Disease Overview:

Fabry disease is a rare genetic, X-linked lysosomal storage disease caused by decreased activity of the enzyme α-galactosidase A (α-Gal A) and results in lysosomal accumulations of neutral glycosphingolipids and globotriaosylceramide GL-3.

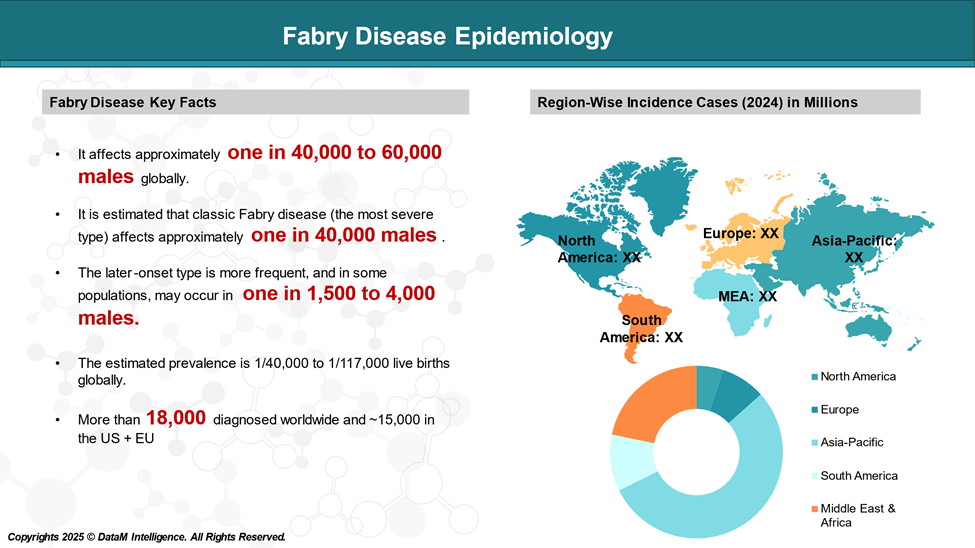

Epidemiology Analysis (Current & Forecast)

Fabry disease is a rare genetic disorder, with an estimated prevalence is 1/40,000 to 1/117,000 live births globally.

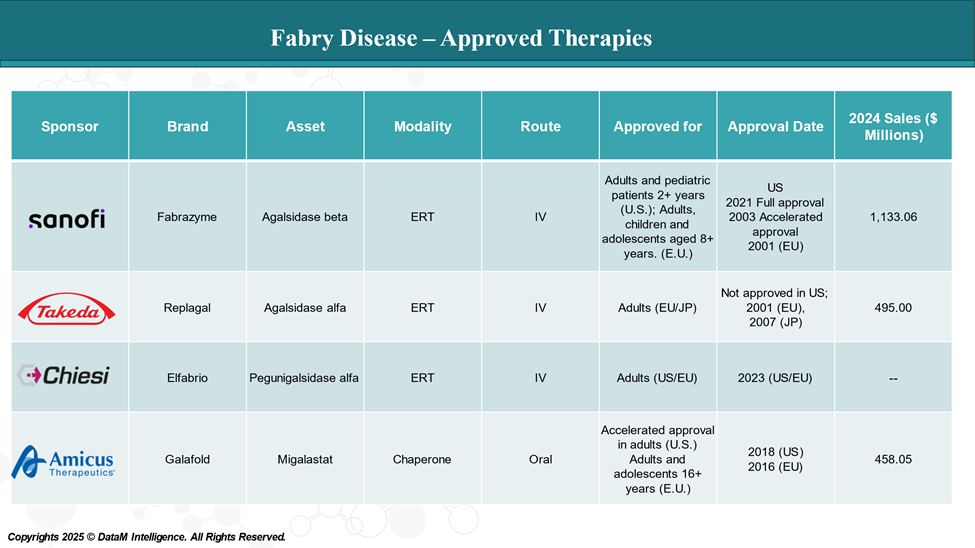

Approved Drugs (Current SoC) - Sales & Forecast

Currently, two ERTs Fabrazyme (agalsidase beta) and Elfabrio (pegunigalsidase alfa-iwxj) are approved in the U.S. for Fabry disease. Another ERT, Replagal (Agalsidase alfa), is approved in Europe. And, Galafold (migalastat) is the only chaperone therapy approved for Fabry disease.

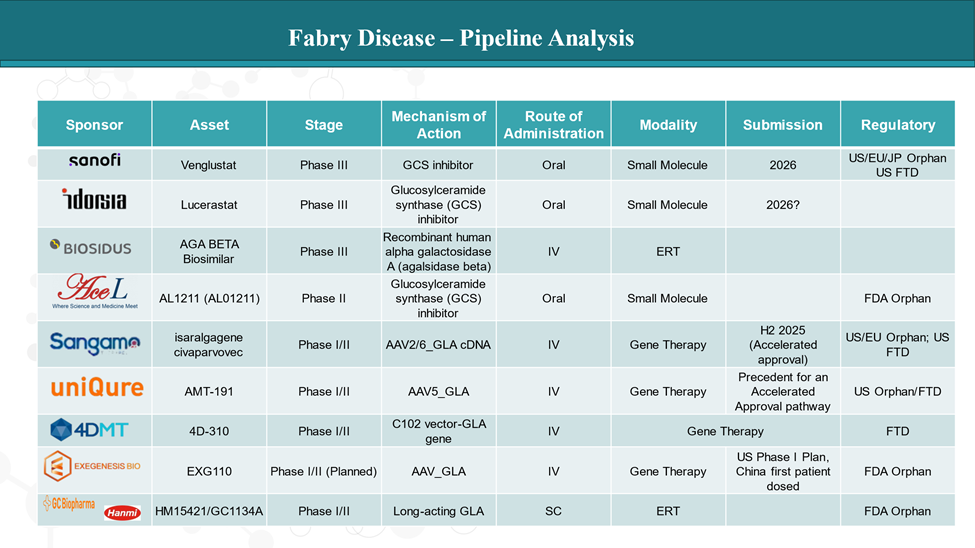

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for Fabry disease is rapidly evolving, with several new gene therapy and ERT in the pipeline targeting various disease mechanisms.

Competitive Landscape and Market Positioning

The Fabry disease treatment landscape is experiencing significant growth, driven by four approved therapies and with an upcoming pipeline therapies.

| Therapy | Manufacturer | Type | Unique Advantages | Challenges | Market Share / Penetration |

| Fabrazyme | Sanofi | Enzyme Replacement Therapy (ERT) | Well-established therapy, robust clinical data, long-term use | Persistent symptoms in some patients; IV burden | ~53% global market share (2024); strongest in the US and Europe |

| Replagal | Takeda | Enzyme Replacement Therapy (ERT) | Alternative to Fabrazyme in Europe; long-term safety data | Not approved in the US; limited access compared to Fabrazyme | Moderate market share in Europe and Japan |

| Elfabrio | Chiesi / Protalix | PEGylated ERT | Longer half-life (less frequent dosing); potentially better tissue uptake | New entrant; needs real-world evidence and uptake | Early stage, gaining attention from switching patients (post-2023) |

| Galafold | Amicus | Oral Chaperone Therapy | First and only oral treatment; improved patient convenience; mutation-specific | Only works in patients with amenable GLA mutations (~35–50% of cases) | ~22% of treated patients globally (as of 2019); growing among eligible |

Key Companies:

Target Opportunity Profile (TOP)

The TOP outlines the ideal characteristics that emerging therapies for Fabry disease should aim to demonstrate to outperform or replace current approved treatments.

Key Differentiators for Emerging Therapies

| Parameter | Current Approved Therapies | Target for Emerging Therapies |

| Mechanism of Action | - ERT: Enzyme replacement (Fabrazyme, Replagal) - Chaperone: Stabilization of mutant enzyme (Migalastat) | - Durable endogenous enzyme production (e.g., gene therapy) - Enhanced delivery across tissues (e.g., CNS) |

| Route of Administration | - IV (ERTs) - Oral (Chaperone for amenable mutations only) | - Oral or one-time IV (gene therapy) - Non-invasive or less frequent delivery |

| Dosing Frequency | - ERT: Every 2 weeks - Migalastat: Every other day | - Monthly, quarterly, or ideally one-time dosing |

| Efficacy | - Reduces Gb3/Lyso-Gb3 accumulation - Slows organ damage (kidney, heart) | - Sustained reduction or normalization of biomarkers - Halt/reverse organ damage |

| Onset of Action | - Gradual (months) | - Faster onset with sustained effect |

| Safety & Tolerability | - IRRs, potential for anti-drug antibodies (ERT) - Migalastat: generally well-tolerated | - Minimal immunogenicity - No IRRs - No severe off-target effects |

| Mutation Coverage | - ERT: All mutations - Migalastat: Limited to amenable GLA mutations | - Broad or universal mutation coverage (e.g., gene therapy or next-gen chaperones) |

| Crosses Blood-Brain Barrier (BBB) | - No (ERT) - Unclear for Migalastat | - Yes (to address CNS manifestations of Fabry) |

| Patient Convenience | - Biweekly IV infusions or frequent oral pills | - Oral or single-administration IV/SC - Home-based or infrequent treatment |

| Diagnostic Dependency | - Migalastat: Requires genetic testing for amenability | - Minimal diagnostic restrictions (broad applicability regardless of mutation) |

| Cost (per year) | - $200,000–$500,000+ (ERT) - Migalastat: lower but ongoing | - One-time gene therapy or less frequent doses - Lower total lifetime cost |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.