Disease Overview:

- Lysosomal storage disorders are hereditary metabolic disorders. Hereditary disorders occur when parents pass on to their children the defective genes that cause these disorders.

Epidemiology Analysis (Current & Forecast)

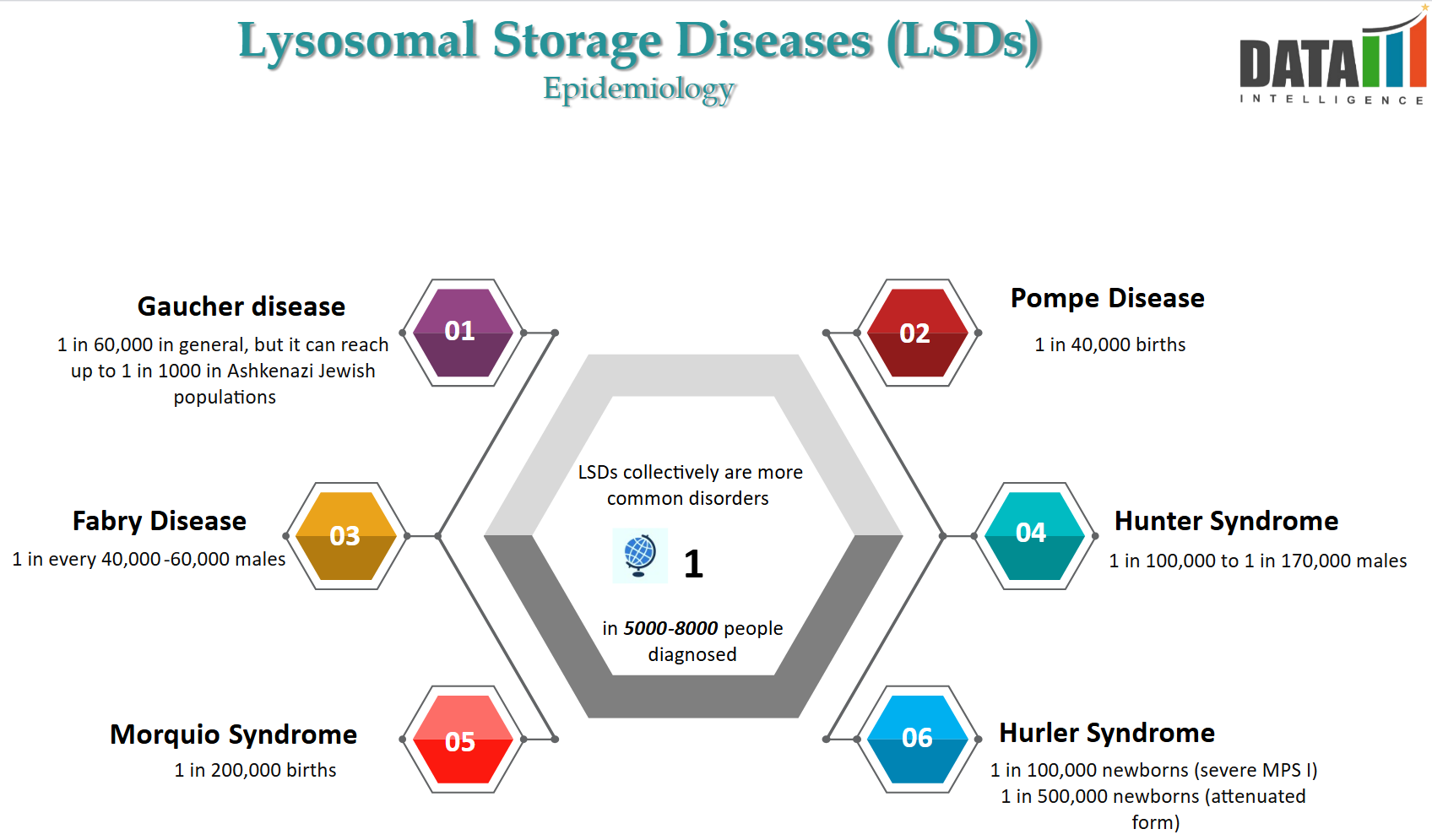

- LSDs comprise a heterogeneous group of approximately ~70 disorders caused by genetic defects resulting in the dysfunction, deficiency, or absence of a lysosomal enzyme. Although each disorder is rare, ranging from 1 in 50,000 to 1 in 250,000 live births.

Approved Drugs (Current SoC) - Sales & Forecast

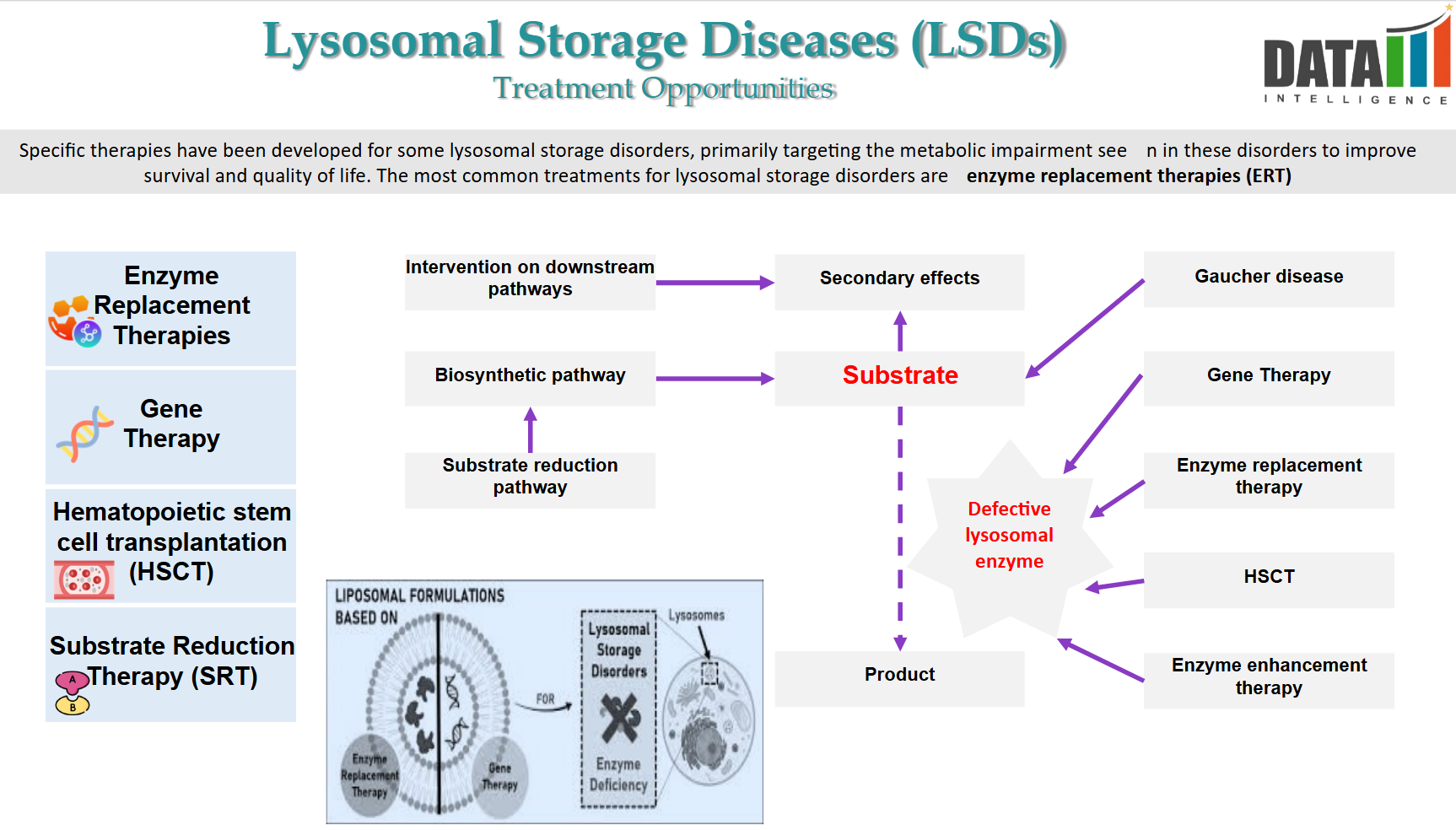

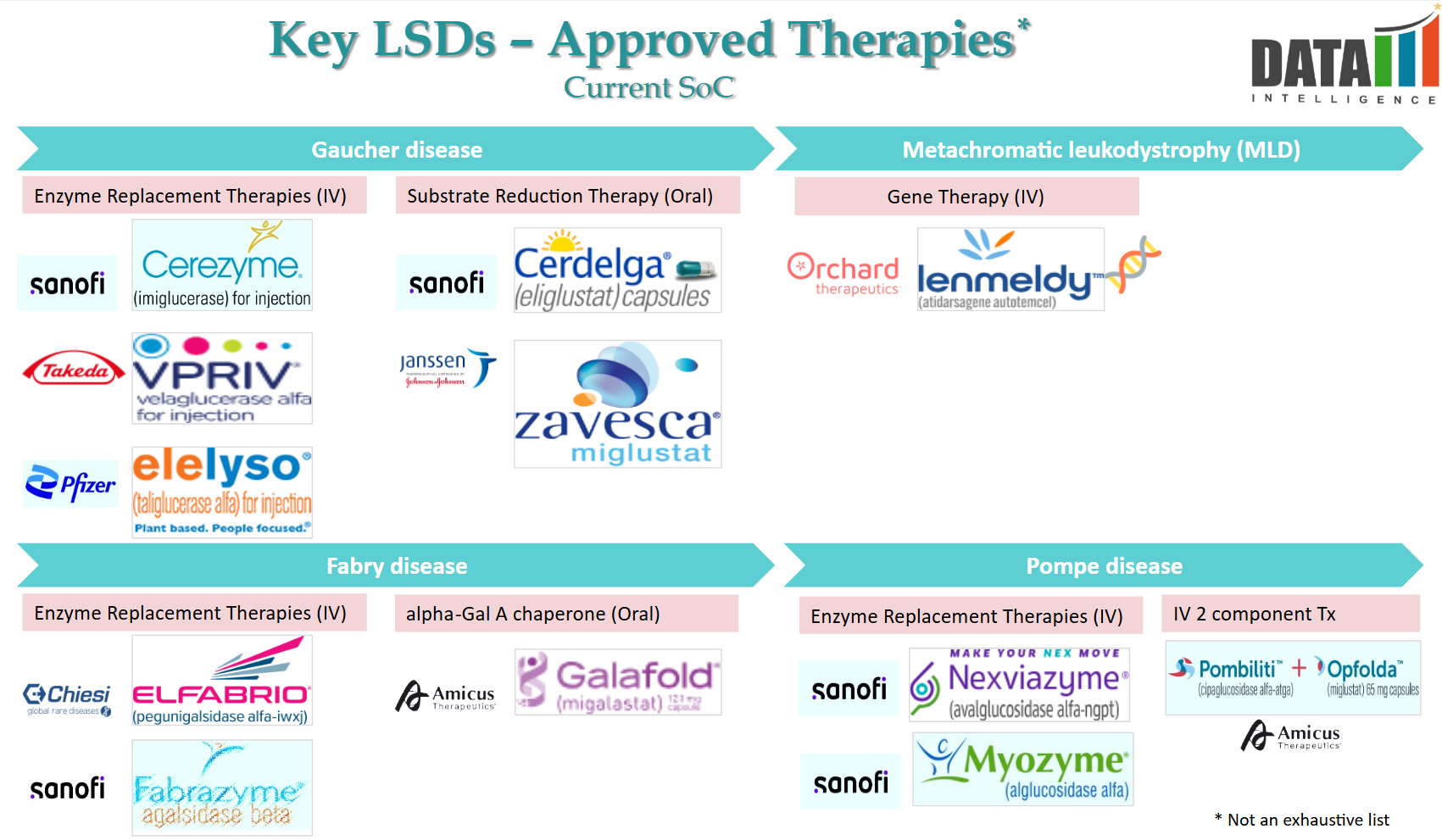

- Lysosomal Storage Disorders (LSDs) are a group of rare genetic metabolic diseases caused by deficiencies in lysosomal enzymes, leading to toxic accumulation of substrates. The current Standard of Care (SoC) primarily includes Enzyme Replacement Therapy (ERT), Substrate Reduction Therapy (SRT), and Gene Therapy.

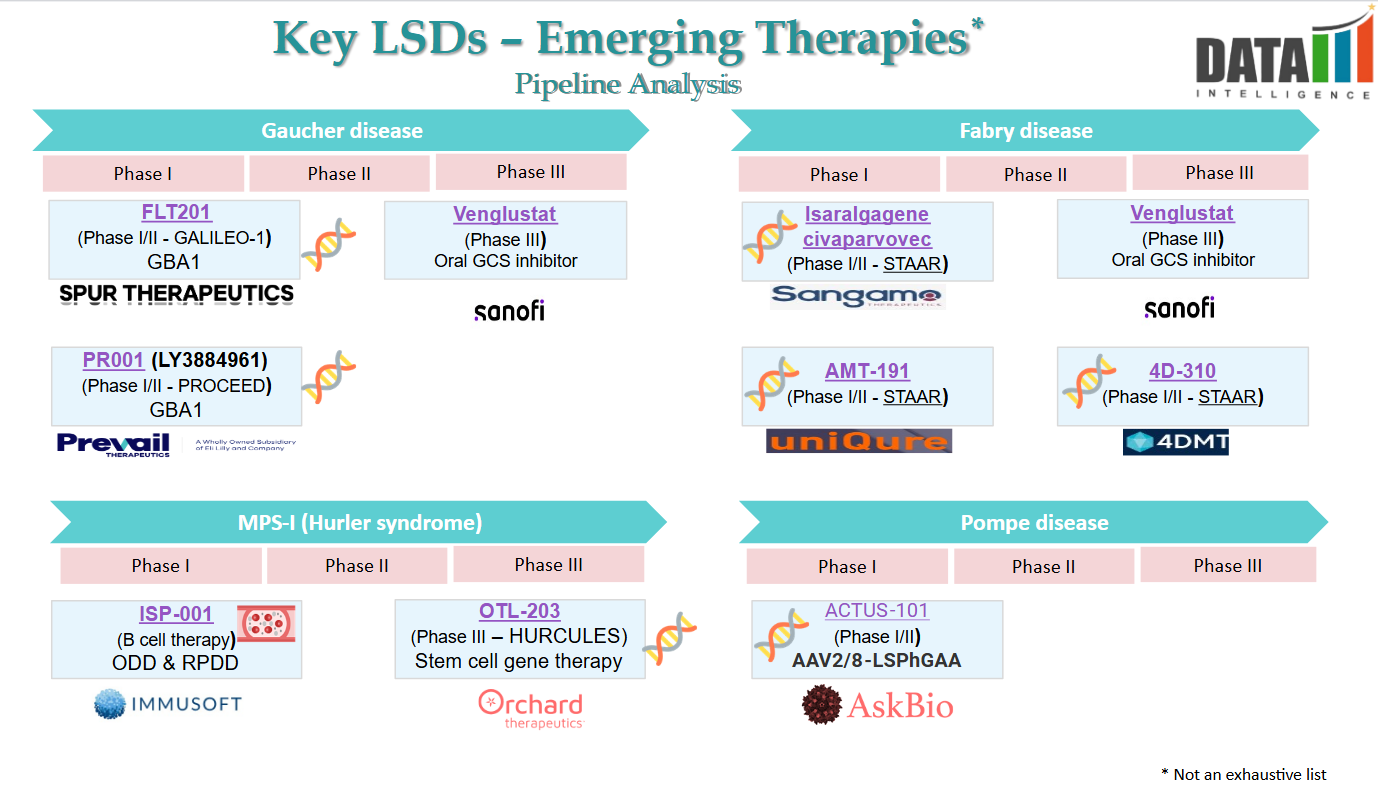

Pipeline Analysis and Expected Approval Timelines

The LSD pipeline is evolving beyond Enzyme Replacement Therapy (ERT) with next-generation Substrate Reduction Therapy (SRT), Gene Therapy, and Chaperone Therapies.

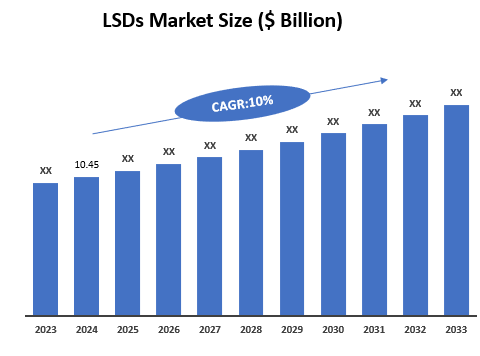

Market Size & Forecasting

The global lysosomal storage diseases therapeutics market was valued at $10.45 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2033, registering a CAGR of 10.0% over the forecast period

Unmet Needs

Lysosomal Storage Diseases (LSDs) are a group of rare genetic disorders caused by enzyme deficiencies within lysosomes, leading to the accumulation of undigested macromolecules and progressive cellular damage.

Despite advances in research and treatment, several unmet needs remain:

| Category | Unmet Needs |

| Early Diagnosis & Screening | Delayed diagnosis due to nonspecific symptoms. - Limited newborn screening for many LSDs. - Need for better diagnostic tools (biomarkers, genetic testing, AI-based diagnostics). |

| Effective Treatments | - Enzyme Replacement Therapy (ERT) does not cross the blood-brain barrier (CNS symptoms remain untreated). - Lifelong ERT infusions are required. - Limited Substrate Reduction Therapy (SRT) options. - Gene therapy in early stages, with challenges like immune responses and delivery. - Need for more small molecule therapies (pharmacological chaperones). |

| Neurological Involvement | - Severe neurodegeneration in many LSDs (e.g., Krabbe, Tay-Sachs, MPS). - Current treatments have poor CNS penetration. - Need for intrathecal therapies, stem cell therapy, and better blood-brain barrier penetration strategies. |

| Accessibility & Affordability | - High cost of treatments (ERTs cost hundreds of thousands per year). - Limited access in low- and middle-income countries. - Insurance and reimbursement challenges. |

| Supportive & Multidisciplinary Care | - Lack of coordinated care across specialties (neurology, cardiology, genetics, etc.). - Need for better psychosocial support for patients and caregivers. - Limited palliative care and quality of life optimization. |

| Research & Clinical Trials | - Difficulty recruiting patients for clinical trials due to rarity of LSDs. - Need for better natural history studies to understand disease progression. - Limited biomarkers to track disease status and treatment response. |

Competitive Landscape and Market Positioning

The LSD market is highly specialized, dominated by a few key players, and driven by high-cost therapies. Below is a structured analysis of the competitive landscape and market positioning:

Key Market Players

| Company | Key Products | Targeted LSDs | Market Positioning |

| Sanofi (Genzyme) | Cerezyme, Fabrazyme, Myozyme, Nexviazyme | Gaucher, Fabry, Pompe | Market leader in ERT, broad portfolio, global reach |

| Takeda | Elaprase, Vpriv, Replagal | Hunter syndrome (MPS II), Gaucher, Fabry | Strong presence in rare disease space |

| BioMarin | Aldurazyme, Naglazyme, Brineura, Palynziq | MPS I, MPS VI, CLN2 disease | Focus on ultra-rare LSDs, CNS-targeted therapy |

| Amicus Therapeutics | Galafold, AT-GAA (under development) | Fabry, Pompe | Leading in pharmacological chaperones |

| Ultragenyx | Mepsevii, UX111 (gene therapy pipeline) | MPS VII, Sanfilippo | Focus on gene therapies and rare diseases |

| Orchard Therapeutics | Libmeldy (OTL-200) | Metachromatic Leukodystrophy (MLD) | Gene therapy pioneer in neurodegenerative LSDs |

Key Companies

Target Opportunity Profile (TOP) & Benchmarking

The Target Opportunity Profile (TOP) outlines the key factors that define the most promising areas for new therapies, while Benchmarking compares existing and emerging treatments against these criteria.

1. Target Opportunity Profile (TOP)

| Category | Key Criteria for High-Impact Market Opportunities |

| Disease Prevalence | Focus on LSDs with a significant patient population but limited treatment options (e.g., Sanfilippo, Krabbe, Niemann-Pick Type C). |

| Unmet Medical Need | Prioritize conditions with severe neurological involvement, where current therapies do not address CNS symptoms. |

| Treatment Limitations | Target LSDs where Enzyme Replacement Therapy (ERT) is inadequate (e.g., does not cross the blood-brain barrier, requires frequent infusions). |

| Regulatory Feasibility | Consider diseases with existing regulatory frameworks that support orphan drug designation and accelerated approvals. |

| Competitive Differentiation | Develop treatments with superior efficacy, convenience (e.g., oral vs. IV), or disease-modifying potential. |

| Market Viability | Prioritize diseases with reimbursement potential, pricing flexibility, and global commercialization opportunities. |

Benchmarking – Comparing Current & Emerging Therapies

| Therapy Type | Companies | Strengths | Limitations |

| Enzyme Replacement Therapy (ERT) | Sanofi, Takeda, BioMarin | Proven efficacy, long market experience, global access | Does not address CNS symptoms, requires lifelong infusions |

| Substrate Reduction Therapy (SRT) | Sanofi, Amicus | Oral administration, lower treatment burden | Limited to specific mutations, does not halt disease progression |

| Gene Therapy | Orchard, Ultragenyx, Avrobio | Potential one-time cure, CNS-targeting potential | High cost, long regulatory pathway, immune response challenges |

| Pharmacological Chaperones | Amicus | Oral, mutation-specific approach, lower immune risk | Only works for certain mutations; limited disease coverage |

| Stem Cell Therapy | Orchard, Bluebird Bio | Potential for systemic & CNS benefit | Complex administration, limited long-term data |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.