Disease Overview:

Polycythemia vera (PV) is a form of blood cancer that falls within the category of myeloproliferative neoplasms (MPNs) and is mainly distinguished by the excessive production of red blood cells.

Polycythemia vera most frequently affects men over the age of 60, though it can occur in individuals of any age or gender. As the disease progresses, patients often develop increased levels of white blood cells and platelets, along with an enlargement of the spleen.

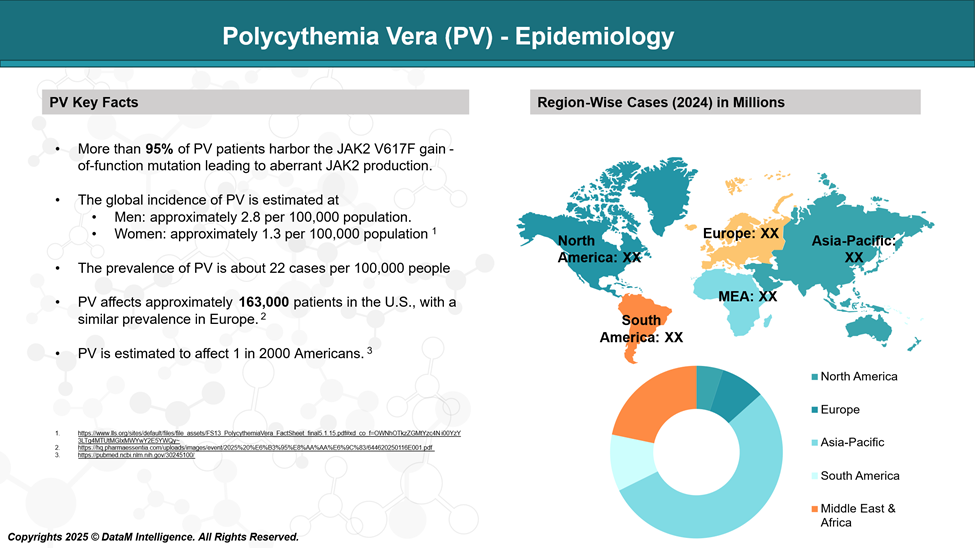

Epidemiology Analysis (Current & Forecast)

Polycythemia vera (PV) is an uncommon blood disorder, affecting about 22 individuals out of every 100,000.

It tends to be more frequently diagnosed in men than in women and typically presents later in life, with the average age at diagnosis being around 60 years.

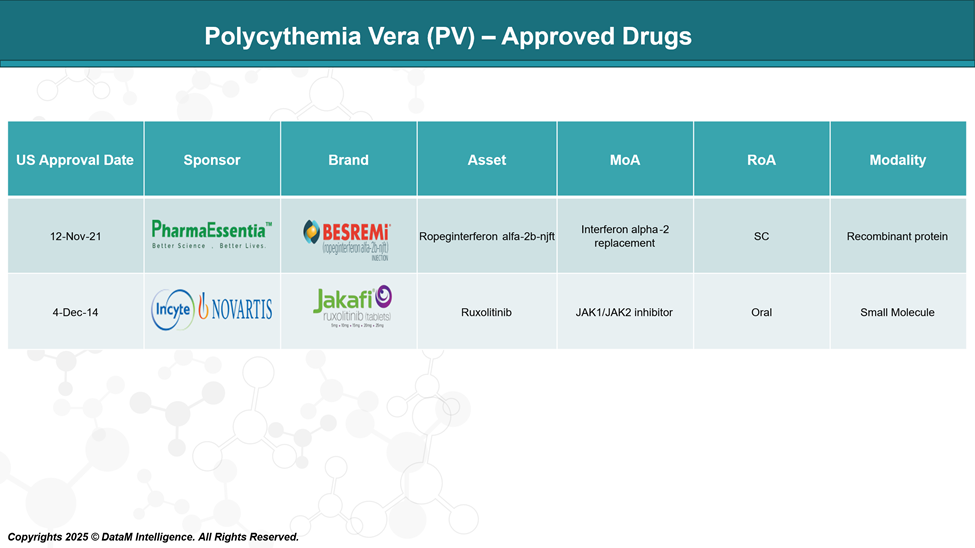

Approved Drugs (Current SoC) - Sales & Forecast

Ropeginterferon and Ruxolitinib are the only FDA-approved drugs for the treatment of PV.

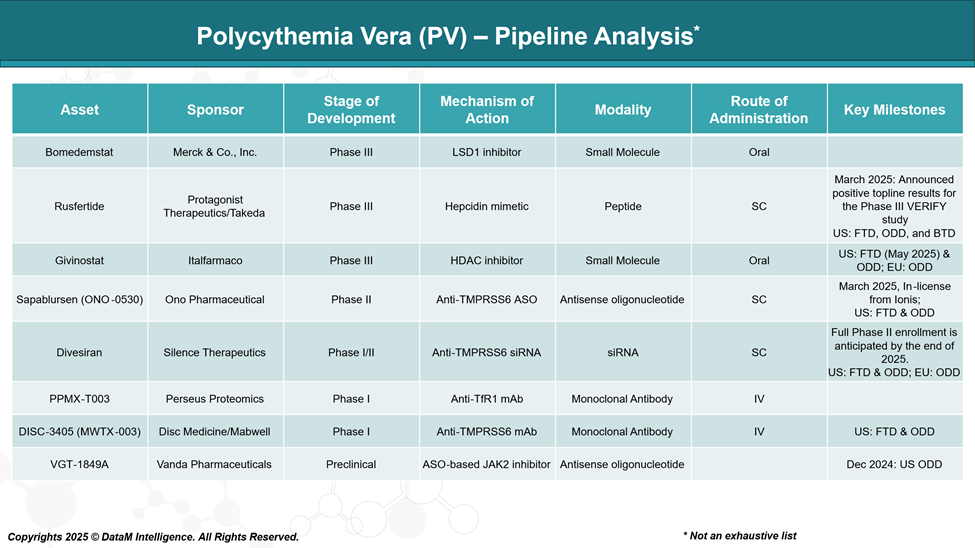

Pipeline Analysis and Expected Approval Timelines

The Polycythemia Vera (PV) pipeline includes several emerging therapies targeting different mechanisms of action, including JAK2 inhibitors, hepcidin mimetics, TMPRSS6-targeting agents, and other approaches.

Competitive Landscape and Market Positioning

The treatment landscape for Polycythemia Vera (PV) is evolving, with both approved therapies and promising pipeline candidates aiming to address unmet medical needs, particularly for patients resistant or intolerant to standard therapies like hydroxyurea.

Approved Therapies

Besremi® (ropeginterferon alfa-2b-njft) – PharmaEssentia

Besremi is the first and only interferon therapy approved for PV in the US and Europe. It is a long-acting, monopegylated interferon designed for chronic use and has demonstrated durable hematologic and molecular responses. Besremi is positioned as a frontline treatment option, especially for patients seeking a disease-modifying therapy.

Jakafi® (ruxolitinib) – Incyte/Novartis

Jakafi, a JAK1/JAK2 inhibitor, is approved for PV patients who have had an inadequate response to or are intolerant of hydroxyurea. It is currently the most widely used second-line therapy and holds a strong market share due to its effectiveness in controlling hematocrit, reducing spleen volume, and improving symptom burden.

Market Outlook

The competitive landscape is becoming increasingly differentiated, with PharmaEssentia’s Besremi carving out a niche in first-line treatment and Incyte/Novartis’ Jakafi maintaining a strong hold in the second-line setting.

The success of emerging agents like rusfertide and bomedemstat could shift treatment paradigms further, especially if they demonstrate robust efficacy with favorable safety profiles and address burdens such as frequent phlebotomies or molecular progression.

| Drug | Company | Mechanism of Action | Stage | Line of Therapy | Key Differentiators |

| Besremi® | PharmaEssentia | Pegylated interferon alfa-2b | Approved | First-line | Long-acting interferon; disease-modifying; less frequent dosing (biweekly to monthly) |

| Jakafi® | Incyte / Novartis | JAK1/JAK2 inhibitor | Approved | Second-line (post-Hydroxyurea) | Proven symptom control, spleen reduction, widely adopted |

| Bomedemstat | Merck & Co., Inc. | LSD1 (epigenetic) inhibitor | Phase III | Investigational | Epigenetic targeting: potential to reduce mutant allele burden |

| Rusfertide | Protagonist / Takeda | Hepcidin mimetic (iron regulation) | Phase III (VERACITY) | Investigational | Reduces the need for phlebotomy; maintains hematocrit; favorable for frequent phlebotomy patients |

| Givinostat | Italfarmaco | HDAC inhibitor | Phase III | Investigational | Targets JAK2V617F mutation; potential disease modification |

| Sapablursen (ONO-0530) | Ono Pharmaceutical | Antisense oligonucleotide (TPO receptor mRNA) | Phase II | Investigational | Targets platelet production and inflammation; novel mechanism |

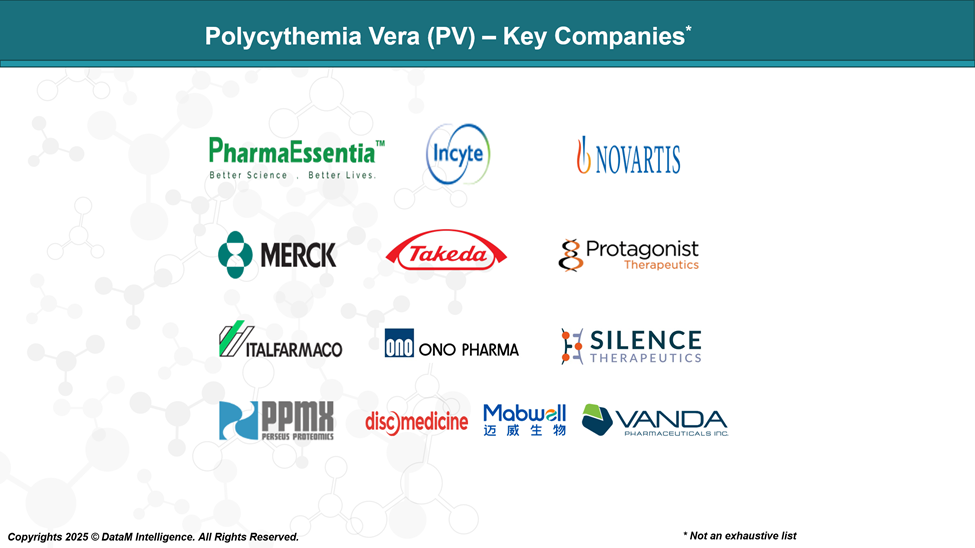

Key Companies:

Target Opportunity Profile (TOP)

This TOP sets clinical and commercial benchmarks that new therapies must meet or exceed to gain a competitive advantage over existing approved treatments like Besremi and Jakafi.

Target Opportunity Profile (TOP) for Emerging PV Therapies

| Parameter | Benchmark (Approved Drugs) | Target for Emerging Therapies | Rationale / Strategic Advantage |

| Efficacy | Besremi: durable hematologic & molecular responses Jakafi: hematocrit control, spleen size reduction, symptom relief | Superior or equivalent efficacy in hematocrit control without phlebotomy, symptom relief, and potential molecular remission | Demonstrates disease modification and addresses unmet needs in long-term disease control |

| Safety & Tolerability | Interferon-related AEs such as flu-like symptoms and mood changes Jakafi: cytopenia, infection risk | Improved safety profile, particularly fewer cytopenia, minimal immunosuppression, and low discontinuation rates | Better tolerability broadens use in elderly/frail patients and improves adherence |

| Mechanism of Action | Jakafi: JAK1/2 inhibition Besremi: interferon signaling | Novel non-JAK/non-interferon mechanism (e.g., iron metabolism, epigenetic, anti-inflammatory) | Avoids resistance and intolerance seen with current MOAs; opportunity in earlier lines |

| Route of Administration | Besremi: subcutaneous injection every 2–4 weeks Jakafi: oral BID | Oral, weekly, or monthly administration, or non-invasive delivery | Improves patient convenience, quality of life, and long-term compliance |

| Dosage Frequency | Jakafi: twice daily oral Besremi: every 2–4 weeks SC injection | Once daily or less frequent dosing with flexible titration | Supports chronic use and reduces treatment burden |

| Onset of Action | Jakafi: relatively fast (hematocrit within weeks) Besremi: slower onset | Rapid hematocrit control within 1–2 months, plus sustained durability | Offers a competitive edge for physicians seeking fast symptom/hematologic control |

| Need for Phlebotomy | Still often required early in Besremi Reduced with Jakafi | Eliminates phlebotomy dependence in the majority of patients | Highly differentiating for patients burdened by frequent phlebotomies |

| Molecular Response | Besremi shows JAK2V617F allele burden reduction Jakafi does not | Clear reduction in JAK2V617F allele burden and/or clonal suppression | Positions therapy as potentially disease-modifying |

| Impact on QoL / Symptoms | Moderate to good (Jakafi > Besremi) | Superior symptom relief and QoL improvement validated via validated tools (e.g., MPN-SAF) | Supports positioning as a holistic patient-centered option |

| Pricing / Cost | Besremi: $180,000/year US) | Competitive or value-based pricing, potentially with outcomes-based models | Payer acceptance is crucial; price must align with perceived innovation and outcomes |

Strategic Implications

To gain a competitive foothold in the PV landscape, pipeline candidates must aim to:

- Offer equal or better efficacy than current standards,

- Demonstrate differentiated mechanisms (non-JAK/non-interferon),

- Show a cleaner safety profile, especially for long-term use,

- Enhance patient convenience (oral, fewer injections), and

- Align price with clinical and economic value.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: