1. Disease Overview:

Generalized myasthenia gravis (gMG) is a long-term autoimmune condition in which the immune system interferes with the normal signaling between nerves and muscles. This disruption causes muscle weakness that tends to become more pronounced with physical activity and improves after rest.

2. Epidemiology Analysis (Current & Forecast)

- The disorder is more frequently seen in women younger than 40 and men older than 60.

- gMG is affecting more than 1,000,000 people worldwide. As per 2021, a systematic review and meta-analysis estimated that the global prevalence of MG was 12.4 per 100,000 persons

- Globally, approximately 150 to 200 of every million people have myasthenia gravis. In the US, it is estimated that 37 out of every 100,000 people have myasthenia gravis.

- The incidence rate of MG ranges from 4.1 to 30 cases per 1,000,000 person-years (as per 2021)

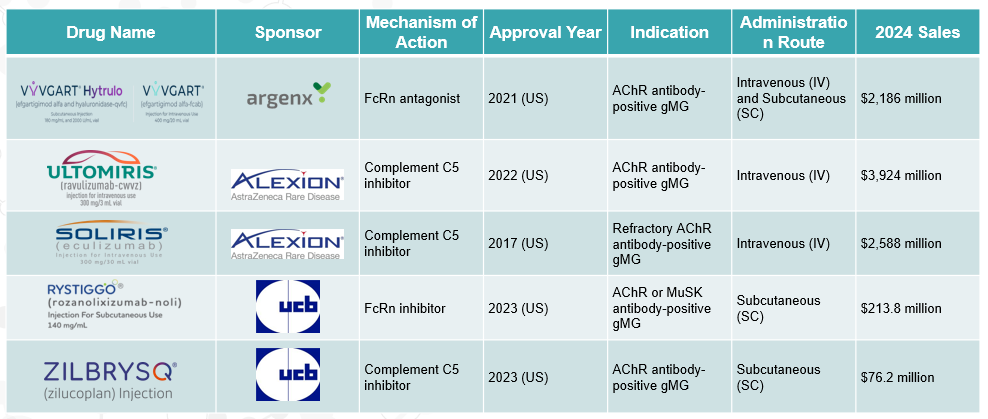

3. Approved Drugs (Current SoC) - Sales & Forecast

The FDA has approved several medications for the treatment of gMG, including the complement inhibitors eculizumab (Soliris), ravulizumab (Ultomiris), and zilucoplan (Zilbrysq), as well as the FcRn inhibitors efgartigimod (Vyvgart) and rozanolixizumab (Rystiggo).

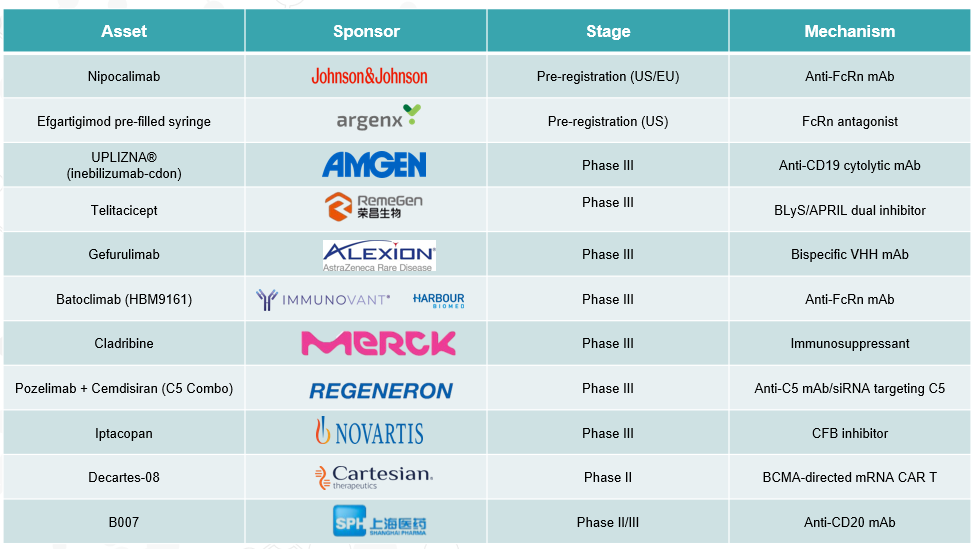

4. Pipeline Analysis and Expected Approval Timelines

Generalized Myasthenia Gravis (gMG) has seen significant advancements in its treatment landscape, with several promising therapies in the pipeline and recent approvals enhancing patient care.

Late-stage Pipeline:

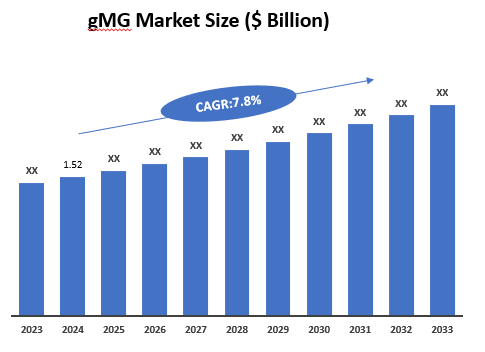

5. Market Size & Forecasting

The global gMG market reached US$ 1.52 billion in 2024 and is expected to reach US$ XX billion by 2033, growing at a CAGR of ~7.8% during the forecast period of 2025-2033.

Unmet Needs

Despite advances, gMG patients continue to face significant challenges across the treatment journey.

| Category | Unmet Need | Details |

| Diagnosis | Delayed and inaccurate diagnosis | Misdiagnosis is common; need for better awareness and early, specific biomarkers |

| Treatment Efficacy | Incomplete or suboptimal response to current therapies | Many patients don’t reach remission; need for more effective, targeted, personalized options |

| Treatment Burden | Inconvenient administration and side effects | IVIG, plasmapheresis, and immunosuppressants are time-consuming and poorly tolerated |

| Monitoring Tools | Lack of objective disease activity markers | Need for reliable biomarkers and tools to track disease progression and response |

| Refractory Disease | Limited options for treatment-resistant cases | The subgroup remains symptomatic despite multiple therapies; novel approaches |

| Access and Cost | High cost and limited access to new therapies | New biologics are expensive; limited availability in some regions or healthcare systems |

| Special Populations | Gaps in care for pediatric and atypical patients | Need more data on children, seronegative MG, and rare antibody subtypes |

| Mental Health & QoL | Underrecognized psychosocial impact | Patients experience fatigue, depression, and anxiety; need for holistic care |

6. Competitive Landscape and Market Positioning

The gMG therapeutics market is marked by robust competition among several key pharmaceutical companies, each striving to offer innovative treatments and capture significant market share.

Market Positioning

| Therapy/Class | Brand Name / Developer | Mechanism of Action | Market Positioning | Notes |

| Corticosteroids | Prednisone (generic) | Broad immunosuppression | First-line or adjunct therapy; low cost, widely used | Long-term use is limited by side effects |

| Immunosuppressants | Azathioprine, Mycophenolate mofetil | T-cell/B-cell suppression | Chronic use for steroid-sparing effect | Slow onset; risk of infections |

| IVIG / Plasma Exchange | Privigen, Octagam | Immune modulation / Antibody removal | Used during exacerbations or pre-surgery | High cost; logistical burden |

| Complement Inhibitors | Soliris (Alexion/AZ) | C5 complement inhibition | First-in-class biologic for AChR+ refractory gMG | High cost; IV administration; restricted to specific population |

| Ultomiris (Alexion/AZ) | Longer-acting C5 inhibitor | Improved dosing schedule (every 8 weeks) | Competitive edge over Soliris | |

| ZILBRYSQ (UCB) | C5 complement inhibition | first once-daily subcutaneous, targeted C5 complement inhibitor for gMG. It is the only once-daily gMG-target therapy for self-administration | ||

| FcRn Inhibitors | Vyvgart (argenx) | Neonatal Fc receptor (FcRn) blockade | First FcRn blocker approved for gMG | SC and IV formulations; high efficacy in AChR+ |

| Rystiggo (UCB) | FcRn blockade | SC option with potential for self-administration | Competing directly with Vyvgart | |

| Emerging Therapies | Nipocalimab, Batoclimab, Decartes-08, Gefurulimab, B007 | Various mechanisms (e.g., IgG cleavage, complement, Anti-CD20 mAb, Bispecific VHH mAb) | In development or recently approved in some regions | Pipeline therapies aiming at better efficacy, convenience, and access |

Market Dynamics & Strategic Insights

- Biologics (Soliris, Ultomiris, Vyvgart) are redefining treatment for AChR+ patients but are high-cost, high-impact therapies with restricted use based on antibody status.

- FcRn inhibitors offer a growing market segment with self-administered options, driving patient preference and uptake.

- Emerging therapies focus on improving convenience, reducing immunogenicity, and targeting broader patient populations (e.g., MuSK+, seronegative).

Off-label drugs like Rituximab provide affordable alternatives in some settings, though lacking formal approvals.

Key Companies:

7. Target Opportunity Profile (TOP)

The Target Opportunity Profile for gMG therapeutics outlines the ideal characteristics of a treatment that addresses the unmet needs in the current market. This profile serves as a framework for identifying promising candidates in development and for evaluating existing therapies.

| Category | Target Profile |

| Indication | Generalized Myasthenia Gravis (AChR+, MuSK+, seronegative) |

| Target Population | Adult and adolescent patients (≥18 years; expanding to pediatric desirable) |

| Disease Stage | Moderate to severe gMG; treatment-naïve or refractory to standard therapies |

| Line of Therapy | First-line or early-line (ideally) or as an add-on for refractory cases |

Product Characteristics

| Attribute | Optimal Profile |

| Mechanism of Action | Targeted immunomodulation (e.g., FcRn, complement, B-cell) |

| Onset of Action | Rapid (≤2 weeks preferred) |

| Route of Administration | Subcutaneous or oral (preferred); IV acceptable for induction or acute cases |

| Dosing Frequency | Biweekly to monthly (or less frequent) |

| Efficacy | High response rate (>70%) with durable symptom control |

| Safety Profile | Favorable; minimal risk of serious infections, no long-term immunosuppression |

| Tolerability | Minimal infusion reactions; suitable for long-term use |

| Patient-Reported Outcomes | Significant improvement in MG-ADL, QoL, fatigue, and daily function |

| Monitoring Requirements | Minimal; ideally no frequent lab/imaging required |

Market and Access Considerations

| Factor | Ideal Characteristics |

| Cost-Effectiveness | Competitive with existing biologics; value-based pricing for payers |

| Reimbursement | Covered under major public and private plans; limited restrictions |

| Differentiation | Superior convenience, broader population eligibility, better safety or efficacy |

| Global Applicability | Scalable across high-income and middle-income markets |

| Pipeline Positioning | Positioned for expansion into related autoimmune diseases |

Strategic Fit

| Factor | Details |

| Unmet Need | High unmet need in refractory and seronegative patients |

| Label Expansion | Opportunity for expansion into pediatric gMG and related neuromuscular conditions |

| First-in-Class Potential | Best-in-class if offering improved administration, durability, or QoL benefits |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.