Disease Overview:

Hepatocellular carcinoma (HCC) is a primary tumor of the liver, and for more than 90% of the primary tumor of the liver.

- Hepatocellular carcinoma (HCC) develops in approximately 85% of individuals diagnosed with cirrhosis.

- About 75% of primary liver cancers are classified as HCC.

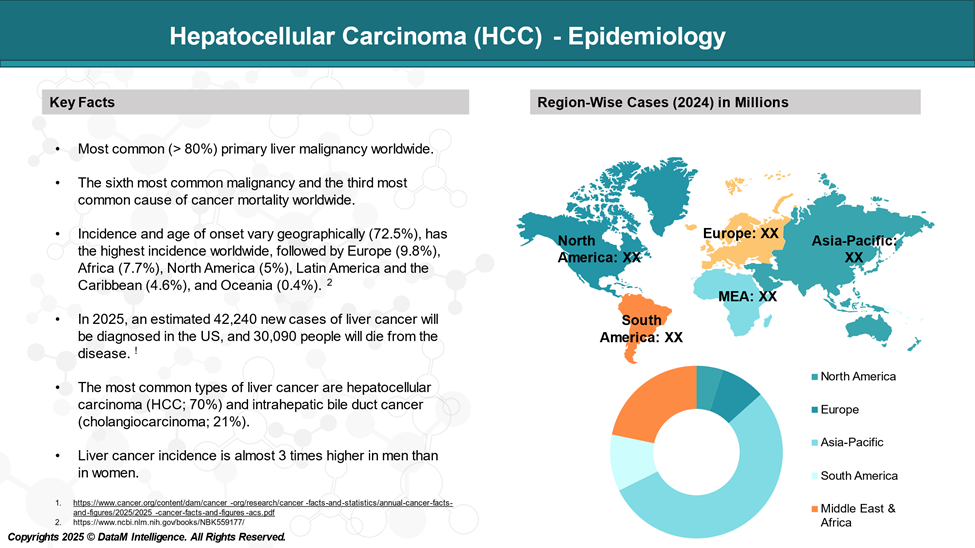

Epidemiology Analysis (Current & Forecast)

HCC is relatively uncommon in the United States, although its incidence is rising, principally concerning the spread of HCV infection. Worldwide, hepatocellular carcinoma (HCC) ranks as the sixth most common cancer and the third leading cause of cancer-related mortality.

Approved Drugs (Current SoC) - Sales & Forecast

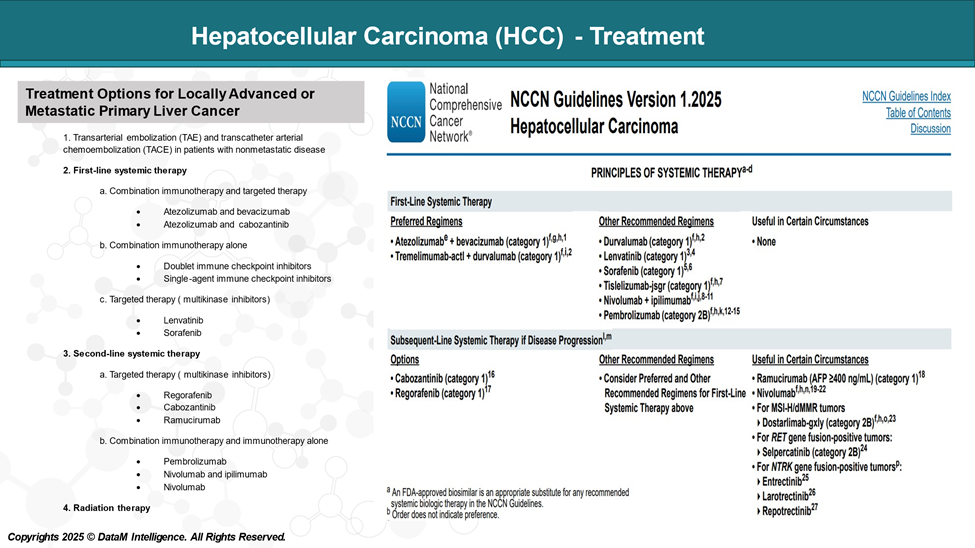

There is no single treatment strategy for patients with hepatocellular carcinoma (HCC), as the selection of treatment is complex due to several factors, including:

- Underlying liver function.

- Extent and location of the tumor.

- General condition of the patient.

Treatment Options for HCC

| Stage | Treatment Options |

| Localized | Surveillance |

| Surgical resection | |

| Liver transplant | |

| Ablation | |

| Radiation therapy | |

| Locally advanced/metastatic | TACE in patients with nonmetastatic disease |

| First-line systemic therapy | |

| Second-line systemic therapy | |

| Radiation therapy | |

| Recurrent (liver-limited disease/without vascular involvement) | Liver transplantation |

| Surgical resection | |

| Ablation | |

| Radiation therapy | |

| Recurrent (extrahepatic disease/vascular involvement) | Palliative therapy |

Treatment for Locally Advanced/Metastatic HCC

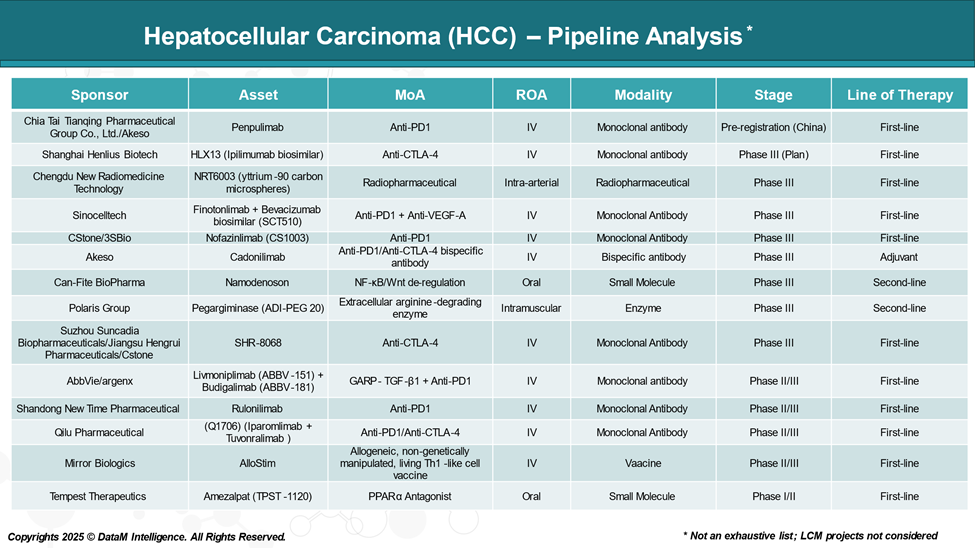

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for HCC is rapidly evolving, with several new immunotherapies are in the pipeline targeting various disease mechanisms.

Competitive Landscape and Market Positioning

The HCC treatment landscape is experiencing significant growth, driven by several approved therapies and with an upcoming pipeline therapies.

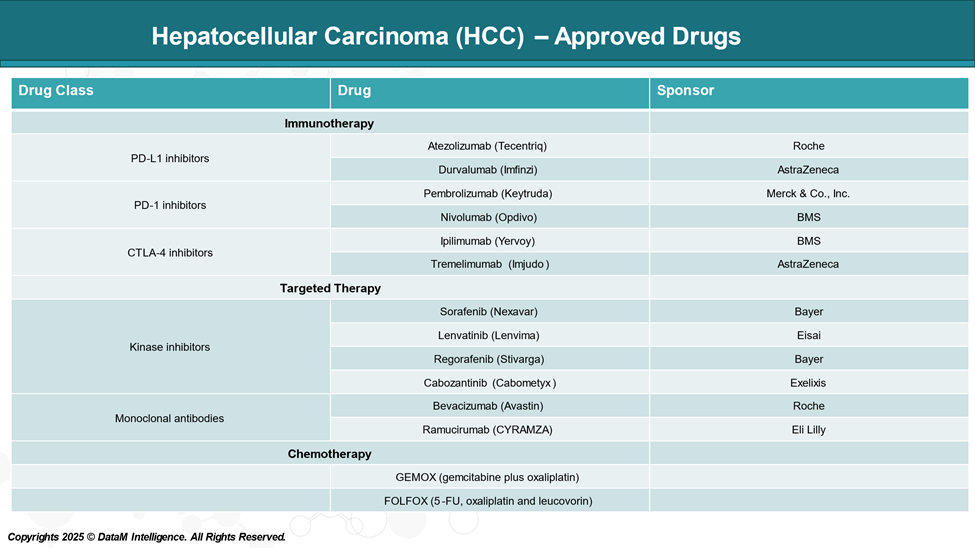

Immunotherapy (Checkpoint Inhibitors)

| Drug Name | Company | Mechanism | Market Positioning |

| Atezolizumab (Tecentriq) | Roche | PD-L1 inhibitor | Combined with Bevacizumab, front-line standard. |

| Durvalumab (Imfinzi) | AstraZeneca | PD-L1 inhibitor | Approved as monotherapy and in combination with Tremelimumab. |

| Tremelimumab (Imjudo) | AstraZeneca | CTLA-4 inhibitor | Used in combination with Durvalumab (STRIDE regimen). |

| Nivolumab (Opdivo) | Bristol Myers Squibb | PD-1 inhibitor | Formerly second-line; role shifting with combos. |

| Ipilimumab (Yervoy) | Bristol Myers Squibb | CTLA-4 inhibitor | Used in combination with Nivolumab in second-line. |

| Pembrolizumab (Keytruda) | Merck & Co. | PD-1 inhibitor | Approved for second-line HCC; studied in other drug combinations. |

Targeted Therapies (TKIs and VEGF Inhibitors)

| Drug Name | Company | Mechanism | Market Positioning |

| Sorafenib (Nexavar) | Bayer | Multi-kinase inhibitor (TKI) | First systemic therapy for HCC; use is declining. |

| Lenvatinib (Lenvima) | Eisai | Multi-kinase inhibitor (TKI) | Approved for front-line; alternative to Sorafenib. |

| Regorafenib (Stivarga) | Bayer | Multi-kinase inhibitor (TKI) | Approved for second-line after Sorafenib failure. |

| Cabozantinib (Cabometyx) | Exelixis | MET/VEGFR2/AXL inhibitor | Second/third-line; used post Sorafenib. |

| Ramucirumab (Cyramza) | Eli Lilly | VEGFR2 inhibitor | It is approved for patients with high AFP (>400 ng/mL). |

Competitive Insights

- Roche is leading in the front-line segment with Atezolizumab plus Bevacizumab, a widely adopted SoC.

- AstraZeneca is gaining traction with the Durvalumab + Tremelimumab STRIDE regimen as an alternative front-line approach.

- Bristol Myers Squibb (BMS) maintains presence in the second-line with the Opdivo + Yervoy combo.

- Merck’s Keytruda plays a significant role in second-line or later settings and combination trials.

- Bayer continues to serve the post-front-line market with legacy TKIs like Sorafenib and Regorafenib.

- Eisai’s Lenvatinib remains a first-line monotherapy alternative where immunotherapy may not be appropriate.

- Exelixis and Eli Lilly address niche segments in second-line and biomarker-driven populations.

Key Companies:

Target Opportunity Profile (TOP)

Creating a Target Opportunity Profile (TOP) for emerging therapies in HCC helps define the clinical and commercial benchmarks new products must meet or surpass to gain a competitive edge over approved therapies. This profile focuses on the essential dimensions: efficacy, safety, mechanism of action, route of administration, dosing frequency, and cost.

Target Opportunity Profile (TOP) for Emerging Therapies

| Dimension | Category | Minimum Benchmark | Preferred / Ideal Target | Strategic Rationale |

| Efficacy | Overall Survival (OS) | Match the current leading best-in-class drugs | Surpass leading combinations (e.g., IO in combination with anti-VEGF or dual IO agents) | OS is the gold standard endpoint for regulatory approval and also for the payer adoption. |

| Progression-Free Survival (PFS) | Comparable to top-performing regimens | Prolong PFS beyond standard-of-care | Supports health economic value and delays progression. | |

| Objective Response Rate (ORR) | Match the response of approved IO/TKI combos | Higher ORR with faster onset | Improves clinical perception and supports market uptake. | |

| Disease Control Rate (DCR) | Competitive with the existing current SoC | Higher rate and durable response (DRR) | Indicates stable disease (SD) control in advanced-stage patients with liver cancer | |

| Safety & Tolerability | Grade ≥3 Adverse Events | Comparable to leading therapies | Lower toxicity, fewer severe AEs | Enhances real-world tolerability and compliance. |

| Immune-related AEs | Manageable with standard protocols | Reduced frequency/severity | Better safety in immunotherapy combinations increases clinical confidence. | |

| Treatment Discontinuation | Low and in line with SoC | Fewer dropouts due to toxicity | Prolongs treatment duration and outcomes. | |

| Mechanism of Action | Innovation & Differentiation | Proven pathway with clinical precedent | Novel target (e.g., TGF-β, Wnt, bispecifics) | Differentiation supports premium pricing, faster uptake, and scientific leadership. |

| Synergy with Existing Therapies | Compatibility with TKIs or IO agents | Demonstrated synergy in combinations | Enables combination development and second-line positioning. | |

| Biomarker Utility | Optional or exploratory | Companion diagnostic or biomarker-defined use | Precision targeting increases efficacy and payer alignment. | |

| Administration | Route of Administration | IV acceptable | Oral or subcutaneous preferred | Improves patient convenience and expands access to community or home-based care. |

| Infusion Time / Setting | Standard infusion clinic setup | Shorter infusion or home-based administration | Reduces burden on infusion centers and patients. | |

| Dosing & Convenience | Dosing Frequency | Every 2–4 weeks | Monthly or longer intervals | Enhances adherence and reduces clinic burden. |

| Regimen Simplicity | Combination feasible | Monotherapy or simple regimens | Supports ease of use, especially in global and resource-limited settings. | |

| Cost & Market Access | Drug Pricing (Monthly) | Comparable to SoC (~$15–20K) | Lower cost or justified by superior value | Drives payer acceptance and broader adoption. |

| Value-Based Access | Supported by clinical data | Reinforced by QoL, QALY, and real-world outcomes | Strengthens HTA and reimbursement arguments. | |

| Diagnostic Bundling | Not required | Integrated companion diagnostics | Improves targeting and supports precision reimbursement models. |

*Actual benchmark values will be available in the full CI report.

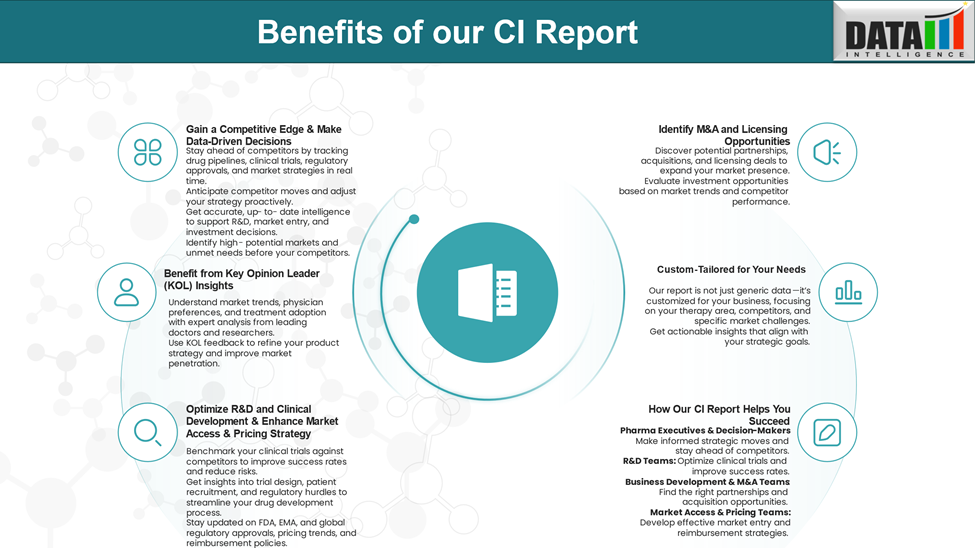

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.