1. Disease Overview

- Pulmonary Fibrosis (PF) is a chronic condition affecting the lungs. It causes tissue scarring (fibrosis), which results in the obstruction of oxygen movement from air sacs to the bloodstream. Idiopathic pulmonary fibrosis is a common type of PF in which the cause of fibrosis is unknown.

2. Epidemiology Analysis (Current & Forecast)

- Idiopathic pulmonary fibrosis is more prevalent in the population in the 5th or 6th decade of their life. The male population is more prevalent than the female population.

- South Korea is the most prevalent country in the world, with more than 230 prevalent cases per million and more than 80 annual incidence cases

3. Approved Drugs (Current SoC) - Sales & Forecast

There is no cure for idiopathic pulmonary fibrosis (IPF). Pharmacological interventions include pirfenidone or nintedanib to be used as first-line therapy, concomitantly with non-pharmacological therapies like oxygen therapy, pulmonary rehabilitation, and palliative medication.

4. Pipeline Analysis and Expected Approval Timelines

Idiopathic Pulmonary Fibrosis (IPF) is a progressive lung disease with limited treatment options. The therapeutic pipeline for IPF is active, with several promising agents in various stages of clinical development.

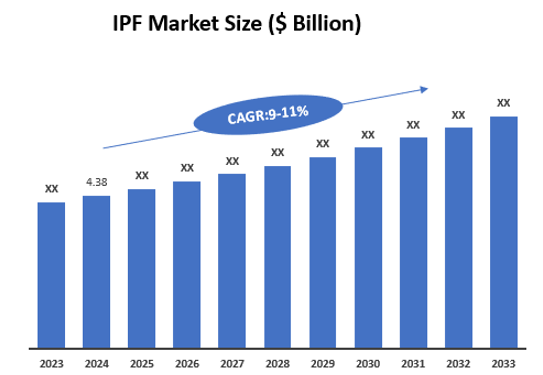

5. Market Size & Forecasting

The global idiopathic pulmonary fibrosis market was valued at $4.38 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2033, registering a CAGR of `9-11% over the forecast period

Unmet Needs

Despite advancements in antifibrotic therapies, significant gaps remain in the management of Idiopathic Pulmonary Fibrosis (IPF)

| Unmet Need | Current Challenges | Desired Advancements |

| Disease Modification | Existing therapies (Pirfenidone, Nintedanib) slow progression but do not stop or reverse fibrosis. | Novel agents that halt or reverse fibrosis instead of just delaying decline. |

| Improved Efficacy | Many patients still experience rapid disease progression despite treatment. | More potent and targeted therapies with superior efficacy. |

| Better Tolerability & Safety | Current treatments cause side effects like nausea, diarrhea, and liver toxicity, leading to poor adherence. | Safer, better-tolerated drugs with minimal side effects. |

| Less Frequent Dosing | Oral antifibrotics require daily dosing, causing adherence challenges. | Long-acting formulations or injectable therapies with extended dosing intervals. |

| New Mechanisms of Action | Current treatments mainly target fibrosis-related pathways (TGF-β, VEGF). | Therapies that address inflammation, immune response, and fibrosis reversal. |

| Biomarkers & Early Diagnosis | IPF is often diagnosed late, limiting treatment options. | Non-invasive biomarkers for early and accurate diagnosis. |

| Combination Therapies | Current monotherapies offer limited benefits. | Combining antifibrotics with anti-inflammatory or regenerative therapies. |

| Lung Regeneration Therapies | Lung transplantation is the only definitive option for end-stage disease. | Stem cell, gene therapy, or regenerative medicine approaches. |

| Broader Accessibility & Affordability | High costs and limited access to antifibrotics in certain regions. | Cost-effective treatments, and improved healthcare access. |

6. Competitive Landscape and Market Positioning

The IPF market is evolving rapidly, with major players defending their dominance while new entrants challenge the status quo with innovative therapies. Below are exclusive insights into competitive strategies, upcoming market disruptions, and key differentiators.

| Company | Drug(s) | Market Share | Competitive Strategy | Challenges |

| Roche (Genentech) | Pirfenidone (Esbriet) | ~45% | Strong global footprint, physician trust, generic defense | Patent expiration risk, tolerability issues |

| Boehringer Ingelheim | Nintedanib (Ofev) | ~50% | Expanded indication (progressive pulmonary fibrosis), superior market access | High cost, GI side effects affecting adherence |

Key Companies:

7. Target Opportunity Profile (TOP) & Benchmarking

The ideal IPF treatment must address existing gaps while demonstrating strong differentiation. Below are the key attributes defining the TOP for next-generation therapies:

| Attribute | Current Standard of Care (SoC) Limitations | Target Profile for Future Therapies |

| Efficacy | Slows but does not halt fibrosis progression | Disease-modifying, fibrosis reversal potential |

| Tolerability | GI side effects (nausea, diarrhea) impact adherence | Minimal side effects, better patient compliance |

| Administration | Daily oral pills (Pirfenidone, Nintedanib) | Less frequent dosing (e.g., inhaled, long-acting injectable) |

| Mechanism of Action | Primarily antifibrotic (TKIs, anti-inflammatory) | Multi-target approach (fibrosis + inflammation + regeneration) |

| Combination Potential | Single-agent therapy limits efficacy | Synergistic combos with anti-inflammatory/immunomodulatory drugs |

| Patient Stratification | One-size-fits-all approach | Biomarker-driven precision medicine |

| Pricing & Access | ~$100K/year; reimbursement varies globally | Affordable & widely accessible |

Benchmarking Analysis of Current & Pipeline IPF Therapies

To assess market positioning, we benchmark current SoCs against emerging pipeline candidates based on efficacy, safety, differentiation, and market potential.

| Drug | Company | Mechanism of Action | Efficacy (Disease Modification) | Tolerability | Dosing Convenience | Market Differentiation |

| Pirfenidone (Esbriet) | Roche | Antifibrotic, anti-inflammatory | Moderate | GI side effects, liver toxicity | Oral, 3x daily | Established but high side effects |

| Nintedanib (Ofev) | Boehringer Ingelheim | TKI (VEGF, FGF, PDGF) | Moderate | GI side effects | Oral, 2x daily | Expanded use in progressive fibrosis |

| Admilparant (BMS-986278) | Bristol-Myers Squibb | LPA1 receptor antagonist | High (Phase III data awaited) | Expected better tolerability | Oral | First-in-class MOA |

| Treprostinil (TETON Trials) | United Therapeutics | Prostacyclin analogue | Under investigation | Well-tolerated | Inhaled | First inhaled therapy for IPF |

| GB0139 | Galecto Biotech | Galectin-3 inhibitor | Potential disease modification | Mild | Inhaled | First inhaled antifibrotic |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.