1. Disease Overview:

Diabetic macular edema (DME) manifests as retinal thickening caused by the accumulation of intraretinal fluid, primarily in the inner and outer plexiform layers. It is believed to result from the hyperpermeability of the retinal vasculature.

Two Types of AMD

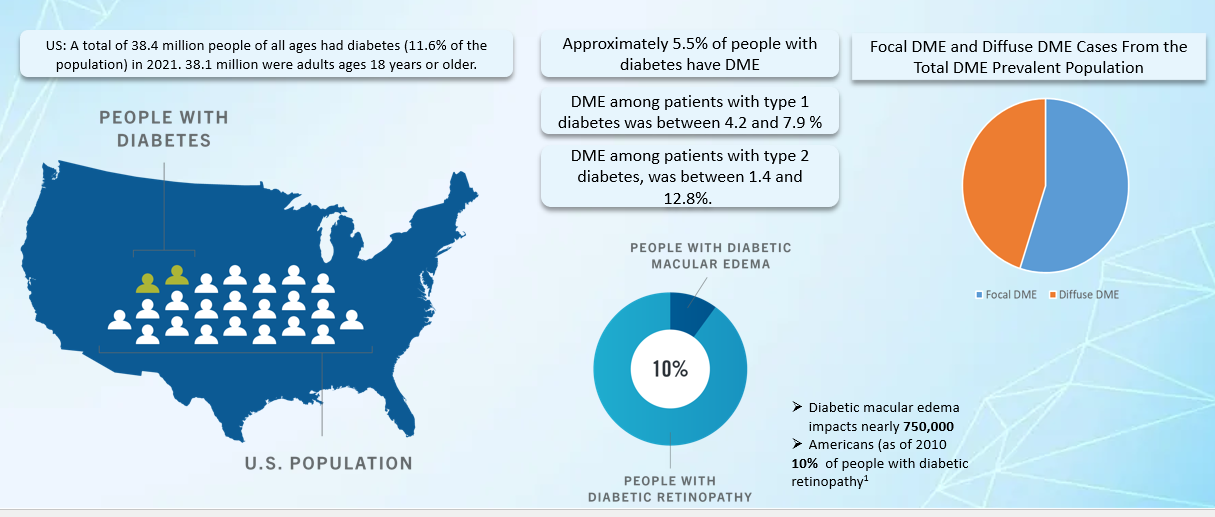

Diabetic Macular Edema (DME) can be broadly classified into focal and diffuse types:-

Focal DME:

- Characterized by discrete points of retinal hyperfluorescence (leakage) on fluorescein angiography (FA) due to leakage from microaneurysms.

- Associated with hard exudates (circinate exudates).

Diffuse DME:

- Characterized by diffuse areas of leakage on FA due to widespread capillary dysfunction and breakdown of the blood-retinal barrier (BRB).

- Associated with cystoid macular edema (CME).

2. Epidemiology Analysis (Current & Forecast)

- DME is a leading cause of vision loss among the working-age population of most developed countries. Approximately 750,000 Americans have DME. Of an estimated 285 million people worldwide with diabetes, over one-third have signs of DR, and a third of these are afflicted with vision-threatening diabetic retinopathy (VTDR).

3. Approved Drugs (Current SoC) - Sales & Forecast

The therapy landscape for DME has changed dramatically, with multiple approved medications largely targeting vascular endothelial growth factor (VEGF) and corticosteroids. Anti-VEGF medications are the cornerstone of DME treatment because they inhibit the overproduction of VEGF, a protein that causes aberrant blood vessel development and leaking in the retina.

Corticosteroids are considered when patients have an inadequate response to anti-VEGF therapy or when anti-VEGF treatments are contraindicated. The choice between anti-VEGF agents and corticosteroids, as well as the decision to incorporate laser therapy or surgery, depends on individual patient factors, including the severity of edema, visual acuity, and overall health status.

Approved Treatments for DME:

- Anti-VEGF Injections: These medications inhibit vascular endothelial growth factor (VEGF), a protein that promotes abnormal blood vessel growth and leakage in the retina. By blocking VEGF, these treatments reduce macular swelling and can improve vision. Common anti-VEGF agents include:

- Aflibercept (Eylea®): Often administered monthly for the initial 4-6 months, followed by less frequent injections as determined by the treating physician.

- Bevacizumab (Avastin®): Used off-label for DME; treatment schedules are similar to other anti-VEGF therapies.

- Ranibizumab (Lucentis®): Typically given monthly initially, with potential for reduced frequency based on patient response.

- Brolucizumab-dbll (Beovu®): Another anti-VEGF option with dosing intervals determined by the healthcare provider.

- Faricimab-svoa (Vabysmo®): Targets both VEGF and angiopoietin-2 (Ang-2), another protein involved in blood vessel formation, potentially offering a longer-lasting effect.

- Corticosteroid Injections: For patients who do not respond adequately to anti-VEGF therapy or cannot undergo such treatments, corticosteroids may be considered to reduce retinal inflammation and swelling. Options include:

- Dexamethasone (Ozurdex®): An intravitreal implant that slowly releases medication over several months.

- Fluocinolone acetonide (Iluvien®): Another implant designed for extended drug delivery to manage DME.

- Laser Therapy (Photocoagulation): This procedure uses laser pulses to seal leaking blood vessels, thereby reducing macular swelling. While it can stabilize vision and prevent further loss, it is less commonly used as a standalone treatment in the current therapeutic landscape.

- Vitrectomy: In cases where DME is accompanied by significant vitreous hemorrhage or traction, surgical removal of the vitreous gel (vitrectomy) may be performed to alleviate macular distortion and improve visual outcomes.

4. Pipeline Analysis and Expected Approval Timelines

Diabetic Macular Edema (DME) is a significant complication of diabetes leading to vision impairment. Several clinical-stage drugs are under investigation for DME treatment.

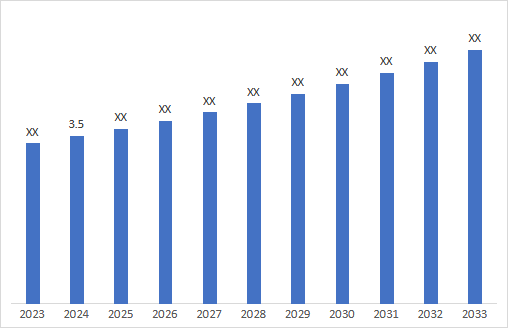

5. Market Size & Forecasting

The Diabetic Macular Edema (DME) market was valued at ~$3.5 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2032, registering a CAGR of ~4.2% over the forecast period.

CAGR:4.2%

Unmet Needs

Despite significant advancements in the treatment of DME, several unmet needs persist in terms of efficacy, durability, accessibility, and patient adherence.

Below are key gaps in current therapeutic approaches:

- Treatment durability & reduced treatment burden

- Non-responders & incomplete disease control

- Need for alternative mechanisms of action

- Early detection & prevention

- Systemic disease control & personalized medicine

- Accessibility & cost barriers

- Real-world long-term data

6. Competitive Landscape and Market Positioning

The DME treatment landscape is evolving, with anti-VEGF therapies dominating the market, but emerging biosimilars, gene therapies, and combination approaches are reshaping competition.

Market Leaders in DME Treatment

The current standard of care (SoC) for DME includes anti-VEGF therapies and corticosteroid implants. Anti-VEGF therapy dominates, but long-acting solutions and biosimilars are gaining ground.

| Drug | Company | Mechanism of Action | Market Positioning |

| Eylea (Aflibercept) | Regeneron/Bayer | Anti-VEGF-A (fusion protein) | Market leader with bi-monthly dosing, expanding into high-dose formulations. |

| Lucentis (Ranibizumab) | Roche/Genentech | Anti-VEGF-A (monoclonal antibody) | First FDA-approved anti-VEGF for DME, but shorter duration than Eylea. |

| Vabysmo (Faricimab) | Roche/Genentech | Dual VEGF-A & Ang-2 inhibitor | Longest treatment durability (16 weeks), challenging Eylea’s market dominance. |

| Beovu (Brolucizumab) | Novartis | Anti-VEGF-A (single-chain antibody fragment) | Higher potency, but safety concerns (inflammatory events) have limited its adoption. |

| Iluvien (Fluocinolone acetonide) | Alimera Sciences | Corticosteroid implant | Long-acting option (3 years), mainly for non-VEGF responders. |

| Ozurdex (Dexamethasone implant) | Allergan (AbbVie) | Corticosteroid implant | Used for patients who do not respond well to anti-VEGF. |

7. Target Opportunity Profile (TOP) & Benchmarking

A new therapy entering the DME market must address key unmet needs and outperform existing options in the following areas:

| Category | Ideal Target Opportunity |

| Efficacy | Equal or superior to Eylea/Vabysmo in BCVA gains and fluid reduction. |

| Durability | ≥6-month dosing interval (significantly longer than Eylea’s 2 months). |

| Mechanism of Action | Novel pathways beyond VEGF (e.g., Ang-2 inhibition, inflammation targeting, or gene therapy). |

| Administration | Minimally invasive (one-time injection or sustained-release implant). |

| Safety Profile | There is a lower risk of ocular inflammation, IOP rise, or vascular occlusions. |

| Market Access | Competitive pricing & payer reimbursement strategy for broad adoption. |

| Real-World Data | Strong Phase III & real-world evidence (RWE) to support physician adoption. |

Benchmarking: Competitive Comparison

| Drug | Company | MoA | Dosing Frequency | Efficacy (BCVA Gains) | Key Differentiator |

| Eylea (Aflibercept) | Regeneron/Bayer | Anti-VEGF-A | Every 8 weeks | ~8–10 letters | Market leader with strong safety & durability. |

| Vabysmo (Faricimab) | Roche/Genentech | Anti-VEGF + Ang-2 | Up to 16 weeks | Comparable to Eylea | Dual inhibition (VEGF + Ang-2) → Longer durability. |

| Lucentis (Ranibizumab) | Roche/Genentech | Anti-VEGF-A | Monthly | ~8 letters | First FDA-approved, but shorter duration than Eylea. |

| Beovu (Brolucizumab) | Novartis | Anti-VEGF-A | Every 12 weeks | Non-inferior to Eylea | High potency, but safety issues (ocular inflammation). |

| Iluvien (Fluocinolone) | Alimera | Corticosteroid | 3-year implant | Variable | Sustained-release option for VEGF non-responders. |

| Ozurdex (Dexamethasone) | Allergan | Corticosteroid | ~6 months | Variable | Used in anti-VEGF non-responders. |

| ADVM-022 | Adverum | Gene Therapy | One-time injection | Early-stage data | Potential cure for DME if durable & safe. |

| GB-102 | Graybug Vision | Tyrosine Kinase Inhibitor | Every 6 months | Phase IIb data pending | Alternative to VEGF inhibitors. |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.