Disease Overview:

Myelofibrosis is a chronic myeloproliferative neoplasm characterized by clonal proliferation of hematopoietic stem cells and progressive bone marrow fibrosis. This fibrotic transformation disrupts normal hematopoiesis, often resulting in peripheral blood cytopenia, extramedullary hematopoiesis (especially in the spleen), and constitutional symptoms. The disease is commonly associated with mutations in JAK2, CALR, or MPL genes and may present as primary (de novo) or evolve from other MPNs.

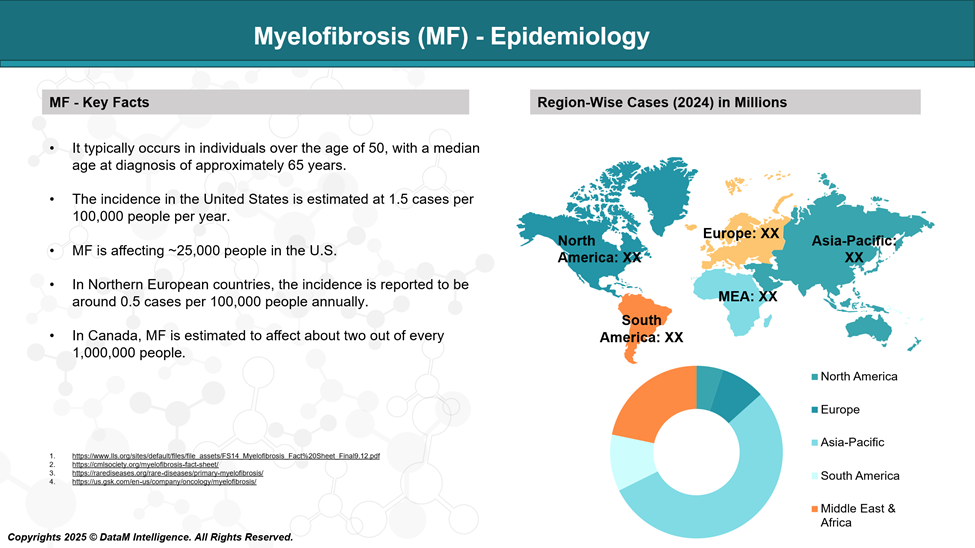

Epidemiology Analysis (Current & Forecast)

MF occurs equally in males and females, though some regional variations exist. Incidence rates vary by geography but generally range between 0.5 and 1.5 cases per 100,000 people annually.

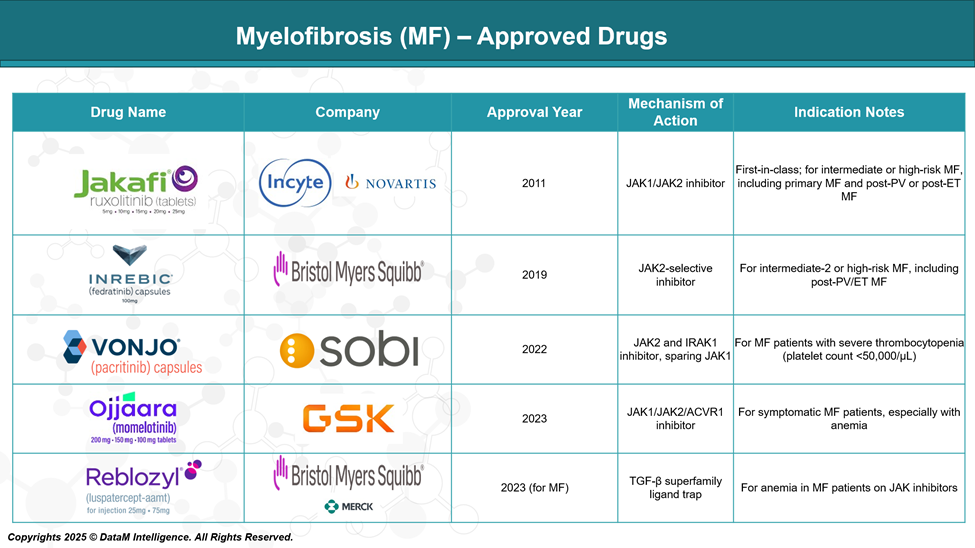

Approved Drugs - Sales & Forecast

MF treatment has evolved significantly with the development of targeted therapies, particularly JAK inhibitors, which address key molecular pathways driving the disease. Several drugs have gained regulatory approval, improving symptom management, reducing spleen size, and enhancing quality of life for patients with intermediate- to high-risk MF.

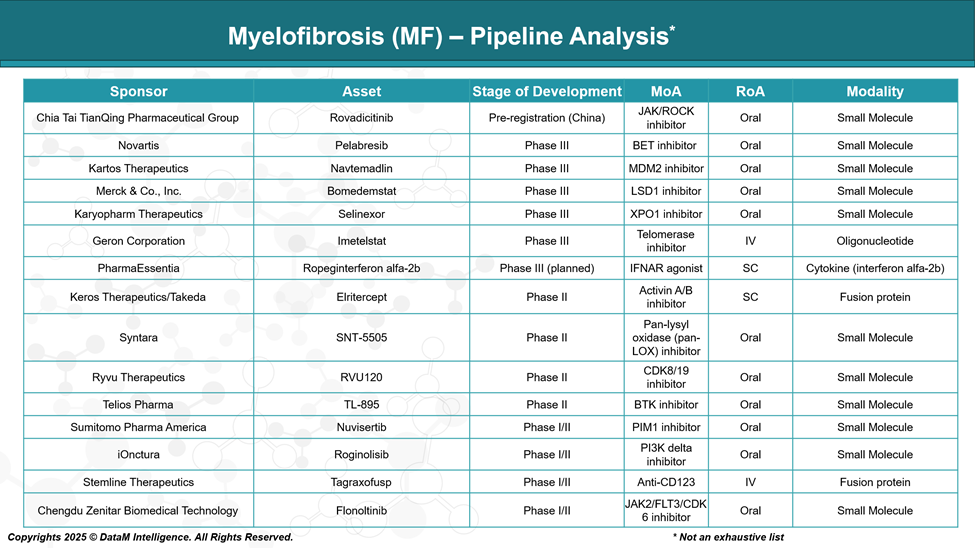

Pipeline Analysis and Expected Approval Timelines

The current therapeutic pipeline reflects a strategic shift toward combination regimens, non-JAK pathways, and disease-modifying therapies, with several promising agents in late-stage development. This evolving landscape aims to deliver deeper and more durable responses while expanding treatment options for previously underserved MF populations.

Competitive Landscape and Market Positioning

The treatment landscape for Myelofibrosis (MF) has undergone significant evolution, primarily driven by the approval of JAK inhibitors that target the underlying dysregulated JAK-STAT pathway. However, residual unmet needs such as anemia, thrombocytopenia, JAK inhibitor resistance, and a lack of disease modification have prompted the development of next-generation therapies targeting novel mechanisms.

Below is a comprehensive snapshot of approved and pipeline assets shaping the competitive dynamics of this space.

Drug Name | Company | Mechanism of Action / Class | Regulatory Status | Key Positioning / Differentiation |

Jakafi (ruxolitinib) | Incyte/Novartis | JAK1/JAK2 inhibitor | Approved (Global) | First-in-class; standard of care; symptom & spleen control |

Inrebic (fedratinib) | BMS (Celgene) | JAK2 inhibitor | Approved (US/EU) | Alternative for ruxolitinib-intolerant/resistant patients |

Vonjo (pacritinib) | CTI BioPharma/ SOBI | JAK2/FLT3 inhibitor | Approved (US) | For patients with severe thrombocytopenia (<50k/μL) |

Ojjaara (momelotinib) | GSK | JAK1/JAK2 & ACVR1 inhibitor | Approved (US, 2023) | Addresses both anemia and splenomegaly; dual pathway |

Reblozyl (luspatercept-aamt) | BMS /Merck | TGF-β ligand trap | Approved (for MDS); Phase III (MF) | Anemia-focused; improving transfusion independence |

Rovadicitinib (TQ05105) | Chia Tai Tianqing | JAK1/2 & IRAK1 inhibitor | Pre-registration (China) | Dual pathway inhibition; China-first strategy |

Pelabresib | Novartis (via MorphoSys) | BET inhibitor | Phase III | Combines with ruxolitinib; potential disease modification |

Navtemadlin (KRT-232) | Kartos Therapeutics | MDM2 antagonist | Phase III | Non-JAK agent; for ruxolitinib-refractory MF; targets p53 |

Bomedemstat | Merck (Imago BioSciences) | LSD1 inhibitor (epigenetic) | Phase III | Potential to reduce fibrosis and mutant allele burden |

Selinexor | Karyopharm Therapeutics | XPO1 inhibitor | Phase III | Non-JAK; explored for JAK-inhibitor failures |

Imetelstat | Geron Corporation | Telomerase inhibitor | Phase III | Disease-modifying; shown OS benefit in JAK-refractory MF |

Ropeginterferon alfa-2b | PharmaEssentia | Long-acting interferon | Phase III (planned) | Targets early-stage MF and molecular remission |

Strategic Market Positioning Highlights

- Ruxolitinib remains the market leader due to early entry and broad use; however, its limitations in cytopenic and anemic patients open the door for newer agents.

- Momelotinib and pacritinib are capturing specific subpopulations (anemia and thrombocytopenia, respectively), offering precision-based positioning.

- Imetelstat, bomedemstat, and pelabresib have potential disease-modifying effects, setting them apart from symptom-based JAK inhibitors.

- Navtemadlin and selinexor aim to penetrate the post-JAK failure space a critical niche with limited options.

- Rovadicitinib’s regulatory progress in China signals regional expansion opportunities, especially in emerging markets.

Key Companies:

Target Opportunity Profile (TOP)

Here’s a Target Opportunity Profile that outlines the attributes emerging therapies must demonstrate to outperform currently approved Myelofibrosis (MF) treatments, particularly the JAK inhibitors like ruxolitinib, fedratinib, pacritinib, and momelotinib:

Target Opportunity Profile: Key Differentiators for Emerging MF Therapies

Parameter | Benchmark (Approved Therapies) | Target Opportunity for Emerging Therapies |

Mechanism of Action (MoA) | Primarily JAK1/JAK2 inhibition (± FLT3, ACVR1) | Novel MoAs (e.g., BET, MDM2, LSD1, telomerase, XPO1) to avoid JAK-related toxicity and resistance |

Efficacy | 30–45% SVR35; moderate symptom relief (TSS50 ~25–40%) | ≥45% SVR35 and ≥50% TSS50 rates; sustained spleen and symptom responses; disease modification (BM fibrosis grade improvement, allele burden reduction) |

Safety | Myelosuppression common, esp. anemia/thrombocytopenia | Improved hematologic safety, especially in cytopenic patients (platelets <50k/μL, Hb <10 g/dL); minimal GI and CNS side effects |

Anemia Benefit | Only momelotinib shows anemia improvement | Clear hemoglobin gains, reduced transfusion burden; synergy with erythropoiesis agents (e.g., luspatercept) |

Disease Modification | Minimal; current JAKi relieve symptoms but don’t reverse fibrosis | Proof of fibrosis reversal, telomerase activity reduction, or molecular remission (e.g., JAK2V617F allele burden decline) |

Route of Administration (RoA) | All approved drugs are oral | Oral preferred; SC/IV acceptable only if tied to curative or fibrosis-reversing outcomes |

Dosing Convenience | 1–2x daily oral | Once-daily oral or longer-acting regimens with flexible titration in cytopenic settings |

Modality | Small molecule inhibitors | Opportunity in targeted biologics, bispecifics, or epigenetic modulators for deeper responses |

Innovation Value | Incremental benefits over ruxolitinib | First-in-class or best-in-class profile; ability to combine safely with JAK inhibitors or other backbones |

Line of Therapy | Approved mostly in 1L or 2L post-ruxolitinib | Viable in frontline or ruxolitinib-refractory settings; safe in high-risk or elderly patients |

Regulatory Differentiation | Approved on spleen/symptom endpoints | Must show novel endpoints: survival benefit, fibrosis reversal, or anemia improvement; Orphan/Breakthrough status desired |

Summary Strategic Insight:

To displace or complement JAK inhibitors in MF, emerging drugs must demonstrate either:

- Superior safety and efficacy in cytopenic or ruxolitinib-refractory populations,

- Disease-modifying properties, or

- Anemia correction with good tolerability.

Combination regimens (e.g., ruxolitinib + BET/MDM2/epigenetic agents) are also being explored to exploit synergy without amplifying toxicities.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: