Disease Overview:

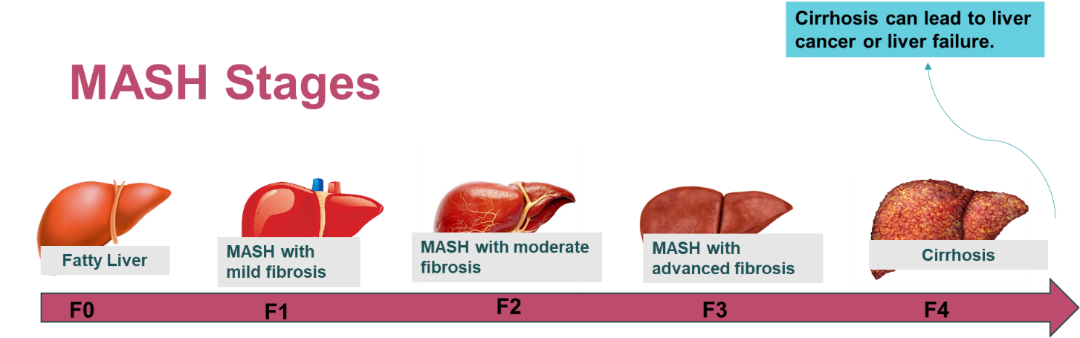

Metabolic Dysfunction-Associated Steatohepatitis (MASH), formerly known as Nonalcoholic Steatohepatitis (NASH), is a disease caused by a build-up of fat in the liver, not caused by alcohol consumption. As a result of fat deposition, the liver becomes inflamed (hepatitis).

MASH Staging:

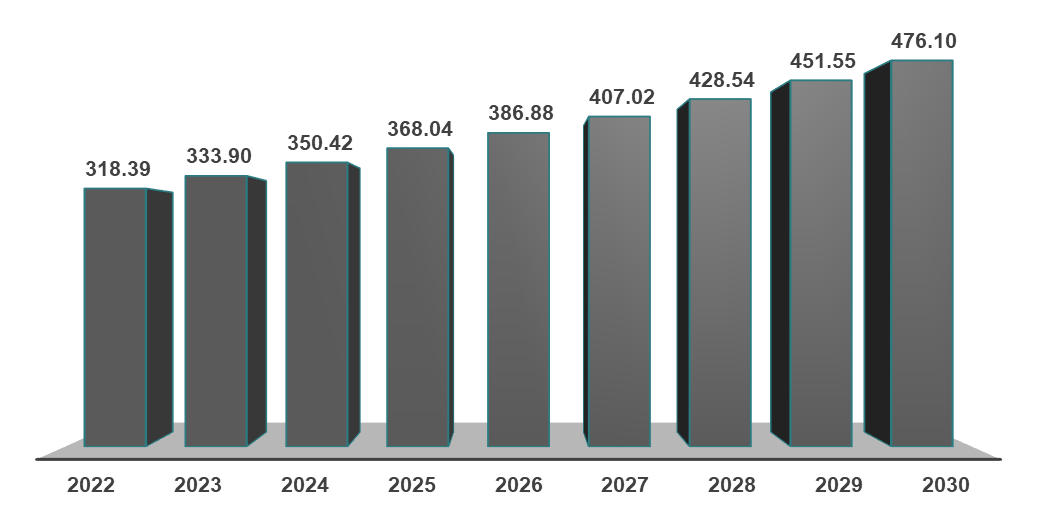

Epidemiology Analysis (Current & Forecast)

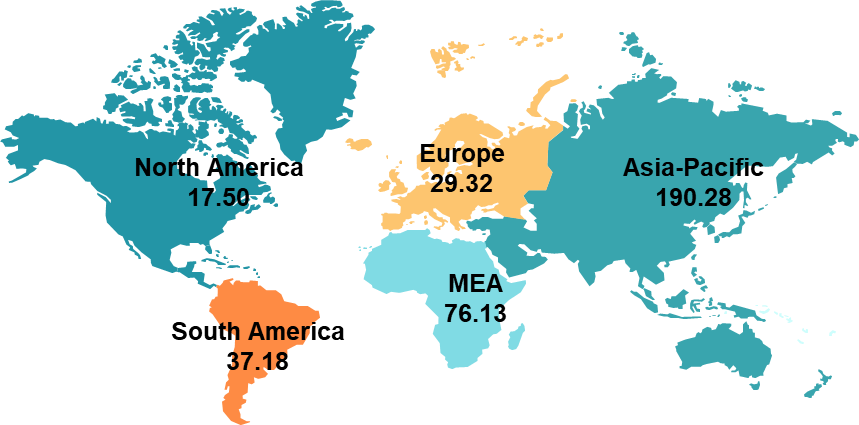

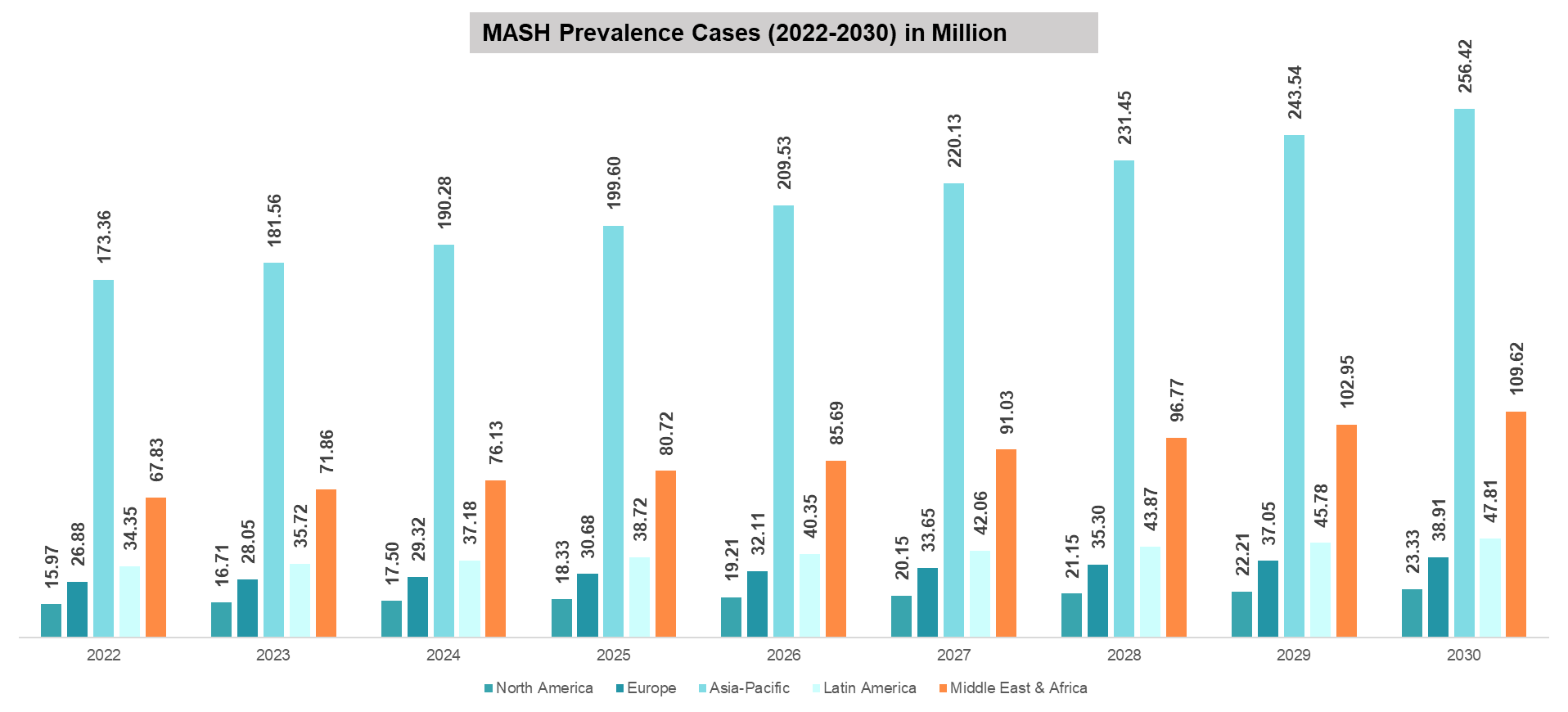

DataM intelligence estimates that nearly 350.42 million prevalent cases are estimated worldwide in 2024. The region with the highest prevalence is the Asia-Pacific, accounting for 190.28 million cases. The prevalent cases of MASH across global regions are as follows:

As per DataM estimates, globally, the prevalent cases of MASH were estimated to be 333.90 million in 2023 and 350.42 million in 2024, and a rise of up to 476.10 million by 2030.

Epidemiology by Region:

Asia-Pacific is the leading region with the highest number of estimated MASH prevalent cases. In 2024, a total of up to 190.28 million prevalent cases were estimated in the region, which may reach up to 256.42 million by 2030. This higher prevalence is majorly attributed to the region’s huge population.

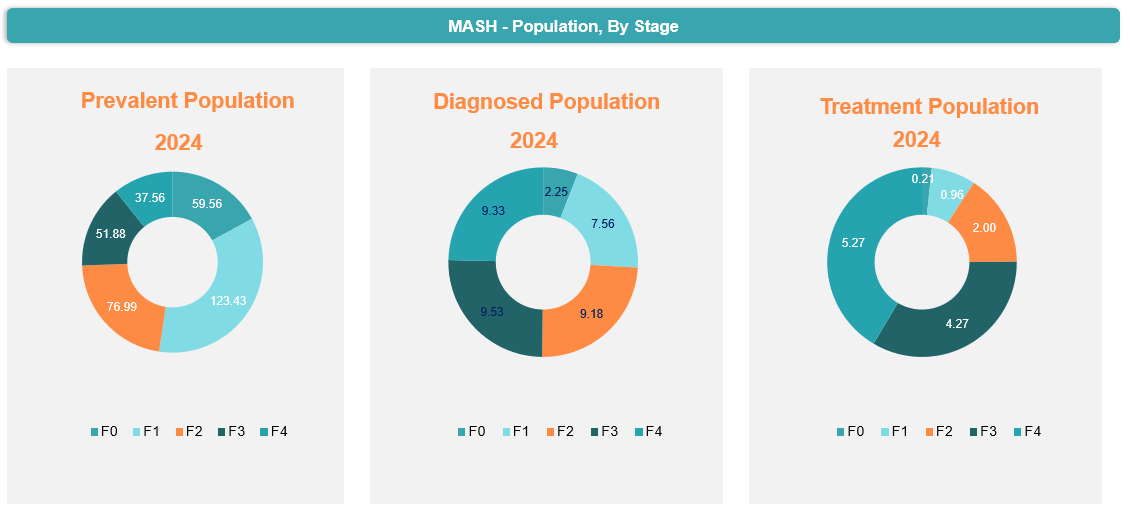

Globally, the overall prevalent cases of MASH in 2024 were 350.42 million, of which the diagnosed population was 37.84 million, and the patients who were taking one or the other treatment were 12.71 million.

In North America, the overall prevalent cases in 2024 were 17.50 million, of which the diagnosed population were estimated to be 3.49 million and among the diagnosed population, nearly 1.82 million were estimated to be getting treatment.

Approved Drugs (Current SoC) - Sales & Forecast

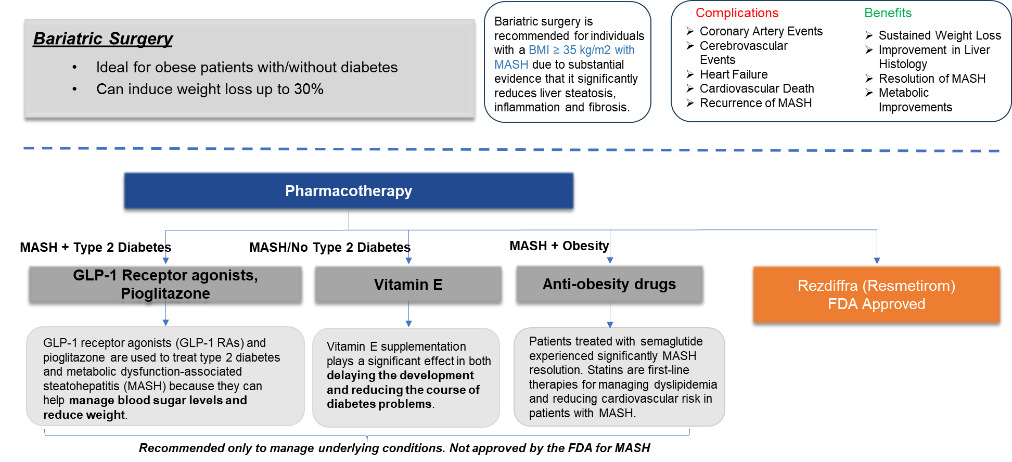

There are limited treatment options available for MASH. Following a healthy diet and maintaining a healthy weight is essential to managing this disease. Most people diagnosed with early-stage non-alcoholic fatty liver disease will not develop serious complications if it is managed properly.

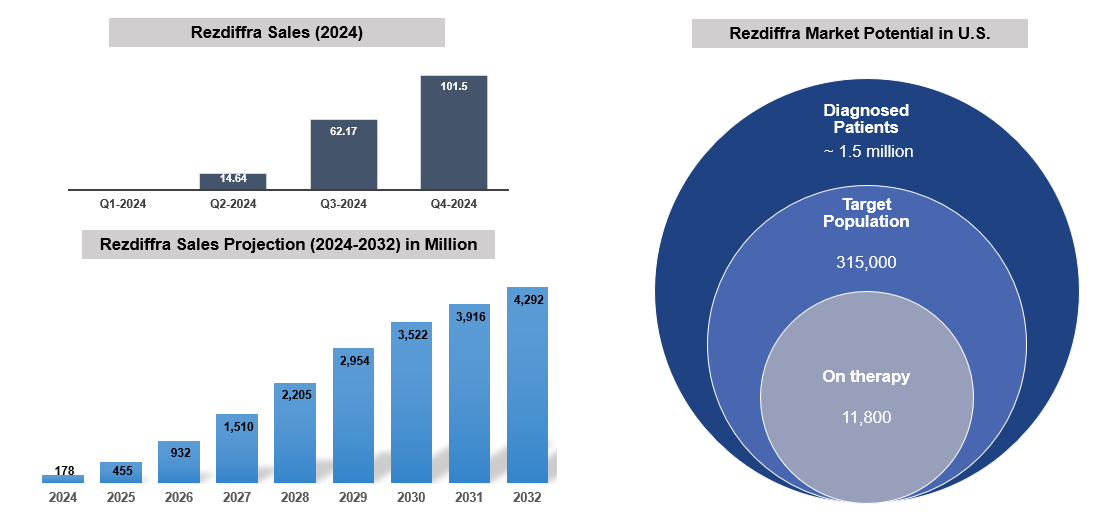

The first FDA-approved drug for treating MASH, is resmetirom (Rezdiffra/Madrigal Pharma), a thyroid hormone receptor-beta agonist, approved for adults with noncirrhotic MASH and moderate to advanced liver fibrosis.

Pipeline Analysis and Expected Approval Timelines

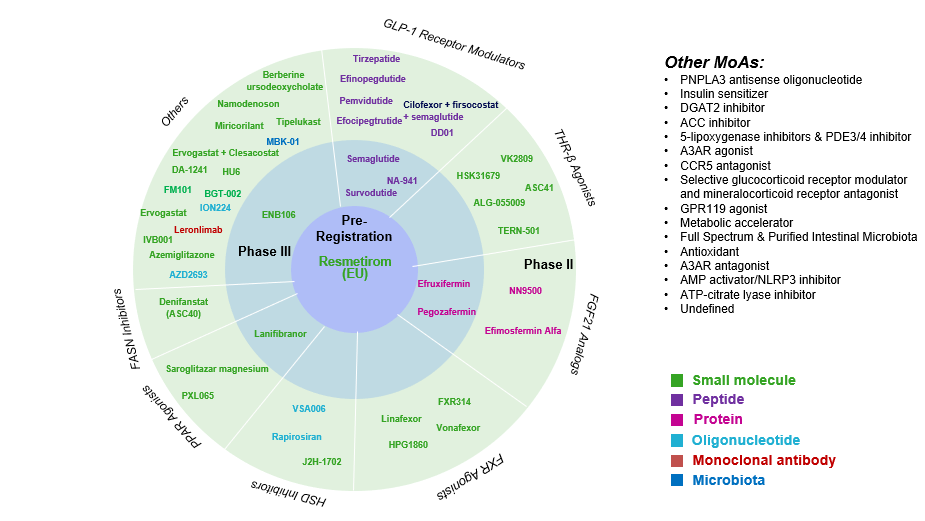

Various therapeutic approaches for NASH have been developed clinically, which can be mainly categorized based on the targets as follows: FXR agonists, THR-β agonists, GLP-1R agonists, FGF19 and FGRF21 analogs, etc.

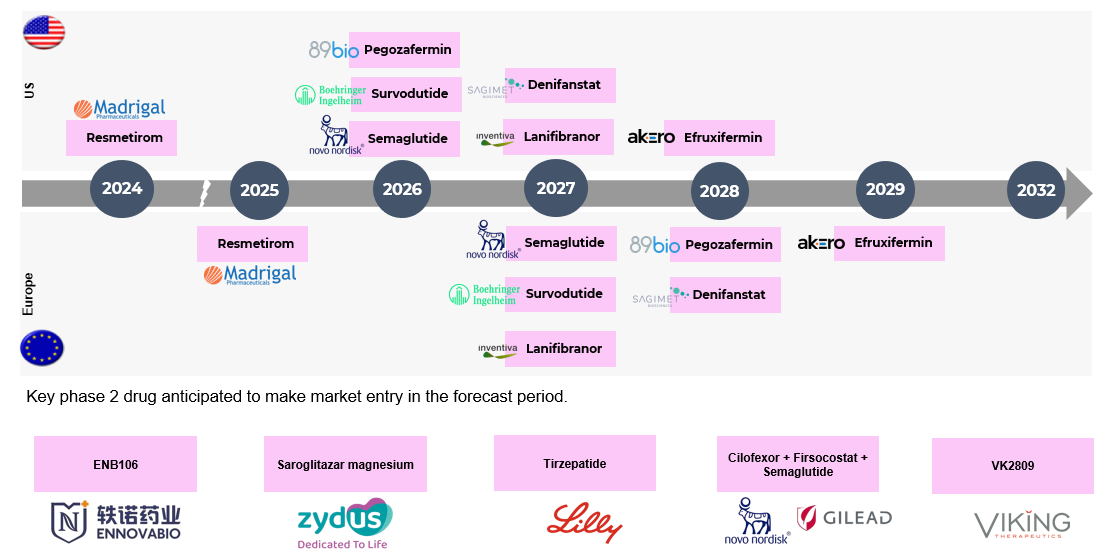

Expected Approval Timelines:

Some of the NASH drugs in the pipeline that can be launched in the coming years include Saroglitazar Magnesium (Zydus Therapeutics), Obeticholic Acid (OCA) (Intercept Pharmaceuticals), Efruxifermin (EFX) (Akero Therapeutics), Pegozafermin (89bio), MSDC-0602K (Cirius Therapeutics), Lanifibranor (Inventiva Pharma), and Semaglutide (Novo Nordisk A/S), and others.

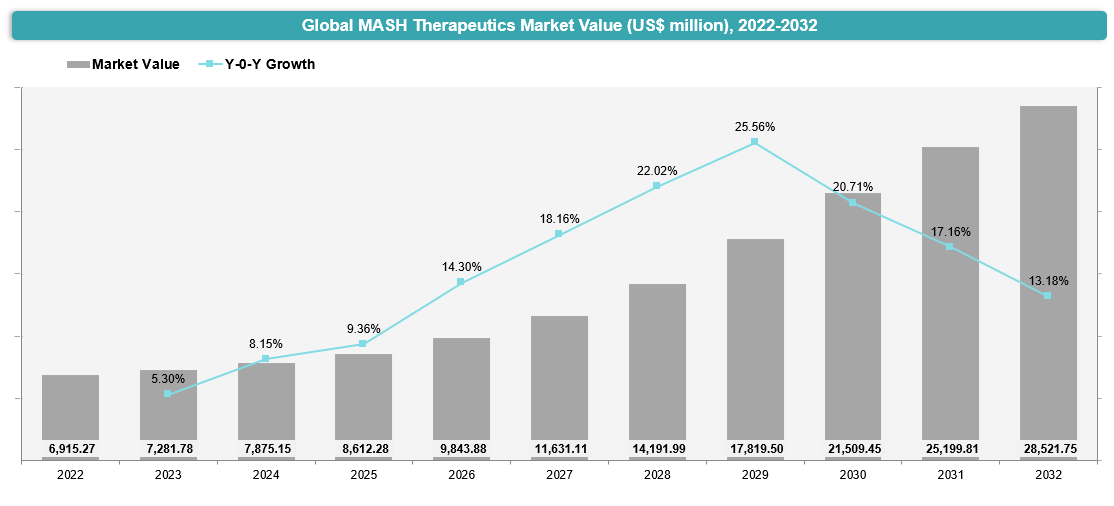

Market Size & Forecasting

The global MASH Therapeutics market is poised for substantial growth from 2022 to 2032. In 2023, the market was valued at approximately US$ 7,281.78 million, with a rise to US$ 7,875.15 million in 2024, and is expected to reach US$ 28,521.75 million in 2032, exhibiting a CAGR of 18.7% during the forecast period (2025-2032).

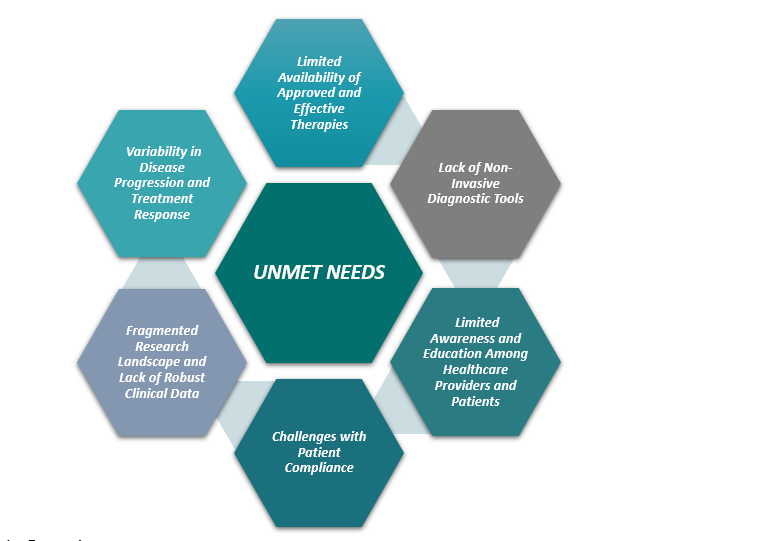

Unmet Needs & Market Dynamics

MASH presents a significant unmet medical need, with only one approved therapy currently available, leading to a high prevalence of liver disease and related complications.

Competitive Landscape and Market Positioning

Several major pharmaceutical companies and biotech firms are actively pursuing treatments for MASH:

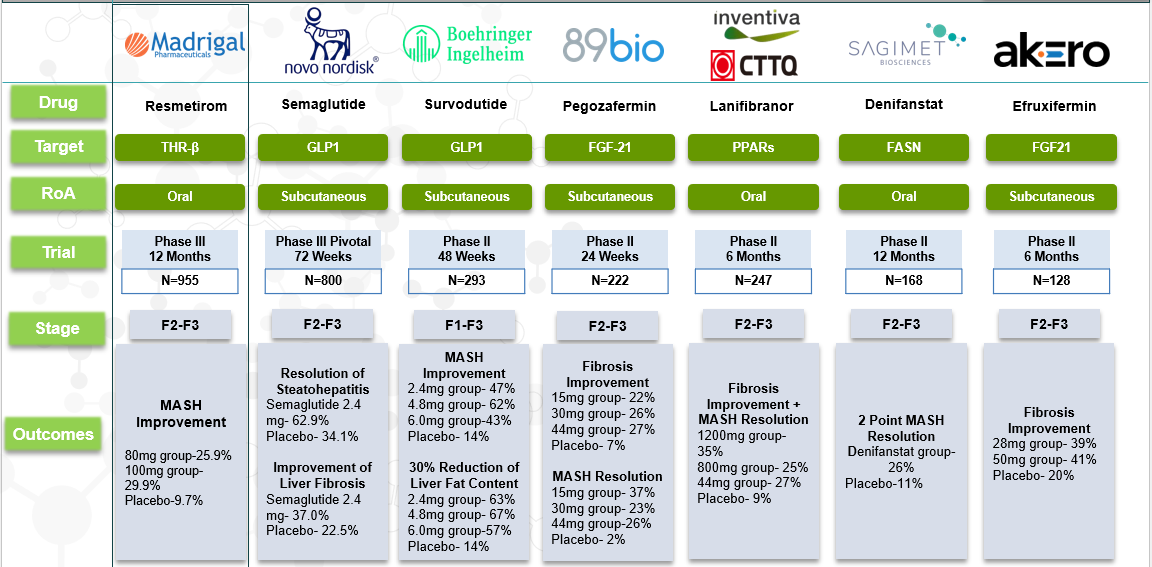

Leading Late-Stage Pipeline Candidates

Several key players are in advanced clinical development:

- Madrigal Pharmaceuticals – Resmetirom (THR-β Agonist)

- Intercept Pharmaceuticals – Ocaliva (Obeticholic Acid, FXR Agonist)

- Akero Therapeutics – Efruxifermin (FGF21 Analog)

- 89bio – Pegozafermin (FGF21 Analog)

- Novo Nordisk – Semaglutide (GLP-1 Agonist)

- Eli Lilly – Tirzepatide (GLP-1/GIP Agonist)

- Pfizer – PF-06865571 (DGAT2 Inhibitor)

Target Opportunity Profile (TOP) & Benchmarking

The complex pathophysiology of NASH offers multiple therapeutic targets, including:

- Metabolic Pathways: Targeting insulin resistance and lipid metabolism to reduce liver fat accumulation.

- Inflammatory Pathways: Modulating inflammatory responses to prevent liver damage.

- Fibrosis Pathways: Inhibiting fibrogenesis to prevent or reverse liver scarring.

Recent advancements include the European Medicines Agency's approval of AIM-NASH, an AI tool developed using machine learning and trained with extensive pathological data, to assess disease severity in clinical trials.

Several companies are at the forefront of NASH drug development:

- Madrigal Pharmaceuticals: Their drug, Rezdiffra, is currently the only approved treatment for MASH in the U.S.

- Novo Nordisk: Conducted a late-stage trial of semaglutide, demonstrating significant improvements in liver fibrosis and resolution of steatohepatitis. Regulatory approval is being sought in the U.S. and EU by mid-2025.

- Akero Therapeutics: Reported that 39% of patients treated with their drug efruxifermin (EFX) experienced a reversal in cirrhosis symptoms without worsening, compared to 15% in the placebo group.

- Viking Therapeutics: Their drug VK2809 showed promising results in Phase IIb trials, with significant improvements in liver fibrosis and a favorable safety profile.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.