1. Disease Overview:

- Prader-Willi Syndrome (PWS) is a rare and complex genetic condition affecting multiple body systems, including metabolic, endocrine, and neurological functions. It typically presents in infancy with severe hypotonia (low muscle tone) and feeding difficulties, which can lead to global developmental delays. As individuals with PWS grow, they often experience intellectual and behavioral challenges, alongside distinctive physical features such as strabismus (crossed eyes) and musculoskeletal abnormalities.

2. Epidemiology Analysis (Current & Forecast)

- PWS is a rare genetic condition that affects one in 12,000 to 15,000 people in the U.S.

- PWS occurs in all geographic regions of the world. Approximately 10,000 to 20,000 individuals with PWS live in the US.

| Parameter | Estimate |

| Incidence of PWS | 1 in 10,000 to 30,000 live births |

| Global prevalence of PWS | 1 to 9 per 100,000 individuals |

| Total affected worldwide | 350,000 to 400,000 individuals |

3. Approved Drugs (Current SoC) - Sales & Forecast

- While there is no cure for Prader-Willi Syndrome (PWS), a comprehensive treatment plan can help manage the condition and improve the quality of life for individuals affected.

- March 2025: The US FDA approved VYKAT XR (diazoxide choline) extended-release tablets, previously referred to as DCCR, for the treatment of hyperphagia in adults and children 4 years of age and older with Prader-Willi syndrome (PWS).

- Soleno expects VYKAT XR to be available in the U.S. beginning in April 2025.

Medical Treatment

Medical therapy plays a crucial role in managing the symptoms of PWS. These may include:

- Growth hormone therapy (Pfizer- Genotropin & Sandoz- Omnitrope, a biosimilar for Genotropin), : To promote growth and development in children with PWS.

- Hormone replacement therapy: To regulate hormone levels, particularly growth hormone and insulin-like growth factor-1 (IGF-1).

- Medications for behavioral symptoms: To manage hyperphagia, anxiety, and obsessive-compulsive behaviors.

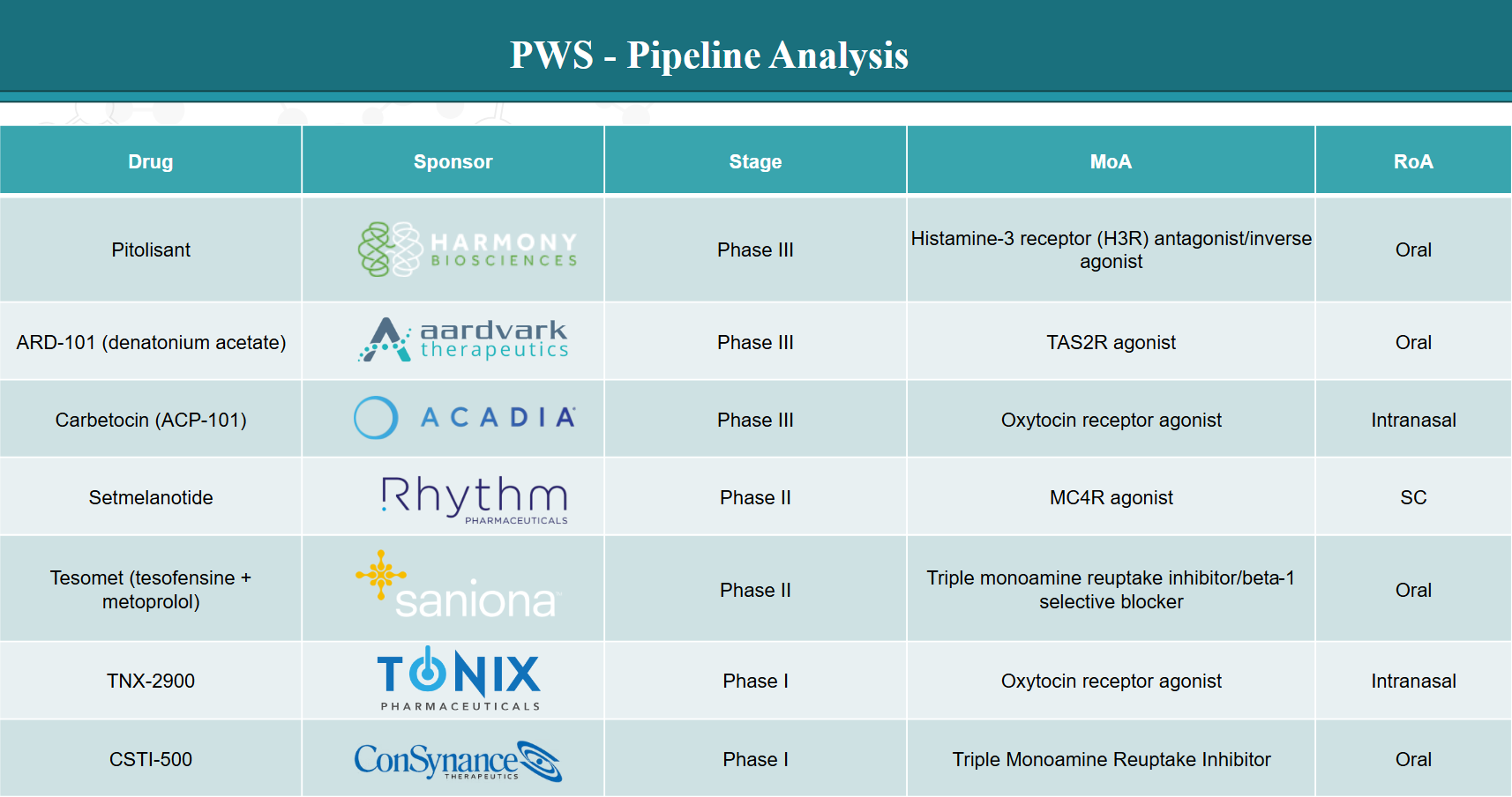

4. Pipeline Analysis and Expected Approval Timelines

The development pipeline for PWS includes several promising therapies at various stages of clinical development. Below is an overview of notable drugs, their respective companies, and their highest achieved development phases:

5. Market Size & Forecasting

The global Prader-Willi syndrome market reached US$ 633.56 million in 2024 and is expected to reach US$ 1,078.80 million by 2033, growing at a CAGR of 6.0% during the forecast period 2025-2033.

Unmet Needs

Despite advances in treatment, Prader-Willi Syndrome (PWS) remains a challenging condition with multiple unmet needs. These gaps highlight areas requiring further research and therapeutic development.

| Unmet Need | Current Gap | Potential Solution |

| Hyperphagia Control | Only one FDA-approved treatment | Targeted appetite-suppressing drugs (e.g., ghrelin inhibitors, melanocortin agonists) |

| Obesity & Metabolic Issues | Limited weight-loss options | More effective anti-obesity drugs, metabolic modulators |

| Behavioral & Psychiatric Care | Few targeted treatments for aggression, anxiety, OCD | PWS-specific psychiatric medications |

| Sleep Disorders (Sleep Apnea, Insomnia) | CPAP intolerance, lack of alternative therapies | Non-invasive sleep treatments, better sleep medications |

| Cognitive & Developmental Support | No approved therapies for intellectual disability | Neurocognitive drugs, enhanced education strategies |

| Hormonal Imbalances | Limited treatments beyond growth hormone | Improved endocrine therapies |

| Adult Transition & Long-Term Care | Lack of structured support for independent living | Specialized transition programs, vocational training |

| Gene-Based & Personalized Therapies | No disease-modifying treatments | Gene therapy, epigenetic interventions |

6. Competitive Landscape and Market Positioning

The PWS treatment market is currently focused on growth hormone therapy, appetite suppression, and metabolic regulation. While somatropin remains the only widely approved therapy, along with the recent FDA approval of VYKAT XR (diazoxide choline) extended-release tablets, multiple companies are advancing novel treatments targeting hyperphagia and behavioral issues.

Market Positioning

| Segment | Current Leaders | Emerging Competitors | Market Gap |

| Growth Hormone Therapy | Pfizer, Novo Nordisk, Sandoz | Biosimilars | No direct competitors, limited impact on hyperphagia |

| Hyperphagia Treatment | Soleno (VYKAT XR (diazoxide choline) | ACADIA Pharmaceuticals (Intranasal Carbetocin (ACP-101)) Saniona (Tesomet), Rhythm (Setmelanotide) | Recent approval of VYKAT XR |

| Obesity & Metabolic | Rhythm (Setmelanotide) | Saniona (Tesomet), Lipidio (GDD3898) | Limited options for obesity prevention |

| Gene Therapy & Future Innovations | – | - | No disease-modifying treatments yet |

3. Competitive Advantages & Challenges

A. Key Advantages for Leading Companies

First-mover advantage: Soleno (VYKAT XR (diazoxide choline) received the first FDA approval for the treatment of hyperphagia in adults and children 4 years of age and older with Prader-Willi syndrome (PWS). Soleno expects VYKAT XR to be available in the U.S. beginning in April 2025.

- Targeted therapy focus: Companies like Rhythm and Saniona focus on appetite/metabolism-specific treatments.

- Diverse mechanisms: Multiple approaches (oxytocin, ghrelin inhibition, MC4R agonists) provide differentiation.

B. Challenges & Barriers

- Regulatory approval delays: FDA scrutiny on novel rare disease treatments.

- Patient recruitment for trials: The Small PWS patient population slows research.

- Long-term efficacy concerns: The Sustainability of hunger suppression and weight loss remains unclear.

7. Target Opportunity Profile (TOP) & Benchmarking

| Attribute | Current Gap | Ideal Target Profile |

| Efficacy | Existing treatments provide partial relief (e.g., growth hormone helps growth but not hyperphagia). | ≥ 50% reduction in hyperphagia and weight gain, measurable metabolic benefits. |

| Safety | Many drugs have side effects (e.g., mood changes, cardiovascular risks). | Minimal long-term side effects, suitable for lifelong use. |

| Mode of Action | Non-specific treatments (e.g., growth hormone, psychiatric meds). | Targeted pathways (e.g., ghrelin inhibition, oxytocin modulation). |

| Rout of Administration | Daily injections or frequent dosing (e.g., growth hormone, GLP-1 drugs). | Once-daily or long-acting formulations (oral, nasal, or subcutaneous). |

| Behavioral Benefits | No FDA-approved psychiatric drug for PWS. | Improvement in aggression, anxiety, and OCD symptoms. |

| Weight & Metabolism | Obesity management is limited. | Significant and sustained weight loss (>5-10% body weight reduction). |

| Regulatory Approval | Only one FDA-approved drug for hyperphagia. | Fast-track approval based on strong clinical outcomes. |

| Market Accessibility | High treatment costs and limited insurance coverage. | Affordable pricing, broad insurance reimbursement. |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.