Disease Overview:

Gaucher’s disease is a rare, genetic, autosomal recessive disorder and one of the common lysosomal storage disorders. Gaucher’s disease occurs in patients in whom the glucocerebrosidase (GBA1) enzyme activity is deficient due to mutations in the GBA1 gene.

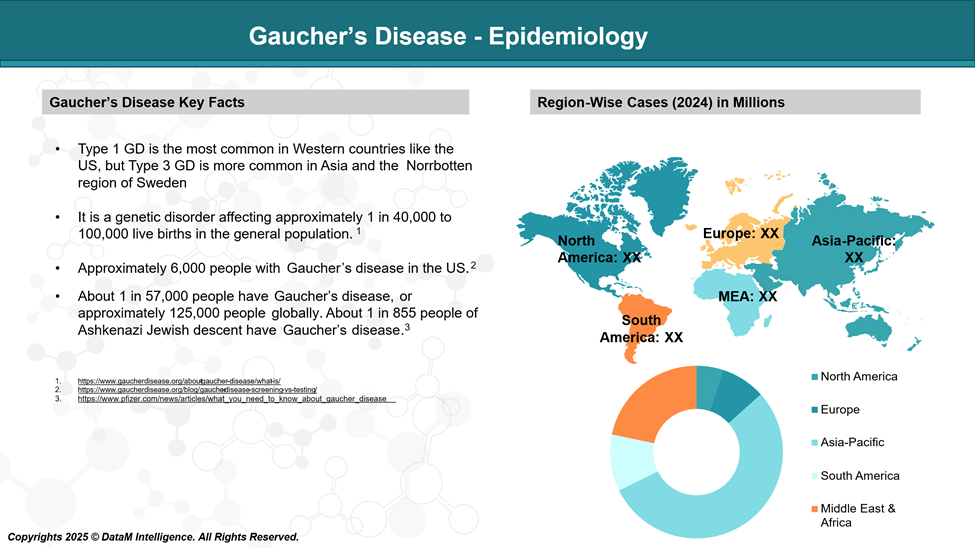

Epidemiology Analysis (Current & Forecast)

Gaucher’s disease is the commonest lysosomal storage disorder (LSD) with an estimated global incidence of 1 in 40,000 to 100,000 live births.

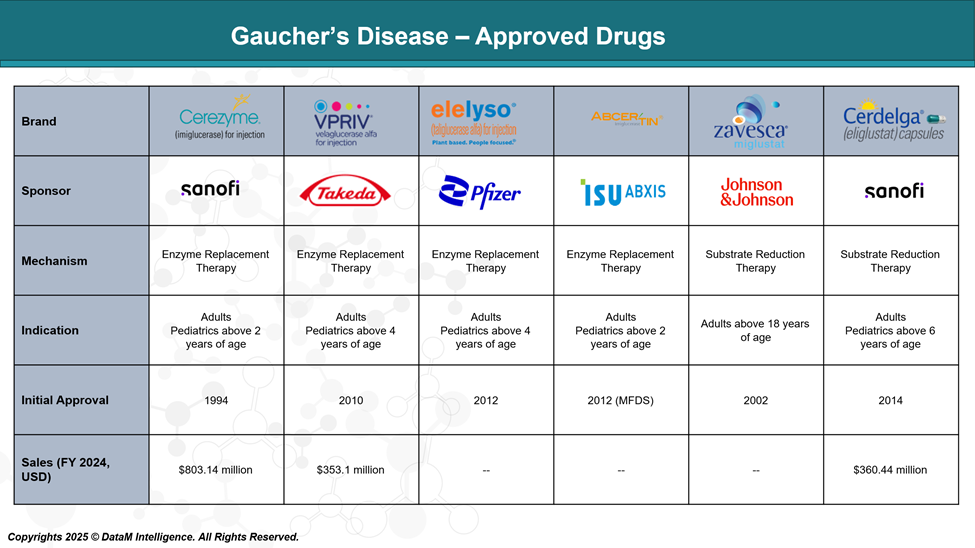

Approved Drugs (Current SoC) - Sales & Forecast

Currently, the U.S. Food and Drug Administration (FDA) has approved two substrate reduction therapies (SRTs): Cerdelga (eliglustat; Sanofi) and Zavesca (miglustat; Johnson & Johnson), as well as three enzyme replacement therapies (ERTs): Cerezyme (imiglucerase; Sanofi), VPRIV (velaglucerase alfa; Takeda), and Elelyso (taliglucerase alfa; Pfizer).

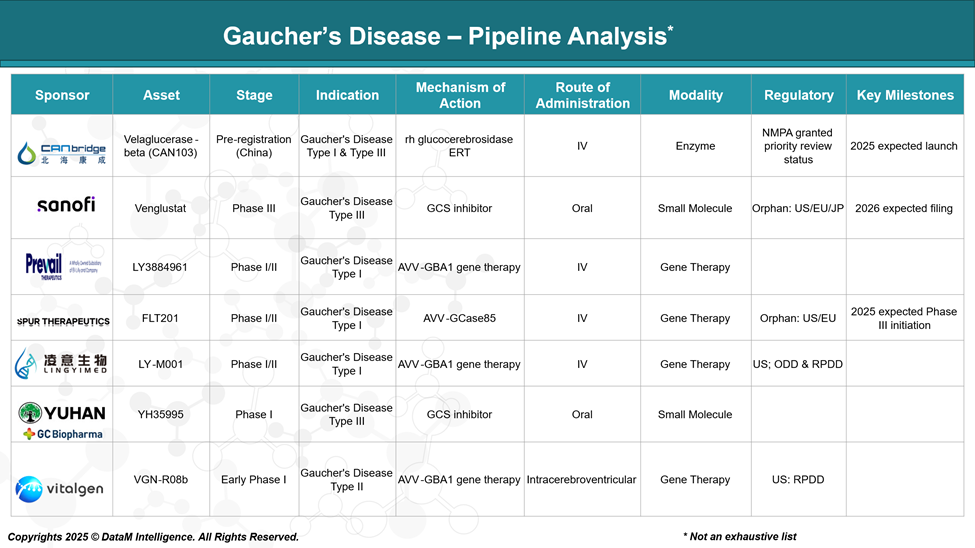

Pipeline Analysis and Expected Approval Timelines

Gaucher’s disease treatment landscape is undergoing significant evolution, with advancements in gene therapies and substrate reduction therapies (SRTs) complementing established enzyme replacement therapies (ERTs).

Competitive Landscape and Market Positioning

Here’s a benchmarking analysis of key GD drug candidates and approved therapies, comparing them across critical dimensions such as clinical development stage, mechanism, administration, target population, and market potential:

Company | Therapy | Type | Market Positioning | Strengths | Challenges / Risks |

Sanofi | Cerezyme (imiglucerase) | ERT | Longtime market leader in ERT | Established efficacy, global reach | Patent expiries, infusion burden |

Cerdelga (eliglustat) | SRT (oral) | Only oral first-line SRT | Oral convenience, good tolerability profile | Not effective in all genotypes; limited CNS access | |

J&J | Zavesca (miglustat) | SRT (oral) | Backup SRT (less used now) | Early oral option | GI side effects, CNS adverse events |

Takeda | VPRIV (velaglucerase alfa) | ERT | Second-largest ERT market share | Alternative for anti-Cerezyme patients | No major differentiation; infusion required |

Pfizer | Elelyso (taliglucerase alfa) | ERT | Low-cost recombinant ERT | Lower production costs (plant-based) | Limited uptake outside LATAM/Israel |

Spur Therapeutics | FLT201 | Gene Therapy | Leading innovative candidate | AAV delivery, CNS reach, potential one-time cure | Long-term safety, pricing, and scalability |

Eli Lilly / Prevail | PR001 | Gene Therapy | Major competitor in gene therapy space | AAV9 vector, CNS-targeted, ties to Parkinson’s research | Still in early-phase trials |

CANbridge Pharma | Velaglucerase-beta | ERT | New entrant focused on China/Asia-Pacific | Faster regulatory pathways in China (waiting for NMPA approval) | Limited global access; intense competition in the ERT market |

Strategic Market Segmentation Overview

Market Segment | Players | Key Selling Points | Barriers / Risks |

Enzyme Replacement (ERT) | Sanofi, Takeda, Pfizer | Proven clinical efficacy, established reimbursement | Infusion burden, high cost, poor CNS penetration |

Substrate Reduction (SRT) | Sanofi (Cerdelga), J&J (Zavesca) | Oral administration, suitable for mild/moderate cases | Limited for severe cases, side effects, and genotype limits |

Gene Therapy | Spur, Eli Lilly (Prevail), LingyiMed | One-time treatment potential, CNS targeting | Regulatory hurdles, long-term safety, and high upfront cost |

Emerging Markets (Asia) | CANbridge | Cost-effective ERT options | Regional limitations, global competition |

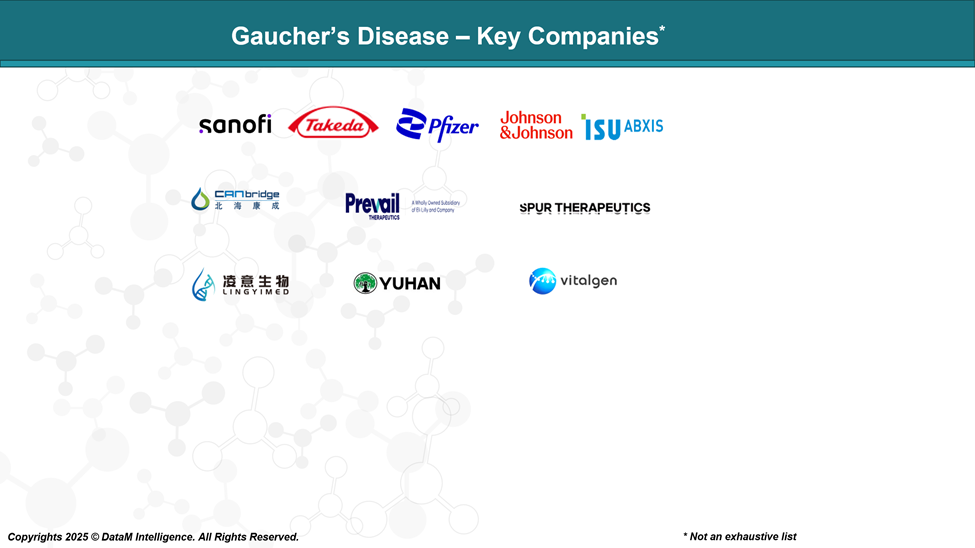

Key Companies:

Target Opportunity Profile (TOP)

Here is a Target Opportunity Profile (TOP) specifically structured to define what emerging drugs for Gaucher disease must demonstrate to outperform approved therapies (ERTs and SRTs like Cerezyme, VPRIV, Elelyso, Cerdelga, and Zavesca).

Target Opportunity Profile (TOP) – Gaucher’s Disease

Attribute | Current Standard (ERT/SRT) | Target Profile for Emerging Therapies |

Safety | - Generally well-tolerated | - Comparable or superior safety |

Efficacy | - Controls visceral symptoms | - Equivalent or superior control of hematologic, visceral, and neurological symptoms |

Mechanism of Action | - ERT: Enzyme replacement | - Gene correction or sustained endogenous enzyme expression |

Route of Administration | - ERT: IV infusion every 2 weeks | - Oral or single IV/SC dose preferred |

Dosing Frequency | - ERT: Biweekly infusions | - Monthly or one-time dosing |

Modality | - Protein replacement (ERT) | - Gene therapy, mRNA, genome editing, or next-gen small molecules |

Patient Segment | - Type 1 (non-neuronopathic) well-served | - Neuronopathic (Type 2/3) and pediatric populations |

Commercial Price (U.S.) | - ~$200,000–$350,000/year (ERT/SRT) | - Gene/cell therapy: $1M–$3M (one-time) if durable |

Differentiation Levers | - Legacy market hold, but few offer innovation | - First-to-market curative therapy |

Top Requirements for Emerging Drugs to Beat Approved Therapies

Parameter | Minimum Threshold to Compete | Ideal Target to Win Market Share |

Safety | Equal to or fewer adverse events than ERT/SRT | No serious AEs, manageable safety with broad patient eligibility |

Efficacy | Equal efficacy on visceral symptoms | + CNS efficacy + biomarker normalization (e.g., lyso-Gb1) |

Duration | At least 6–12 months per dose (non-curative) | Lifelong effect or 5–10+ years durability (gene therapy) |

Delivery | IV or SC | Oral or single-dose IV/SC |

Population | Type 1 | Types 2 and 3, pediatric, refractory, and global expansion |

Access/Cost | Value-based pricing with cost offset | Demonstrated cost-effectiveness over lifetime vs ERT |

What Emerging Therapies Must Do to Succeed

- Deliver CNS benefit – key unmet need

- Reduce treatment frequency dramatically

- Maintain or improve safety profile

- Demonstrate real-world QoL gains

- Offer economic value (even at a high upfront price)

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: