1. Disease Overview:

- Hereditary angioedema (HAE) is an autosomal dominant disorder resulting from either a deficiency or dysfunction of the C1-inhibitor protein. The traditional classification into types 1, 2, and 3 has been updated to reflect the underlying pathology. The revised terminology includes HAE with deficient C1-inhibitor (formerly type 1), HAE with dysfunctional C1-inhibitor (formerly type 2), and HAE with normal C1-inhibitor (previously referred to as type 3).

2. Epidemiology Analysis (Current & Forecast)

- Hereditary angioedema is a rare condition that affects both males and females equally. Symptoms usually appear in early childhood. It is estimated to affect approximately one in 50,000 to 150,000 people worldwide.

- It's estimated that only 6,000 people in the United States live with HAE.

3. Approved Drugs (Current SoC) - Sales & Forecast

Management of hereditary angioedema (HAE) has significantly progressed in recent years, emphasizing both acute attack treatment and long-term prevention. Advances in faster, more convenient, and effective therapies have enhanced patient outcomes, enabling personalized treatment plans based on attack frequency, severity, and individual patient needs and preferences.

| Category | Product | Description | FDA Approval / Status | Administration | Sponsor |

| C1-Inhibitor Products | Berinert | Plasma-derived C1-INH concentrate for acute attacks | FDA-approved in 2009 | Intravenous | CSL Behring |

| Cinryze | Plasma-derived C1-INH concentrate for acute attacks | FDA-approved in 2008 | Intravenous | Takeda | |

| Ruconest | Recombinant C1-INH for treating acute attacks in adults and adolescents | FDA-approved in 2014 | Intravenous | Pharming Group | |

| Kallikrein Inhibitors | Kalbitor (ecallantide) | Subcutaneous kallikrein inhibitor for acute attacks in patients ≥16 years | FDA-approved in 2009 | Subcutaneous | Takeda |

| Bradykinin B2 Receptor Blockers | Firazyr | Subcutaneous B2 receptor blocker; approved for patients ≥2 years; allows self-administration | FDA-approved | Subcutaneous (self-injected) | Takeda |

| Emerging Therapies | Garadacimab | Fully human monoclonal antibody targeting FXIIa; blocks prekallikrein to kallikrein transformation | Filed (Approved outside U.S.) | Subcutaneous | CSL Behring |

4. Pipeline Analysis and Expected Approval Timelines

The therapeutic pipeline for hereditary angioedema (HAE) is robust, with several promising agents in various stages of clinical development. These therapies aim to further improve efficacy, convenience, and patient quality of life through novel mechanisms of action, oral formulations, and extended duration of effect. Key candidates currently under investigation include:

| Company | Drug | Mechanism of Action | RoA | Stage of Development | Role in Therapy |

| KalVista | Sebetralstat | Kallikrein inhibitor | Oral | Filed | Acute |

| Pharvaris | Deucrictibant | B2 receptor antagonist | Oral | III | Acute and Prophylaxis |

| CSL | Andembry® (garadacimab) | Anti-factor XII mAb | Subcutaneous | Filed (Approved outside U.S.) | Prophylaxis |

| Ionis | Donidalorsen | Prekallikrein Antisense | Subcutaneous | Filed | Prophylaxis |

| Astria | Navenibart | Kallikrein inhibitor | Subcutaneous | II/III | Prophylaxis |

| ADARx | ADX-324 | siRNA | Subcutaneous | I | Prophylaxis |

| Intellia | NTLA-2002 | Gene Editing | Intravenous | III | One-time Prophylaxis |

| Poseida Therapeutics | P-KLKB1-101 | Gene Editing | Intravenous | Preclinical | One-time Prophylaxis |

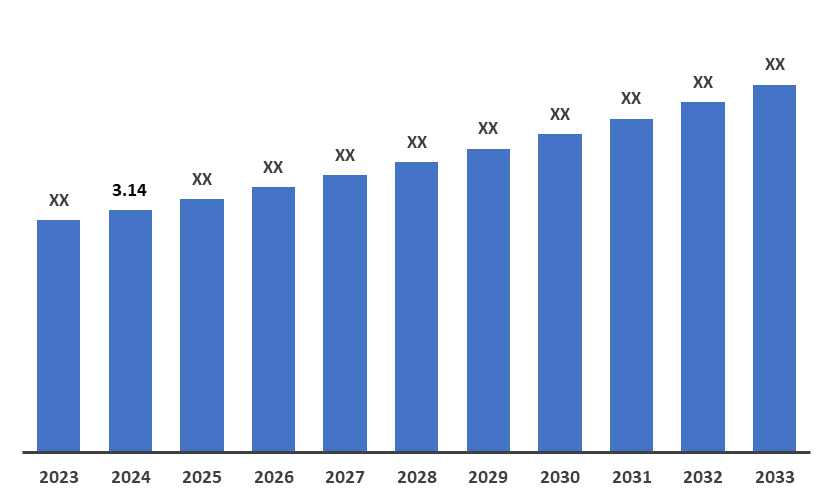

5. Market Size & Forecasting

The global HAE market reached US$ 3.14 billion in 2024 and is expected to reach US$ XX billion by 2033, growing at a CAGR of ~10.0% during the forecast period of 2025-2033.

Unmet Needs

Despite advances, HAE patients continue to face significant challenges across the treatment journey.

| Category | Unmet Need | Impact |

| Clinical | Invasive or ineffective prophylaxis | Poor control of attacks, adherence issues |

| Lack of pediatric/pregnancy-safe options | Limited treatment population | |

| Suboptimal rescue therapies | Increased ER visits, hospitalizations | |

| Diagnosis | Long diagnostic delay (avg. 8-10 years) | Disease progression, mismanagement |

| Misdiagnosis as allergies or GI disorders | Improper treatment, patient frustration | |

| Access & Economics | High cost of treatment | Inequity in access |

| Insurance/reimbursement barriers | Discontinuity of care | |

| Limited availability in rural/low-resource areas | Regional disparity | |

| Psychosocial | Mental health burden (anxiety, depression) | Reduced quality of life |

| Impact on work, school, social life | Economic and emotional toll | |

| Innovation Gap | No curative options | Lifelong burden |

| HAE with normal C1-INH poorly understood | Few therapies, clinical uncertainty |

6. Competitive Landscape and Market Positioning

The hereditary angioedema (HAE) therapeutics market is marked by robust competition among several key pharmaceutical companies, each striving to offer innovative treatments and capture significant market share.

Market Positioning

| Company | Product(s) | Primary Advantage | Positioning Focus |

| Takeda | Takhzyro, Cinryze, Firazyr | Broadest portfolio (acute + prophylaxis), global reach | Comprehensive HAE care leader |

| CSL Behring | Haegarda | Subcutaneous C1-INH; proven, well-tolerated | Reliable prophylaxis option |

| BioCryst | Orladeyo | First oral prophylactic therapy | Convenience-first prophylaxis |

| KalVista | Sebetralstat (Filed) | Oral acute therapy in development | Next-gen acute treatment |

| Pharvaris | Deucrictibant (Phase III) | Oral acute bradykinin antagonist | Fast-acting, oral acute solution |

Key Companies:

7. Target Opportunity Profile (TOP) & Benchmarking

The Target Opportunity Profile for HAE therapeutics outlines the ideal characteristics of a treatment that addresses the unmet needs in the current market. This profile serves as a framework for identifying promising candidates in development and for evaluating existing therapies.

Ideal Product Profile Includes:

- Route of Administration: Oral or subcutaneous (preferred over intravenous) for improved patient convenience and adherence.

- Frequency of Administration: Once-daily (or less frequent) prophylaxis; fast-acting on-demand therapies for acute attacks.

- Efficacy:

- Significant reduction in attack frequency (≥90% reduction for prophylactics).

- Rapid symptom relief (within 1–2 hours) for on-demand treatments.

- Safety: Minimal side effects with a favorable long-term safety profile; low risk of hypersensitivity or immunogenic reactions.

- Patient Population Coverage: Broad indication including pediatric, adolescent, and adult patients.

- Stability & Storage: Room-temperature-stable formulations are preferred for global distribution.

Benchmarking: Current vs. Ideal Therapies

| Product | Company | Type | Route | Use | Benchmark Fit |

| Takhzyro (lanadelumab) | Takeda | SC kallikrein inhibitor | Subcutaneous | Prophylactic | ✔ High efficacy, ✔ SC route |

| Orladeyo (berotralstat) | BioCryst | Oral kallikrein inhibitor | Oral | Prophylactic | ✔ Oral, ✖ Moderate efficacy |

| Haegarda | CSL Behring | C1 esterase inhibitor | Subcutaneous | Prophylactic | ✔ SC route, ✖ Frequency (2x/week) |

| Firazyr | Takeda | Bradykinin B2 antagonist | Subcutaneous | On-demand | ✔ Fast-acting, ✖ Painful injection |

| Ruconest | Pharming Group | Recombinant C1-INH | IV | On-demand | ✔ Effective, ✖ IV administration |

| Garadacimab | CSL Behring (EU only) | FXIIa inhibitor (mAb) | Subcutaneous | Prophylactic | ✔ Innovative MoA, ✔ SC route |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.