Disease Overview:

Non–Cystic Fibrosis Bronchiectasis (NCFB) is a chronic lung disease marked by permanent widening of the airways, not linked to cystic fibrosis. It results from recurring inflammation or infection that damages the bronchial walls. Common symptoms include persistent cough, sputum production, and frequent respiratory infections. Diagnosis is typically made using high-resolution CT scans.

Epidemiology Analysis (Current & Forecast)

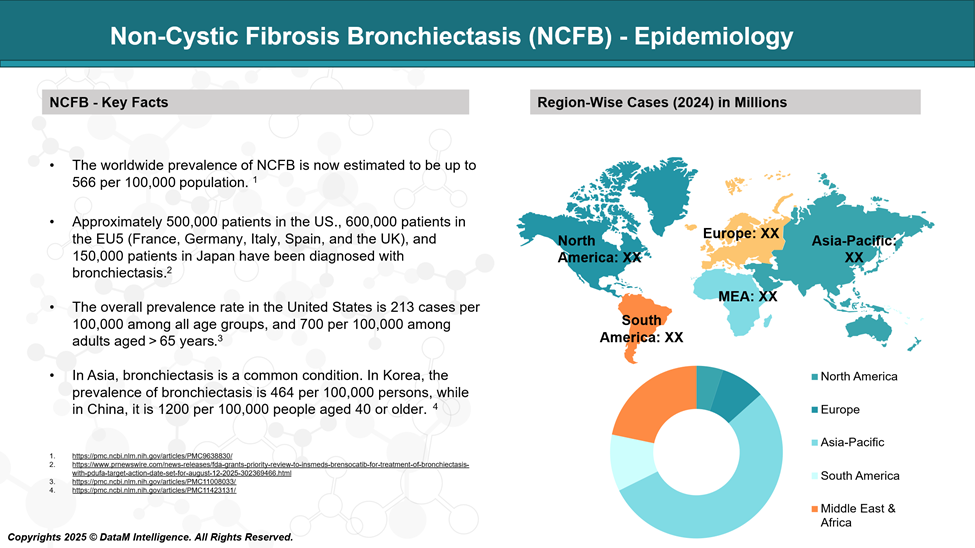

Non–Cystic Fibrosis Bronchiectasis (NCFB) affects an estimated 67 to 566 cases per 100,000 individuals, with higher prevalence observed in older adults and females. The disease burden is rising globally, partly due to improved diagnostic tools and aging populations.

Incidence rates vary by region but are notably higher in individuals over 65. NCFB is also more common in patients with underlying conditions such as COPD, asthma, or immunodeficiencies.

Approved Drugs - Sales & Forecast

Currently, there are no drugs specifically approved by the FDA or EMA exclusively for Non–Cystic Fibrosis Bronchiectasis (NCFB). However, several treatments are used off-label or as part of symptom management and infection control, based on clinical guidelines and patient condition. These include:

Commonly Used Therapies:

- Antibiotics (oral, inhaled, IV)

- Inhaled antibiotics: Tobramycin, Colistin, Aztreonam lysine, used especially for Pseudomonas aeruginosa colonization.

- Oral/IV antibiotics: Amoxicillin-clavulanate, Macrolides (e.g., Azithromycin) for acute exacerbations or long-term suppression.

- Macrolide therapy (long-term, anti-inflammatory & antibacterial)

- Azithromycin or Erythromycin is used to reduce exacerbations and inflammation.

- Airway Clearance Agents

- Hypertonic saline, Dornase alfa (though less effective in NCFB compared to CF), and bronchodilators in some patients.

- Bronchodilators and corticosteroids

- Used mainly when NCFB overlaps with asthma or COPD.

Thus, current management relies on repurposed or supportive therapies rather than NCFB-specific drug approvals.

Pipeline Analysis and Expected Approval Timelines

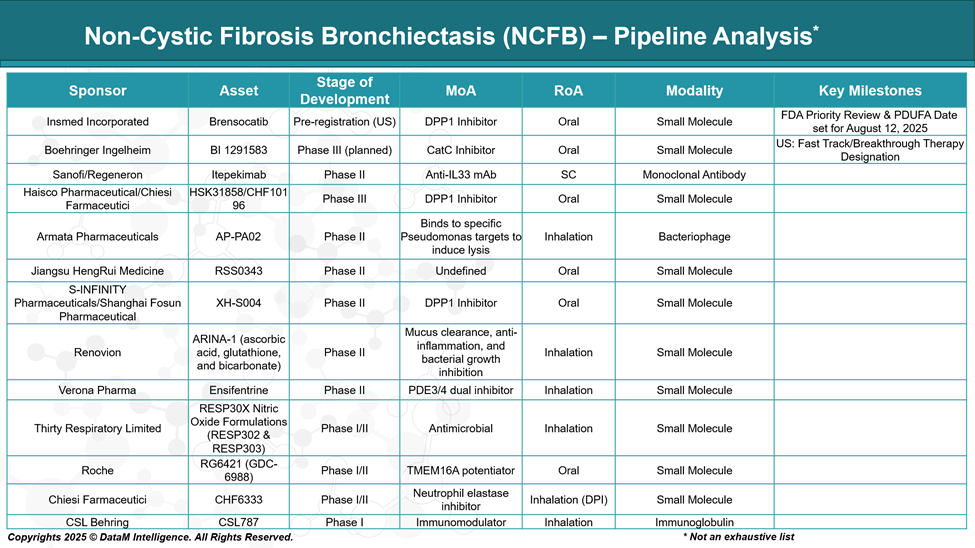

The drug development pipeline for Non–Cystic Fibrosis Bronchiectasis (NCFB) is advancing, with several promising therapies in various stages of clinical development. Here's an overview of key candidates:

Competitive Landscape and Market Positioning

Despite the absence of any approved therapies specifically for NCFB, the competitive landscape is rapidly evolving, driven by a growing understanding of the disease's immunologic and microbiologic mechanisms.

Company | Drug | Stage | Mechanism of Action | Positioning / Competitive Edge |

Insmed Incorporated | Brensocatib | Pre-registration (US) | DPP1 inhibitor (anti-neutrophilic) | First-in-class; targets neutrophilic inflammation; potential first approved disease-modifying drug |

Boehringer Ingelheim | BI 1291583 | Phase III (Planned) | Cathepsin C (DPP1 class) inhibitor | Competing directly with brensocatib; potential differentiation via safety or trial outcomes |

Sanofi / Regeneron | Itepekimab | Phase II | Anti-IL-33 monoclonal antibody | Targets Th2/eosinophilic inflammation; may benefit patients with asthma overlap |

Haisco / Chiesi Farmaceutici | HSK31858 / CHF10196 | Phase III | DPP1 inhibitor | Global expansion with Chiesi; competition in neutrophilic endotype space with possible regional focus |

Strategic Considerations

- Target Differentiation: Companies are segmenting patients based on inflammatory endotypes (neutrophilic vs eosinophilic) and frequency of exacerbations to define therapeutic niches.

- First-Mover Advantage: Insmed’s brensocatib is ahead in development, gaining regulatory priority designations and is likely to set the benchmark for future therapies.

- Pipeline Diversity: While most candidates focus on neutrophilic inflammation (DPP1/CatC inhibition), alternative pathways, such as IL-33 inhibition and bacterial modulation (e.g., inhaled antibiotics, phage therapy), are gaining interest.

Key Companies:

Target Opportunity Profile (TOP)

The Target Opportunity Profile (TOP) for NCFB defines the critical attributes that emerging drugs must demonstrate, across safety, efficacy, mechanism of action, route of administration, and patient-centric innovation, to establish therapeutic and commercial value. Given the heterogeneous nature of the disease and evolving understanding of its inflammatory drivers, successful entrants will likely need to deliver both clinical differentiation and precision targeting to gain traction in this untapped market.

Target Opportunity Profile – Emerging Drugs for Non-Cystic Fibrosis Bronchiectasis

Attribute | Ideal Profile for Emerging Therapies |

Market Context | No FDA/EMA approved therapies; high unmet need; management is symptomatic (antibiotics, mucolytics, bronchodilators). |

Mechanism of Action (MoA) | Anti-inflammatory (e.g., DPP1 inhibitors), immune modulation (e.g., anti-IL-33 mAbs), neutrophil regulation, and mucus clearance enhancers. |

Efficacy | Must significantly reduce exacerbation rates, improve lung function (FEV1), decrease sputum production, and enhance quality of life (QoL) (SGRQ, LCQ scores). |

Safety | Chronic use requires a strong safety/tolerability profile, minimal systemic immunosuppression, and low infection risk. |

Route of Administration (RoA) | Preferably oral or inhaled for better compliance; subcutaneous is acceptable if infrequent. |

Dosing | Once-daily or weekly dosing is ideal for adherence in a chronic condition; avoid IV regimens unless high efficacy justifies. |

Modality | Small molecules, monoclonal antibodies, or novel inhaled biologics should be scalable and cost-manageable. |

Innovation | Novel targets (e.g., neutrophil elastase, Cathepsin C), patient stratification based on inflammatory phenotypes (neutrophilic vs eosinophilic), and biomarker-driven treatment personalization. |

Patient Population Target | Moderate to severe NCFB patients with frequent exacerbations; subgroups with elevated neutrophilic inflammation or P. aeruginosa colonization. |

Differentiation Needs | Superior to current SOC (e.g., antibiotics, airway clearance) by modifying disease progression, not just symptom control. |

Endpoints for Clinical Trials | Reduction in annualized pulmonary exacerbation rate (APER), time to first exacerbation, hospitalization rate, QoL measures, and inflammatory biomarkers. |

Regulatory Strategy | Orphan drug designation is possible in some jurisdictions, and fast-track/breakthrough designations may be available if clinical endpoints are met. |

Strategic Implications for Entry

- First-Mover Advantage: High opportunity to become the first approved treatment if a company demonstrates clear efficacy in Phase III trials.

- Precision Medicine: Subgroup targeting (e.g., neutrophil-dominant inflammation) could be key to regulatory and clinical success.

- Combination Therapy: Potential to be used alongside macrolides, inhaled antibiotics, or airway clearance devices.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: