Diabetic Retinopathy (DR) - Disease Overview

Diabetic retinopathy is an eye condition caused by damage to the blood vessels in the retina due to long-term high blood sugar levels in people with diabetes. It can lead to vision problems and even blindness if untreated. The disease progresses from mild vessel changes to the formation of abnormal new vessels. Early stages often have no symptoms, making regular eye exams crucial for early detection and effective management.

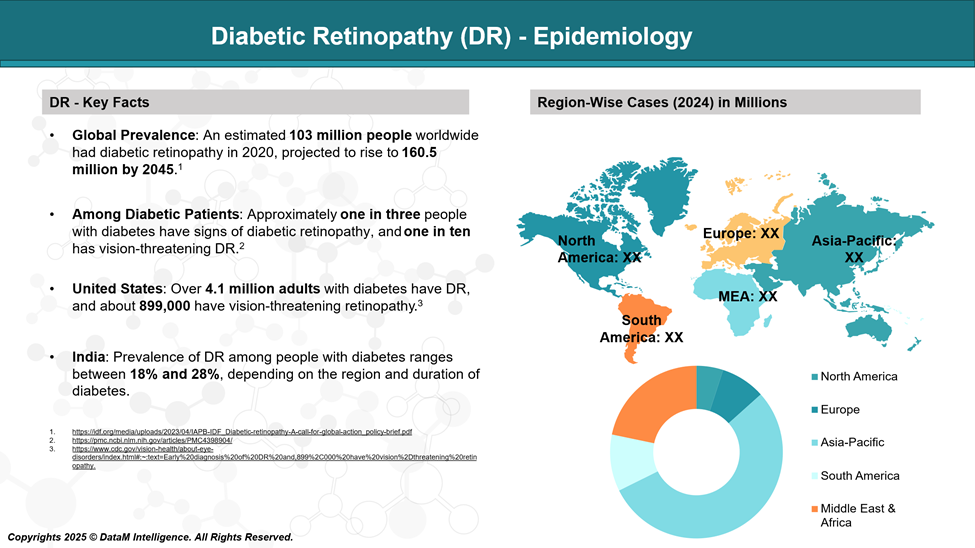

Diabetic Retinopathy (DR) - Epidemiology Analysis (Current & Forecast)

Diabetic retinopathy affects over 100 million people globally and is a leading cause of blindness in working-age adults. Without timely treatment, non-proliferative diabetic retinopathy (NPDR) can advance to more severe stages, significantly increasing the risk of vision loss.

Diabetic Retinopathy (DR) Approved Drugs - Sales & Forecast

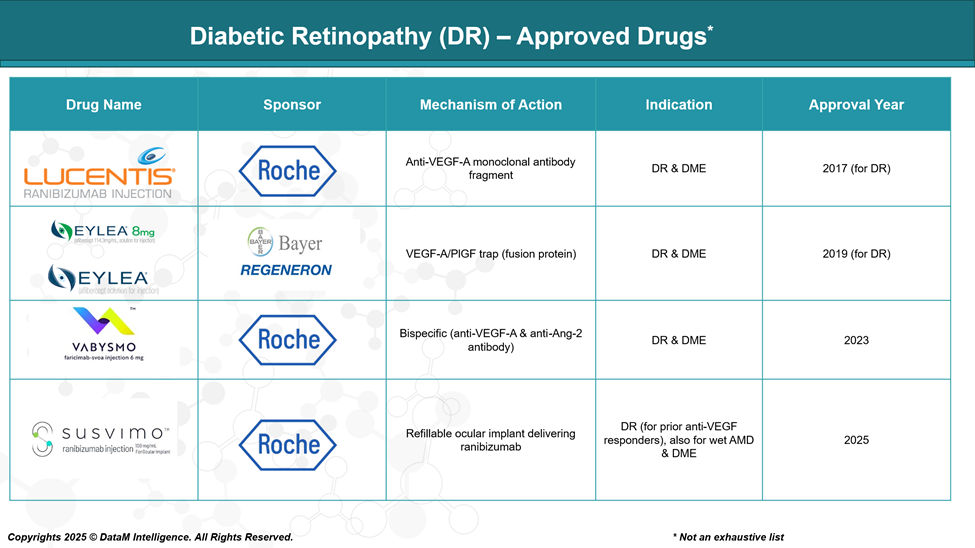

The FDA has approved several therapeutic options over the past decade that have transformed the management of DR. These include:

- Anti-VEGF agents, which inhibit vascular endothelial growth factor to prevent abnormal blood vessel growth and leakage.

- Corticosteroid implants, used for managing inflammation-driven macular edema.

- Innovative delivery platforms, such as refillable ocular implants, that offer sustained drug release and reduce treatment burden.

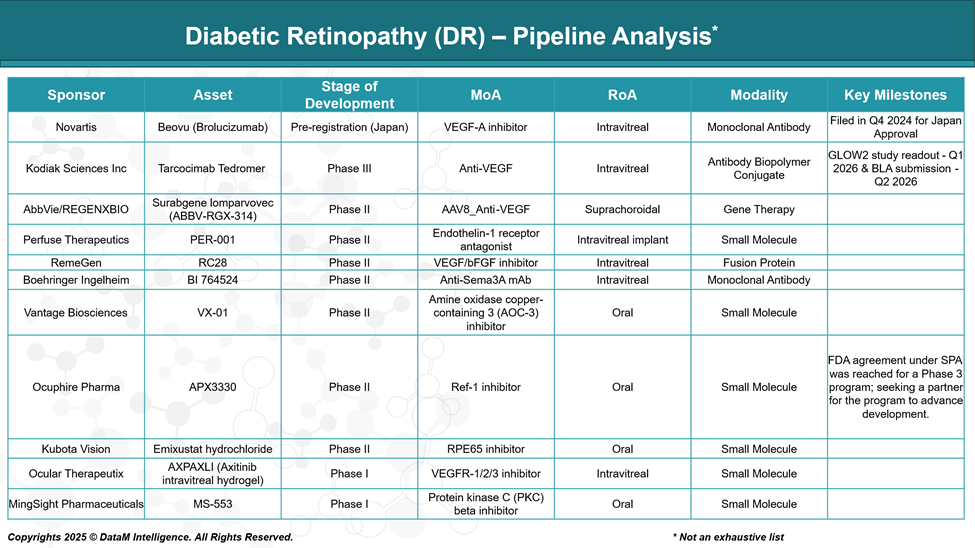

Diabetic Retinopathy (DR) Pipeline Analysis and Expected Approval Timelines

The diabetic retinopathy (DR) pipeline is evolving beyond traditional anti-VEGF therapies, with innovations targeting multiple pathways, including Ang-Tie2 and inflammation. Emerging treatments focus on extended durability, non-invasive delivery, and early intervention, reflecting strong momentum in addressing unmet needs across all DR stages.

Diabetic Retinopathy (DR) Competitive Landscape and Market Positioning

The DR market is currently dominated by anti-VEGF agents such as Eylea, Lucentis, Vabysmo, and Susvimo, which offer robust efficacy in reducing disease progression. These agents target the VEGF-A pathway and have set the standard of care. Corticosteroid implants (Ozurdex, Iluvien) and biosimilars (Cimerli) provide additional therapeutic options.

However, the market is now shifting toward long-acting therapies, non-VEGF pathways, and gene-based interventions to address limitations in durability, injection burden, and resistance.

Drug | Status | MoA / Target | Dosing & Route | Key Differentiator | Limitations / Challenges |

Eylea /Eylea HD (Aflibercept) | Approved | VEGF-A / PlGF inhibitor | Intravitreal; every 4–8 weeks | High efficacy; widely adopted standard of care | Injection burden; limited efficacy in non-responders |

Lucentis (Ranibizumab) | Approved | VEGF-A inhibitor | Intravitreal; monthly | Proven efficacy; early anti-VEGF entrant | Shorter durability; biosimilar erosion |

Vabysmo (Faricimab) | Approved | Dual VEGF-A / Ang-2 inhibitor | Intravitreal; up to every 4 months | Dual-target, extended dosing intervals | Newer entrant; real-world durability data evolving |

Susvimo | Approved | Ranibizumab port delivery | Surgical implant; refill every 6 months | Sustained delivery reduces injection frequency | Surgical risks; indicated only in select DR/DME cases |

Cimerli (Biosimilar) | Approved | Ranibizumab biosimilar | Intravitreal; similar to Lucentis | Cost-effective biosimilar; interchangeable | No innovation; same limitations as the originator |

Beovu (Brolucizumab) | Pipeline (Pre-Reg JP) | VEGF-A inhibitor | Intravitreal; quarterly dosing possible | Higher molar concentration, longer durability | Safety concerns (inflammation, vasculitis) previously reported |

Tarcocimab Tedromer | Phase III | Anti-VEGF biopolymer conjugate | Intravitreal; every 4–6 months | Long-acting biologic, designed for fewer injections | Awaiting pivotal data; efficacy vs Vabysmo under watch |

ABBV-RGX-314 | Phase II | AAV8 gene therapy encoding anti-VEGF | Suprachoroidal | One-time durable gene therapy solution | Surgical procedure required; long-term safety still under review |

PER-001 | Phase II | Endothelin-1 receptor antagonist | Intravitreal | Novel vascular target; non-VEGF path | Early-stage; unproven efficacy in humans |

RC28 | Phase II | Dual VEGF + bFGF inhibitor | Intravitreal | Broader angiogenesis inhibition | Early-phase; unknown durability & safety |

BI 764524 | Phase II | Anti-Sema3A monoclonal antibody | Intravitreal | Neurovascular protection: vascular permeability blocker | Niche target; efficacy to be proven |

VX-01 | Phase II | AOC-3 inhibitor (anti-inflammatory) | Intravitreal | Anti-leukostasis and inflammation pathway | Early-phase, novel MoA; limited clinical exposure |

APX3330 | Phase II | Ref-1 inhibitor | Oral (Systemic) | First-in-class oral anti-inflammatory and anti-VEGF effect | Systemic safety profile: lower potency vs local agents |

Emixustat | Phase II | RPE65 modulator / antioxidant | Oral | Visual cycle modulation: neuroprotective potential | Experimental approach: niche neuroprotective benefit |

Summary Insights:

- Approved drugs set a high bar for safety and efficacy, but suffer from injection burden and VEGF resistance.

- Pipeline assets focus on:

- Extended durability (Tarcocimab, Beovu)

- One-time gene therapy (ABBV-RGX-314)

- Oral alternatives (APX3330, Emixustat)

- Non-VEGF innovations (PER-001, BI 764524)

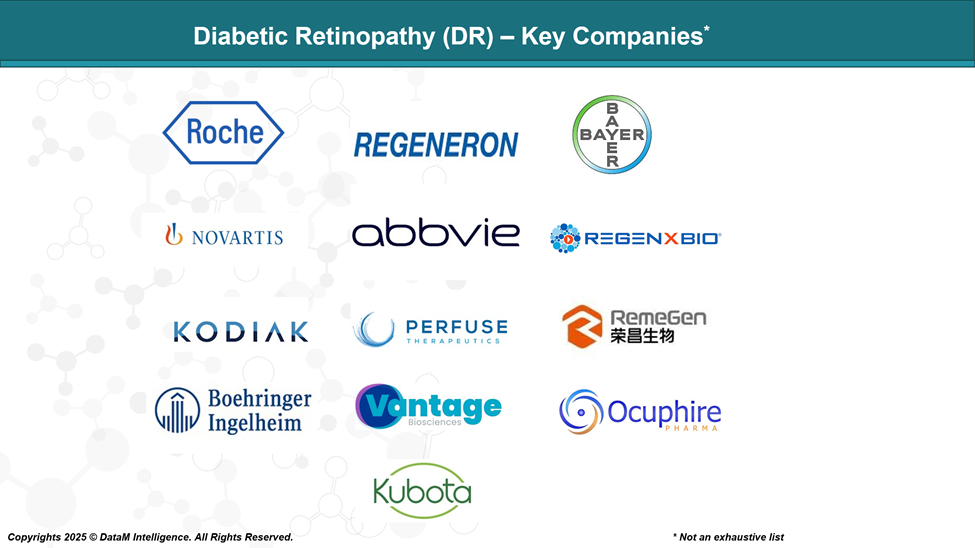

Diabetic Retinopathy (DR) Key Companies:

Diabetic Retinopathy (DR) - Target Opportunity Profile (TOP)

As the treatment landscape for Diabetic Retinopathy becomes increasingly saturated with anti-VEGF agents and corticosteroid implants, a Target Opportunity Profile (TOP) helps define the strategic and clinical benchmarks that emerging therapies must meet or exceed to gain competitive traction. This includes a clear understanding of unmet needs in efficacy, safety, durability, delivery innovation, and mechanism of action, especially for subgroups such as VEGF non-responders and early-stage DR patients.

Target Opportunity Profile for Emerging DR Therapies

Parameter | Current Standard (Approved Drugs) | Target for Emerging Therapies |

Efficacy | High retinal thickness reduction, vision improvement (e.g., Eylea, Vabysmo) | Equal or superior BCVA/CRT outcomes, ideally in early-stage and non-VEGF responders |

Safety / Tolerability | Well-characterized intravitreal safety; steroid implants have IOP risks | Maintain or improve safety profile, avoid ocular inflammation, and reduce IOP/CME risks |

Mechanism of Action (MoA) | Anti-VEGF (+ Ang-2 for Vabysmo) | Novel or multi-target MoAs: VEGF-resistant pathways (e.g., endothelin-1, Ref-1, Sema3A, AOC-3) |

Route of Administration (RoA) | Intravitreal injection or surgical implant | Non-invasive or extended delivery: oral, gene therapy, or ultra-long-acting injection |

Dosing Frequency | Every 1–2 months (anti-VEGF); Susvimo = 6-month refill; Iluvien = 3 years | Quarterly or longer durability; one-time treatments (e.g., gene therapy) are ideal |

Modality | Monoclonal antibodies, steroids, implants | Gene therapy, oral small molecules, novel biologics for differentiated delivery & access |

Innovation Level | Incremental improvements (dual targeting, implants, biosimilars) | Breakthrough class innovation — first-in-class, MoA novelty, convenience-driven design |

Patient Segmentation | Broad usage in DR and DME; limited in early-stage disease or VEGF non-responders | Target unmet segments: early DR, non-responders, systemic disease, and underserved geographies |

Cost & Access | High cost; biosimilars (Cimerli) reducing pressure | Competitive pricing, payer-friendly outcomes (e.g., fewer injections, QoL improvement) |

Success Factors for Emerging Drugs:

- Show equal or superior efficacy with less frequent dosing.

- Offer differentiated MoA to expand the responder base (especially VEGF-resistant).

- Focus on delivery innovation: oral, gene therapy, or sustained-release alternatives.

- Aim for strong safety, especially for chronic use and early-stage DR.

- Align with healthcare system priorities: fewer clinic visits, real-world durability, and lower caregiver burden.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: