Disease Overview:

Alopecia areata is a chronic autoimmune condition in which the immune system mistakenly attacks the body’s own hair follicles, particularly those in the active growth phase (anagen). This results in hair loss that is typically reversible, as the follicles remain structurally intact. The disorder may also impact the nails and the retinal pigment epithelium in some cases.

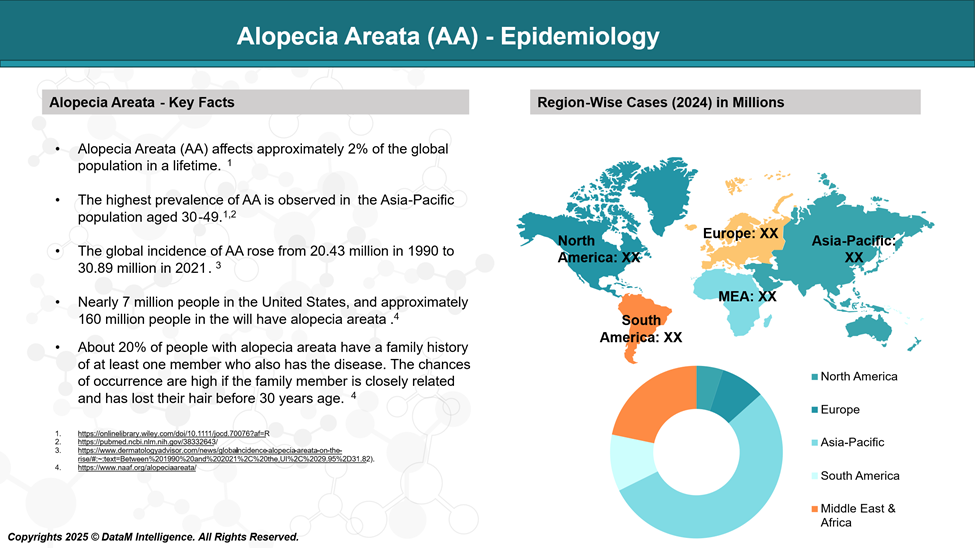

Epidemiology Analysis (Current & Forecast)

It affects around 2% of people worldwide over their lifetime. AA is often linked with both psychological and physical health issues, such as anxiety, depression, and other autoimmune diseases, contributing to a significant global health burden.

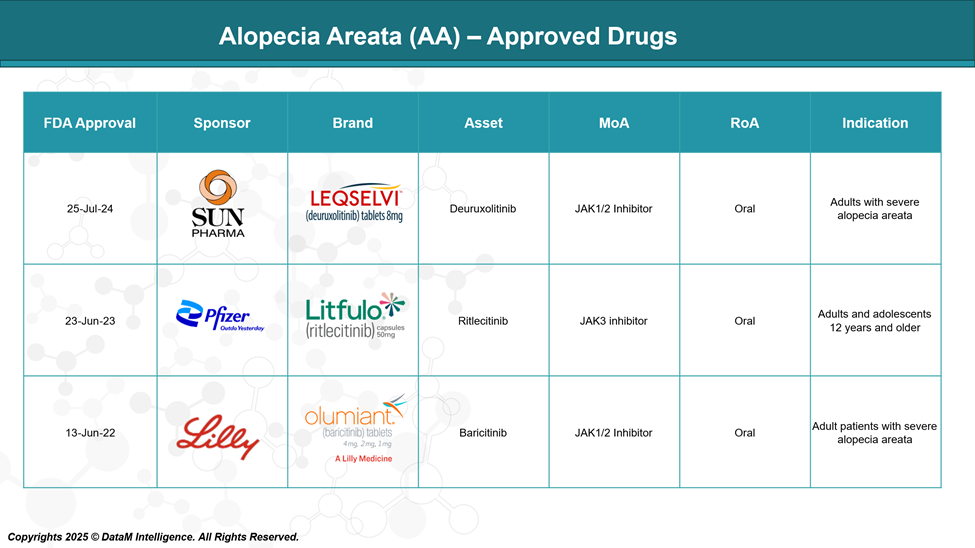

Approved Drugs - Sales & Forecast

As of 2025, three JAK inhibitors baricitinib, ritlecitinib, and Deuruxolitinib have received FDA approval, marking a significant breakthrough in the therapeutic landscape for this condition.

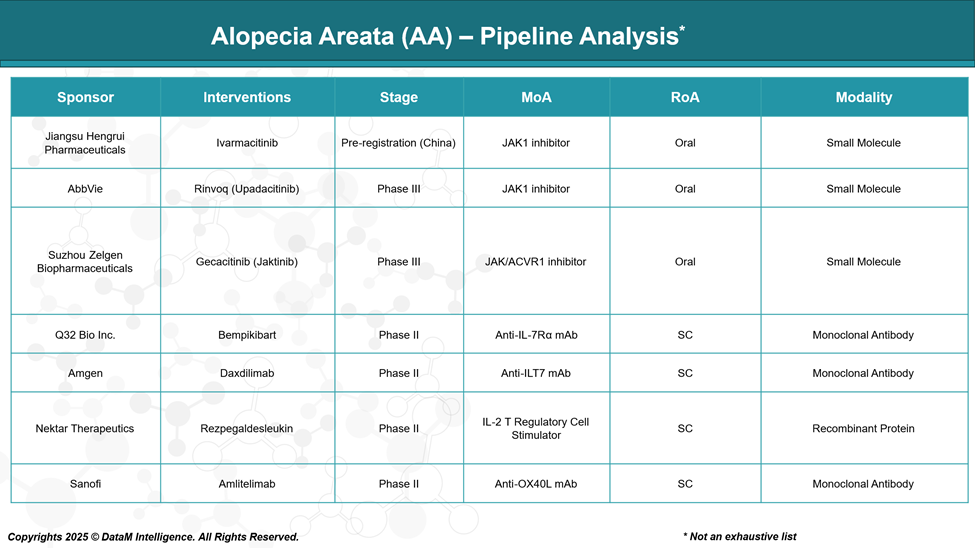

Pipeline Analysis and Expected Approval Timelines

The therapeutic landscape of AA is rapidly evolving, particularly with the development of targeted immunomodulators. Most pipeline candidates focus on JAK inhibition, immune modulation, or hair follicle regeneration.

Competitive Landscape and Market Positioning

The market for alopecia areata therapies is becoming increasingly competitive due to a growing understanding of the disease’s autoimmune basis and regulatory recognition of its burden. The entry of Janus kinase (JAK) inhibitors has transformed the treatment paradigm, but companies are now also exploring next-generation immunomodulators and alternative pathways to achieve differentiation.

Drug Name | Developer(s) | Mechanism of Action | Status (2025) | Key Differentiator | Strategic Insight |

Olumiant® (Baricitinib) | Eli Lilly & Incyte | JAK1/JAK2 inhibitor | FDA Approved (2022) | First FDA-approved systemic therapy for AA | First-mover advantage, strong autoimmune portfolio, targeting adults |

Litfulo™ (Ritlecitinib) | Pfizer | JAK3/TEC kinase inhibitor | FDA Approved (2023) | Approved for patients ≥12 years | Pediatric label sets it apart; novel JAK3 selectivity |

LEQSELVI™ (Deuruxolitinib) | Sun Pharmaceutical (Concert Pharma) | JAK1/JAK2 inhibitor | Approved (2024) | High efficacy with favorable tolerability | Sun's market reach and pricing strategy may disrupt competition |

Ivarmacitinib | Jiangsu Hengrui Pharmaceuticals | JAK1 inhibitor | Pre-registration (China) | Focus on Asian populations | Strong regional positioning; potential for global out-licensing |

Rinvoq® (Upadacitinib) | AbbVie | JAK1 inhibitor | Phase III | Extensive autoimmune track record | Positioned for label expansion; leverages success in RA, AD |

Gecacitinib (Jaktinib) | Suzhou Zelgen | JAK1/JAK2 inhibitor | Phase III (China) | Domestic innovation | Regional strength, potential competition to Ivarmacitinib in China |

Bempikibart | Q32 Bio | IL-7Rα inhibitor | Phase II | Non-JAK pathway | Targets lymphocyte activation upstream; novel angle for refractory cases |

Daxdilimab | Amgen | Anti-ILT7 monoclonal antibody | Phase II | First-in-class targeting pDCs | May reduce interferon-driven inflammation; candidate for combo regimens |

Rezpegaldesleukin | Nektar Therapeutics | CD25-targeted IL-2 pathway agonist | Phase II | Boosts regulatory T cells | Potential for durable immune reset; attractive in long-term disease control |

Amlitelimab | Sanofi | Anti-OX40L antibody | Phase II | T-cell co-stimulation blockade | Novel immune checkpoint target; potential for synergy with other biologics |

Key Companies:

Target Opportunity Profile (TOP)

To outperform currently approved therapies in alopecia areata (AA), emerging treatments must demonstrate a compelling Target Opportunity Profile across several critical dimensions. Below is a comprehensive framework outlining the ideal profile that new entrants should aim for to differentiate and gain a competitive advantage.

Category | Ideal Profile for Competitive Advantage | Rationale |

Efficacy | ≥50% patients achieving SALT ≤20 at 24–36 weeks | Must match or exceed benchmark efficacy of JAK inhibitors like baricitinib and ritlecitinib |

Safety & Tolerability | No boxed warnings; minimal long-term immune suppression | Approved JAK inhibitors carry risks (e.g., infections, thrombosis); safer profiles will appeal to clinicians and regulators |

Mechanism of Action (MoA) | Novel or upstream immune modulation (e.g., IL-7R, Tregs, OX40L, pDCs) | Avoid JAK-class competition; MoAs that restore immune balance or prevent recurrence could offer durable responses |

Route of Administration (RoA) | Non-oral preferred: Topical, subcutaneous, or infrequent injection | Offers an alternative to daily oral JAK inhibitors; improved convenience and potentially reduced systemic exposure |

Dosing Frequency | Weekly to monthly dosing | Improves adherence and quality of life over daily oral treatments |

Patient Population | Broad label including adolescents and moderate AA | Approved drugs focus on severe AA; expansion into mild-moderate or pediatric groups opens untapped markets |

Onset of Action | Visible improvement within 8–12 weeks | JAK inhibitors show responses by 12–16 weeks; faster onset could improve patient satisfaction |

Durability of Response | Sustained response post-treatment or reduced relapse rates | High relapse rates post-JAK discontinuation are a challenge; therapies inducing immune tolerance may lead the field |

Modality | Biologic or targeted protein therapy | Modalities like mAbs or fusion proteins can offer better specificity and longer half-lives than small molecules |

Innovation Index | First-in-class or best-in-class designation; patentable MoA | Needed to attract investment, justify premium pricing, and avoid the crowded IP space of JAKs |

Biomarker/CompanionDx | Ability to stratify responders or monitor disease | Predictive biomarkers would support precision medicine, improve outcomes, and reduce trial failure risk |

Combination Potential | Synergy with current JAKs or topical therapies | Opens door for co-administration or step-up strategies in resistant AA |

Regulatory Pathway | Orphan/Rare disease designation, pediatric exclusivity | Incentives for faster approval and market protection, rare disease status may still be viable |

Global Access Strategy | Suitability for LMICs, affordable pricing, room-temp stability | Essential for expansion beyond North America and Europe, especially for topical or biologic options |

Strategic Sweet Spot for Emerging Therapies

To beat the approved JAK inhibitors, emerging therapies must:

- Show equivalent or superior efficacy with better safety/tolerability

- Offer novel mechanisms that reduce relapse or extend durable remission

- Diversify administration routes (e.g., topical, injectable) and simplify dosing

- Address underserved populations (e.g., adolescents, mild AA)

- Leverage biologic innovation and immune modulation beyond JAK-STAT

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: