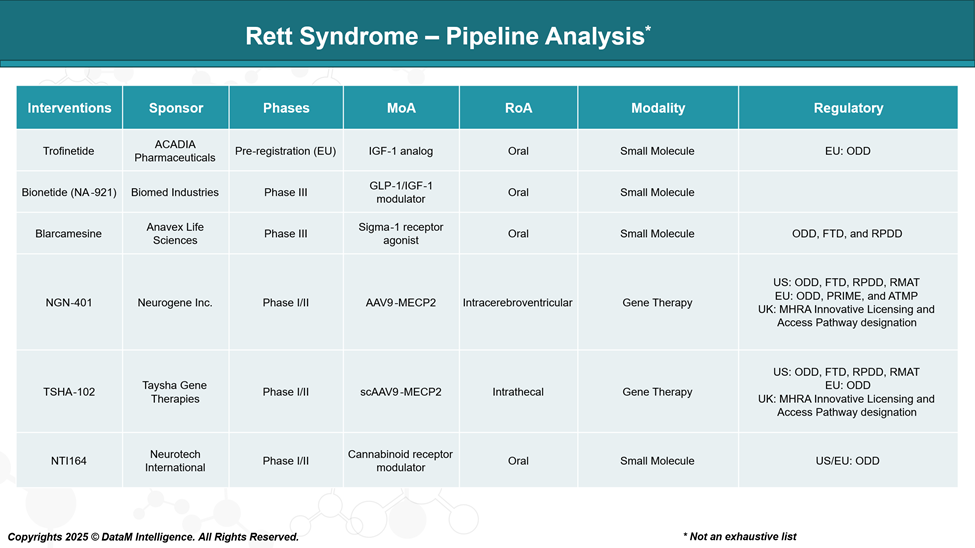

Pipeline Analysis and Expected Approval Timelines

The Rett syndrome therapeutic landscape has expanded significantly, with several companies actively developing emerging drugs aimed at improving the quality of life for individuals with Rett syndrome.

Competitive Landscape and Market Positioning

Rett syndrome is a rare neurodevelopmental disorder with limited treatment options. The current pipeline spans:

- Oral small molecules targeting symptomatic relief or modulation of neuroinflammation

- Gene therapies targeting the underlying MECP2 mutation

Comparative Analysis

Therapy | Sponsor | Market Access | Differentiation Strategy | Commercial Risk Profile | Long-Term Potential | Clinical Momentum |

Trofinetide (DAYBUE) | Acadia Pharmaceuticals | Approved (US) | First-in-class; broad label; high unmet need addressed | Low (Approved, payer backed) | Moderate (symptomatic only) | High (strong Phase 3 data) |

Bionetide (NA-921) | Biomed Industries | None (pre-commercial) | IGF pathway enhancement; oral delivery; safer alternative to Daybue | Medium (needs large-scale validation) | Moderate-High (better safety, efficacy TBD) | Moderate (late-stage, lean visibility) |

Blarcamesine (ANAVEX-2-73) | Anavex Life Sciences | None | Neuroplasticity & cognition; biomarker-driven trials | Medium-High (reproducibility, trial design) | High (broader CNS potential) | Low (multiple trials, supportive data) |

TSHA-102 | Taysha Gene Therapies | None | First-in-class gene therapy; MECP2 regulation | High (early-stage gene therapy) | Very High (potential disease modification) | Rising (early efficacy/safety promising) |

NGN-401 | Neurogene | None | Gene replacement (MECP2); unique delivery route | Very High (recent safety concerns) | High (curative intent if risks controlled) | Weakening (halted high-dose cohort) |

NTI164 | Neurotech | None | Plant-derived; natural therapeutic class; complementary use | Medium (less robust evidence) | Low-Moderate (adjunct potential only) | Moderate (behavioral symptom improvement) |

Key Takeaways

- Trofinetide is currently the market leader with both first-mover advantage and regulatory approval.

Bionetide and Blarcamesine are likely to be near-term market entrants with competitive efficacy and safety profiles.

Gene therapies (TSHA-102, NGN-401) may shift the paradigm in the mid-to-long term if safety and durability are validated.

NTI164 may serve as a niche or complementary therapy, especially for behavioral symptoms.

Key Companies:

Target Opportunity Profile (TOP)

Here’s a detailed Target Opportunity Profile (TOP) for emerging Rett syndrome therapies, structured around the key benchmarks they must meet or exceed to outcompete Trofinetide (DAYBUE) and secure meaningful clinical, commercial, and payer adoption:

Category | Benchmark (Trofinetide) | Target for Emerging Therapies | Rationale |

Efficacy | Moderate symptom improvement (motor, communication, behavior); plateau after ~12 weeks | Superior functional gains (motor + cognitive) sustained over 6–12 months | Need to offer clinically meaningful, sustained improvement to justify switching or premium pricing |

Safety | Generally well tolerated; mild to moderate GI side effects | Minimal AEs, no systemic toxicity (esp. in pediatrics) | Any increased efficacy must not come at the cost of tolerability |

Mechanism of Action (MoA) | IGF-1 analog — indirect neurotrophic effect | More proximal or disease-modifying MoA (e.g., MECP2 correction, neuroplasticity, gene regulation) | Must differentiate mechanistically to offer curative or disease-slowing potential |

Route of Administration (RoA) | Oral (liquid, daily) | Oral preferred, or < quarterly dosing if invasive (e.g., gene therapy) | Oral RoA sets a high bar for compliance; gene therapies must justify intrathecal/ICV with durability |

Dosage / Dosing Frequency | Daily oral, weight-based | Less frequent than daily (e.g., weekly, monthly, or one-time gene therapy) | Reduced burden improves adherence and quality of life |

Innovation Level | First-in-class symptomatic therapy | High innovation: disease modification, gene correction, self-regulating expression, multi-pathway activity | Stakeholders (investors, payers, prescribers) expect true therapeutic innovation, not incrementalism |

Price | ~$375,000/year (US WAC) | Cost-justified premium or cost-efficient alternative | Either undercut on cost with equal/better efficacy or justify a higher price with transformative outcomes |

Patient Segment | Broadly indicated for girls and women with RTT (2–10 years studied) | Wider inclusion (earlier intervention, broader phenotype, or adults); or precision-targeted (e.g., MECP2 mutations only) | New entrants can differentiate by expanding the addressable population or focusing deeply on subsegments |

Biomarker Strategy | Not biomarker-driven | Clear biomarker-based responder strategy (e.g., EEG, MECP2, neuroimaging) | Precision-based positioning improves trial outcomes, payer acceptance, and real-world success |

Strategic Insights: What It Takes to Win

Therapeutic Edge Must Be Clear

- Symptomatic improvement alone is not enough unless it is significantly superior or more durable.

- Therapies must either:

- Improve quality and duration of benefit, or

- Modify the disease course (especially in MECP2-linked pathology).

Differentiation via Mechanism and Patient Selection

- Targeting MECP2 directly (gene therapy or gene regulation) is the most compelling innovation track.

- Tailored therapies based on genetic or functional biomarkers will have a clear payer value proposition.

Delivery and Dosing Matter

- Oral delivery remains ideal. However, infrequent durable administration (like one-time gene therapy) is also competitive if it offsets the administration burden.

Pricing Must Match Perceived Value

- A higher price can be justified for curative gene therapies, but it must come with:

- Long-term follow-up data

- Durable efficacy

- Safety over time

- Lower-cost small molecules must either rival Trofinetide’s efficacy or prove superior tolerability.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: