Disease Overview:

Idiopathic Hypersomnia (IH) is a rare neurological sleep disorder marked by excessive daytime sleepiness, even after long or sufficient nighttime sleep. Individuals often experience difficulty waking up, confusion upon waking, and unrefreshing naps. The exact cause remains unknown, and the condition can severely impact daily functioning and quality of life. Diagnosis typically requires sleep studies to rule out other disorders.

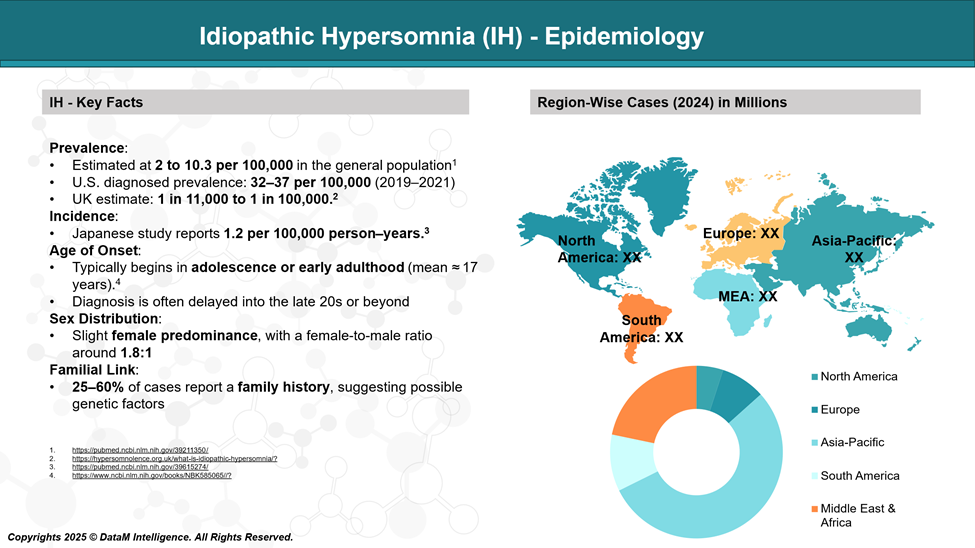

Epidemiology Analysis (Current & Forecast)

Idiopathic Hypersomnia (IH) is a rare disorder, with an estimated prevalence of 1 to 2 per 10,000 people. It typically begins in adolescence or early adulthood, though diagnosis is often delayed. IH affects both men and women, but some studies suggest a slight female predominance.

Approved Drugs - Sales & Forecast

As of June 2025, Xywav is the only FDA-approved drug specifically for Idiopathic Hypersomnia.

Parameter | Details |

Drug Name | Xywav® |

Company | Jazz Pharmaceuticals |

FDA Approval | August 2021 |

Indication | Idiopathic Hypersomnia in Adults |

Mechanism of Action | CNS depressant; modulates GABA-B and GHB receptors |

Formulation | Oral solution (calcium, magnesium, potassium, sodium oxybates) |

Dosing | Once or twice nightly |

Key Benefits | Improves daytime wakefulness, reduces sleep inertia, lowers sodium exposure |

Special Feature | First and only drug approved specifically for IH |

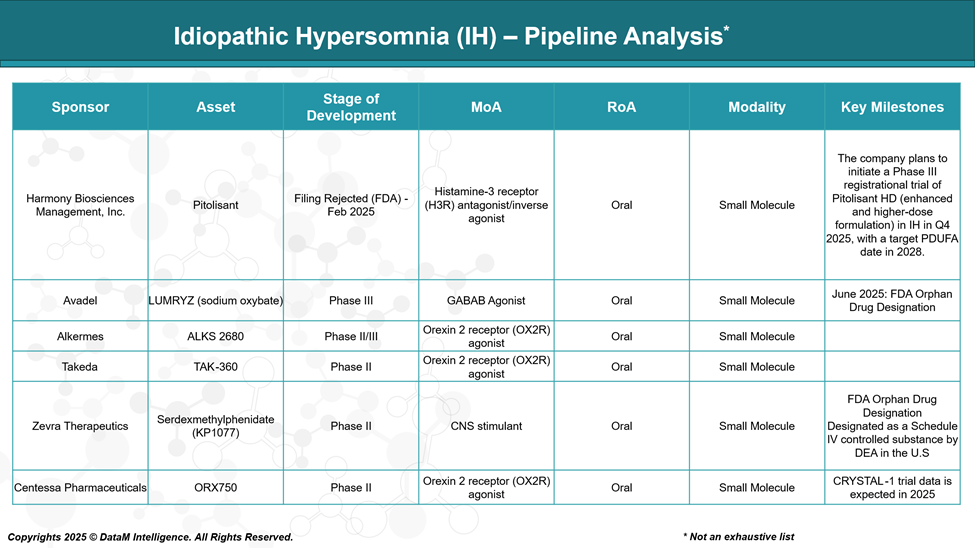

Pipeline Analysis and Expected Approval Timelines

As of June 2025, the treatment landscape for Idiopathic Hypersomnia (IH) is evolving, with several investigational therapies in various stages of development.

Below is an overview of the most promising pipeline candidates:

Competitive Landscape and Market Positioning

Despite the absence of any approved therapies specifically for NCFB, the competitive landscape is rapidly evolving, driven by a growing understanding of the disease's immunologic and microbiologic mechanisms.

Company | Drug (Status) | Mechanism of Action | Market Positioning & Notes |

Jazz Pharmaceuticals | Xywav® (Approved, FDA 2021) | GABA-B receptor agonist (Oxybate formulation) | Only FDA-approved drug specifically for IH; lower sodium content vs. older oxybate therapies; improves daytime sleepiness, sleep inertia, and overall function; market leader with established brand presence. |

Harmony Biosciences, Inc. | Pitolisant (FDA Filing Rejected Feb 2025) | Histamine H3 receptor antagonist/inverse agonist | Despite a setback with FDA rejection, pitolisant is a wake-promoting agent used in narcolepsy and IH off-label; potential for resubmission with additional data. |

Avadel Pharmaceuticals | LUMRYZ (sodium oxybate) (Phase III) | GABA-B receptor agonist | Extended-release formulation of sodium oxybate; aims to improve convenience and tolerability; competing in the same class as Xywav but not yet approved for IH. |

Alkermes | ALKS 2680 (Phase II/III) | Orexin 2 receptor (OX2R) agonist | Targeting the orexin system to promote wakefulness represents a novel MOA; it could address unmet needs with better symptom control and tolerability. |

Takeda Pharmaceutical | TAK-360 (Phase II) | Orexin 2 receptor (OX2R) agonist | Also targeting orexin system; potential to offer oral wakefulness-promoting treatment; early clinical data pending. |

Zevra Therapeutics | Serdexmethylphenidate (KP1077) (Phase II) | CNS stimulant (prodrug of d-methylphenidate) | Positive Phase 2 data showing efficacy in EDS and sleep inertia; potential oral stimulant option with improved safety/tolerability; anticipated Phase 3 start soon. |

Centessa Pharmaceuticals | ORX750 (Phase II) | Orexin 2 receptor (OX2R) agonist | Focused on orexin receptor activation; early clinical data are promising for wakefulness restoration; still in early development stages. |

Market Positioning Insights:

- Xywav dominates as the only approved, disease-specific therapy for IH, setting the standard for symptom control, especially in improving daytime sleepiness and sleep inertia with a favorable safety profile.

- Pitolisant had potential as a non-oxybate alternative with a novel mechanism targeting histamine pathways, but the FDA rejection in early 2025 limits near-term prospects; however, its established use in narcolepsy and off-label IH keeps it relevant.

- The orexin receptor agonist class (ALK2680, TAK-360, ORX750) is emerging as a promising area, aiming to directly restore wakefulness mechanisms, which could shift treatment paradigms if clinical data confirm efficacy and safety.

- Stimulant therapies like Zevra’s Serdexmethylphenidate (KP1077) offer an oral alternative targeting EDS and cognitive symptoms, potentially with improved tolerability and abuse liability profiles compared to traditional stimulants.

- Extended-release sodium oxybate (LUMRYZ) seeks to improve on existing oxybate therapies by enhancing patient convenience and compliance, but approval and positioning for IH are pending.

Key Companies:

Target Opportunity Profile (TOP)

To compete effectively with the only approved treatment for Idiopathic Hypersomnia (IH)—Xywav® (Jazz Pharmaceuticals), emerging therapies must demonstrate a target opportunity profile that surpasses or differentiates from Xywav across key parameters.

Here’s a structured target opportunity profile for pipeline drugs to succeed in the IH space:

Target Opportunity Profile for Emerging IH Drugs

Attribute | Benchmark (Xywav) | Opportunity for Emerging Drugs |

Efficacy | Improves excessive daytime sleepiness (EDS), sleep inertia, and overall functioning (clinically proven in Phase 3 trial) | Match or exceed Xywav’s outcomes in ESS, IHSS, and PGI/CQI scores; demonstrate faster onset and sustained wakefulness. |

Safety & Tolerability | Well tolerated; reduced sodium load vs. sodium oxybate | Show fewer CNS side effects, minimal abuse potential, and better tolerability (esp. GI or neuropsychiatric side effects). |

Mechanism of Action (MoA) | GABA-B receptor agonist (oxybate) | Offer non-GABAergic or novel MoA (e.g., orexin receptor agonist, H3 inverse agonist) for mechanistic diversity and reduced sedation burden. |

Route of Administration (RoA) | Oral solution; often twice nightly dosing | Oral, once-daily, or extended-release formulations preferred; non-liquid and simplified regimens highly attractive. |

Dosing Convenience | 1–2 times per night, requiring awakening to redose | Once-daily morning dosing or bedtime extended-release options; reduced need for nighttime interruptions. |

Modality | Small molecule (oxybate salts) | Innovative delivery systems (e.g., modified-release, prodrugs) or biologics for long-term symptom modulation. |

Innovation Value | First disease-specific FDA-approved therapy | Must offer differentiated mechanism, improved patient QoL, and support for precision medicine or biomarker-guided use. |

Abuse Liability | CIII controlled substance, but improved vs. sodium oxybate | Lower or no scheduling (CIV or unscheduled preferred); reduced risk of dependence or misuse. |

Onset & Duration | Effective but requires multiple doses | Show rapid onset, day-long wakefulness, and minimal rebound effects. |

Strategic Positioning Suggestions:

- Orexin 2 receptor agonists (e.g., ALKS 2680, TAK-360, ORX750) offer MoA innovation by addressing the upstream cause of wakefulness, positioning them as potentially disease-modifying or more physiological treatments.

- Serdexmethylphenidate (KP1077) can succeed if it demonstrates comparable efficacy with a cleaner stimulant profile, lower abuse potential, and simpler once-daily dosing.

- Pitolisant, despite FDA rejection, may still compete in markets where GABAergic drugs are poorly tolerated or contraindicated, especially with a non-sedating, non-addictive profile.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: