Disease Overview:

- Hunter Syndrome (Mucopolysaccharidosis Type II, MPS II) is a rare, progressive genetic disorder caused by a deficiency in the enzyme iduronate-2-sulfatase (I2S). This deficiency leads to glycosaminoglycans (GAGs) accumulation in various tissues, resulting in severe physical and cognitive impairments.

- MPS-I encompasses three subtypes: Hurler syndrome (MPS-IH), Hurler-Scheie syndrome, and Scheie syndrome.

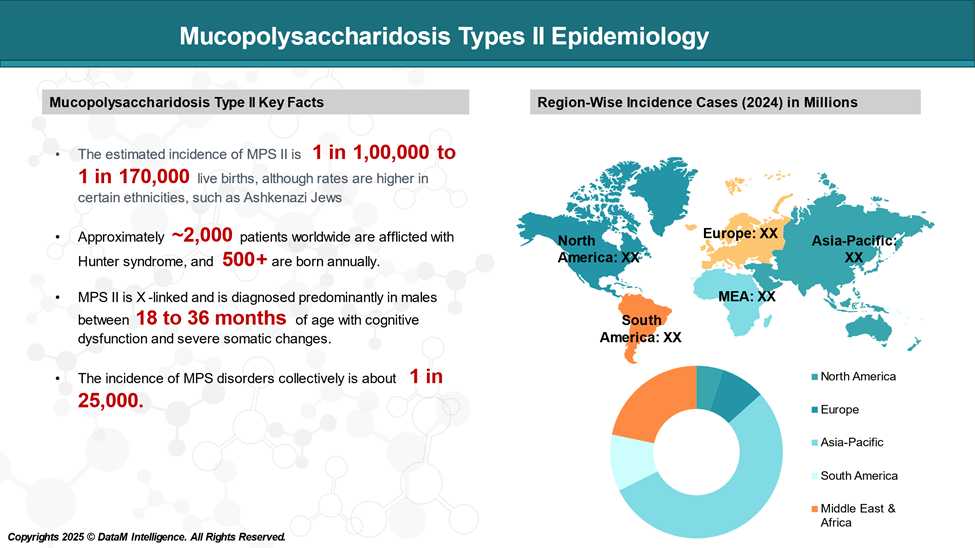

Epidemiology Analysis (Current & Forecast)

Hunter's syndrome is a rare genetic disorder, with an incidence rate ranging from 0.38 to 1.09 per 100,000 live male births.

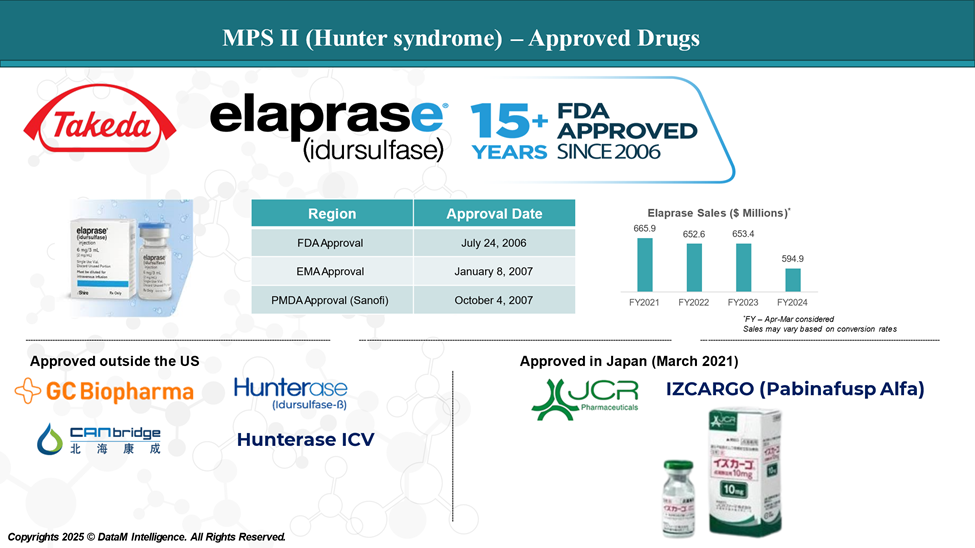

Approved Drugs (Current SoC) - Sales & Forecast

Currently, Takeda's Elaprase is the only FDA-approved enzyme replacement therapy for Hunter syndrome. This enzyme replacement therapy is administered intravenously weekly and is indicated for patients with Hunter syndrome.

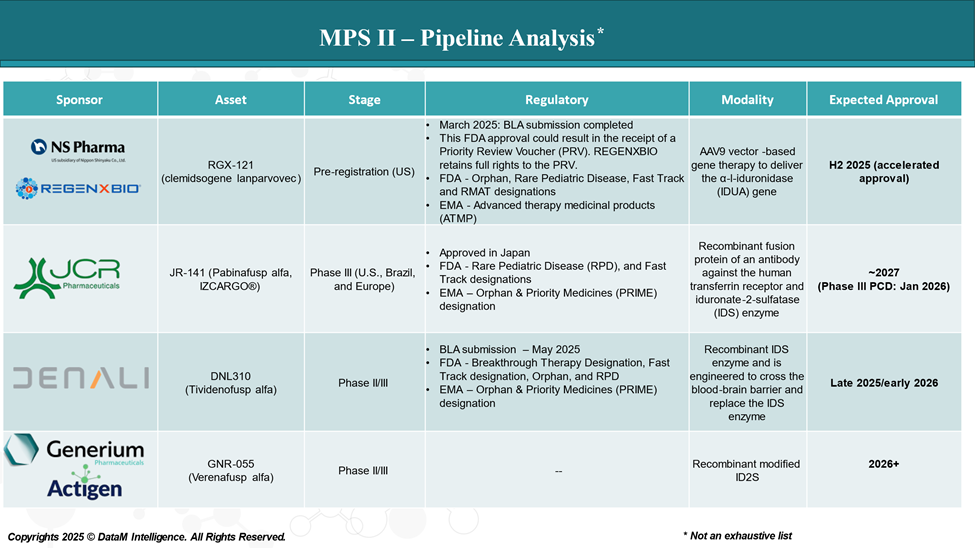

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for MPS II is rapidly evolving, with several new gene therapy and ERT in the pipeline targeting various disease mechanisms.

Competitive Landscape and Market Positioning

The MPS II treatment landscape is experiencing significant growth, driven by only one approved therapy and with an upcoming pipeline assets.

| Therapy | CNS Efficacy | Delivery Method | Approval Status | Key Advantage | Limitations |

| Elaprase | No | IV infusion | Global | Proven track record | Does not address neurological symptoms |

| Hunterase | No | IV infusion | Regional | Cost-effective alternative | Not approved in the U.S.; similar to Elaprase |

| IZCARGO | Yes | IV infusion | Japan (2021) | First to address both somatic and CNS symptoms | Approved only in Japan |

| RGX-121 | Yes | Single IV infusion | Pending (H2 2025) | One-time gene therapy targeting the CNS | Pending regulatory approval |

| Tividenofusp alfa | Yes | Single IV infusion | Pending (2025/2026) | Targets both CNS and peripheral symptoms | Pending regulatory approval |

| Verenafusp alfa | Yes | IV infusion | Pending | Targets both CNS and peripheral symptoms | Limited data; awaiting regulatory review |

Strategic Insights

- Tividenofusp alfa represents a significant advancement by offering a single administration that addresses both somatic and neurological symptoms of MPS II, potentially reducing the need for lifelong ERT.

- RGX-121 offers a one-time gene therapy approach targeting the CNS, with the potential for long-term benefits.

- Verenafusp alfa combines enzyme replacement with targeted delivery across the blood-brain barrier, aiming to address both somatic and neurological manifestations of the disease.

Key Companies:

Target Opportunity Profile (TOP)

The TOP outlines the ideal characteristics that emerging therapies for Hunter Syndrome (MPS II) should aim to demonstrate to outperform or replace current approved treatments like Elaprase, Hunterase, and IZCARGO.

| Parameter | Ideal Target Profile | Rationale / Differentiation from Approved Therapies |

| Safety | - Low immunogenicity - Minimal infusion reactions - Long-term tolerability | Elaprase and Hunterase are associated with infusion-related reactions and antibody formation. |

| Efficacy | - Significant reduction in both somatic and CNS symptoms - Improved neurocognition - Long-term functional gains | Most current therapies do not impact neurological function. CNS involvement is the major unmet need. |

| Mechanism | - CNS-penetrant enzyme replacement or - Durable gene expression with single-dose gene therapy | IZCARGO and Tividenofusp alfa are novel in crossing BBB. Gene therapy (e.g., RGX-121) is transformational. |

| Route of Admin | - Non-invasive or less frequent IV/SC or - Single-dose IV (gene therapy) | Elaprase and Hunterase require weekly IV infusions, which are burdensome. |

| Dose Frequency | - Monthly or less - Ideally one-time (for gene therapy) | Frequent dosing reduces adherence and increases burden on patients and caregivers. |

| Novelty | - Novel CNS-targeting technology - New transport platforms (e.g., ETV, J-Brain Cargo®) - AAV-mediated gene delivery | Must show mechanistic differentiation from legacy ERTs to justify use and pricing. |

| Modality | - Gene therapy, fusion protein, or next-gen ERT capable of CNS delivery | Gene therapy offers a potential functional cure. Fusion proteins aim to overcome BBB. |

| Price / Value | - High up-front cost is acceptable if supported by durable clinical outcomes - Must demonstrate cost-effectiveness over ERTs | Elaprase is >$500,000/year; new drugs must demonstrate health economic value to justify reimbursement. |

Strategic Implications for Developers

To displace Elaprase, Hunterase, or even IZCARGO, emerging therapies must:

- Target the brain effectively (either via platform tech or vector delivery).

- Reduce or eliminate ERT dependency.

- Demonstrate durable outcomes from early-stage trials.

- Quantify value with biomarkers + functional outcomes + health economics.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.