Disease Overview:

Neurofibromatosis type 1 (NF1) is a hereditary condition that leads to a higher likelihood of developing both benign and malignant tumors. It is also associated with a range of physical and neurological symptoms. Among the most common features of NF1 are neurofibromas, tumors that form on nerves and beneath the skin and distinctive changes in skin pigmentation.

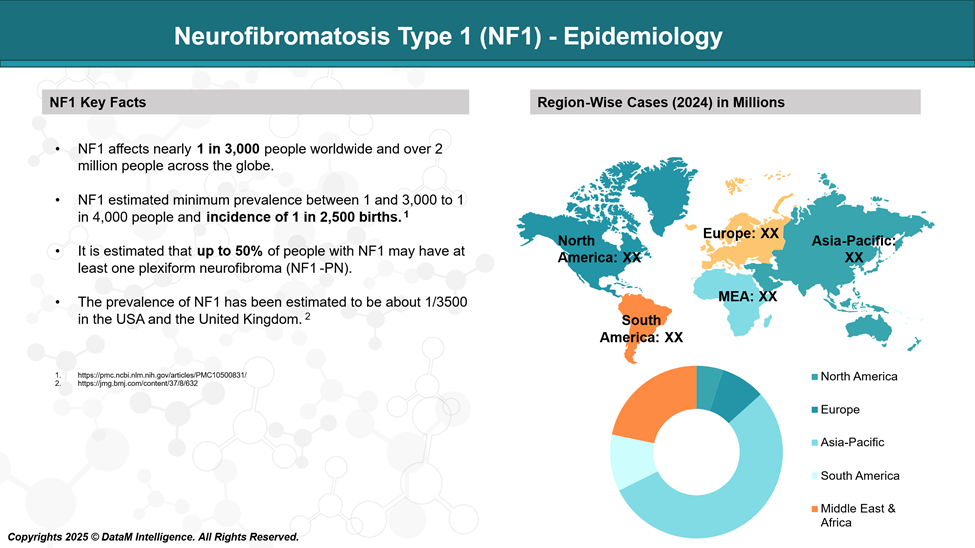

Epidemiology Analysis (Current & Forecast)

Neurofibromatosis type 1 (NF1) affects approximately 1 in every 3,000 individuals. It occurs across all ethnic backgrounds, with no group showing an unusually high or low frequency. The condition tends to be slightly more common in children than in adults, likely due to the reduced life expectancy associated with more severe cases.

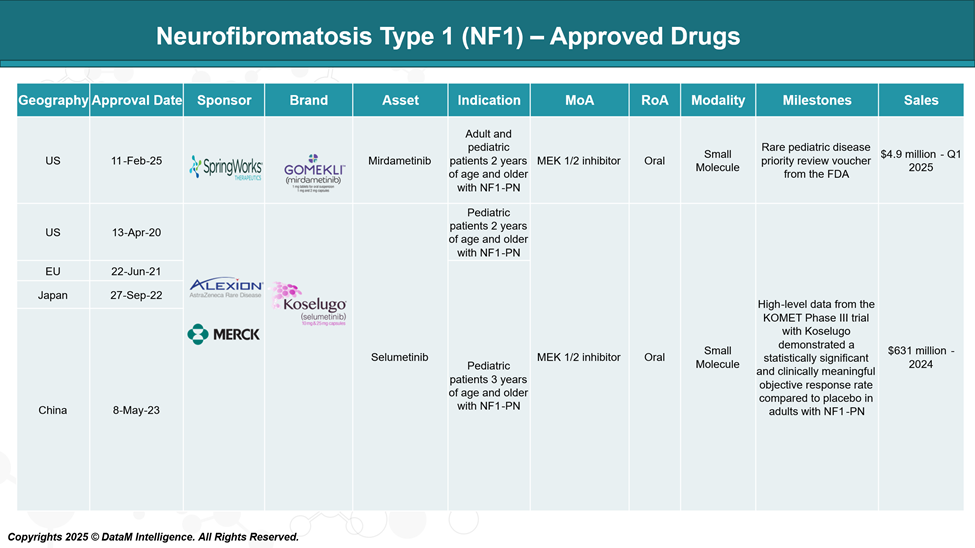

Approved Drugs (Current SoC) - Sales & Forecast

Currently, the U.S. Food and Drug Administration (FDA) has approved two medications for the treatment of plexiform neurofibromas linked to NF1: selumetinib (Koselugo) and mirdametinib (Gomekli).

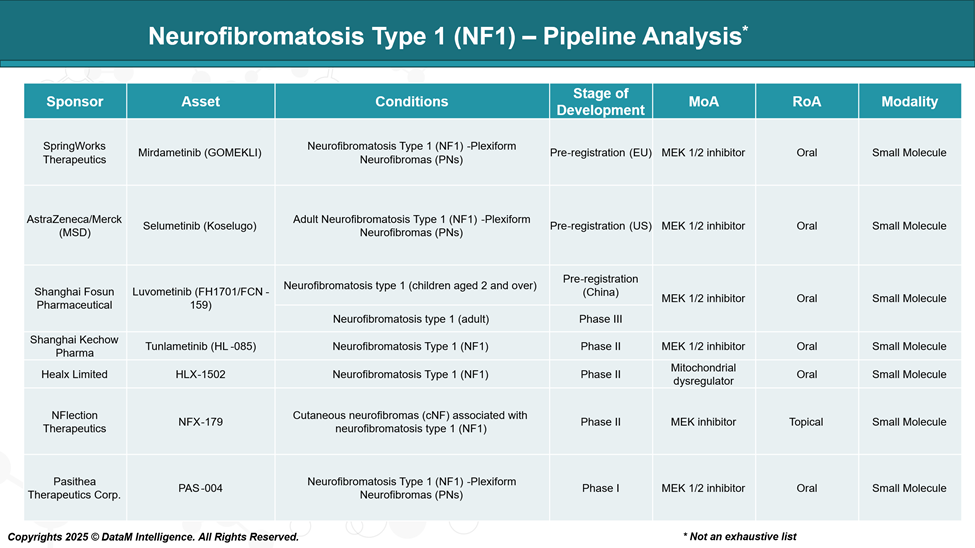

Pipeline Analysis and Expected Approval Timelines

The therapeutic landscape for NF1 has evolved, with several treatments approved or in development:

Competitive Landscape and Market Positioning

Here’s a benchmarking analysis of key NF1 drug candidates and approved therapies, comparing them across critical dimensions such as clinical development stage, mechanism, administration, target population, and market potential:

| Metric | Koselugo (AstraZeneca/Merck) | GOMEKLI (SpringWorks) | Luvometinib (Fosun) | Tunlametinib (Kechow) | HLX-1502 (Healx) | NFX-179 (NFlection) | PAS-004 (Pasithea) |

| Approval Status | FDA Approved (Pediatric) | FDA Approved (Peds + Adults) | Pre-registration (China) | Phase II | Phase II | Phase II | Phase I |

| Target Indication | NF1 – Plexiform Neurofibromas | NF1 – Plexiform Neurofibromas | NF1 (Children + Adults) | NF1 General | NF1 General | cNF (cutaneous NF1) | NF1 – Plexiform NFs |

| Age Group | Pediatric only | Pediatric + Adult | Pediatric + Adult | Not specified | Not specified | Pediatric + Adult (assumed) | Not specified |

| Mechanism of Action | MEK1/2 inhibitor | MEK1/2 inhibitor | MEK1/2 inhibitor | MEK1/2 inhibitor | Mitochondrial dysregulator | MEK inhibitor | MEK1/2 inhibitor |

| Formulation/Route | Oral | Oral | Oral | Oral | Oral | Topical | Oral |

| Differentiating Feature | First approved, AZ/MSD backing | Broadest age indication | Major Chinese player | Regional competitor | Novel MoA | Unique topical route | Early-stage, MEK focused |

| Safety Profile (in trials) | Manageable, dose reductions noted | Similar to Koselugo | TBD | TBD | TBD | Mild, localized (topical) | TBD |

| Market Entry Timeline | 2020 (US) | 2025 (US) | Expected 2025 (China) | Likely post-2026 | TBD (2026+) | TBD (2026+) | TBD (2027+) |

| Potential for Global Expansion | High (EU, US, Asia) | High (Broad label) | High (Asia-first) | Medium (China-focused) | High (if MoA proves novel) | High (non-invasive option) | High (if trials succeed) |

Approved Leaders

- Koselugo (selumetinib): First FDA-approved therapy for NF1-associated plexiform neurofibromas (2020). Positioned as the gold standard for pediatric NF1 treatment.

- GOMEKLI (mirdametinib): More recent approval, offering treatment for both pediatric and adult patients, expanding the addressable market significantly.

Late-Stage Contenders

- Luvometinib (Fosun Pharma): Strong positioning in China with both pediatric and adult indications nearing approval. Expected to challenge GOMEKLI regionally.

Innovative Niche Approaches

- NFX-179 (NFlection): Unique topical formulation, specifically targeting cutaneous neurofibromas, which may be more patient-friendly and non-invasive.

- HLX-1502 (Healx): Novel mechanism (mitochondrial dysregulator), potentially offering a non-MEK alternative and differentiated safety profile.

Early Development Prospects

- PAS-004 (Pasithea): Still in early stages but targeting the same MEK pathway. May compete in the future pending clinical success.

- Tunlametinib (Kechow): Competitive Phase II MEK inhibitor, likely aiming for expansion in Asia-Pacific regions.

Strategic Considerations

- MEK inhibitors dominate the pipeline, reflecting the central role of the Ras/MAPK pathway in NF1 pathophysiology.

- Geographic expansion (e.g., Fosun and Kechow in China) is crucial for increasing global access.

- Differentiation by formulation (topical, mitochondrial pathways) is an emerging trend to improve tolerability and patient adherence.

Key Companies:

Target Opportunity Profile (TOP)

To successfully compete with or surpass approved NF1 therapies like Koselugo (selumetinib) and GOMEKLI (mirdametinib), emerging drug candidates must demonstrate a Target Opportunity Profile (TOP) that exceeds current benchmarks across several key dimensions.

| Category | Ideal Profile | Rationale / Comparator Weakness |

| Efficacy | - ≥50% confirmed objective tumor response rate (ORR) (per REiNS criteria) | GOMEKLI showed ~42-52% tumor shrinkage in pivotal studies |

| - Durable response (≥12 months in ≥70% of responders) | Need longer-lasting benefit to reduce recurrence risk | |

| Safety/Tolerability | - Lower rates of dose-limiting toxicities (DLTs), especially GI and skin-related AEs | Koselugo/GOMEKLI often require dose reduction due to adverse events |

| - Minimal or no need for corticosteroid rescue or treatment discontinuation | High tolerability = better compliance, especially in pediatrics | |

| Mechanism of Action | - MEK-independent or MEK+combination mechanisms (e.g., SHP2, PI3K, mitochondrial targets) | All current options target MEK1/2, which has a narrow therapeutic window |

| - Synergistic pathways to avoid resistance seen with prolonged MEK inhibition | Reduces long-term treatment failure | |

| Route of Administration | - Oral or topical preferred (depending on target lesion type) | Koselugo and GOMEKLI are oral; topical (e.g., NFX-179) could dominate cNF segment |

| Dosage Frequency | - Once-daily (QD) or even less frequent (e.g., weekly) if long-acting formulations | Koselugo is BID; once-daily or depot versions would improve patient adherence |

| Formulation | - Child-friendly, liquid or dissolvable tablet forms (for pediatric population) | Liquid forms important for younger children who cannot swallow pills |

| Onset of Action | - Clinically meaningful tumor shrinkage within 2-3 months | Koselugo and GOMEKLI often require >4 months for visible impact |

| Modality | - Small molecule (with differentiated mechanism) OR non-traditional (RNA, antisense, gene therapy) | Non-small molecule therapies may avoid MEK-related toxicities and offer disease modification |

| Target Population Expansion | - Proven safety/efficacy across full age spectrum (2–60+), including cutaneous and deep PNs | Most current approvals are limited to pediatric or PN only |

| Biomarker Integration | - Predictive biomarkers (e.g., MAPK pathway activity, NF1 mutation type) | Personalized medicine approach may increase efficacy and reduce unnecessary exposure |

Strategic Priorities for Development Teams

Emerging therapies targeting NF1 should:

- Differentiate beyond MEK: Avoid "me-too" MEK inhibitors unless they offer superior safety or efficacy.

- Address cutaneous neurofibromas (cNF): A large unmet need not well-addressed by systemic therapies.

- Leverage non-invasive routes: Topical and long-acting injectable formulations could dramatically improve quality of life.

- Prioritize tolerability: Pediatric and chronic-use indications demand minimal side effects.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: