1. Introduction:

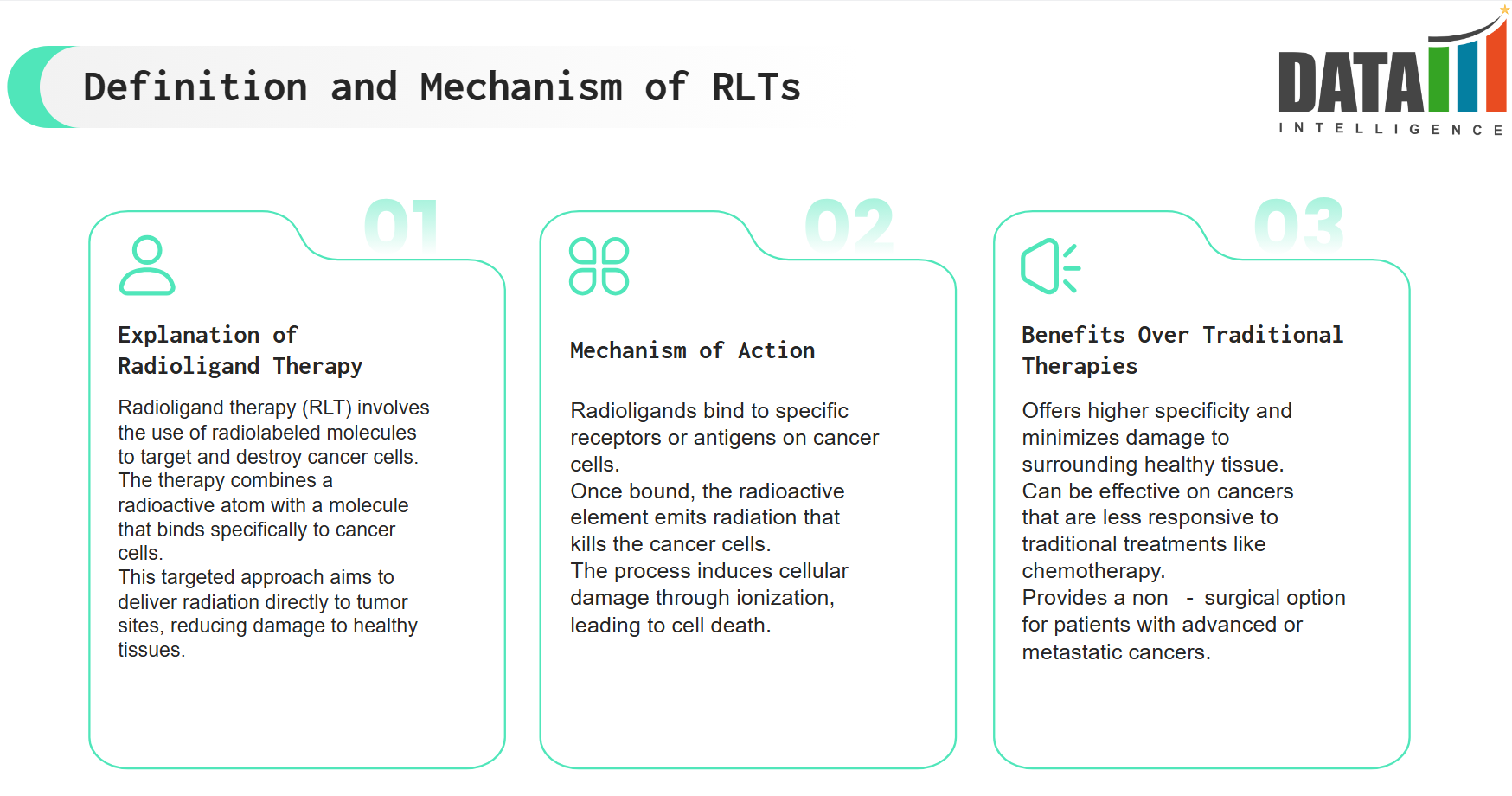

Radioligand Therapy (RLT) is an innovative cancer treatment that precisely targets malignant cells by delivering radiation through a radioactive isotope linked to a specific ligand, such as a monoclonal antibody or peptide. This method enhances treatment accuracy, reducing harm to healthy tissues while effectively eliminating cancer cells.

Key Components of RLT

| Component | Description |

| Radioligand (Radioisotope + Ligand) | A molecule that binds specifically to cancer cell receptors, delivering radiation directly to tumors |

| Radioactive Isotope | Emits radiation (e.g., Lutetium-177, Actinium-225, Yttrium-90) to kill cancer cells |

| Targeting Ligand | Peptides or antibodies that bind to tumor-specific receptors (e.g., PSMA for prostate cancer, SSTR for neuroendocrine tumors) |

| Delivery Mechanism | When injected intravenously, it circulates in the bloodstream and binds selectively to tumor cells |

2. Key Trends & Advancements in RLT

Radioligand Therapy (RLT) is rapidly evolving, driven by advancements in precision medicine, novel radioisotopes, and expanding clinical applications.

Below are the key trends and innovations shaping the future of RLT:

Expansion of Approved Indications

- Beyond Neuroendocrine & Prostate Cancer – While Lutathera (NETs) and Pluvicto (mCRPC) are approved, ongoing research aims to expand RLT into lung, breast, brain, and colorectal cancers.

- Emerging Targets – Novel RLTs are being designed for HER2+ breast cancer, glioblastoma, and hematologic malignancies.

Next-Generation Radioisotopes

| Radioisotope | Type | Advantage | Current Applications |

| Lutetium-177 | Beta-emitter (β) | Moderate penetration, well-tolerated | Approved for NETs & prostate cancer |

| Actinium-225 | Alpha-emitter (α) | Higher potency, stronger DNA damage | Prostate, leukemia (clinical trials) |

| Thorium-227 | Alpha-emitter (α) | More precise targeting | Solid tumors (early-stage research) |

| Yttrium-90 | Beta-emitter (β) | Used in liver cancer treatment | Approved for lymphomas & liver tumors |

Combination Therapies for Enhanced Efficacy

- RLT + Immunotherapy – Trials combining RLT with immune checkpoint inhibitors (PD-1, PD-L1) to enhance the immune response against tumors.

- RLT + Chemotherapy or PARP Inhibitors – Used in prostate cancer to improve DNA damage response.

- RLT + CAR-T Therapy – Investigated for blood cancers to increase tumor cell destruction.

Advancements in Targeting Ligands

- Peptide-Based RLTs – PSMA-targeted therapies (Pluvicto) have demonstrated success in prostate cancer.

- Monoclonal Antibody-Based RLTs – Being developed for breast cancer (HER2) and hematologic cancers (CD45-targeted RLTs).

- Bispecific & Multi-Target Ligands – Enhance selectivity and reduce off-target effects

Innovations in Isotope Production & Supply Chain

- Scalability Challenges – Short half-life radioisotopes require localized production and distribution.

- New Suppliers – Investments in radioisotope reactors and cyclotron facilities to meet increasing demand.

- Partnerships – Pharma and nuclear medicine firms (e.g., Novartis, Bayer) collaborating to scale isotope supply chains.

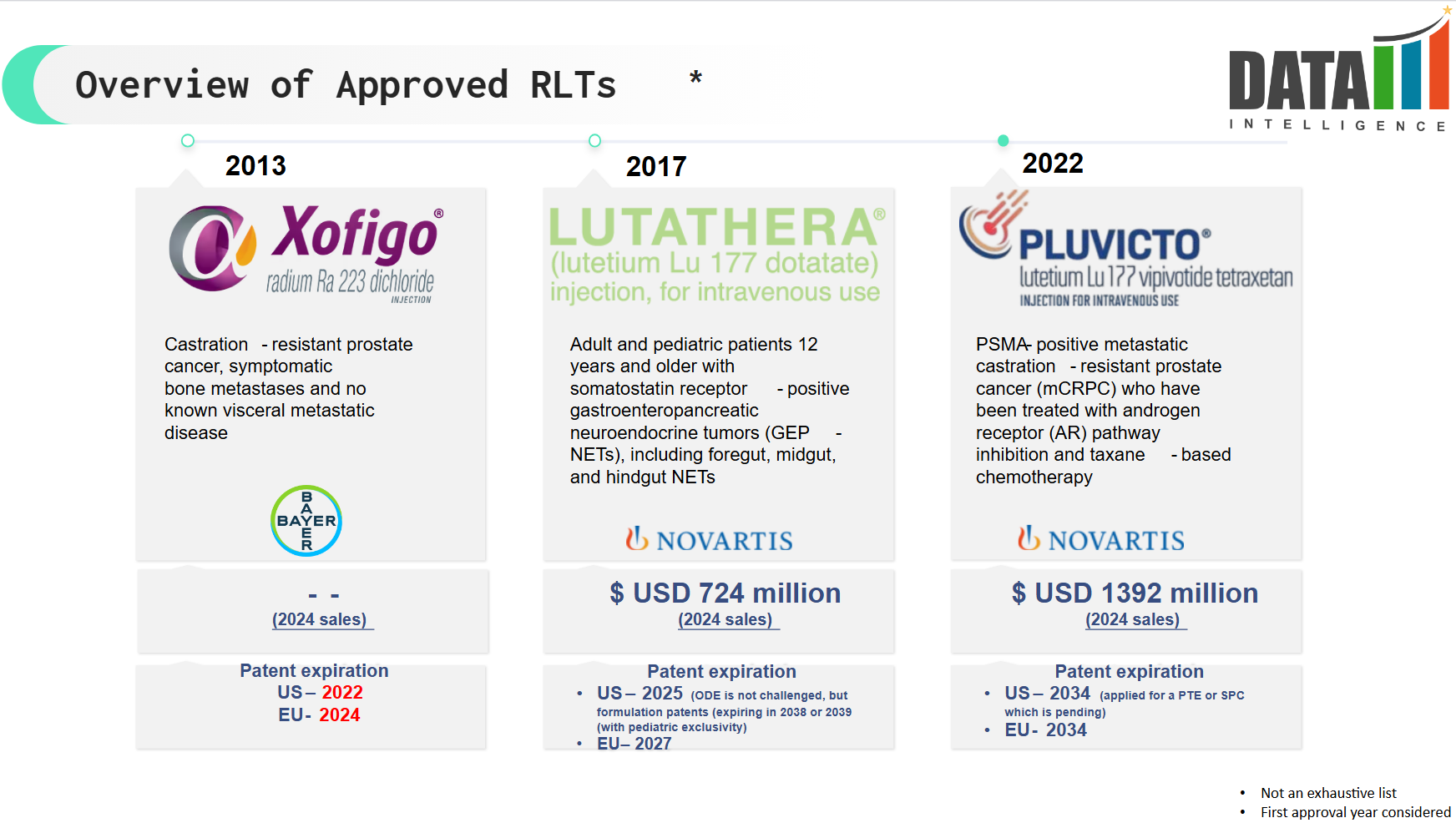

3. Approved RLTs - Sales & Forecast

4. Pipeline Analysis and Expected Approval Timelines

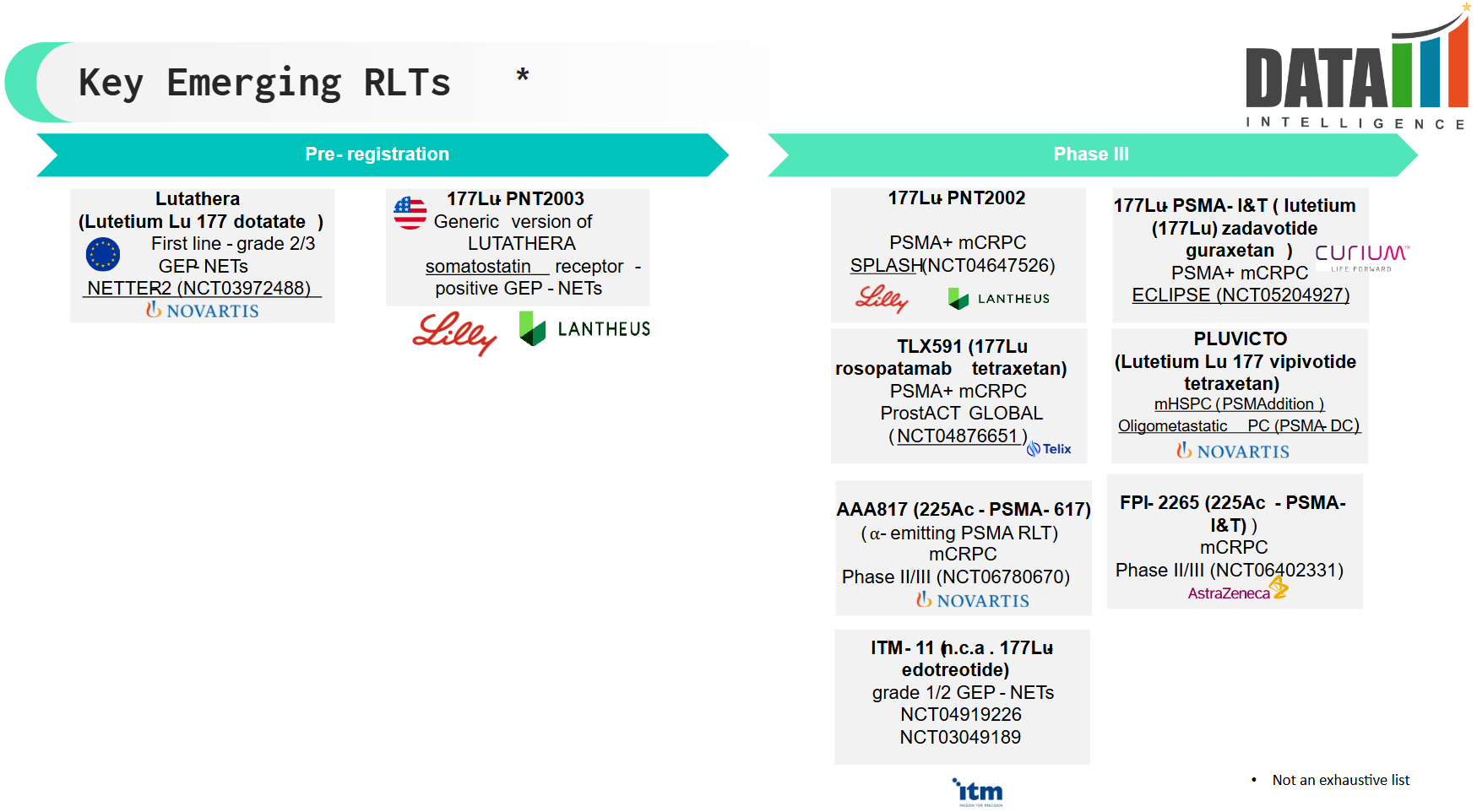

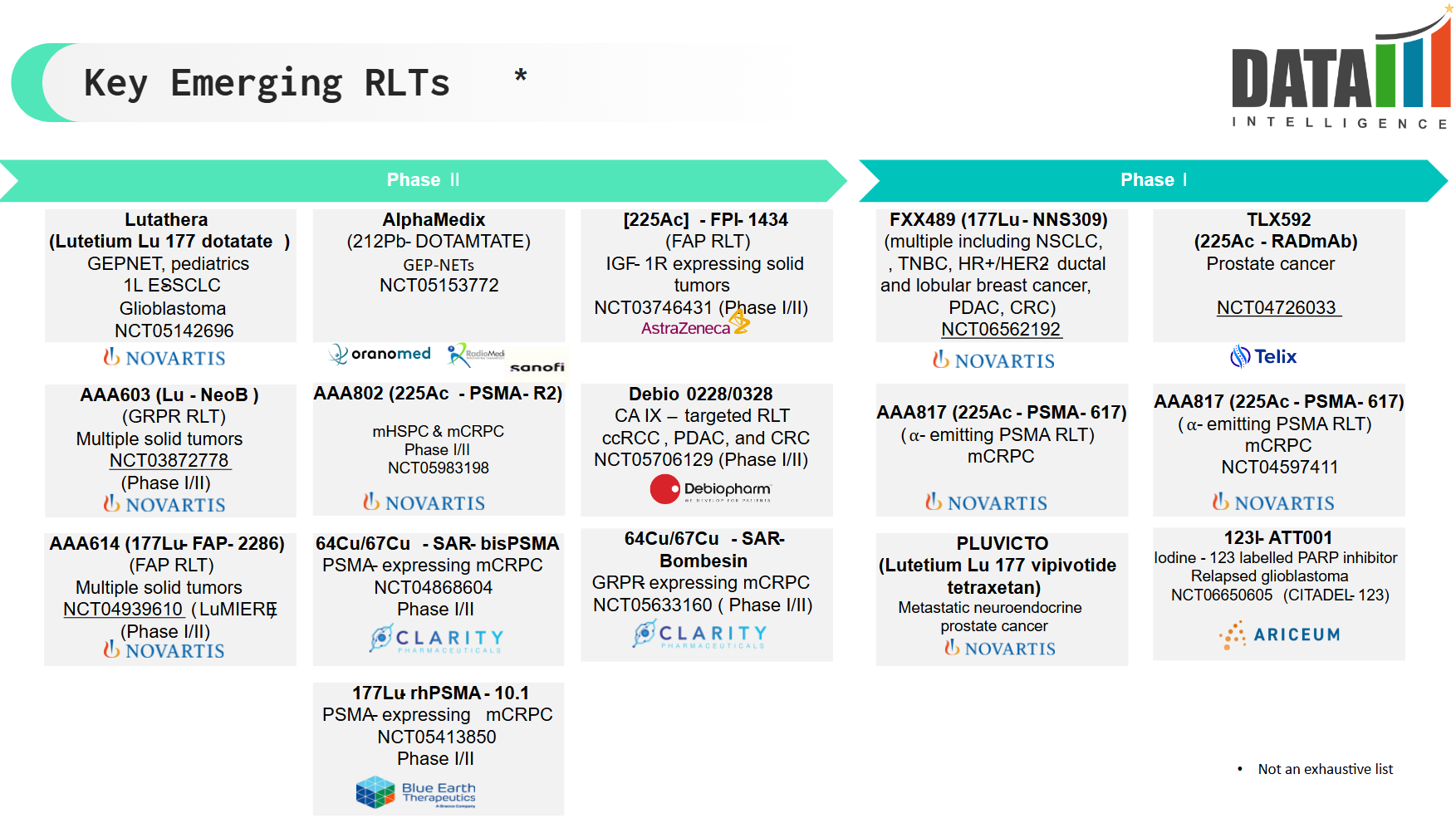

The RLT pipeline is expanding rapidly, with several late-stage clinical trials and next-generation therapies in development.

Below is a breakdown of key pipeline candidates, their indications, and projected approval timelines.

5. Market Size & Forecasting

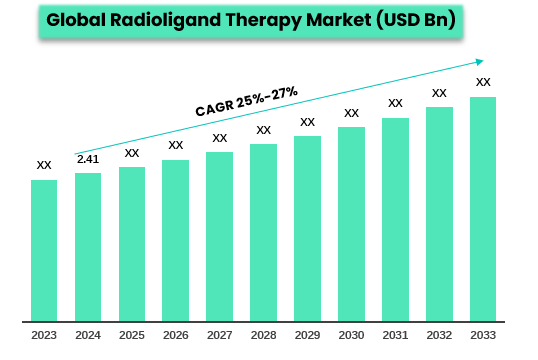

The global radioligand therapy (RLT) market reached US$2.41 billion in 2024 and is expected to reach US$ XX billion by 2033, growing at a CAGR of 25%-27% during the forecast period of 2024-2033.

Unmet Needs

Radioligand therapy (RLT) has shown promise in treating certain cancers, such as neuroendocrine tumors and prostate cancer, but there are still several unmet needs in this field. These include:

| Unmet Need | Challenges | Potential Solutions |

| Limited Availability & Access | RLT is not widely available; high costs and reimbursement issues | Improve regulatory approvals, increase funding, and expand treatment centers |

| Expanded Indications | Currently approved for neuroendocrine tumors and prostate cancer | Research to explore RLT for other cancers (e.g., breast, lung, glioblastoma) |

| Personalized & Precision Treatment | Lack of biomarkers to predict response; standardized dosing may not be optimal | Develop predictive biomarkers and personalized dosimetry strategies |

| Combination Therapies | Limited studies on combining RLT with other therapies | Conduct clinical trials on RLT with immunotherapy, chemotherapy, and targeted drugs |

| Managing Resistance & Side Effects | Some patients develop resistance; toxicity issues (e.g., kidney damage, bone marrow suppression) | Study mechanisms of resistance and develop protective agents for toxicity management |

| Supply Chain & Production Issues | The short half-life of radiopharmaceuticals complicates manufacturing and distribution | Improve production methods, logistics, and infrastructure for better availability |

6. Competitive Landscape and Market Positioning

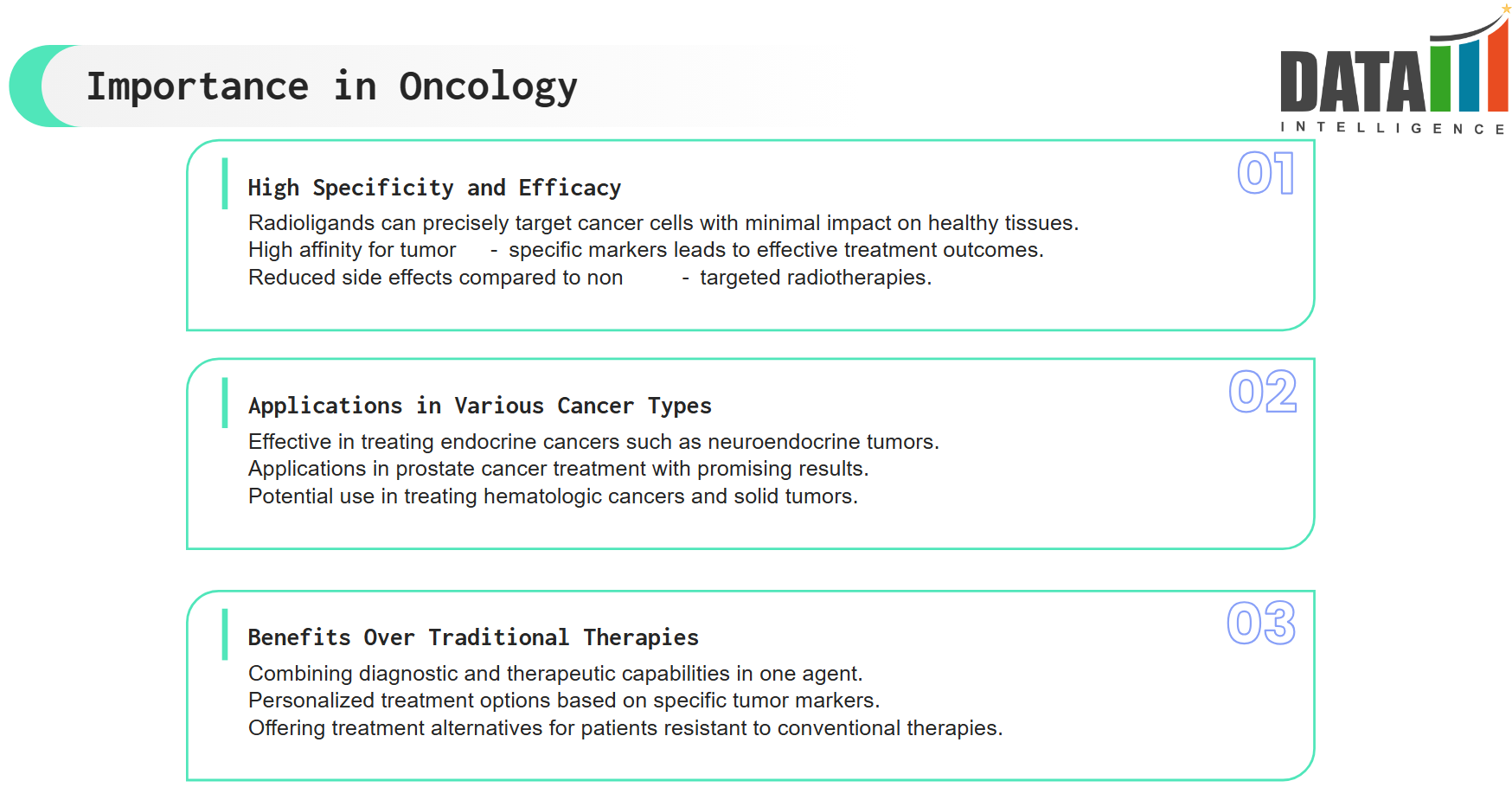

Radioligand therapy (RLT) is emerging as a transformative treatment option for various cancers, offering high specificity and efficacy, particularly in metastatic and refractory tumors. The market is currently dominated by a few key players, with increasing competition from new entrants and evolving technologies.

| Aspect | Details |

| Key Players | Novartis (Lutathera, Pluvicto), Telix Pharmaceuticals, Bayer, Curium, ITM Isotopen Technologien München, Fusion Pharmaceuticals |

| Approved Therapies | Lutathera (for neuroendocrine tumors), Pluvicto (for prostate cancer) |

| Emerging Therapies | Several RLTs in development for breast, lung, and other solid tumors (e.g., FAP-targeted therapies, HER2-directed radiopharmaceuticals) |

| Market Growth Drivers | Increasing incidence of cancer, growing adoption of targeted therapies, expanding RLT indications, improved diagnostic imaging (PSMA-PET, SSTR-PET) |

| Challenges | High cost, limited production capacity, logistical hurdles (short isotope half-life), reimbursement barriers, competition from other targeted therapies (e.g., CAR-T, ADCs) |

| Competitive Advantage of RLT | High tumor specificity, ability to treat metastatic and refractory cancers, potential for personalized treatment (via dosimetry and biomarker selection) |

| Key Market Trends | Expansion into new cancer types, increasing partnerships between pharma and biotech firms, advancements in theranostics (combining therapy and diagnostics) |

Key Companies:

7. Target Opportunity Profile (TOP) & Benchmarking

The Target Opportunity Profile (TOP) and Benchmarking framework help assess market potential, competitive positioning, and key differentiators in the RLT landscape.

Target Opportunity Profile (TOP)

| Criteria | Description | Example in RLT |

| Target Expression & Selectivity | Identifies specific molecular targets highly expressed in cancer cells with minimal normal tissue expression. | PSMA (Prostate Cancer), SSTR2 (Neuroendocrine Tumors) |

| Ligand Binding Affinity & Specificity | Ensures the ligand strongly and specifically binds to the target for effective delivery. | PSMA-617 has high affinity for PSMA-expressing tumors. |

| Internalization & Retention | Evaluates whether the target internalizes the radioligand to enhance radiation delivery. | SSTR2-targeted Lutathera efficiently internalizes into tumor cells. |

| Biodistribution & Off-Target Effects | Examines how the radioligand spreads in the body and its impact on healthy tissues. | 177Lu-PSMA shows kidney uptake, requiring nephroprotection. |

| Clinical & Commercial Viability | Assesses feasibility, market demand, and regulatory approval potential. | Lutathera (NETs) and Pluvicto (mCRPC) FDA-approved therapies. |

Benchmarking of Radioligand Therapies

| Parameter | Lutetium-177 (177Lu-PSMA-617) | Actinium-225 (225Ac-PSMA-617) | Lutetium-177 (177Lu-DOTATATE) |

| Indication | Prostate Cancer (mCRPC) | Prostate Cancer (mCRPC) | Neuroendocrine Tumors (NETs) |

| Target | PSMA | PSMA | Somatostatin Receptor (SSTR2) |

| FDA Approval | ✅ Approved (Pluvicto) | ❌ Experimental (Clinical Trials) | ✅ Approved (Lutathera) |

| Efficacy (ORR) | ~30% | ~60% (higher potency) | ~65% |

| Progression-Free Survival (PFS) | ~8-10 months | ~12-15 months | ~28 months |

| Overall Survival (OS) | ~15 months | ~18-20 months | ~48 months |

| Toxicity (Side Effects) | Mild-moderate (bone marrow & kidneys) | Higher (xerostomia, marrow suppression) | Mild (nausea, kidney concerns) |

| Treatment Cost | High (~$250K per course) | Higher (limited supply) | High (~$200K per course) |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.