Disease Overview:

Retinitis pigmentosa (RP) refers to a collection of genetic disorders that cause progressive degeneration of the retina, the light-sensitive tissue at the back of the eye. The condition primarily impacts rod cells, responsible for peripheral and night vision, more severely than cone cells, essential for central vision and color perception.

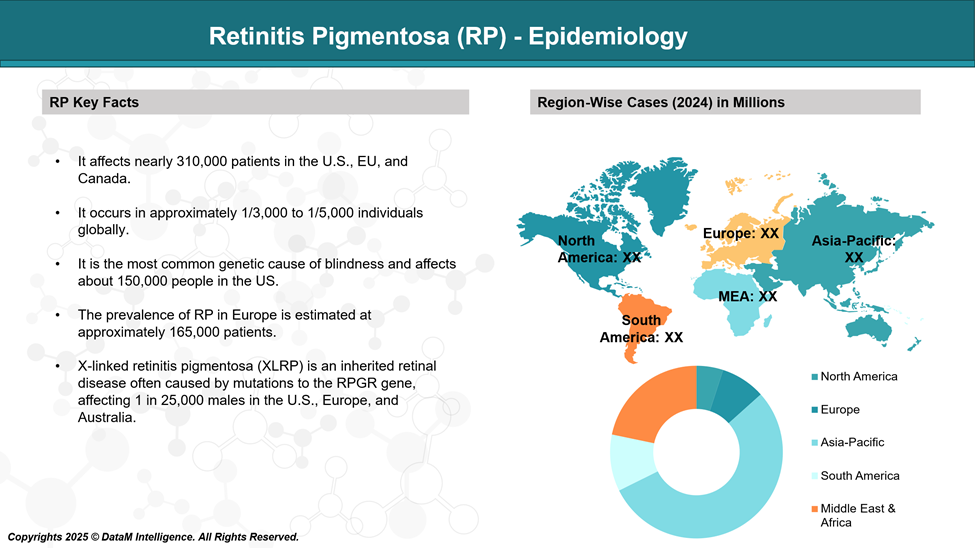

Epidemiology Analysis (Current & Forecast)

Retinitis pigmentosa is associated with mutations in more than 100 genes. It is the most common inherited eye disease (IRD), affecting more than 2 million patients globally.

Approved Drugs (Current SoC) - Sales & Forecast

At present, there are no FDA-approved medications or universally accepted standard treatments for Retinitis pigmentosa. However, a gene therapy called LUXTURNA (voretigene neparvovec) is available for a small subset of patients those with mutations in the RPE65 gene, which accounts for approximately 1–6% of RP cases.

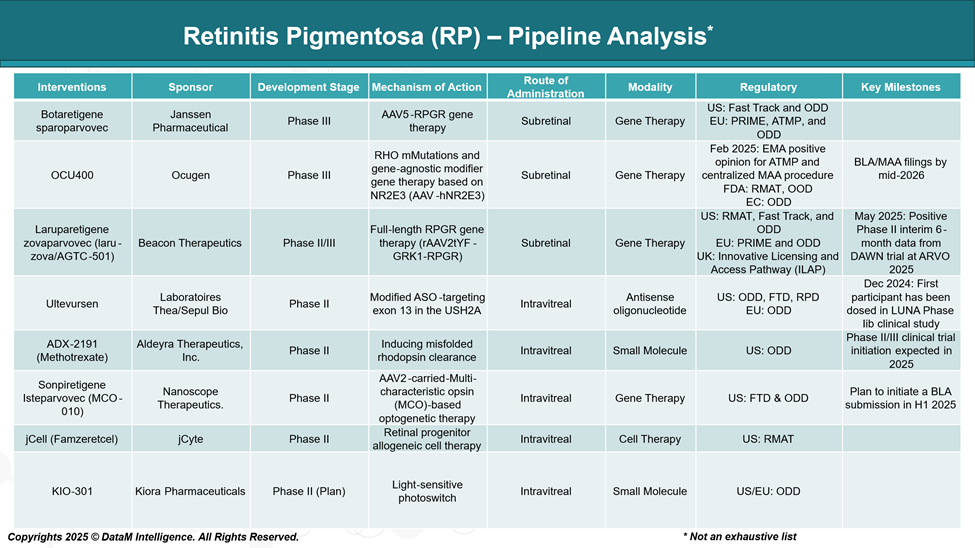

Pipeline Analysis and Expected Approval Timelines

While Luxturna (voretigene neparvovec) remains the only FDA-approved gene therapy for RP, targeting RPE65 mutations, several promising cell and gene therapies are advancing through clinical trials.

Competitive Landscape and Market Positioning

The RP therapeutic landscape is expanding rapidly, with emerging candidates differentiated by their target populations, modalities, delivery approaches, and regulatory designations. While LUXTURNA has established gene therapy as a viable approach, its narrow applicability (RPE65 mutations) has left significant unmet needs. Several pipeline therapies are now positioned to address these gaps, either by broadening genetic coverage or introducing mutation-independent solutions.

The table below outlines how each key candidate is positioned in the market:

Retinitis Pigmentosa Therapies: Strategic Positioning Table

| Asset | Company | Target Scope | Differentiator | Delivery | Modality | Market Positioning |

| LUXTURNA | Spark/Roche/Novartis | RPE65 mutation (~1–6% of RP) | First and only FDA-approved therapy | Sub-retinal | Gene Therapy | Established a regulatory and clinical benchmark for RP gene therapies; limited scope. |

| Botaretigene sparoparvovec | Janssen | X-linked RP (RPGR) | Late-stage gene therapy with global regulatory designations | Sub-retinal | Gene Therapy | High potential to become the first marketed treatment for X-linked RP. |

| OCU400 | Ocugen | Gene-agnostic + RHO mutations | Broad-acting modifier gene approach (NR2E3) | Sub-retinal | Gene Therapy | Positioned to address multiple RP types; strong regulatory support (RMAT, ODD). |

| Laruparetigene zovaparvovec | Beacon Therapeutics | X-linked RP (RPGR) | Full-length RPGR with proprietary capsid | Sub-retinal | Gene Therapy | Competitive X-linked candidate; may benefit from unique delivery vector (rAAV2tYF). |

| Sonpiretigene Isteparvovec | Nanoscope Therapeutics | Mutation-independent | Optogenetic MCO-based therapy | Intravitreal | Gene Therapy (Opsin) | Non-genotype restricted; targets patients with advanced degeneration. |

| Ultevursen | Laboratoires Théa/Sepul Bio | USH2A mutation (Exon 13) | Splice-modulating antisense oligonucleotide | Intravitreal | RNA Therapy (ASO) | Precision therapy for USH2A; first-in-class approach with orphan/fast designations. |

| ADX-2191 (Methotrexate) | Aldeyra Therapeutics | Misfolded rhodopsin clearance | mTOR pathway modulation for protein clearance | Intravitreal | Small Molecule | Cost-efficient repurposing strategy; supports earlier intervention and maintenance. |

| jCell (Famzeretcel) | jCyte | Broad RP stages | Allogeneic retinal progenitor cell transplant | Intravitreal | Cell Therapy | Non-gene dependent; positioned for patients with end-stage RP or vision loss. |

| KIO-301 | Kiora Pharmaceuticals | Late-stage RP | Photoswitch reactivation of retinal cells | Intravitreal | Small Molecule | Vision restoration concept, promising for low vision patients; early-stage clinical. |

Summary Insights

- Gene Therapies Dominate: Sub-retinal gene therapies continue to lead in clinical advancement and regulatory support, with Botaretigene sparoparvovec and OCU400 at the forefront of Phase III development.

- Broadening Access: Mutation-independent approaches like MCO-010, OCU400, and jCell are strategically positioned to treat wider patient populations, improving commercial scalability.

- Intravitreal Advantage: Therapies with intravitreal delivery (e.g., MCO-010, Ultevursen) may benefit from easier clinical administration, increasing adoption in routine ophthalmology settings.

- Innovation in Mechanism: Therapies like KIO-301 and Sonpiretigene Isteparvovec reflect a shift toward vision restoration, which is critical for late-stage RP patients beyond gene rescue.

Key Companies:

Target Opportunity Profile (TOP)

Target Opportunity Profile (TOP) helps to highlight what emerging therapies need to demonstrate to surpass approved treatments like Tepezza (teprotumumab) in Thyroid Eye Disease (TED).

Target Opportunity Profile (TOP) – Thyroid Eye Disease (TED)

| Category | Details |

| Indication | Retinitis Pigmentosa (RP) – a group of inherited retinal degenerative disorders causing progressive vision loss |

| Prevalence | ~1 in 4,000 individuals globally (~1.5–2 million patients) |

| Onset | Typically begins in childhood or adolescence; it progresses with age |

| Pathophysiology | Loss of rod and cone photoreceptors due to genetic mutations; rods are affected first (night/blindness), followed by cones (central/color vision) |

| Genetic Basis | >80 known causative genes; inheritance patterns include autosomal dominant, autosomal recessive, and X-linked |

| Patient Segments |

|

| Approved Therapies | LUXTURNA (Spark/Roche) – gene therapy for RPE65 mutations (sub-retinal delivery; limited scope); supportive care only for others |

| Unmet Needs | Broader genotype coverage, mutation-independent options, therapies for late-stage vision loss, non-invasive delivery, affordability/access |

| Emerging Modalities | Gene-agnostic therapies (e.g., OCU400), optogenetics (e.g., MCO-010), cell therapy (e.g., jCell), ASOs (e.g., Ultevursen), small molecules (e.g., ADX-2191) |

| Delivery Innovation | Shift from surgical subretinal to intravitreal/in-office injection methods for wider accessibility |

| Regulatory Incentives | ODD, RMAT, Fast Track, PRIME, and ATMP designations support accelerated development for many candidates |

| Competitive Intensity | High in RPGR (X-linked) gene therapy; moderate in gene-agnostic and optogenetics; low in ASO and small molecule spaces |

| Commercial Opportunity | High potential for first-in-class or broad-coverage therapies; scalable delivery, mutation independence, and ease of use will drive adoption |

Strategic Takeaways

- The addressable patient base remains large due to the diversity of RP mutations and the lack of existing therapies.

- Therapies that transcend genotype or target downstream degeneration (e.g., optogenetics, cell therapy) will be crucial in expanding treatment reach.

- Early market entrants in broader or underserved segments may gain first-mover advantages, especially with expedited regulatory pathways (e.g., RMAT, ODD, PRIME).

- Partnerships with diagnostic/genetic testing companies may be strategic for identifying and segmenting eligible patients.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: