Disease Overview:

- Mucopolysaccharidosis type I (MPS I) is a rare, inherited metabolic disorder caused by a deficiency of the enzyme alpha-L-iduronidase (IDUA). This enzyme deficiency leads to glycosaminoglycans (GAGs) accumulation in various tissues and organs, resulting in progressive multi-systemic manifestations.

- MPS-I encompasses three subtypes: Hurler syndrome (MPS-IH), Hurler-Scheie syndrome, and Scheie syndrome.

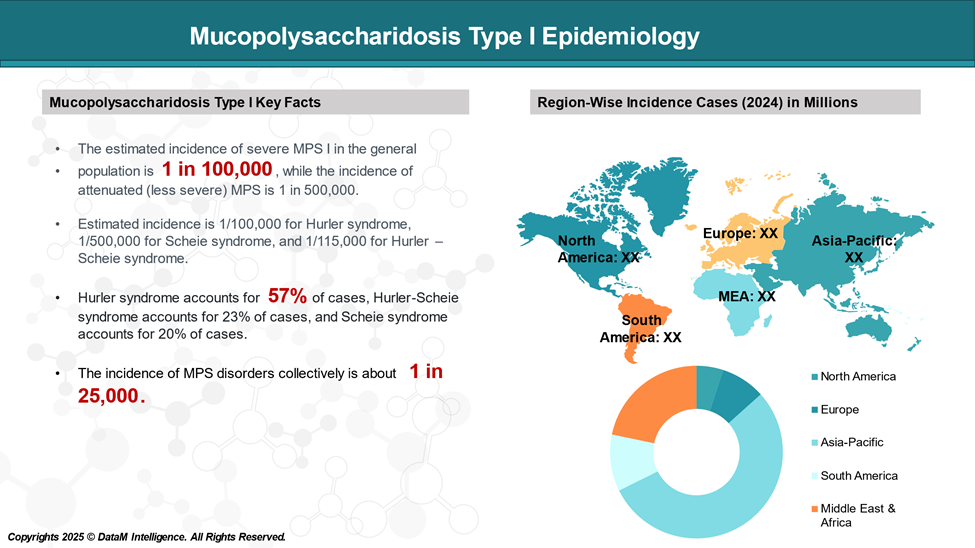

Epidemiology Analysis (Current & Forecast)

The incidence of Hurler syndrome is approximately 1 in 100,000 births. Male and female children are equally affected. All races and ethnicities are at risk of inheriting the disease.

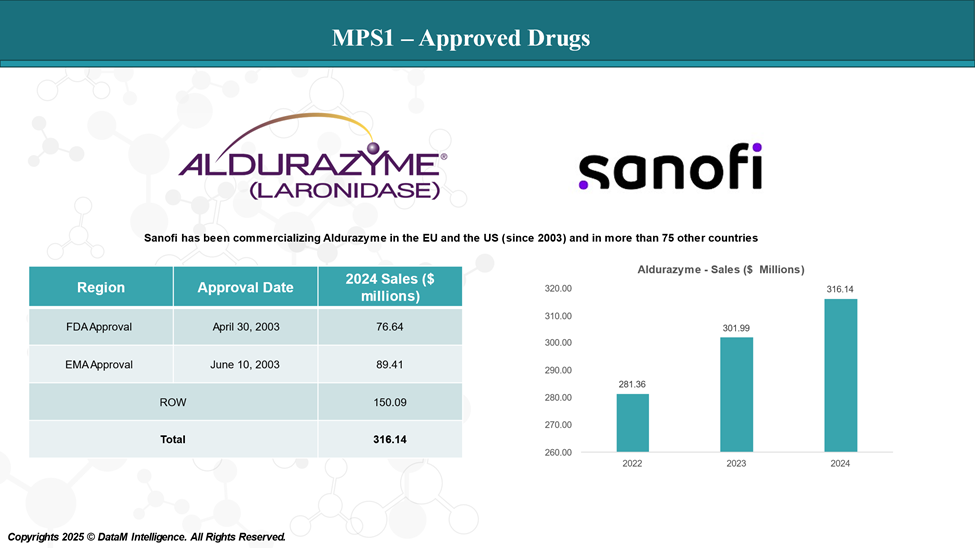

Approved Drugs (Current SoC) - Sales & Forecast

Enzyme replacement (ERT) and stem cell transplant (SCT) are the only treatment options for MPS type I.

Aldurazyme is the only FDA-approved ERT for MPS type I. It is approved for adult and pediatric patients with Hurler and Hurler-Scheie forms of MPS type I and for patients with the Scheie form who have moderate to severe symptoms.

ERT should be initiated on the judgment of the treating physician and can be held in milder disease until a more significant clinical picture presents. If patients are found to have severe disease or be at risk for neurocognitive decline, they should be assessed for SCT

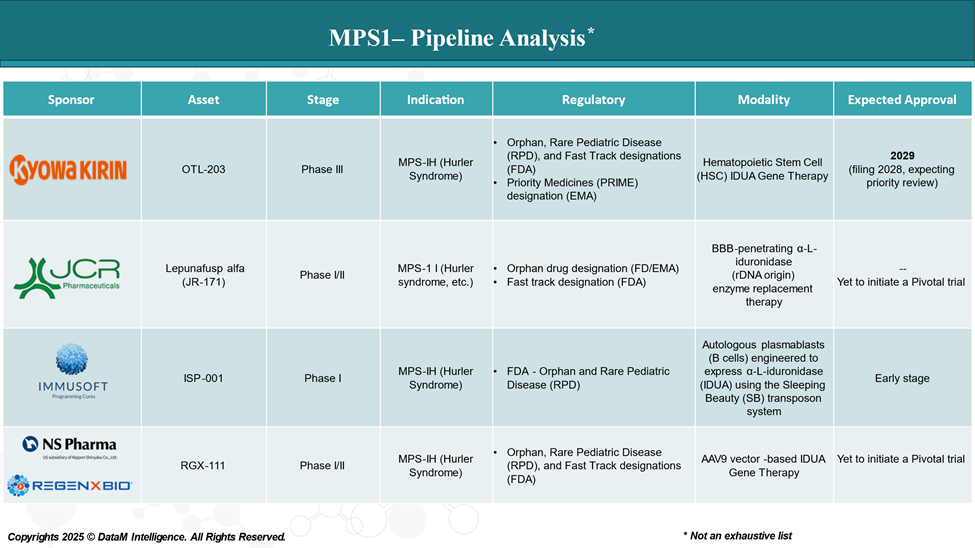

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for MPS I is rapidly evolving, with several new gene and cell therapies in the pipeline targeting various disease mechanisms.

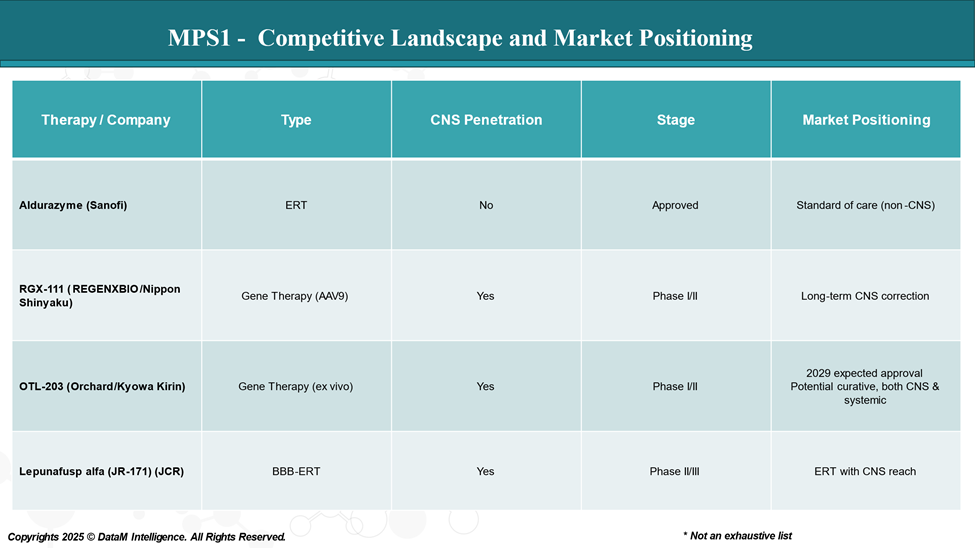

Competitive Landscape and Market Positioning

The MPS I treatment landscape is experiencing significant growth, driven by only one approved therapy and with an upcoming pipeline assets.

Strategic Insights

- Sanofi is at risk of losing market share to new entrants targeting neurological involvement.

- Gene therapies could reshape the market with one-time, potentially curative options, but challenges remain in cost, delivery, and long-term data.

- BBB-penetrating ERTs offer a near-term solution and could serve as a bridge before gene therapies become mainstream.

Key Companies:

Target Opportunity Profile (TOP)

To outperform current approved therapies for MPS I, emerging therapies must demonstrate clear, differentiated value across clinical and commercial dimensions.

| Parameter | Current Standard (Aldurazyme) | Opportunity/Target for Emerging Therapies |

| Mechanism | Exogenous enzyme replacement (α-L-iduronidase) | Gene therapy or ERT with CNS penetration; ideally, long-acting or curative |

| Efficacy | Improves somatic symptoms; no CNS benefit | Systemic + CNS efficacy; halts or reverses neurocognitive decline |

| Safety | Generally well-tolerated; infusion-related reactions | Comparable or better safety, reduced immunogenicity, minimal vector toxicity |

| Dose Frequency | Weekly IV infusions (lifelong) | Less frequent (monthly, single-dose gene therapy, or quarterly ERT) |

| Route of Administration | Intravenous (IV) | Intrathecal, intracisternal (for CNS), or IV with BBB-crossing capability |

| Novelty | Traditional recombinant enzyme | First-in-class gene therapy or BBB-penetrant biologics |

| Durability | Lifelong therapy required | Long-lasting or one-time treatment (e.g., gene therapy or HSC therapy) |

| Onset of Action | Gradual; requires months for clinical improvement | Faster or equal onset, especially for CNS symptoms |

| Patient Burden | High: frequent IVs, hospital visits | Lower: fewer administrations, home delivery, or single procedure |

| Pricing Strategy | ~$200,000–$500,000/year (high cost, reimbursed via orphan route) | Justifiable premium if curative or CNS-active; value-based pricing required |

| Unmet Need Coverage | No effect on CNS, skeletal, or cognitive issues | Effective CNS treatment is a key differentiator |

To displace Aldurazyme, emerging drugs must:

- Cross the blood-brain barrier or target CNS directly.

- Show equal or better systemic efficacy, ideally with less frequent dosing.

- Offer a safer, more convenient patient experience.

- Demonstrate long-term durability or curative potential (esp. gene therapy).

- Provide compelling pharmacoeconomic value despite premium pricing.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.