1. Disease Overview:

- Retinal Vein Occlusion (RVO) is a condition where one or more veins that carry blood away from the retina become obstructed, leading to the swelling of the veins and the leakage of blood into the retina, which can cause vision loss.

Two Types of RVO:

- Central retinal vein occlusion (CRVO)

- Branch retinal vein occlusion (BRVO)

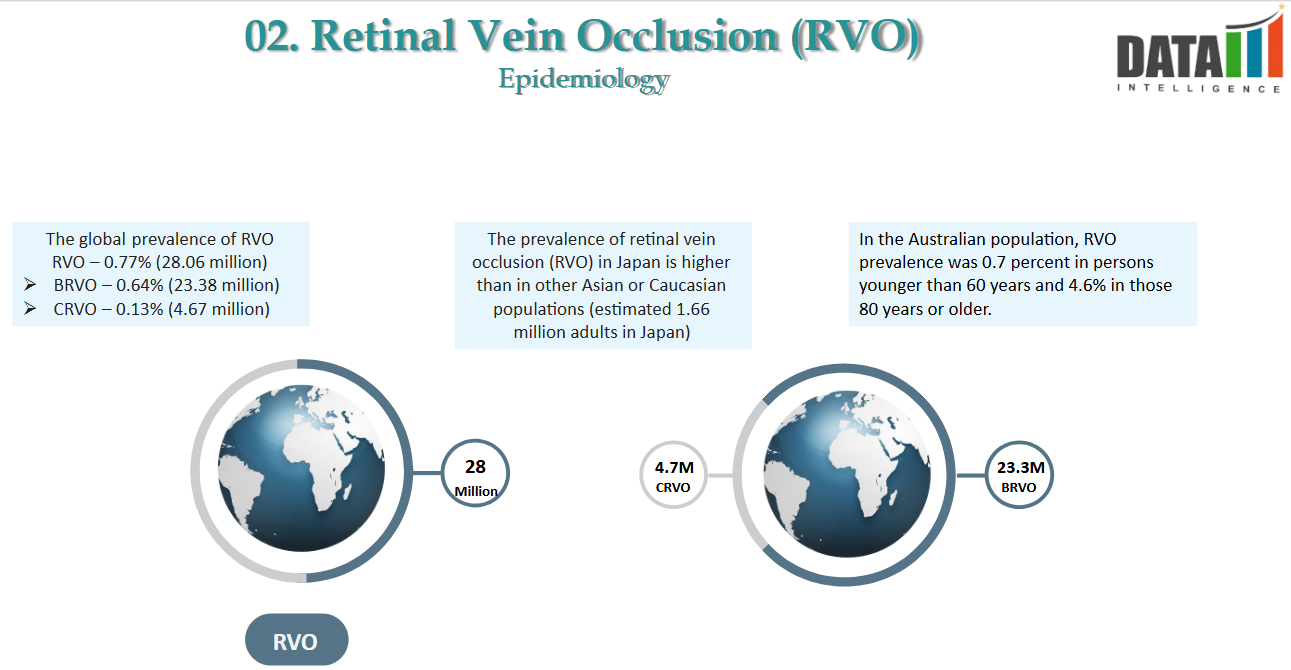

2. Epidemiology Analysis (Current & Forecast)

- RVO is the second most common cause of vision loss due to retinal vascular diseases. It affects an estimated ~28 million adults globally, mainly those aged 60 or older, and an estimated 1.66 million adults in Japan, and can lead to severe and sudden vision loss.

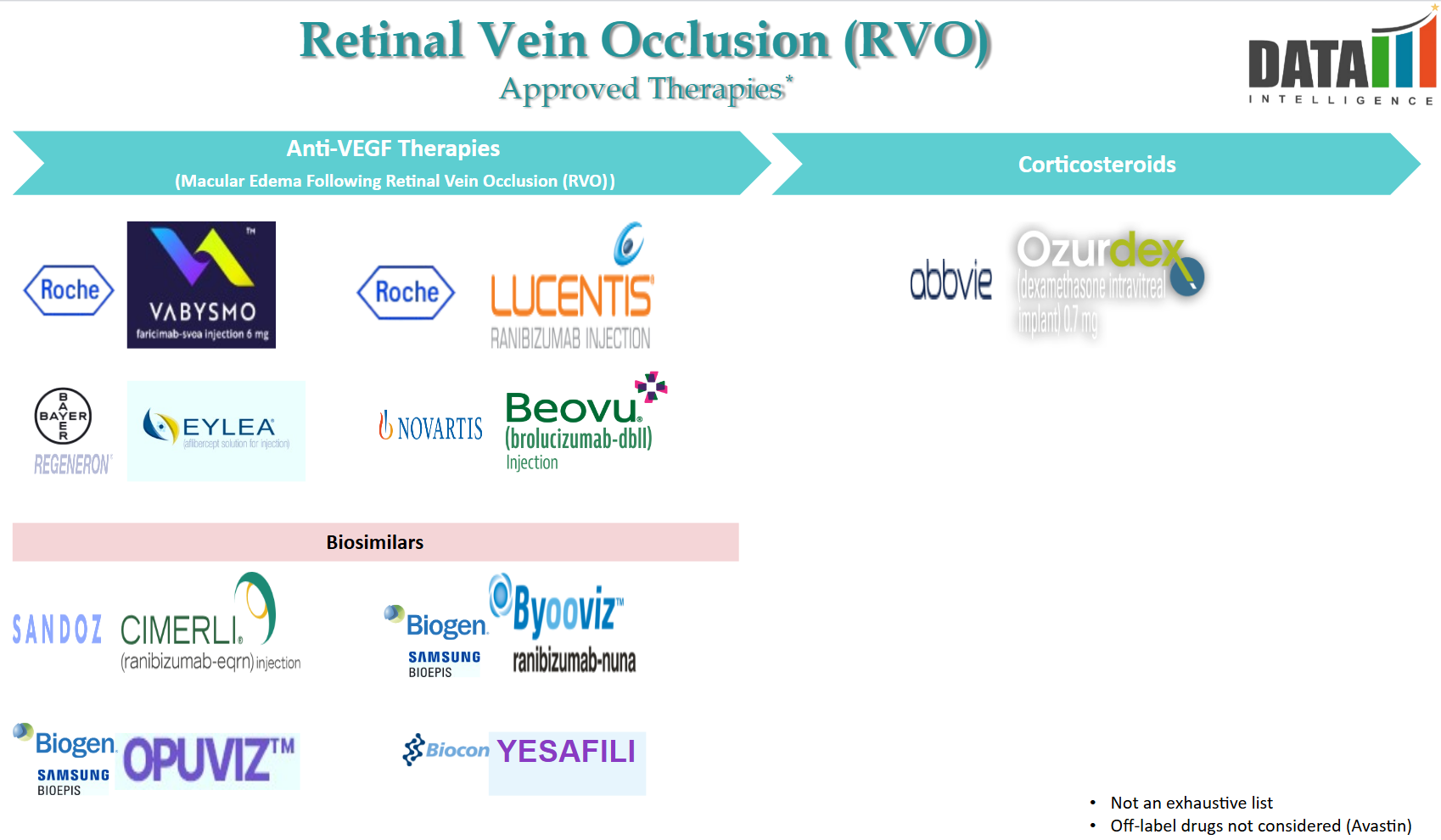

3. Approved Drugs (Current SoC) - Sales & Forecast

- Retinal Vein Occlusion (RVO) is a condition where blockage of the retinal veins leads to vision impairment. The current standard of care primarily involves intravitreal injections aimed at reducing macular edema and preventing further vision loss.

The key FDA-approved medications include:

- Anti-VEGF Agents:

- Ranibizumab (Lucentis): Approved in June 2010, ranibizumab is a monoclonal antibody that inhibits vascular endothelial growth factor A (VEGF-A), reducing abnormal blood vessel growth and leakage. It's administered via monthly intravitreal injections.

- Aflibercept (Eylea): Approved in October 2014, aflibercept acts as a decoy receptor for VEGF-A and placental growth factor (PlGF), preventing them from promoting abnormal blood vessel formation. It's typically administered monthly.

- Faricimab-svoa (Vabysmo): Approved in October 2023, faricimab is a bispecific antibody targeting both VEGF-A and angiopoietin-2 (Ang-2), addressing multiple pathways involved in RVO. Clinical trials demonstrated its efficacy comparable to aflibercept, with additional benefits in reducing retinal fluid leakage.

- Corticosteroids:

- Dexamethasone Intravitreal Implant (Ozurdex): This implant delivers sustained-release dexamethasone, a corticosteroid that reduces inflammation and macular edema associated with RVO. It's particularly considered when anti-VEGF therapies are insufficient or contraindicated.

In addition to these approved treatments, off-label use of medications such as bevacizumab (Avastin) and intravitreal triamcinolone has been employed to manage RVO-related macular edema.

The choice of therapy depends on individual patient factors, including the severity of the condition, response to previous treatments, and potential side effects. Regular monitoring and follow-up with an ophthalmologist are essential to optimize treatment outcomes.

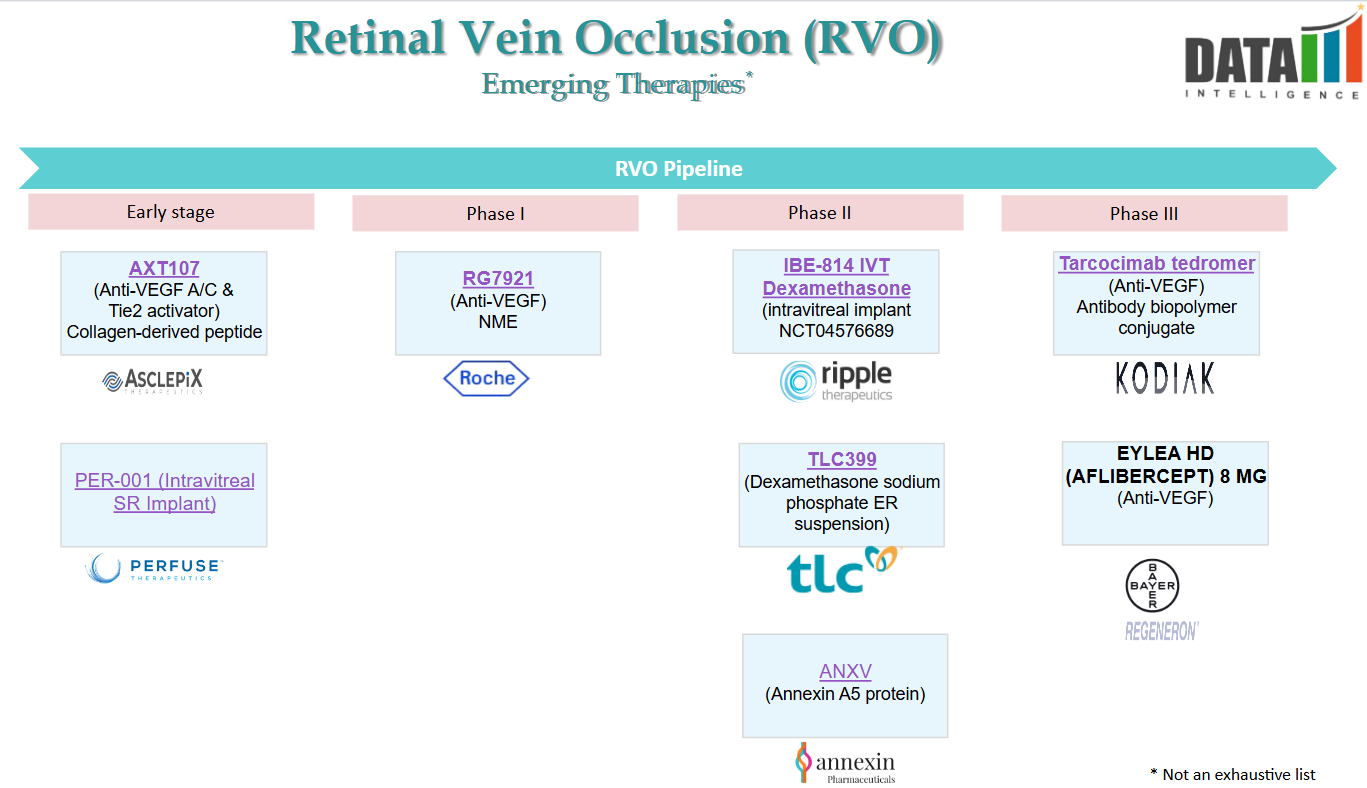

4. Pipeline Analysis and Expected Approval Timelines

Retinal Vein Occlusion (RVO) treatment is advancing with several promising therapies in the pipeline. Notably:

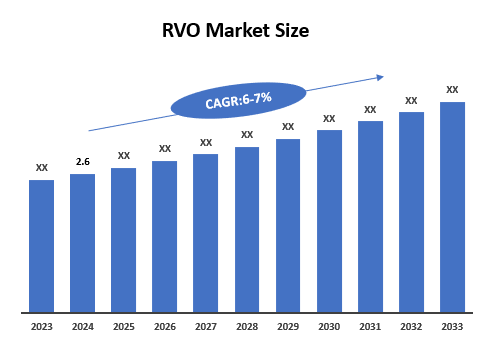

5. Market Size & Forecasting

The global retinal vein occlusion therapeutics market was valued at ~$2.6 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2033, registering a CAGR of 6-7% over the forecast period.

Unmet Needs

Despite advancements in RVO treatment, several unmet medical needs remain:

| Unmet Need | Challenges | Potential Solutions |

| Longer-acting therapies | Frequent intravitreal injections (monthly or bi-monthly) burden patients and healthcare systems. | Gene therapy or sustained-release drug delivery systems. |

| Improved efficacy | Some patients exhibit suboptimal response or resistance to anti-VEGF therapy. | Combination therapies targeting multiple pathways (e.g., VEGF + Ang-2 inhibitors). |

| Better treatment for non-ischemic & ischemic RVO | Ischemic RVO can lead to severe vision loss with limited treatment options. | Novel neuroprotective agents and regenerative therapies. |

| Reduction of treatment burden | High injection frequency leads to non-adherence and undertreatment. | Longer-lasting biologics and innovative drug formulations. |

| Personalized medicine | Current treatment strategies are not tailored to individual patient responses. | Biomarkers to predict treatment response and guide therapy selection. |

| Safer alternatives | Corticosteroids (e.g., Ozurdex) have side effects like cataracts and increased intraocular pressure. | Non-steroidal anti-inflammatory treatments with fewer adverse effects. |

| Management of underlying risk factors | RVO is associated with hypertension, diabetes, and cardiovascular disease, yet systemic management is often overlooked. | Integrating ophthalmology with systemic disease management. |

6. Competitive Landscape and Market Positioning

The Retinal Vein Occlusion (RVO) treatment market is experiencing significant growth, driven by the increasing prevalence of retinal diseases and advancements in therapeutic options.

| Company | Key Drug(s) | Market Positioning | Strategic Focus |

| Regeneron / Bayer | Eylea (Aflibercept), Eylea HD | Market leader in anti-VEGF therapies | High-dose formulations for extended dosing intervals |

| Genentech / Roche | Vabysmo (Faricimab-svoa) | First bispecific antibody targeting VEGF-A & Ang-2 | Improved durability and efficacy with fewer injections |

| Biosimilar Manufacturers (Samsung Bioepis, Amgen, Sandoz) | Byooviz (Ranibizumab-nuna), Cimerli (Ranibizumab-eqrn), Aflibercept biosimilars | Cost-effective alternatives to reference biologics | Expanding accessibility and affordability |

| Kodiak Sciences | KSI-301 (Tarcocimab Tedromer) | Emerging player with long-acting anti-VEGF therapy | Reducing treatment burden with extended durability |

Key Companies

7. Target Opportunity Profile (TOP) & Benchmarking

TOP outlines the key attributes required for an ideal therapy in RVO treatment based on unmet needs and market demands.

| Attribute | Current Standard of Care (SoC) | Ideal Target Profile |

| Efficacy | Anti-VEGF agents (Eylea, Vabysmo) provide vision improvement but require frequent injections | Higher efficacy with fewer injections, improved visual outcomes |

| Dosing Frequency | Monthly or bi-monthly injections | Longer intervals (≥6 months) |

| Durability | Limited durability, requiring frequent re-administration | Extended durability, reducing patient burden |

| Mechanism of Action | Primarily VEGF inhibition | Multi-targeted (e.g., VEGF + Ang-2) or novel pathways |

| Safety Profile | Risk of inflammation, intraocular pressure rise | Reduced side effects, improved tolerability |

| Cost & Accessibility | High cost, reimbursement limitations | Cost-effective, accessible, and covered by payers |

Benchmarking – Competitive Comparison of RVO Treatments

| Company | Drug Name | Mechanism of Action | Dosing Frequency | Market Positioning |

| Regeneron / Bayer | Eylea (Aflibercept) | VEGF-A Inhibitor | Every 4-8 weeks | Market leader in anti-VEGF |

| Genentech / Roche | Vabysmo (Faricimab) | VEGF-A + Ang-2 Inhibitor | Every 8-16 weeks | Dual-target mechanism |

| Kodiak Sciences | KSI-301 (Tarcocimab) | Long-acting anti-VEGF | Under trial for extended durability (≥6 months) | Potential first-in-class durable therapy |

| Biosimilar Manufacturers | Byooviz, Cimerli | VEGF-A Inhibitor (Biosimilar to Lucentis) | Similar to Lucentis | Cost-effective alternative |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.